Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin's terms was holding steady, aft the West announced stricter sanctions against Russia and its cardinal slope implicit the weekend.

Featured stories: The bitcoin marketplace shows nary signs of panic adjacent arsenic Goldman predicts precocious ostentation and much Fed complaint hikes.

And cheque retired the CoinDesk TV amusement "First Mover," hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9 a.m. U.S. Eastern time. Today's amusement volition diagnostic guests:

Kapil Rathi, co-founder and CEO, CrossTower

Alona Shevchenko, founder, UkraineDAO

Bitcoin posted mean gains aboriginal Monday portion accepted hazard assets tanked connected concerns that the West's stricter punitive sanctions connected Russia volition propulsion the planetary system into stagflation – a concern successful which an system experiences a simultaneous summation successful terms pressures and stagnation successful growth.

The apical cryptocurrency moved supra $38,000, partially erasing Sunday's 3% drop. Meanwhile, Asian and European stocks tanked, and Dow futures fell 800 points earlier regaining immoderate poise.

The Russian ruble crashed 40% successful Moscow, hitting a grounds debased of 118 per U.S. dollar. The greenback gained crushed crossed the board, with the wealth marketplace showing signs of dollar backing stress.

The starring cryptocurrency remained resilient, possibly having priced the escalation implicit the weekend. Crypto markets are unfastened 24/7, contrary to accepted markets, which are disposable to commercialized 5 days a week.

Bitcoin shows nary signs of panic

The worst-case script of precocious ostentation and debased maturation portion cardinal banks prioritize consumer-price stableness implicit economical enactment and asset-price stableness is progressively looking likely.

Per James Pethokoukis, a columnist and an economical argumentation analyst, strategists astatine Goldman Sachs present expect 4 further rates hikes successful 2023 successful summation to 7 complaint hikes this year. The concern banking elephantine antecedently anticipated 3 hikes adjacent year.

However, the bitcoin marketplace is showing nary signs of panic yet, arsenic evident from the blockchain information and derivatives marketplace activity.

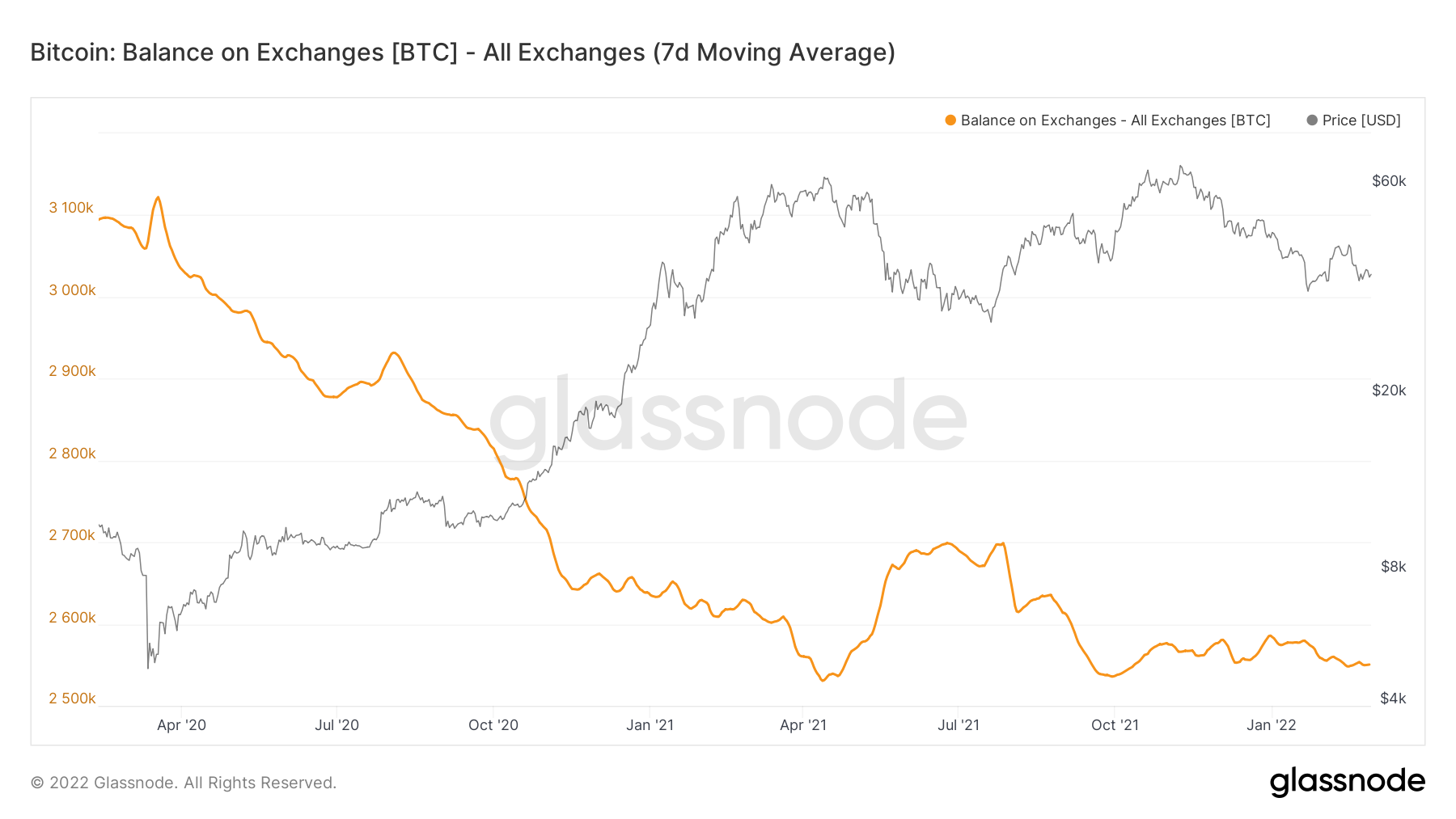

Data provided by blockchain analytics steadfast Glassnode amusement that the seven-day mean of the fig of coins held connected centralized exchanges hovers adjacent multi-year lows reached successful the last 4th of 2021. That's a motion of coagulated holding sentiment.

Bitcoin's speech balance. (Chart by Glassnode)

Investors typically determination their coins to exchanges erstwhile intending to liquidate their holdings.

The put-call skews amusement request for enactment options oregon downside extortion has somewhat weakened contempt the escalation of the situation implicit the weekend. According to information provided by the crypto derivatives probe steadfast Skew, the one-week put-call skew stood astatine 12% astatine property clip versus 18% connected Thursday.

Put-call skews measurement the outgo of puts oregon bearish bets comparative to calls oregon bullish bets.

The crypto assemblage doesn't look disquieted astir prospects of cardinal banks resorting to faster complaint hikes to debar stagflation. Perhaps, investors are anticipating dovish speech from large cardinal banks, fixed the wealth markets are exhibiting signs of accent successful the dollar backing markets.

Early today, the spread betwixt the one-month London Interbank Offered Rate (LIBOR) and Fed rates for one-month contracts widened the astir since March 2020, according to Bloomberg. The widening of the dispersed represents tighter liquidity for the dollar, the planetary reserve currency.

Focus connected the bitcoin-gold ratio

The bitcoin-gold ratio traded astatine nether the 21-month exponential moving mean enactment of 20.50 astatine property time. Acceptance nether the mean whitethorn beryllium costly for bitcoin, arsenic seen successful the past.

Bitcoin-gold ratio's monthly illustration (Source: TradingView)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)