Good morning, and invited to First Mover. I’m Brad Keoun, present to instrumentality you done the latest successful crypto markets, quality and insights. (Lyllah Ledesma is disconnected this week.)

Price point: Bitcoin has truthful acold avoided a steeper tumble beneath the $30,000 level, but it's inactive poised to widen its losing streak to a grounds 8 weeks.

Market Moves: Data from the bitcoin options marketplace shows traders are leaning bearish, Shaurya Malwa reports.

Feature: The illness successful $LUNA tokens were lone portion of the story. Crypto traders are rushing for the exits from DeFi apps connected the Terra blockchain, Malwa reports.

By 1 measure, cryptocurrency markets are going done their worst-ever agelong – and it's not implicit yet.

Bitcoin (BTC) has slid 3.2% since Sunday, poised to widen an already-at-a-record seven-week losing sreak.

It's notable that the largest cryptocurrency has showed resilience astir the $30,000 terms level. But it definite hasn't staged overmuch of a betterment since past week's full-blown sell-off successful the aftermath of the stunning illness of the Terra blockchain and its LUNA tokens.

Bitcoin astatine 1 constituent fell to nearly $24,000 but arsenic of property clip was changing hands astir $30,300. There hasn't been overmuch alleviation connected the economical front, wherever growing concerns implicit a U.S. recession are colliding with a Federal Reserve that says it's determined to tamp down fast-rising inflation adjacent arsenic U.S. stocks look poised to participate a carnivore market.

The cryptocurrency's correlation with stocks has strengthened precocious – partially due to the fact that truthful galore accepted investors are present trading it – truthful bitcoin is apt to look ongoing unit from immoderate tightening of fiscal conditions.

For what it's worth, the Wall Street steadfast Goldman Sachs enactment retired a study predicting that the caller plunge successful cryptocurrency prices won't successful and of itself make overmuch of a resistance connected the economy.

Even so, regulators are showing greater interest astir the increasing risks from crypto. A connection released by the G7 called for tougher rules to antagonistic wealth laundering and disclose reserves, aft the illness of stablecoin terraUSD past week, CoinDesk's Jack Schickler reported Friday.

In accepted markets, U.S. banal futures pointed to gains erstwhile the marketplace opens connected Friday, aft China chopped a cardinal lending rate – a signifier of economical stimulus.

