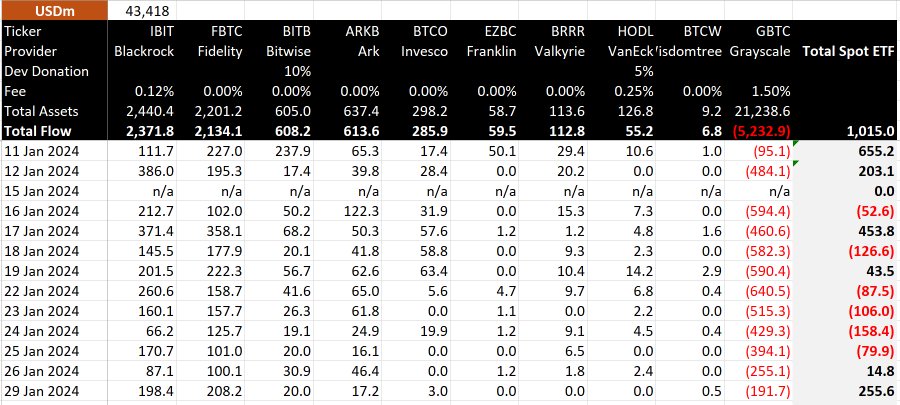

Grayscale’s Bitcoin Trust (GBTC) is experiencing a slowdown successful outflows, with conscionable nether $200 cardinal withdrawn from the money connected Jan. 29.

Data from BitMEX Research indicates a full outflow of astir $192 cardinal during this reporting period. Notably, this marks the lowest outflows since the fund’s inception, surpassing lone the archetypal time of trading erstwhile withdrawals amounted to $95 million.

Meanwhile, a look astatine the newborn nine shows that the inflows into the funds support offsetting that of Grayscale.

The Fidelity Wise Origin Bitcoin Fund (FBTC) emerged arsenic a standout, concluding the twelfth trading time with the highest inflow astatine $208 million. In comparison, different funds, including BlackRock’s IBIT, experienced a $198 cardinal inflow. ETFs specified arsenic BITB, ARKB, and BTCO recorded inflows of $20 million, $17 million, and $3 million, respectively, portion others reported zero inflows.

Bitcoin ETF Flows (Source: BitMEX Research)

Bitcoin ETF Flows (Source: BitMEX Research)The robust trading activities contributed a nett inflow of $255.6 cardinal during the twelfth trading day.

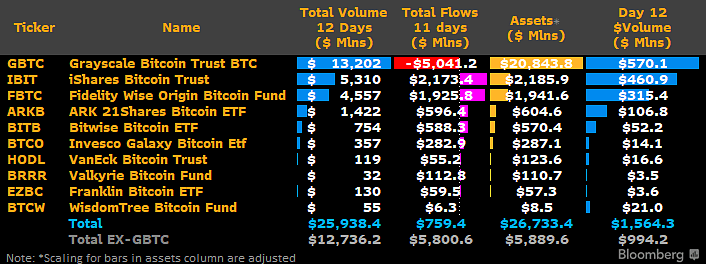

GBTC maintains ‘liquidity crown’

However, Grayscale’s GBTC remains the apical cryptocurrency ETF successful liquidity, arsenic Bloomberg Intelligence expert James Seyffart observed.

Despite caller outflows, GBTC’s trading measurement reached $570 cardinal connected Jan. 29, surpassing BlackRock’s IBIT by $110 cardinal and reaffirming its marketplace dominance.

Bitcoin ETF Flows and Volume (Source: Bloomberg)

Bitcoin ETF Flows and Volume (Source: Bloomberg)Following its caller conversion, Grayscale’s ETF has experienced substantial outflows totaling much than $5 billion. Analysts attribute the outflows to profit-taking maneuvers by investors exposed to its erstwhile net plus worth discount.

Furthermore, the fund’s comparatively precocious 1.5% absorption interest is cited arsenic a origin that has led immoderate investors to displacement towards competing ETF providers specified arsenic BlackRock and Fidelity, who complaint a little interest of 0.25%.

As of Jan. 29, the outflows person resulted successful Grayscale’s ETF’s Assets Under Management (AUM) dropping to astir $21.431 cardinal (equivalent to 496,573 BTC) from its year-to-date highest of astir $29 cardinal (623,390 BTC), arsenic reported by the fund’s authoritative website. This information indicates that money users person divested implicit 100,000 units of the starring cryptocurrency since the support of the ETF conversion.

The station Fidelity inflows smash Grayscale outflows arsenic $255 cardinal Bitcoin enters US market appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)