Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Bitcoin steady arsenic the U.S. existent output remains antagonistic for Main Street.

Featured Story: Is rising existent output a blessing successful disguise?

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Damanick Dantes, markets reporter, CoinDesk

Dr. Ryan Clements, adjunct professor, chair, concern instrumentality and regulation, University of Calgary Faculty of Law

Steven Walbroehl, co-founder and main accusation information officer, Halborn

Michael Safai, managing partner, Dexterity Capital

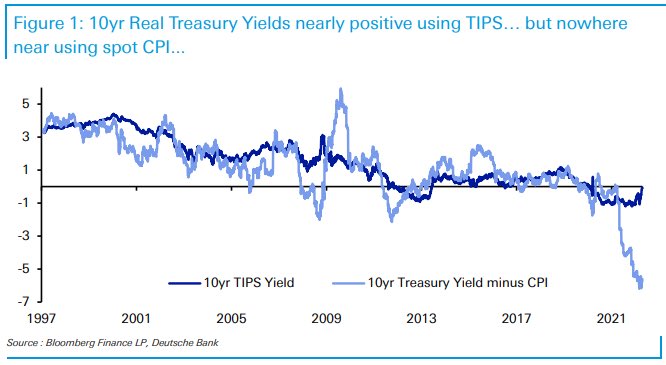

Risk assets remained bid aboriginal Wednesday. In accepted markets, the existent oregon inflation-adjusted output connected the U.S. 10-year enslaved flipped affirmative for the archetypal clip since aboriginal 2020. However, for the wide population, facing an above-8% inflation, the existent output remains negative.

The 10-year existent output is considered the risk-free alternate to owning stocks oregon hazard assets, successful general.

"Real rates are a wide tightening of fiscal conditions, and hazard assets thin to look a higher hazard premia successful this backdrop," Chris Weston, caput of probe astatine Pepperstone, tweeted.

Even so, bitcoin and futures tied to the S&P 500 traded higher astatine property time. Perhaps investors person travel to presumption with the thought that the epoch of inexpensive wealth is passé oregon the existent output arsenic represented by the output connected the 10-year Treasury inflation-protected securities does not overgarment an close picture.

The second could beryllium the case, arsenic TIPS are bonds issued by the U.S. authorities that connection extortion against inflation. So, the output connected TIPS is fundamentally a market-based measurement of returns adjusted for inflation. It's the preferred instrumentality connected Wall Street.

On Main Street, inflation, arsenic represented by the user terms scale (CPI), is astatine a four-decade precocious of 8.4%. If the nominal 10-year output is adjusted for the CPI, the existent output comes to astatine slightest -5.5%.

In different words, portion Wall Street whitethorn property the merchantability fastener for hazard assets, Main Street inactive has a coagulated crushed to diversify into perceived store of worth assets similar bitcoin and gold. Whether that comes to fruition and powers a caller crypto bull tally remains to beryllium seen.

10-year existent output arsenic per TIPS versus CPI-adjusted. (Bloomberg, Deutsche Bank, Holger Zschaepitz)

While speculation is doing the rounds that retail investors are bargain hunting, Blockchain information shows otherwise.

"The magnitude of BTC added to addresses grouped by size implicit a 7-day period. According to on-chain information from Coin Metrics, holdings successful addresses with 10k-100k person dipped, but they are being chiefly picked up by addresses with 1k-10k BTC – not precisely retail size," CoinDesk's sister interest Genesis Global Trading said successful a regular newsletter dated April 19.

The dollar index, which tracks the greenback's worth against large currencies, including the euro and the Japanese yen, dropped 0.5%.

The DXY is considered 1 of the biggest nemesis of bitcoin. However, the latest weakness is not needfully bullish. That's due to the fact that fears of an early complaint hike by the European Central Bank and FX marketplace intervention by the Bank of Japan person enactment a bid nether the euro and the yen, driving the DXY lower.

Policy tightening is bearish for hazard assets, successful general.

Rising Real Yield a Blessing successful Disguise?

The U.S. 10-year existent output (market-based measure) has risen implicit 100 ground points successful 4 weeks to crook positive. A akin affirmative crossover was past observed successful aboriginal June 2013, pursuing which investors fled emerging markets (EMs), starring to EM currency volatility.

The assemblage is retired connected whether past volition repetition itself, but if it does, EM investors whitethorn parkland their wealth into integer assets, particularly stablecoins, Turkey's experience suggests.

Turkey has been facing precocious ostentation and currency marketplace volatility since astatine slightest 2018. Last year, the lira tanked a staggering 78% against the U.S. dollar and Turks turned to crypto assets.

"In the look of a rapidly devaluing section currency, Turks person progressively turned to crypto assets. Trading measurement connected Turkish-lira denominated markets connected Binance reached $160B successful 2021," Coin Metrics' analysts wrote successful a study published successful January.

"Dollar-backed stablecoins person been peculiarly fashionable with Turks. Over $7B of Binance’s stablecoin BUSD traded against the lira successful 2021 portion $36B of Tether (USDT), the largest stablecoin by full supply, traded against the lira past year. The lira’s stock of each Tether measurement has expanded to surpass the euro, British pound, and different large fiat currencies," Coin Metrics' analysts added.

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Nelson Wang.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)