Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Dollar's betterment keeps bitcoin nether $40,000. While Federal Reserve's Chairman Jerome Powell downplayed prospects of a 75 ground points (0.75 percent points) complaint hike successful coming months, the policymaker expressed willingness to tolerate recession to bring down inflation.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Matt Hougan, main concern officer, Bitwise

Mohak Agarwal, CEO, ClayStack

Nicole Buffett, creation director

Joseph Kelly, CEO, Unchained Capital

Bitcoin bulls struggled to support Wednesday's post-Fed betterment rally going, leaving the apical cryptocurrency successful stasis nether $40,000.

The upward momentum stalled arsenic the dollar bounced against large fiat currencies, trimming losses seen precocious Wednesday aft Fed Chairman Jerome Powell downplayed prospects of a 75 ground constituent complaint hike successful coming months.

The dollar scale (DXY), which tracks the greenback's worth against large currencies, jumped 0.7% to 103.25, having dropped 0.9% to 102.51 Wednesday. The futures tied to the S&P 500, Wall Street's benchmark scale and the tech-heavy Nasdaq scale traded astatine slightest 0.5% lower, signaling a anemic unfastened pursuing Thursday's surge. Heading into the meeting, the Fed funds futures saw astir a 40% accidental of a 75 ground constituent hike successful June. Therefore, hazard assets picked up a bid aft Powell dashed hopes of a bigger move.

Observers were unsure if the rally could continue, fixed the Fed has embarked connected a steepest tightening rhythm successful decades. After March's 25 ground constituent hike, the cardinal slope raised rates by 50 ground points yesterday and signaled akin outsize moves successful the coming months. Further, the cardinal slope announced quantitive tightening – the process of reducing the Fed equilibrium expanse – which volition commencement with an archetypal combined magnitude of $47.5 cardinal from June and scope the $95 cardinal level wrong 3 months.

The astir hawkish connection came erstwhile a newsman asked Powell whether the FOMC has the courageousness to endure recessions to bring ostentation down if that were the lone mode necessary. Powell replied, "we won't hesitate to bash it."

"The hawkish Fed expectations whitethorn not fto the bulls instrumentality the reins of the market," Ipek Ozkardeskaya, elder expert astatine Swissquote Bank, wrote successful a LinkedIn post portion noting the post-Fed bounce successful hazard assets.

Brian Tehako, CIO of Warwick Capital, said, "bitcoin could stitchery steam if the DXY breaks down from this [up] trend," adding that the Fed wide was hawkish.

DXY's monthly illustration (TradingView, CoinDesk)

The dollar scale has bounced up from the erstwhile resistance-turned-support, indicating the way of slightest absorption is to the higher side.

The forward-looking U.S. ostentation expectations surged pursuing the Fed complaint decision. So, the Fed officials could edifice to much hawkish jawboning up of the June meeting, keeping gains successful hazard assets nether check.

Lastly, monetary tightening is becoming a planetary phenomenon. The Reserve Bank of India raised rates by 40 ground points yesterday, portion Hong Kong, Saudi Arabia, Kuwait, UAE, and Bahrain matched the Fed's 50 ground constituent hike aboriginal today. The Bank of England raised rates by 25 ground points to 1% soon earlier property time.

Onchain information overgarment bullish picture

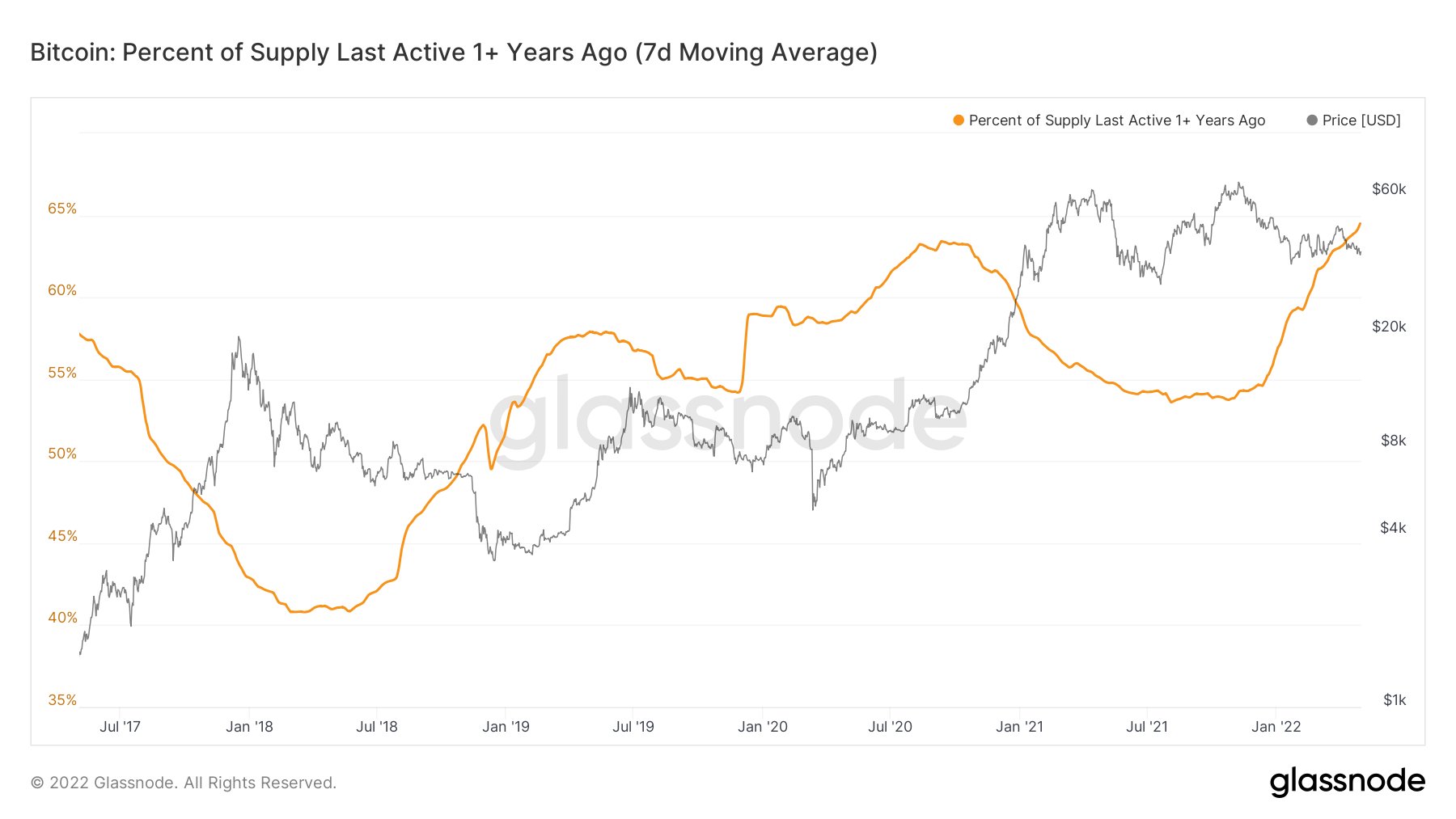

The seven-day mean of the fig of coins past progressive astatine slightest twelvemonth agone has risen to a grounds precocious of 64% of full bitcoin successful circulation, according to information provided by Glassnode.

That's a motion of beardown holding sentiment successful the market, according to Noelle Acheson, caput of marketplace insights astatine Genesis Global.

"If BTC isn't moving, it's a semipermanent holding. At an all-time high. Definitely not nothin," Acheson tweeted.

Percent of bitcoin's proviso past progressive a year ago (Glassnode)

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)