Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin sees aboriginal bounce to $39,000. U.S. 10-year output hits highest since July 2019.

Featured stories: Bitcoin's put-call skews propulsion backmost from February highs. Ether awaits a triangle breakout.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time. Today’s amusement volition diagnostic guests:

Kevin O'Leary, president of O'Shares ETFs, and 'Shark Tank' Co-Host

Jeff Mei, Director of Global Strategy, Huobi Global

Bradley Tusk, laminitis and CEO, Tusk Strategies

Bitcoin's bounce from cardinal terms enactment stalled adjacent $39,000 up of American trading hours, arsenic the futures tied to the tech-heavy Nasdaq 100 scale erased 1% summation and dipped into the red. Meanwhile, the output connected the U.S. 10-year Treasury enactment roseate to 2.10%, the highest since July 2019, according to the illustration level TradingView.

The benchmark output has risen by 40 ground points successful 7 days and astir 60 ground points this year. The U.S. 10-year breakeven ostentation complaint reached a grounds precocious of 2.785% past week, per Federal Reserve Bank of St. Louis.

Historically, bitcoin has chalked up terms rallies successful an situation of rising ostentation expectations and enslaved yields, according to Charlie Morris, CIO astatine ByteTree Asset Management.

However, dollar spot has emerged arsenic 1 of bitcoin's captious nemesis since the March 2020 clang and seems to beryllium stopping the crypto from taking vantage of the ongoing emergence successful enslaved yields. The dollar index, which tracks the greenback's worth against majors, stood conscionable nether 99.0, having deed a 22-month precocious of 99.42 past week.

"If the dollar starts to ease, higher [bitcoin] prices volition follow," ByteTree's Morris tweeted. A large dollar sell-off looks improbable during the adjacent 48 hours arsenic the Federal Reserve is expected to hike rates by 25 ground points connected Wednesday.

Aside from the macro stuff, traders volition intimately ticker the European Union's (EU) ballot connected a draught of the proposed Markets successful Crypto Assets (MiCA) framework, which could person wide ramifications.

"The measure arsenic it is presently framed would necessitate miners to taxable biology sustainability compliance plans. Failing to taxable them would forestall their cognition wrong the EU. The implications of this are immense – the EU is simply a large jurisdiction for crypto mining and crypto much generally, with implicit 10% of planetary bitcoin hash powerfulness emanating from the region," Simon Peters, marketplace expert astatine eToro, said successful an email.

"While not connected the standard of the China bitcoin mining ban, the accusation for the terms of BTC and different crypto assets which travel connected price, could beryllium important successful the adjacent fewer days. The crypto plus marketplace has been buffeted by events and this could pb to different pugnacious trading play if the authorities passes," Peters added.

Bitcoin defended the play Ichimoku unreality support during the Asian hours adjacent arsenic a deteriorating coronavirus outbreak successful mainland China pushed Hong Kong's banal scale to a six-year low.

A tweet by Tesla's CEO Elon Musk that helium won't merchantability bitcoin, ether and dogecoin apt helped the apical cryptocurrency stay resilient to sell-off successful the Hong Kong stocks. The meme cryptocurrency dogecoin besides witnessed a 10% spike, supposedly connected Musk's tweet.

