Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Bitcoin trades astatine a premium successful the Japanese yen markets.

Chartist's Corner: Spike successful planetary FX volatility, boon oregon curse for bitcoin?

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Haseeb Qureshi, managing partner, Dragonfly Capital

Dan Jeffries, managing director, AI Infrastructure Alliance

Bitcoin (BTC) traded higher for the 2nd time arsenic the yen and euro tanked against the dollar and a gauge of FX marketplace volatility deed a two-year high.

The apical cryptocurrency by marketplace worth neared $40,000, having jumped 3% to $39,000 connected Wednesday, CoinDesk information shows. Ether (ETH), the second-largest cryptocurrency, roseate 1%, topping $2,900.

The Japanese yen slipped to 130.80 per U.S. dollar, the lowest successful 20 years. The currency has fallen much than 10% successful 7 weeks. While specified accelerated moves are the norm successful crypto markets, they are uncommon successful currency markets and possibly damaging to nations. Sharp currency depreciation imports ostentation and often has home investors pouring wealth into the perceived store of worth assets similar bitcoin and gold.

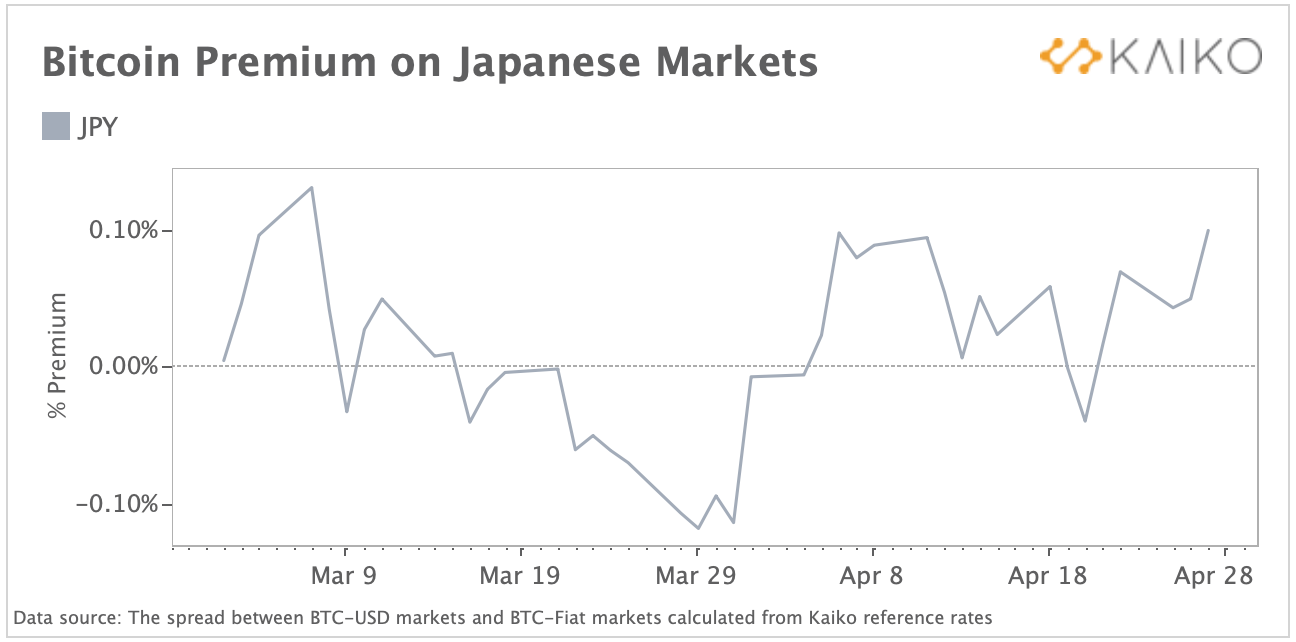

Bitcoin has precocious been drafting a premium successful Japanese yen markets. Still, it whitethorn beryllium excessively aboriginal to accidental that cryptocurrency is the preferred harmless haven of investors exposed to the yen's volatility.

"Bitcoin traded astatine a accordant premium connected Japanese markets since the commencement of April," Dessislava Aubert, expert astatine Kaiko Research, told CoinDesk successful an email. "However, BTC-JPY commercialized volumes remained low, which does not bespeak a durable summation successful request successful section markets."

Aubert added that volumes could prime up if Japan decides to loosen its coin listing regulation.

Bitcoin premium connected Japanese markets. (Kaiko Research)

Experts accidental the progressively divergent central-bank argumentation has driven the yen's descent this year. While the Federal Reserve hiked rates successful March and plans to rise rates six much times by year-end, the Bank of Japan has remained committed to wealth printing.

