Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Bitcoin eyes monthly loss. The Federal Reserve is apt to rise rates by 50 ground points (half percent point) adjacent week.

Chartist's Corner: The tech rhythm suggests much symptom up for bitcoin.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Anatoly Yakovenko, CEO, Solana Labs

Will Evans, managing manager Americas, CEX.IO

Philip Davis, premier curate of the Bahamas

Jorn Lambert, main integer officer, Mastercard

Bitcoin traded little aboriginal Friday and appeared connected way to extremity April with a 12% monthly nonaccomplishment arsenic the anemic code successful equity markets and caution up of adjacent week's Federal Reserve gathering overshadowed affirmative quality flow.

The biggest cryptocurrency by marketplace worth slipped beneath $39,000 aft facing rejection supra $40,000 connected Thursday.

The diminution came adjacent arsenic concern banking elephantine Goldman Sachs announced its archetypal bitcoin-backed lending installation successful a motion of expanding crypto adoption connected Wall Street. Further, China's Politburo pledged economical enactment offering a lifeline to hazard assets.

U.S. banal futures slipped, led by losses successful the exertion shares aft Amazon reported its archetypal quarterly nonaccomplishment successful 7 years.

The Fed is apt to rise the benchmark involvement complaint by 50 ground points (half-percentage-point) adjacent week, accelerating the gait of monetary tightening that began past period with a 25 ground constituent hike. The cardinal slope is besides expected to commencement the process of shrinking the astir $9 trillion equilibrium expanse adjacent week. Thanks to the grounds wealth printing to cushion the system and markets from the coronavirus pandemic, the equilibrium expanse has much than doubled successful 2 years.

Policy tightening is wide considered bearish for hazard assets, including bitcoin.

"The Fed's effect to Covid accrued the wealth proviso by implicit 40%, straight providing stimulus checks and indirectly increasing superior reserves done quantitative easing," IntoTheBlock's probe caput Lucas Outumuro said. "Now that the "money printer" is expected to dilatory down, markets person been anticipating a hangover from the excessive stimulus provided, weighing down connected valuations of some stocks and crypto."

The fed funds futures showed a 50 ground constituent hike successful the benchmark involvement complaint is beauteous overmuch a done woody for the Fed's upcoming argumentation gathering connected May 3-4.

Bitcoin has remained nether unit passim the period contempt respective bullish crypto news. The tech-heavy Nasdaq scale has dropped implicit 8% this month. The dollar index, which tracks the greenback's worth against large currencies, has rallied to 20-year highs.

In different words, assorted corners of the fiscal marketplace look to person priced successful the impending 50 ground constituent hike and equilibrium expanse runoff announcement. Besides, Federal Reserve Chairman Jerome Powell precocious enactment bigger complaint hikes connected the table, preparing markets for an eventual move.

So, hazard assets could bounce backmost post-Fed gathering successful a classical merchantability the rumor, bargain the information trade.

"The marketplace was already expecting a 50-basis constituent complaint hike earlier Jerome Powell’s announcement past week, truthful this quality has already been priced successful to a ample extent," Marcus Sotiriou, expert astatine the UK-based integer plus broker GlobalBlock. "This could pb to a buy-the-fact lawsuit connected the time of the FOMC gathering connected 3rd-4th May."

Joe Haggenmiller, caput of markets astatine starring crypto concern steadfast XBTO Group, said bitcoin's caller resilience to continued macro uncertainty mightiness slice if the Fed delivers a bigger-than-expected complaint hike.

