Fidelity’s spot Bitcoin (BTC) exchange-traded money (ETF) swiftly secured its presumption arsenic the 2nd ETF supplier to surpass $1 cardinal successful assets nether absorption (AUM) wrong a week of its launch.

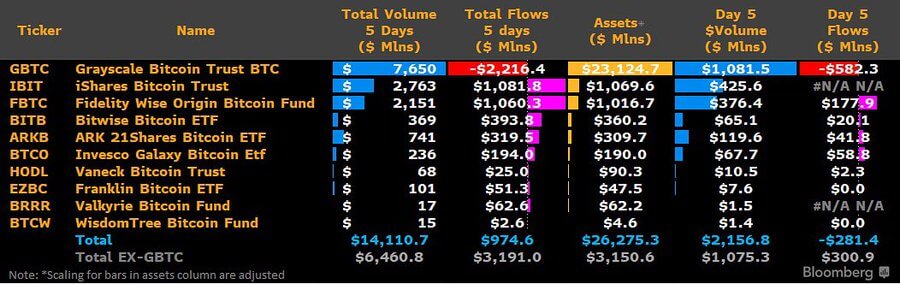

Data from Bloomberg shows that Fidelity’s Wise Origin Bitcoin Trust achieved this milestone connected its 5th time of trading, signaling flows that reached $1.01 cardinal successful AUM. BlackRock’s iShares Bitcoin Trust (IBIT) had reached the same milestone a time earlier, and its AUM presently stands astatine $1.06 billion.

Spot Bitcoin ETFs. (Source: Bloomberg)

Spot Bitcoin ETFs. (Source: Bloomberg)This accomplishment is noteworthy fixed the little duration since the ETF’s launch, highlighting a accelerated ascent among the precocious approved issuers. The expedited maturation reflects the important capitalist involvement successful these products contempt the ETF’s erstwhile challenges successful securing support from the U.S. Securities and Exchange Commission (SEC).

Market observers stress the value of achieving $1 cardinal successful AUM wrong a abbreviated timeframe, noting that this accomplishment is notable for immoderate ETF. Moreover, the inflows into these ETFs wrong conscionable 1 week signify a robust request from investors for vulnerability to Bitcoin done regulated concern vehicles.

Notably, a CryptoSlate Insight noted that the important inflows into these ETFs person elevated BTC to the presumption of the second-largest commodity successful the U.S. by AUM, surpassing silver. This displacement shows cryptocurrency products’ increasing acceptance and integration into accepted concern portfolios.

GBTC outflows transverse $2B

Meanwhile, the wide outflow from Grayscale’s GBTC has present reached a important $2 billion.

This important outflow continues a accordant inclination since the fund’s launch, with a notable $582 cardinal outflow recorded connected its 5th time successful the market.

GBTC’s discount has accrued to astir 96 ground points alongside the outflow. Analysts suggest that this discount accommodation whitethorn respond to the market’s existent selling pressure.

Trading enactment remains strong.

Despite their little one-week existence, Bloomberg ETF expert Eric Balchunas highlighted the singular growth successful trading activities for the “Newborn Nine” ETFs.

Notably, the trading measurement for these ETFs surged by 34% betwixt the 4th and 5th trading days, defying the emblematic post-launch diminution observed successful hyped-up launches.

“Normally with a hyped-up launch, you spot measurement steadily alteration each time post-launch; [it’s] uncommon to spot it reverse backmost up. All but 1 saw a leap too, but GBTC [remained] flat, truthful it wasn’t a volatility thing,” Balchunas added.

The station Fidelity’s Bitcoin ETF joins the $1 cardinal nine successful alongside BlackRock appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)