"The increasing monetary argumentation divergence betwixt the U.S. Fed and the Bank of Japan alongside higher commodities prices person enactment important unit connected the Japanese currency with the JPY touching 20-year lows against the U.S. Dollar," Aubert said.

Bitcoin's programmed tightening path

While the BOJ is moving successful the different absorption from the Fed, bitcoin's monetary argumentation is connected a programmed tightening path.

Bitcoin's gait of proviso enlargement is reduced by 50% each 4 years, and the alleged reward halving is owed successful 2024, aft which the per artifact reward would driblet from 6.25 BTC to 3.125 BTC.

Even so, the cryptocurrency has mislaid implicit 40% successful 5 months, chiefly owed to the Fed complaint hike fears.

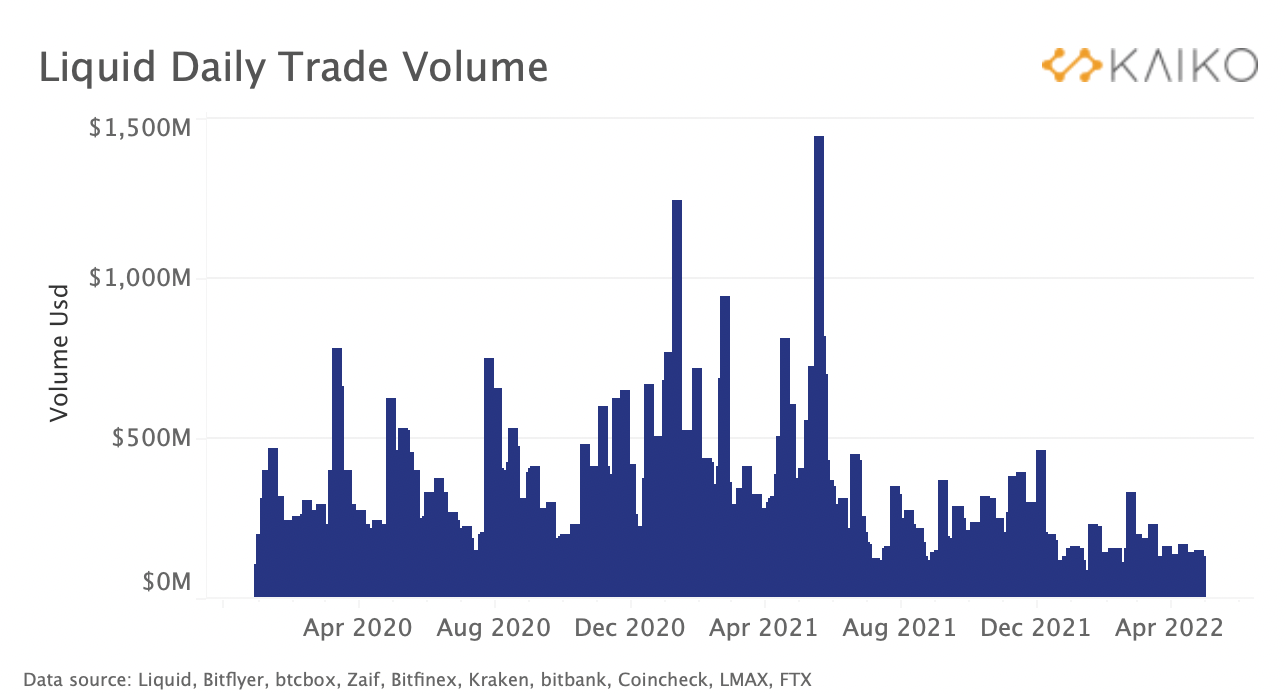

Declining trading volumes on Liquid, 1 of the highest measurement Japanese exchange precocious acquired by FTX. (Kaiko Research)

Spike successful Global FX Volatility: Boon oregon Curse For BTC?

JPMorgan's planetary FX volatility index. (Michael Brown, caput of quality astatine Caxton Payments, Bloomberg)

JPMorgan planetary FX volatility index, which tracks three-month enactment volatilities, has jumped to a two-year precocious of 10.20, the highest successful 2 years, according to information tracked by Bloomberg.

Bitcoin is wide considered a harmless haven and integer golden successful the crypto market. So, 1 whitethorn see the rising FX volatility a boon for cryptocurrency.

However, past information suggests that cryptocurrency does good successful a declining FX volatility environment.

Today’s newsletter was edited by Omkar Godbole and produced by Bradley Keoun and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)