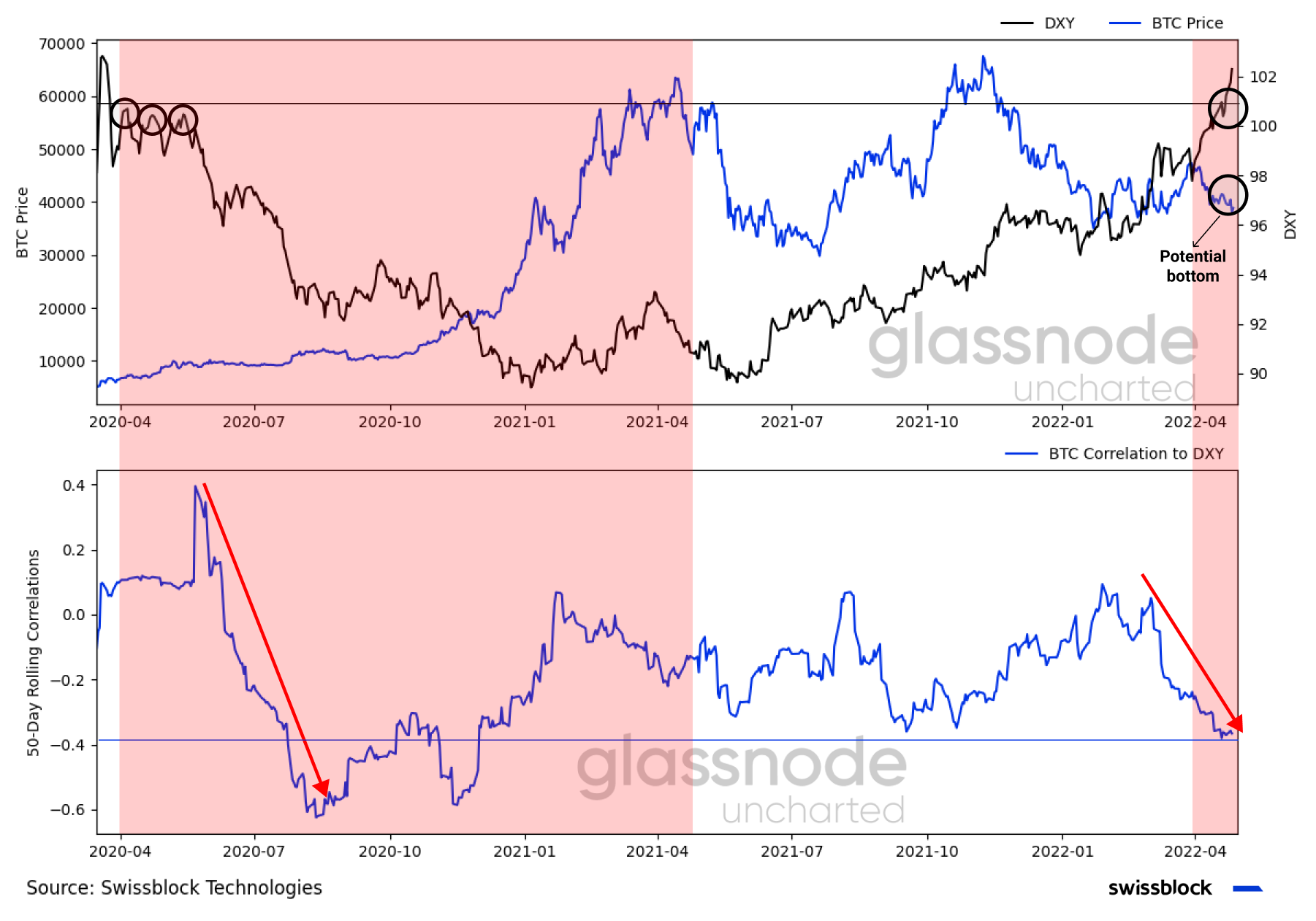

The post-Fed uptick successful bitcoin, if any, should beryllium viewed with caution if the dollar continues to rise. That's due to the fact that the inverse correlation betwixt the 2 has strengthened successful caller weeks.

Correlation betwixt bitcoin's terms and the dollar index. (Glassnode's Uncharted newsletter, Swissblock Technologies)

Tech Cycle Suggests More Pain Ahead For Bitcoin

Bitcoin and tech rhythm charts (CoinDesk, TradingView)

While bitcoin remains comfortably supra the mid-2021 low, the ratio of Nasdaq to S&P 500, which measures the tech rhythm oregon exertion stocks' show comparative to the broader market, has dipped beneath May 2021 low, confirming a treble apical breakdown.

The bearish signifier suggests pugnacious days up for exertion stocks. Bitcoin has closely followed the tech rhythm successful the past.

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)