Lido, whose stock of the Ethereum staking marketplace was erstwhile truthful ample it raised concerns the protocol was nearing a level considered a unsafe attraction of power, has dropped to a grounds debased arsenic contention from rivals intensifies and the improvement of infrastructure tailored for organization concern opens caller avenues into the industry.

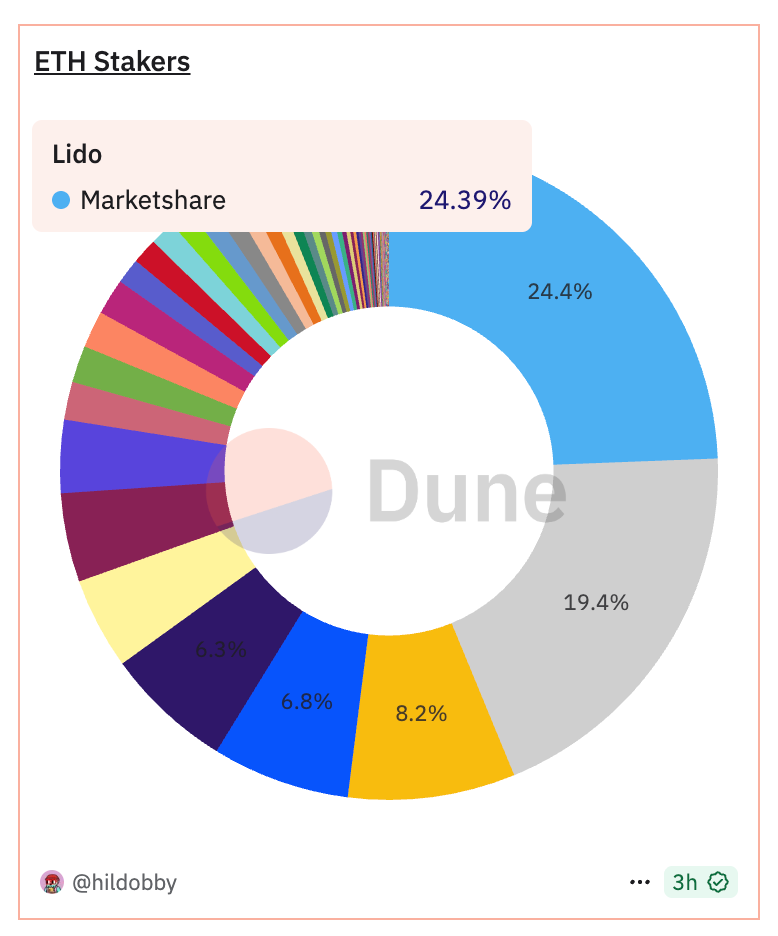

While it's inactive the ascendant force, Lido's marketplace stock is present 24.4%, down from its highs successful precocious 2023 erstwhile it held 32.3%. That's wrong striking region of the 33% level galore researchers and Ethereum halfway developers said would let a azygous liquid staking supplier to exert disproportionate power implicit the blockchain's statement mechanism.

The displacement points to a staking ecosystem that is maturing. Where Lido erstwhile seemed unshakable, it present faces a premix of institutional-grade operators, community-run decentralized protocols and exchange-hosted staking products.

For Ethereum, this diversification whitethorn beryllium a motion of improved blockchain health. If these trends continue, Ethereum staking successful 2025 is apt to beryllium defined little by concerns of single-provider dominance and much by contention among specialized work models.

"Lido’s stock decreased considerably owed to involvement centralization concerns and protocol safety," said Darren Langley, the wide manager of Lido-competitor Rocket Pool. "There was a large assemblage effort to guarantee that Lido did not scope 1/3 of full stake."