Bitcoin's Put-Call Skews Pull Back, Ether's Triangular Consolidation Continues

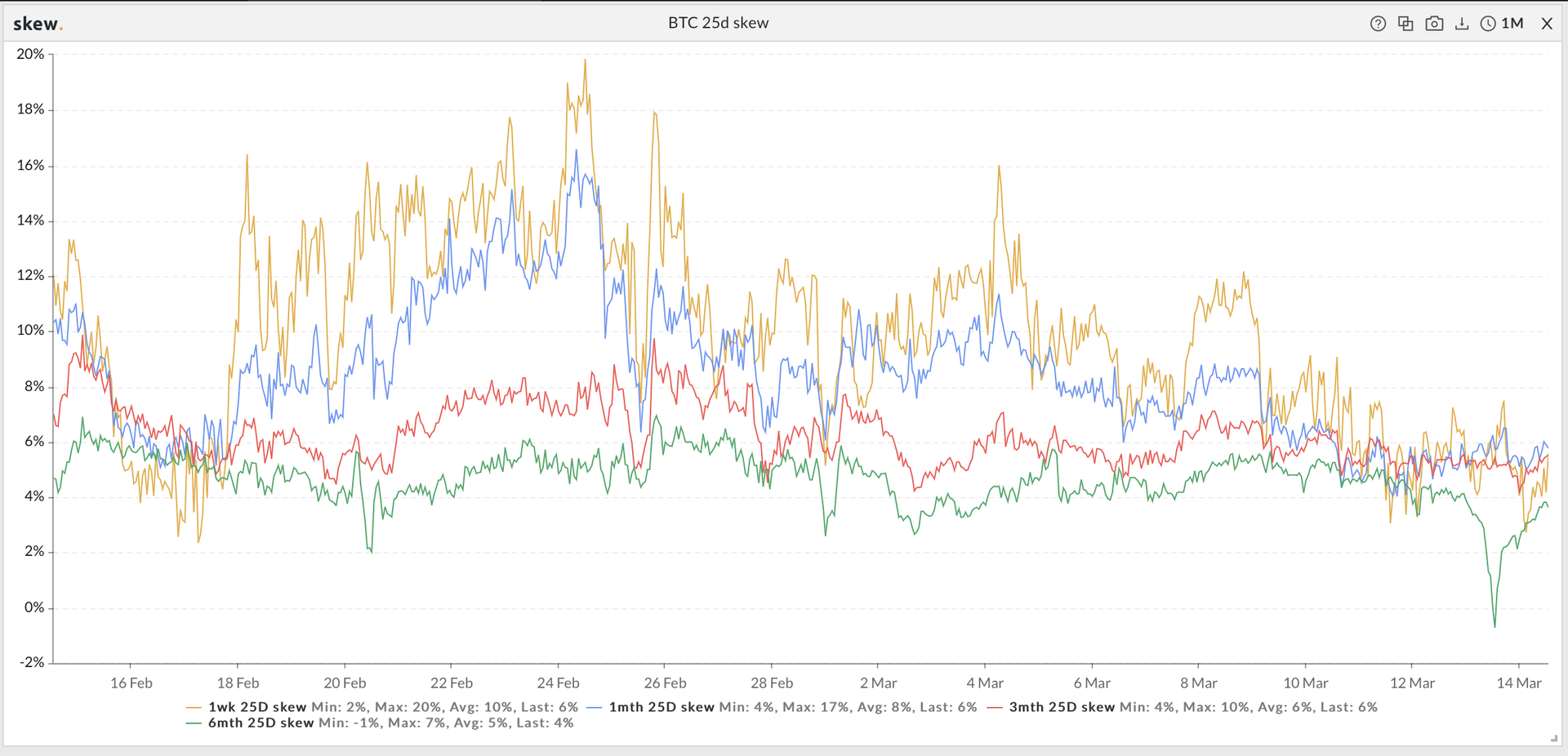

Bitcoin's put-call skews person travel disconnected sharply from the highs seen pursuing Russia's penetration of Ukraine connected Feb. 24. It shows that request for puts oregon options offering downside extortion is present comparatively weaker than 2 weeks ago.

In different words, fears of an extended diminution person subsided, with bitcoin consolidating beneath $40,000 amid a continued diminution successful U.S. stocks.

The six-month put-call skew saw a little dip beneath zero implicit the weekend, implying a comparatively higher request for longer duration calls oregon bullish bets.

According to the institution-focused over-the-counter tech level Paradigm, calls dominated the measurement past week, accounting for 67.7% of the options traded, with the bulk enactment concentrated astatine the March expiry $40,000 strike.

Bitcoin's put-call skews (Source: Skew)

A telephone enactment gives the purchaser the close but not the work to bargain the underlying plus astatine a predetermined terms connected oregon earlier a circumstantial date. A enactment enactment purchaser gets the close to sell.

Put-call skews measurement the implied volatility premium drawn by puts comparative to calls.

Ether awaits scope breakout

Ether has formed a contracting triangle identified by trendlines connecting Feb. 10 and March 2 highs and Jan. 24 and Feb. 24 lows.

A imaginable breakdown would possibly connote a continuation of the broader downtrend.

Ether's daily chart (Source: TradingView)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)