Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Bitcoin's put-call skews proceed to grounds fearfulness of a deeper terms drop. Cardano sees renewed accumulation by whales. Terra-based lending and borrowing protocol Anchor moves to dynamic gain rate.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Sergey Vasylchuk, laminitis and CEO, Everstake

Molly White, editor, Wikipedia

Fear reigns ultimate successful the crypto marketplace arsenic Federal Reserve (Fed) is acceptable to footwear disconnected a two-day gathering aboriginal Tuesday that is apt to extremity with the cardinal slope announcing an outsized 50 ground constituent (half percent point) complaint hike and plans to shrink its astir $9 trillion equilibrium sheet.

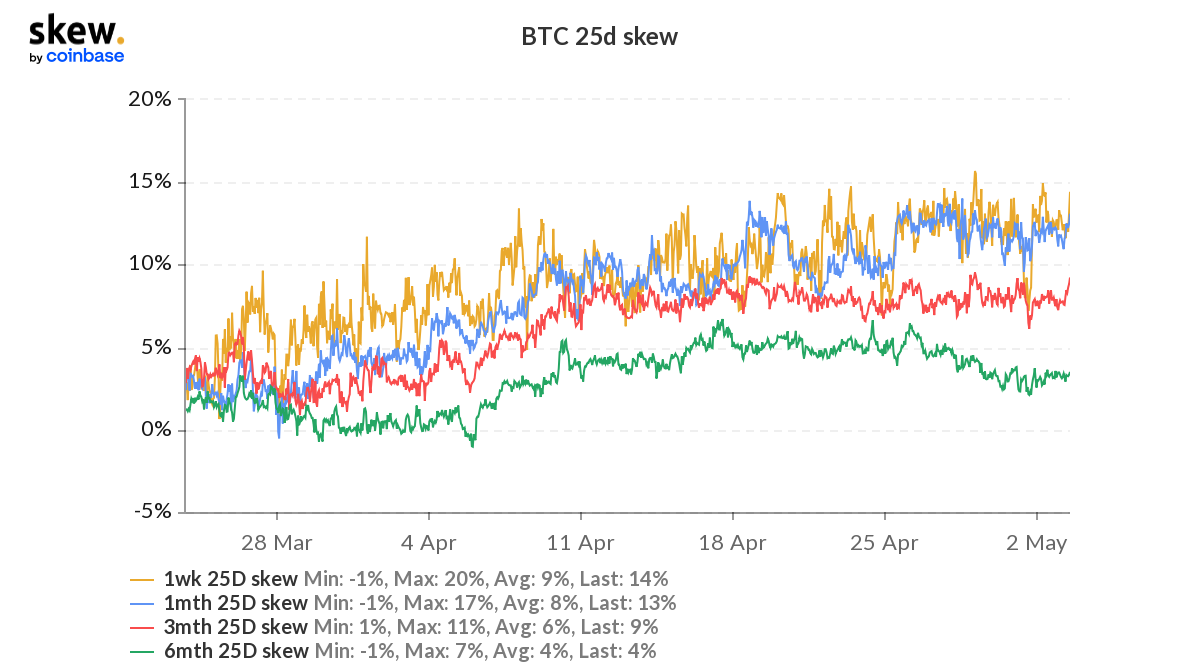

Bitcoin's put-call skews, oregon implied volatility (vol) of calls minus puts, proceed to hover supra zero, indicating stronger request for puts oregon bearish bets.

"Put skew retains a beardown bid," Adam Farthing, main hazard serviceman for Japan astatine crypto trading steadfast B2C2, wrote successful a marketplace update published Monday. "Risk reversals [r/r] are amended bid again for puts (25delta r/r for BTC and ETH astatine 7.0 and 9.0 respectively), reflecting some the oversupply of telephone broadside vol, and the wide macro interest that further USD spot volition correlate with higher generalized volatility."

Bitcoin's put-call skews (Skew)

Data tracked by the crypto derivatives probe steadfast Skew amusement the one-week, one, and three-month put-call skews proceed to March higher. The six-month gauge has travel disconnected from 6% to 3% successful caller days, possibly a motion of renewed optimism astir cryptocurrency's semipermanent prospects.

"We're seeing accordant buying connected precocious 2022/early 2023 options, which tells america that investors are feeling a small gloomy now, but hopeful for aboriginal successful the year," Michael Safai, managing spouse astatine crypto proprietary trading steadfast Dexterity Capital said successful an email. "Perhaps the anticipation is, by then, the results of the Fed's complaint experimentation volition beryllium wide and macro sentiment volition improve."

Safai added that the upside momentum for bitcoin volition request to travel much from banal performance. The banal market's near-term prospects look bleak arsenic expected tightening by the Fed is apt to origin request destruction. The planetary manufacturing activity, measured by the Purchasing Manager's Index, has slipped into contraction, arsenic The Daily Shot tweeted.

Per B2C2, crypto's dependence connected equities looks elevated this week arsenic the Fed, BoE, and RBA are scheduled to denote complaint decisions. Further, the all-important U.S. nonfarm payrolls fig volition beryllium released this Friday. "A large fig could beryllium interpreted arsenic enabling Powell to hike much aggressively this year," B2C2's Farthing said.

Traders looking for clues connected whether bitcoin volition bounce to $40,000 to driblet to $37,000 should support a adjacent oculus connected bitcoin's 4-hour (4H) illustration comparative spot scale (RSI). That's according to method investigation by Nick Mancini, expert astatine crypto sentiment analytics level Trade the Chain.

Bitcoin's 4-hour illustration with comparative spot scale (CoinDesk, TradingView)

"Since mid-April, 4h BTC's RSI has been hovering beneath the existent trend. It is presently investigating the trend, but has yet to marque up its mind," Mancini said successful a play newsletter shared with CoinDesk connected Monday. "If RSI is rejected again, on with the sentiment, we would expect the terms to driblet to $37,000 (white box). If RSI breaks supra the trend, past we would apt spot $40,000 tested."

Cardano whales accumulate

Cardano (ADA) addresses holding 1 cardinal to 10 cardinal ADA person accrued their equilibrium by 196 cardinal coins successful 5 weeks, according to information tracked by blockchain analytics steadfast Sentiment.

The renewed accumulation by whales aft a seven-month play mightiness enactment a bid nether the battered cryptocurrency.

ADA precocious dipped to $0.735, the lowest since February 2021, according to CoinDesk data.

Anchor protocol shifts to dynamic gain rate

Terra-based lending and borrowing protocol Anchor is moving towards a flexible and dynamic deposit rate, abandoning the long-held argumentation of offering a hole complaint of astir 20%.

The complaint volition set dynamically by 1.5% each period depending connected the changes successful the protocol's output reserves. The gain complaint could summation if the reserve rises and vice versa.

"The summation of a semi-dynamic Earn complaint volition lend to the semipermanent sustainability of Anchor & volition payment users of the protocol by enabling output reserve maturation portion continuing to supply an charismatic output connected UST," DeFi contented level Stakingbits noted.

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)