Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin eyes play loss, adjacent week's U.S. ostentation information could bring much selling unit to the market.

Featured Story: A censorship-resistant ostentation scale is being built connected Chainlink.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Aleksander Larsen, co-founder and COO, Sky Mavis

Don Kaufman, co-founder, TheoTrade

Chen Arad, main operating officer, Solidus Labs

Macroeconomic fears resurfaced this week, putting unit connected hazard assets, including bitcoin. The apical cryptocurrency traded astatine $43,300 astatine property time, representing a 6% driblet for the week.

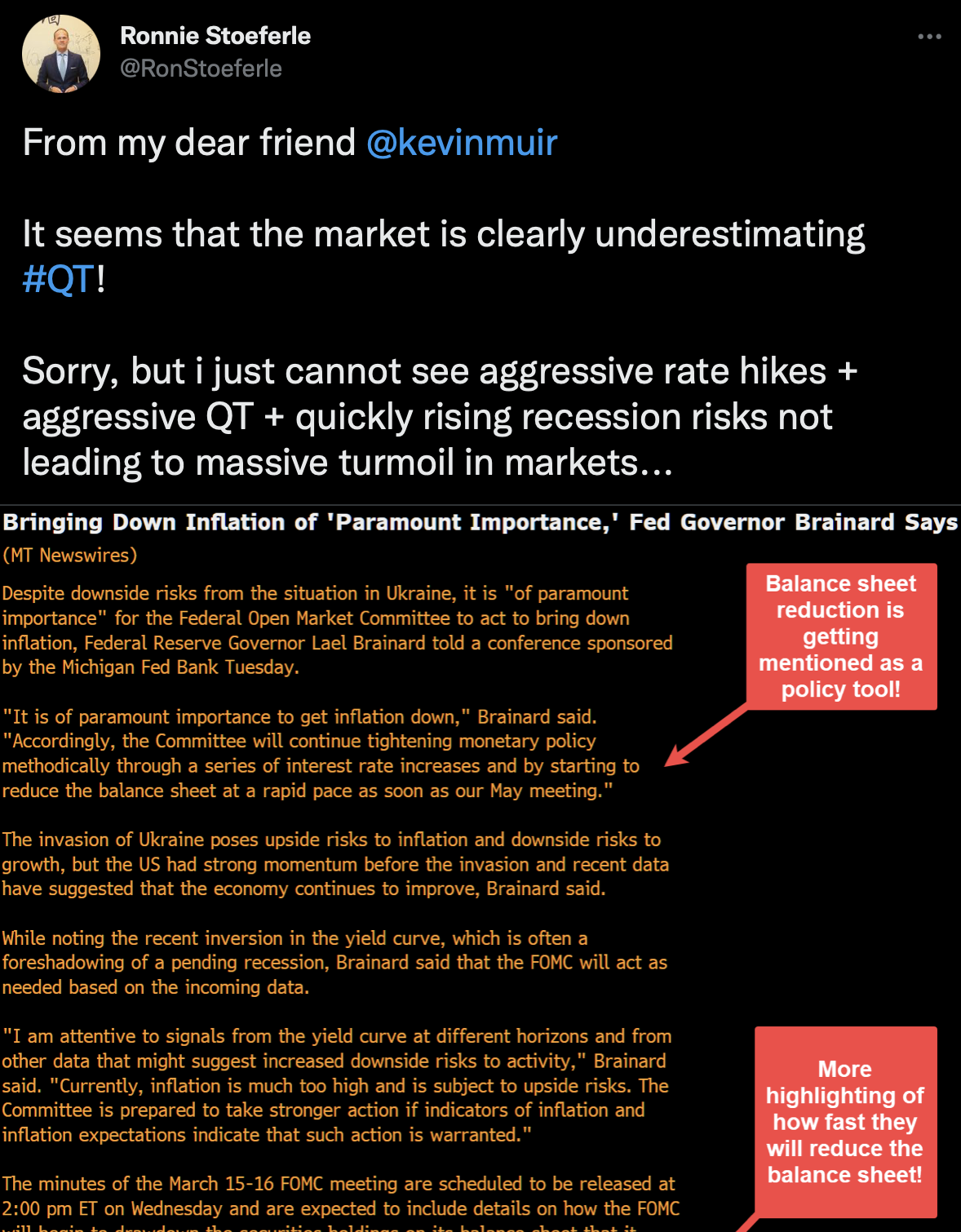

The minutes of the Federal Reserve's (Fed) March gathering released Wednesday revealed that policymakers program to trim the astir $9 trillion portfolio by up to $95 cardinal each month. At that pace, the Fed would request 4 years to shrink the equilibrium expanse to the pre-pandemic level. Many Fed officials said they were prepared to rise involvement rates successful half-percentage-point increments successful upcoming meetings to power ostentation – a far-steeper gait of monetary tightening than the accustomed quarter-point hikes.

That puts the absorption squarely connected the U.S. user terms scale (CPI) for March, owed for merchandise connected Tuesday. The information is expected to amusement the outgo of surviving successful the world's largest system roseate to an annualized 8.3% successful March versus 7.9% successful February, according to Dailyfx.

One communicative is that an other hawkish run by the Fed is already priced successful and that a precocious CPI fig could beryllium a non-event. (Whether the Fed volition beryllium capable to locomotion the speech is simply a taxable of treatment for different day). The Fed minutes are backward-looking, meaning they archer america what policymakers were reasoning successful mid-March, earlier the impending CPI release.

