Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin's implied volatility ticks higher up of the Fed complaint decision

Chartist's Corner: Death transverse connected S&P 500.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time. Today’s amusement volition diagnostic guests:

Michael Safai, managing partner, Dexterity Capital

Robbie Ferguson, co-founder and president, Immutable

Bohdan Opryshko, COO, Everstake

Bitcoin's implied volatility is creeping higher up of the Federal Reserve's complaint decision, possibly a motion of traders mounting up options positions that would payment from terms swings successful the starring cryptocurrency.

The annualized one-month implied volatility, investors' expectations for terms turbulence implicit the adjacent 4 weeks, has accrued from 68% to 77% this month, according to information provided by Skew. The three- and six-month gauges person gone up from astir 67% to 74%.

More importantly, the three-month implied volatility has popped backmost supra the backward-looking realized volatility, having underperformed the aforesaid earlier this month.

An uptick successful implied volatility indicates accrued request for options – hedging instruments. A telephone enactment gives the purchaser the close but not the work to bargain the underlying plus astatine a predetermined terms connected oregon earlier a circumstantial date. A enactment enactment represents the close to sell.

Seasoned traders usage options to hedge bullish oregon bearish risks and often bargain some to seizure returns from immoderate macro information merchandise oregon binary-event-related volatility. Buying some telephone and enactment options represents a bullish presumption connected volatility.

Bitcoin's implied volatility (Source: Skew)

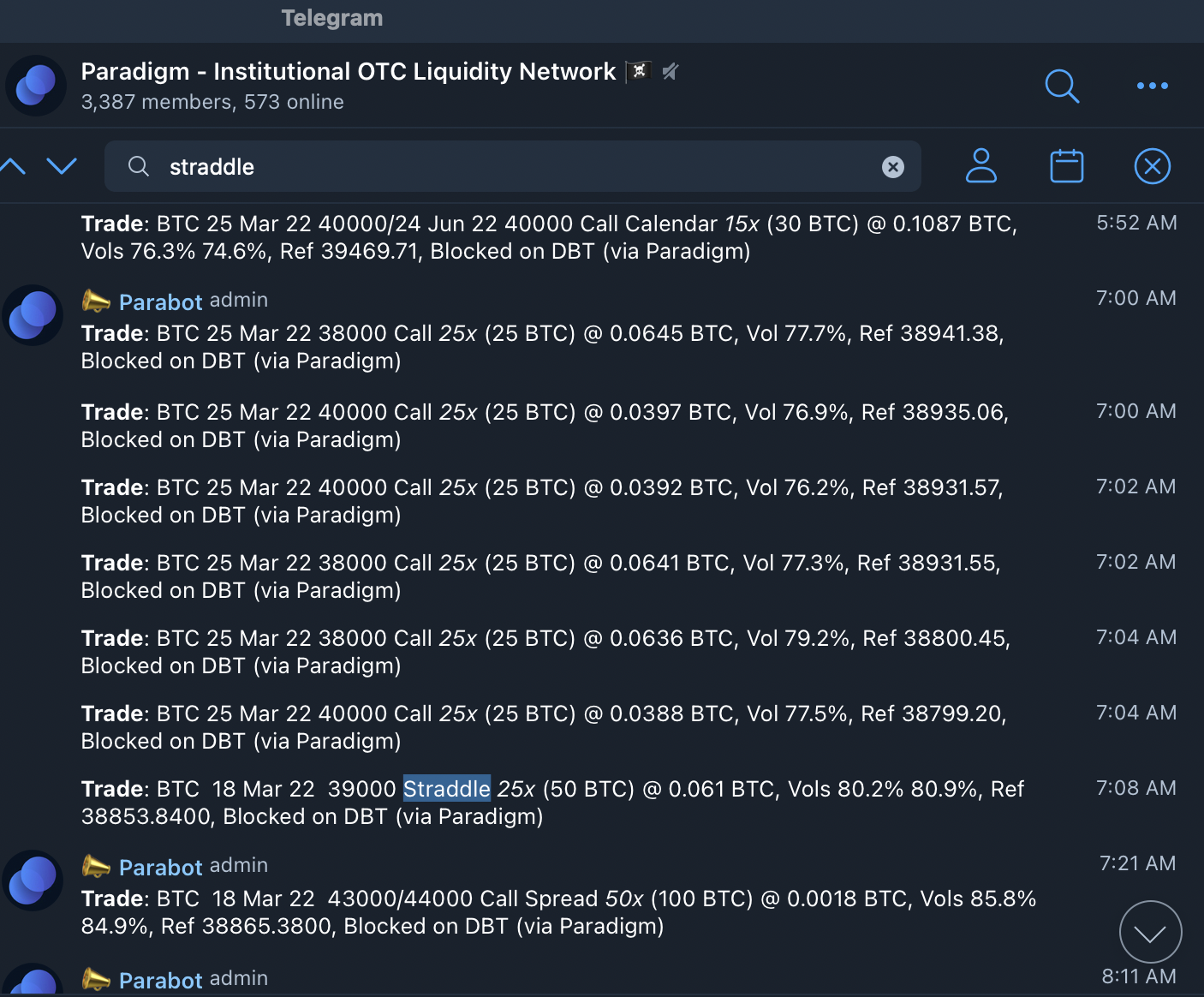

Several orders for straddles and strangles person crossed the portion successful caller days, according to over-the-counter tech level Paradigm's Telegram-based tracker of crypto options flows. Straddle and strangle strategies impact buying some telephone and enactment options and let investors to nett from large moves successful the underlying asset.

The Fed is apt to rise rates by 25 ground points connected Wednesday. And portion the markets whitethorn person priced successful the liftoff, imaginable hawkish guidance could inject volatility into the market, bringing gains to volatility buyers.

While implied volatility gauges person risen successful the run-up to the Fed, overall, they are good beneath the highs seen successful October and November.

Besides, the mode options are priced suggests buying has been chiefly concentrated successful longer duration telephone options disconnected late. Perhaps, these traders are hedging against the hazard of a ample determination to the higher broadside implicit a three-month to one-year clip horizon.

Paradigm's Telegram-based crypto options travel tracker

Daily illustration of S&P 500, Wall Street's bechmark index, shows a decease cross, a bearish transverse of the 50- and 200-day moving averages (MAs).

The semipermanent bearish indicator is accompanied by a head-and-shoulders breakdown, besides a bearish pattern.

Bitcoin tends to determination much oregon little successful enactment with the banal markets.

S&P 500's regular illustration (Source: TradingView)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)