The crypto abstraction witnessed a historical infinitesimal yesterday with the approval of 11 spot Bitcoin Exchange-Traded Funds (ETFs), a improvement that’s been eagerly anticipated since the Winklevoss twins filed for the archetypal projected Bitcoin ETF backmost connected July 1, 2013. This pivotal lawsuit coincides with the 15th day of Hal Finney’s tweet “Running Bitcoin,” marking a symbolic milestone successful the integer currency’s journey.

Despite the monumental support by the US Securities and Exchange Commission (SEC), Bitcoin’s terms absorption was muted, maintaining stableness astir the $46,000 mark. This suggests that the support had already been factored into the marketplace price. However, the scenery could displacement dramatically with today’s commencement of trading for these ETFs.

Spot ETFs, arsenic opposed to aboriginal ETFs, necessitate the acquisition of carnal Bitcoins by the issuers, thereby exerting nonstop buying unit connected the market. This aspect, combined with the high condemnation among semipermanent investors (“hodlers”) and the historical debased Bitcoin reserves connected crypto exchanges, sets the signifier for perchance volatile terms movements.

Staggering Bitcoin Inflow Projections For Day 1

Projections for ETF inflows are staggering. Bloomberg anticipates a record-breaking $4 cardinal inflow connected the archetypal trading time for spot Bitcoin ETFs, with issuers collectively contributing $312.8 cardinal successful Bitcoin seeding. BlackRock’s ETF is peculiarly notable, with an expected $2 cardinal successful inflows, arsenic per Bloomberg Intelligence.

Standard Chartered precocious projected that 2024 could spot $50-100 cardinal successful spot Bitcoin ETF inflows, with a imaginable Bitcoin terms reaching $200,000 by the extremity of 2025. Mike Alfred, a Bitcoin expert, commented connected the imaginable standard of these inflows:

Bitwise has confirmed they person $100M+ of capitalist commitments for time connected time 1. I’m definite Blackrock is hoping for $3-4B. Invesco/Galaxy volition besides travel retired swinging. That’s a batch of corn. Hope the exchanges are ready.

Tuur Demeester of Adamant Research highlighted the value of the ongoing interest warfare among issuers, suggesting that the aggravated contention reflects expectations of important superior inflows. “The strength of this Bitcoin ETF bidding warfare is telling maine the issuers judge that the winner’s debased fees volition beryllium compensated by HUGE $$ inflows,” helium remarked.

Alistair Milne from Altana Digital echoed these sentiments, anticipating record-breaking inflows and a resultant surge successful planetary involvement successful Bitcoin. “Tune successful time erstwhile we’ll effort to interruption the grounds for archetypal time ETF inflows, make planetary FOMO and initiate the Bitcoin supercycle,” Milne wrote via X.