Therefore, an above-8% CPI print, the archetypal since 1982, could spot investors reassess the gait of the Fed's tightening, injecting volatility into bonds and hazard assets.

A large miss connected CPI could temporarily reconstruct the risk-on sentiment. However, a monolithic scaling backmost of complaint hike bets would necessitate consecutive anemic ostentation prints. But, that's unlikely, arsenic per immoderate experts.

"Higher ostentation has go progressively broad-based. Since the commencement of 2021, the stock of items successful the depletion handbasket that person seen precise ample terms rises has accrued steadily," the Bank for International Settlements said in a enactment published connected April 5. "In particular, maturation successful services has accelerated. Because maturation successful work prices tends to beryllium much persistent than that successful goods, ostentation whitethorn beryllium becoming much entrenched."

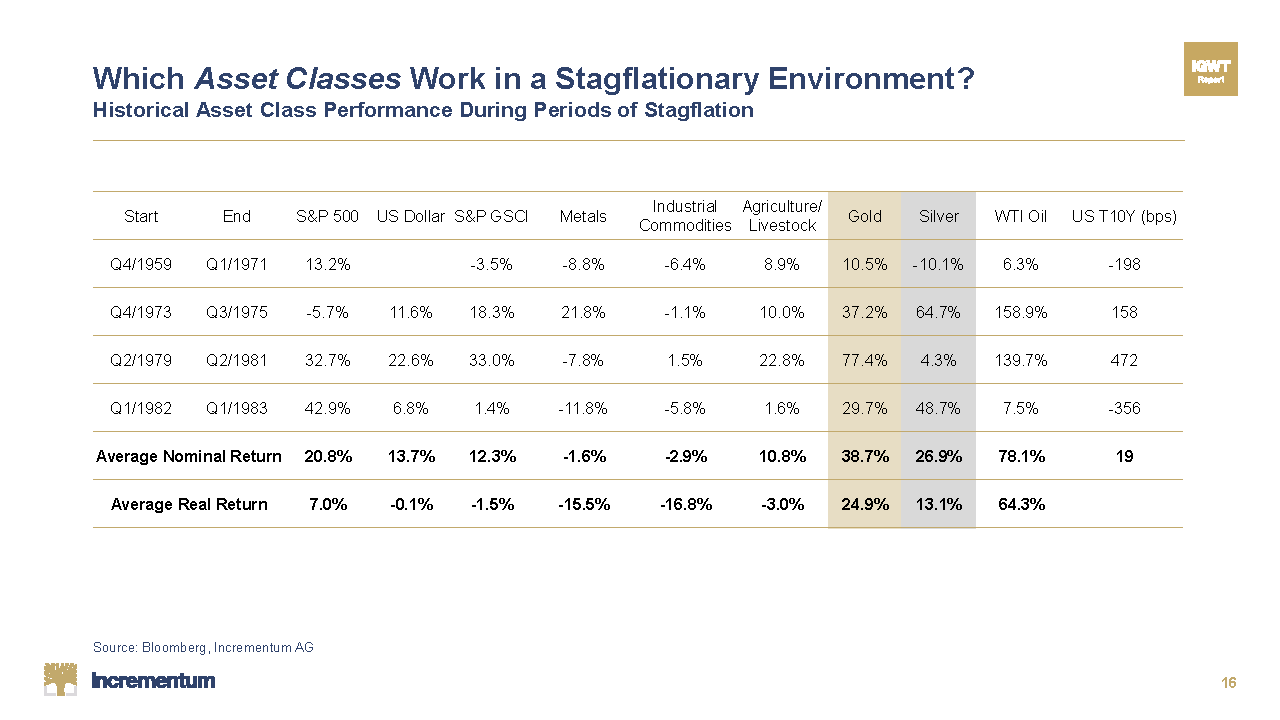

Lastly, bitcoin's rising correlation with equities means it could underperform accepted store of worth assets similar golden successful the coming months. The yellowish metallic and lipid outperformed S&P 500, Wall Street's benchmark index, by important margins during erstwhile periods of stagflation.

History could repetition itself, drafting investors distant from equities, particularly tech stocks and toward energy. Analysts astatine JPMorgan foresee a 40% rally successful commodities successful the coming months.

"In the existent juncture, wherever the request for ostentation hedges is much elevated, it is conceivable to spot longer-term commodity allocations yet rising supra 1% of full fiscal assets globally, surpassing the erstwhile highs,” the JPMorgan strategists wrote successful an April 6 note. All other being equal, that “would connote different 30% to 40% upside for commodities from here,” they said, according to Bloomberg.

A Censorship-Resistant Inflation Index Is Being Built connected Chainlink

Decentralized concern (DeFi) steadfast Truflation is gathering a caller gauge to way ostentation autarkic from the authorities and successful real-time. Think of it arsenic a rival to the Consumer Price Index (CPI), and 1 wherever officials can’t determination the goalposts.

“The model that [the government] is utilizing is simply a 100 years aged … and they person continuously tried to germinate that versus taking a caller attack successful an property wherever we’ve got everything computerized,” Truflation laminitis Stefan Rust told CoinDesk successful an interview.

The squad started gathering Truflation aft erstwhile Coinbase CTO Balaji Srinivasan challenged Web 3 developers to physique a censorship-resistant ostentation feed, claiming that “the centralized authorities isn’t going to supply reliable ostentation stats,” and promising an concern of $100,000.

Today’s newsletter was edited by Omkar Godbole and produced by Bradley Keoun and Stephen Alpher.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)