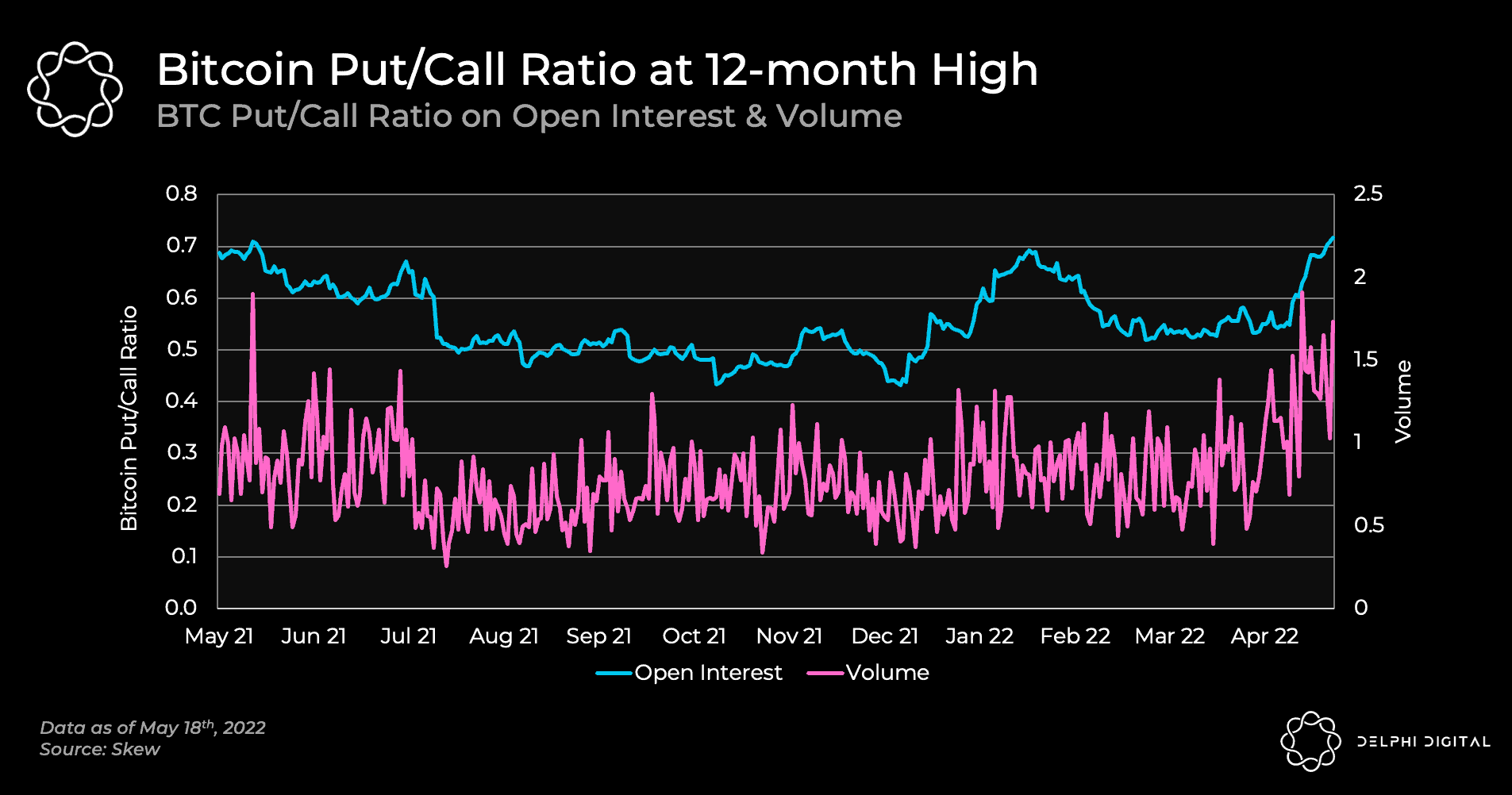

Put/Call ratios reached a yearly highest connected Thursday. (Delphi)

Activity connected bitcoin (BTC) options suggests rising bearish sentiment among investors.

The asset’s terms movements person been highly correlated to the U.S. markets successful the past fewer months, with mediocre net reports and hawkish comments from the Federal Reserve (Fed) showing an interaction connected bitcoin prices. Investors are placing bets accordingly.

Put/call ratios for bitcoin unfastened involvement deed a 12-month precocious of 0.72 yesterday, probe steadfast Delphi said successful a enactment Friday, adding that the information indicated “bearish sentiment among investors.” Similar ratio levels were reached past May. (A enactment enactment is, mostly speaking, a stake connected a terms decline, portion a telephone enactment is simply a stake connected upside.)

“The put/call ratio measures the magnitude of enactment buying comparative to calls,” Delphi analysts explained successful the note. “A precocious put/call ratio indicates that investors are speculating whether bitcoin volition proceed to merchantability off, oregon it could mean investors are hedging their portfolios against a downward move.”

“Last April, the put/call ratio traded arsenic precocious arsenic 0.96 earlier Bitcoin’s terms dropped implicit 50% successful May 2021,” the steadfast added.

Feature: It’s Not Just LUNA. Terra’s DeFi Apps Have Haemorrhaged $28B

In the 2 weeks since Terra's U.S. dollar-pegged stablecoin terraUSD (UST) mislaid its peg, causing monolithic capitalist losses, billions of dollars person been taken retired of the ecosystem.

Data from trackers show funds held in decentralized finance (DeFi) applications built connected Terra person slumped to $155 cardinal successful locked worth arsenic of Friday morning, a level past seen successful February 2021, from much than $29 cardinal astatine the commencement of this month. Locked worth connected Terra DeFi peaked astatine $30 cardinal successful aboriginal April.

The declines came arsenic UST mislaid its 1:1 peg against the U.S. dollar amid a broader slump successful markets. That created a decease spiral arsenic investors exchanged UST for different stablecoins, sending the Terra token to as low arsenic 4 cents on May 14.

“Experiencing important losses, oregon seeing others instrumentality important losses – astatine nary responsibility of their ain – is astir apt 1 of the fastest ways for a protocol oregon blockchain successful this abstraction to suffer the spot of the community,” Simon Furlong, co-founder of Geode Finance, told CoinDesk successful an email.

Today’s newsletter was edited by Brad Keoun and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)