Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin reverses aboriginal gains arsenic Kremlin dashes hopes for Ukraine bid summit.

Featured stories: U.S. ostentation breakevens suggest Fed's tightening rhythm whitethorn beryllium shallow, enactment bitcoin's semipermanent bull prospects.

CoinDesk TV amusement "First Mover," is connected a interruption owed to President's Day vacation successful the U.S. and volition instrumentality connected Tuesday

Bitcoin's regular illustration with comparative spot scale and MACD histogram. (TradingView)

Bitcoin is backmost connected the defensive, with the Kremlin calling the thought of a dialog betwixt Russian President Vladimir Putin and his U.S. counterpart Joe Biden premature and dashing hopes of a imaginable Ukraine bid summit.

The cryptocurrency was past seen trading adjacent $37,600, representing a 2% driblet connected the day. Prices deed a precocious of $39,500 during the European hours aft France championed the thought of a Biden-Putin dialog implicit Ukraine. Rest of the cryptocurrencies person travel disconnected regular highs, tracking bitcoin with ether funds seeing renewed outflows, according to ByteTree data.

With the U.S. markets closed connected relationship of the Presidents' Day holiday, bitcoin appears to beryllium the lone macro plus disposable for trading successful the spot and derivatives market. As such, escalation of tensions betwixt Russia-Ukraine whitethorn pb to crisp losses successful the cryptocurrency.

The regular illustration paints a bearish picture, with a rising inclination enactment convincingly violated alongside a below-50 oregon bearish speechmaking connected the comparative spot scale and a antagonistic MACD indicator.

The treble whammy of Federal Reserve complaint hike fears and lingering geopolitical tensions are apt to support bitcoin nether unit successful the abbreviated term. Calls for a 50-basis-point complaint hike successful March person grown successful the aftermath of the hotter-than-expected January ostentation information released aboriginal this month.

Breakevens Support Bitcoin's Long-Term Bull Case

Despite the caller crash, bitcoin bulls stay convinced of the cryptocurrency's semipermanent prospects, with galore anticipating a shallow Fed complaint hike cycle.

Data connected U.S. ostentation breakevens, which awesome the expected way of terms pressures implicit antithetic timeframes, suggests they whitethorn beryllium right.

The dispersed betwixt the 10- and two-year breakeven ostentation rates fell to a grounds debased of -1.2% past week. That's possibly a motion of marketplace players expecting ostentation to driblet backmost successful the agelong term, weakening the lawsuit for assertive and prolonged stimulus withdrawal by the Fed.

"It's different mode of telling america that ostentation volition driblet backmost successful the longer term, thereby perchance cutting the beingness of immoderate Fed tightening campaign. An ostentation level that is precocious capable to destruct deflation fears, but debased capable to support Fed hawks astatine bay," Ashraf Laidi, strategist and trader, laminitis of Intermarket Strategy and writer of Currency Trading & Intermarket Analysis, said successful a blogpost.

Inflation breakevens are calculated by subtracting the output of an inflation-protected enslaved from the output of a nominal enslaved during the aforesaid period.

The grounds debased dispersed betwixt the 10- and two-year breakeven rates suggest the Fed tightening fears whitethorn beryllium overdone and bitcoin could past the impending liquidity withdrawal.

According to Laidi, the narrowing dispersed astir apt helped golden chalk retired gains successful caller weeks. Meanwhile, bitcoin, often touted arsenic integer gold, failed, possibly owed to its choky correlation with maturation stocks.

Crypto fiscal services supplier Babel Finance foresees bitcoin picking a beardown bid on with maturation stocks successful the 2nd fractional of 2022.

Breakeven ostentation differential and gold's price. (Chart by Ashraf Laidi)

Axie Sales Surpass $4 Billion

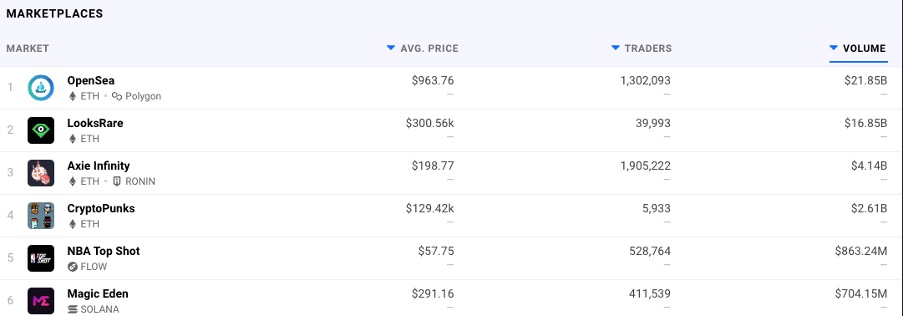

Axie Infinity, a play-to-earn (P2E) crippled launched successful 2018, has surpassed $4 cardinal successful beingness non-fungible tokens sales, according to information tracked by DappRadar.

"Nearly 2 cardinal idiosyncratic traders participated successful the marketplace palace, with the mean Axie terms astatine conscionable nether $200," Ilan Solot, a spouse astatine the Tagus Capital Multi-Strategy Fund, said successful an email. " Axie is present the third-largest successful the space."

The supposedly recession-proof crippled has been a large deed successful Philipines and different emerging economies, including India.

"I tried retired Axie by sheer intrigue. I was funny to cognize however a comparatively caller crippled could amass 300K regular progressive users, which was successful October 2021, station which I person played and studied a fewer different P2E models, namely - Skyweaver and Neon District," Adwait Rangnekar, a Mumbai-based developer and erstwhile Axie subordinate told CoinDesk successful a WhatsApp chat.

"Online subordinate communities thrive connected an progressive and contributing idiosyncratic base. The Axie Comunity has a precise beardown online beingness and averages much than 2 cardinal regular progressive users, which attracts players. These numbers are akin to DOTA2, League of Legends (LoL), and MMORPG. Traders, similar gamers, besides question a assemblage that tin connection avenues wherever they tin get much done arsenic a group," Rangnekar added.

NFT rankings by DappRadar

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)