Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Bitcoin's ascent continues arsenic Commerzbank revives hopes of faster mainstream crypto adoption.

Featured Story: Ether's implied volatility points to large determination ahead.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Marc Lopresti, managing director, The Strategic Funds

Josh Hackbarth, caput of NFT commercialized development, Warner Bros

Alessio Quaglini, CEO, Hex Trust

Major cryptocurrencies traded higher, extending the three-day winning inclination arsenic reports of Commerzbank applying for a crypto licence revived hopes of faster mainstream adoption of integer assets.

Bitcoin, the starring cryptocurrency by marketplace value, topped $42,500, having recovered buyers nether $40,000 aboriginal this week. Technical analysts foresee a continued emergence toward the 200-day elemental moving mean located supra $48,000.

Ether, the second-largest cryptocurrency, roseate to recently established absorption supra $3,150. THETA, XMR and CAKE were different notable winners, boasting much than 6% gains connected a 24-hour basis. 0x (ZRX), the autochthonal token down the 0x protocol, rallied by much than 40% pursuing an announcement that it volition powerfulness Coinbase's NFT marketplace.

Germany's Commerzbank (CBK) applied for a crypto licence earlier this year, a spokesperson for the slope said. That makes it the archetypal large slope successful Germany to determination towards crypto adoption.

"Despite retail being fearful and uninterested, organization adoption continues arsenic the second-largest listed slope successful Germany, Commerzbank, has present applied for a section crypto license," Marcus Sotiriou, an expert astatine the U.K.-based integer plus broker Global Block said. "This would let it to supply speech and crypto-asset services and go the archetypal large slope successful Germany to marque this step."

Mikkel Morch, enforcement manager astatine crypto/digital plus hedge money ARK36, said, "We [are] present starting to spot adoption adjacent from immoderate of the astir blimpish players successful the banking field. These moves tin beryllium interpreted arsenic the beginnings of a contention wrong the accepted banking tract to summation a competitory borderline by being the archetypal entity successful its section marketplace to connection crypto services."

"Inevitably, this volition lone velocity up the adoption of crypto arsenic a mainstream fiscal service. However, it besides shows that the request for it is already truthful precocious crossed the full spectrum of banking clients that it compels entities that were antecedently hostile to crypto to wholly alteration course," Morch added.

The continued involvement from institutions and task superior firms is what differentiates the existent crypto carnivore marketplace from the past 1 seen successful 2018. Back then, accepted institutions stayed distant from integer assets, and galore radical near crypto jobs and moved to accepted finance.

In accepted markets, futures tied to the S&P 500 signaled risk-on with a 0.6% gain. The dollar scale dropped portion the euro roseate connected hawkish comments by the European Central Bank members.

Traders cited ECB President Christine Lagarde's code and Federal Reserve Chairman Jerome Powell's code arsenic the cardinal lawsuit to ticker retired for. some policymakers are scheduled to talk connected Thursday astatine 15:00 UTC.

Hawkish comments whitethorn dilatory down bitcoin's ongoing ascent and the expected emergence toward the 200-day average.

Ether's Implied Volatility Points to Big Move Ahead

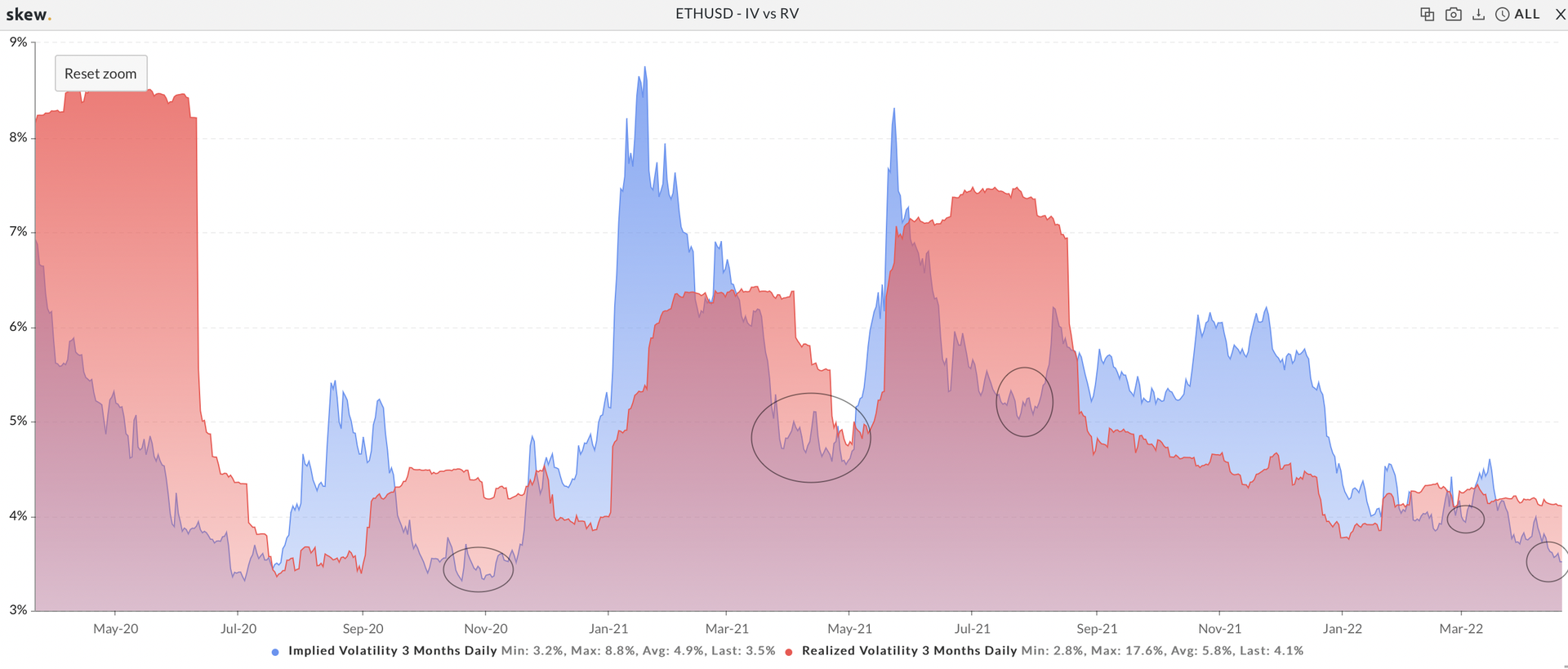

Ether's three-month implied volatility (IV) dropped to 3.5%, the lowest since November 2020. Implied volatility refers to options traders' expectations for terms turbulence implicit a circumstantial period.

The IV is present the cheapest comparative to humanities volatility since July 2021, according to information provided by Skew.

Historically, akin patterns person paved the mode for large moves successful ether.

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Sheldon Reback.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)