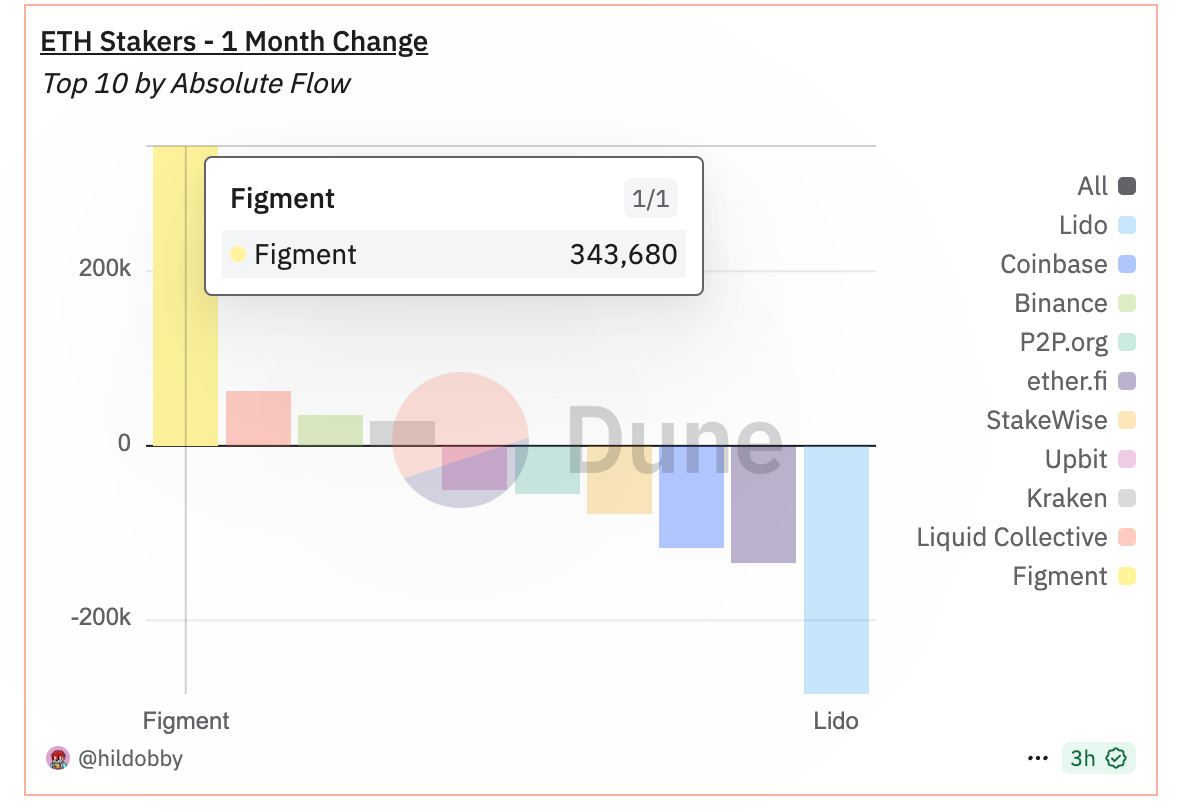

One of the clearest beneficiaries of the rebalancing is Figment, a staking infrastructure supplier with a beardown organization lawsuit base. While Figment has agelong ranked among the largest validator operators connected Ethereum, the past twelvemonth has brought a marked acceleration successful ETH deposits from funds, custodians and large-scale plus managers.

According to information from Dune Analytics, Figment was the largest gainer of caller stakers implicit the past month, adding astir 344,000 and present holding 4.5% of each staked ETH. Lido mislaid the largest number, astir 285,000. Ether.fi, Coinbase (COIN) and Binance besides fig among the largest holders.

Figment said ETH staking demand from its organization clients doubled aft the U.S. Securities and Exchange Commission (SEC) said successful May that staking didn't represent a securities activity, a surge mirrored successful rising validator queue hold times crossed the network. Last week, the SEC clarified that those participating successful liquid staking would besides not request to worry astir securities laws, a determination that is apt to unfastened the doors to much staked products.

“Now that the largest institutions successful the satellite are embracing integer assets, we’re busier than ever onboarding them," Figment CEO Lorien Gabel said successful an interview. "We’ve built our concern from time 1 connected compliance, regulation, and risk-adjusted performance, precisely for customers similar integer plus treasuries and neobanks. It’s working. If we weren’t winning the majority, I’d occurrence myself arsenic CEO.”

Read more: SEC Green Light connected Liquid Staking Sends ETH Past $4K, Spurs Broad Staking and Layer-2 Rally

1 month ago

1 month ago

English (US)

English (US)