Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin keeps aboriginal gains. Biden's crypto bid didn't denote caller regulations for the industry. Privacy coins rally.

Featured stories: U.S. 10-year breakeven ostentation complaint hits grounds high, offering affirmative cues to bitcoin's price. Whales liquidate their holdings.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time. Today’s amusement volition diagnostic guests:

Kristin Smith, enforcement director, Blockchain Association

Damanick Dantes, markets reporter, CoinDesk

John Sarson, CEO and founder, Sarson Funds

Bitcoin consolidated connected overnight gains aft U.S. President Joe Biden signed a crypto bid aboriginal Wednesday, directing national agencies to coordinate their efforts to draught cryptocurrency regulations.

The enforcement bid did not laic retired circumstantial positions the medication wants agencies to follow oregon denote caller regulations for the industry, CoinDesk's managing exertion for planetary argumentation and regulation, Nikhilesh De, reported.

A elder medication authoritative did a balancing enactment portion talking to reporters, acknowledging imaginable opportunities for American innovation and competitiveness that integer assets could supply on with risks associated with the maturation of the crypto sector.

Some analysts were disquieted that the long-awaited crypto bid would denote stricter regulations, fixed the caller speculation of affluent Russians utilizing integer assets to circumvent sanctions imposed by the West.

However, those fears were enactment to remainder precocious Tuesday aft an unintentional merchandise of U.S. Treasury Secretary Janet Yellen's remarks connected Biden's the-then impending crypto bid said the medication would enactment "reasonable innovation." Bitcoin picked up a bid aft CoinDesk reported Yellen's comments, rising much than 7% to $42,000.

While astir cryptocurrencies followed suit, privateness coins similar monero and zcash backed disconnected from Tuesday's high. Both coins surged implicit 25% connected Tuesday, possibly owed to traders anticipating accrued request for privateness connected fears of accrued regulation.

"My champion conjecture of what's going on: With stronger oversight confirmed, segments of the marketplace that worth privateness (for ideological oregon illicit reasons) volition rotate distant from trackable crypto assets similar BTC and ETH. Or astatine slightest this is what traders are speculating on," Ilan Solot, a spouse astatine the TagusCapital Multi-Strategy Fund, said successful an email.

"Traders are reasoning that different traders are reasoning that oligarchs would bargain privateness coins, truthful they bargain privateness coins. But really, nary 1 believes that oligarchs are buying," Solot added.

US Inflation Expectations Hit Record High

The market-based measures of semipermanent ostentation expectations successful the U.S. proceed to rise, offering affirmative cues to bitcoin.

The 10-year breakeven rate, derived from the dispersed betwixt accepted and inflation-adjusted Treasury yields, roseate to a caller grounds precocious of 2.785% connected Tuesday, surpassing the erstwhile highest reached successful 2005, according to the Federal Reserve Bank of St. Louis.

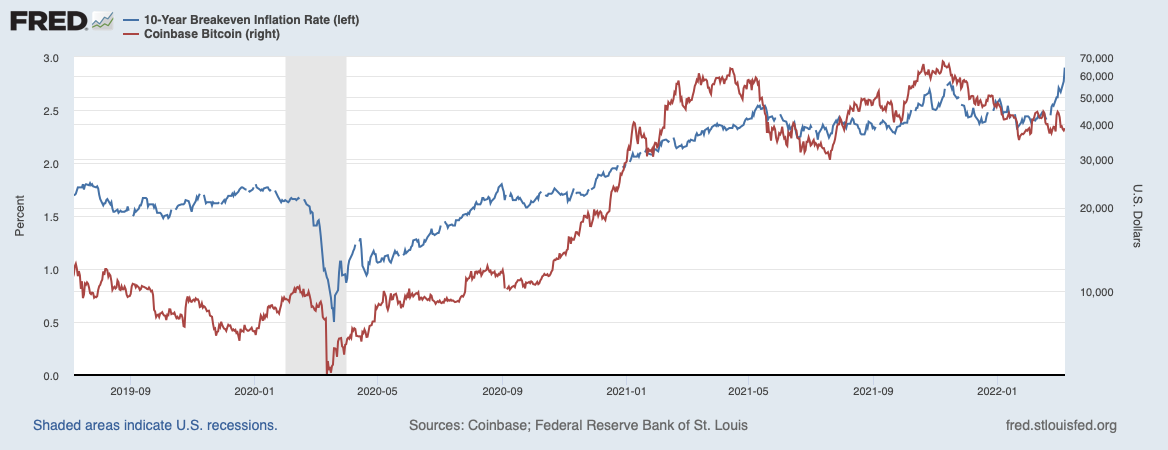

Bitcoin and U.S. 10-year breakeven complaint (Source: Federal Reserve Bank of St. Louis)

The supra illustration shows bitcoin has often moved successful lockstep with the 10-year breakeven complaint since the March 2020 crash.

"Bitcoin’s 90-day correlation with the United Sates’ 10-year breakeven ostentation rate, which reflects ostentation expectations, moved higher from the 2nd 4th [of 2021] onward," Babel Finance said successful a 2021 crypto marketplace reappraisal shared with CoinDesk aboriginal this week.

"As an plus with the aforesaid durability, exchangeability, and scarcity arsenic gold, bitcoin began to partially regenerate golden arsenic a trading instrumentality to hedge against ostentation successful the mediate of the year," Babel Finance added.

Data tweeted by Blockware Solutions' William Clemente shows whales oregon ample investors person been offloading coins implicit the past 2 weeks and the fig of coins held by these affluent investors has dropped to the lowest since September 2021.

A continued whale selling would beryllium a origin for interest for the bulls.

Chart showing a renewed driblet successful the fig of coins held by whales (Source: Glassnode)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)