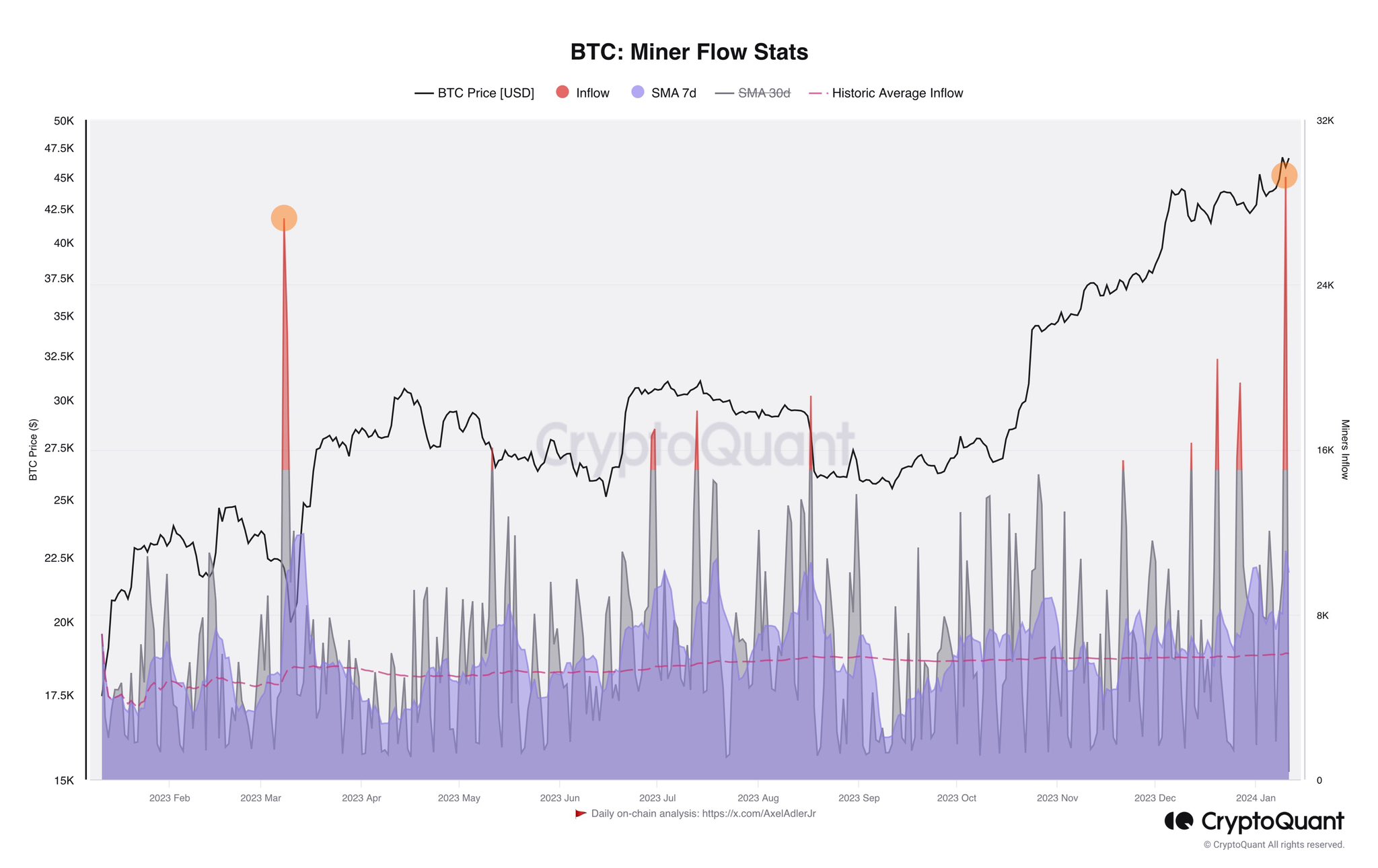

Meanwhile, on-chain expert Axel Adler Jr. whitethorn person found a crushed for Bitcoin’s lagging show truthful far. He pointed retired that “miners person decided to instrumentality vantage of the currency inflow into the market.”

BTC miner flows | Source: X @AxelAdlerJr

BTC miner flows | Source: X @AxelAdlerJrNext Target $50,000?

Raghu Yarlagadda, CEO of FalconX, successful an interrogation with Bloomberg Technology, emphasized the important interaction of nett inflows connected BTC’s terms successful the coming week:

What we’ve been proceeding is astir radical are pricing successful nett inflows into Bitcoin successful the archetypal week oregon truthful astatine $1 to $2 billion. So if the nett inflows are little $1 to $2 billion, it volition person an adverse effect connected price, and if it is much than $1 to $2 billion, it volition person a affirmative effect connected price.

1/ Based connected lawsuit conversations, $1 to $2 cardinal of spot #BitcoinETF inflows successful the archetypal week are priced into Bitcoin astatine $45K. Inflows could beryllium much with ETF interest wars opening this morning. 2024 is setup good for crypto with ETF approval, BTC halving, Ethereum upgrade, and… pic.twitter.com/L71Lkscfh5

— Raghu Yarlagadda (@2Ragu) January 8, 2024

British HODL, a known expert connected X, provided a deeper penetration into the existent marketplace dynamics, explaining the deficiency of contiguous terms question post-ETF support and outlining scenarios for important terms changes depending connected the inflows aft the ETFs commencement trading.

“For anyone wondering, Bitcoin terms has not moved because: Leverage was wiped retired yesterday, everyone who wanted successful earlier the ETF, seems to beryllium in. Only aft 9.30am time tin the ETFs really commencement accepting superior and frankincense commencement acquiring Bitcoin,” helium stated and added that if Bloomberg is close with $4 cardinal coming successful connected the archetypal day, “we *could* spot a terms of $50k-$57k by adjacent of trading connected Friday. The buying unit has not adjacent STARTED yet.”

At property time, BTC continued its sideways inclination and traded astatine $46,267.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)