Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

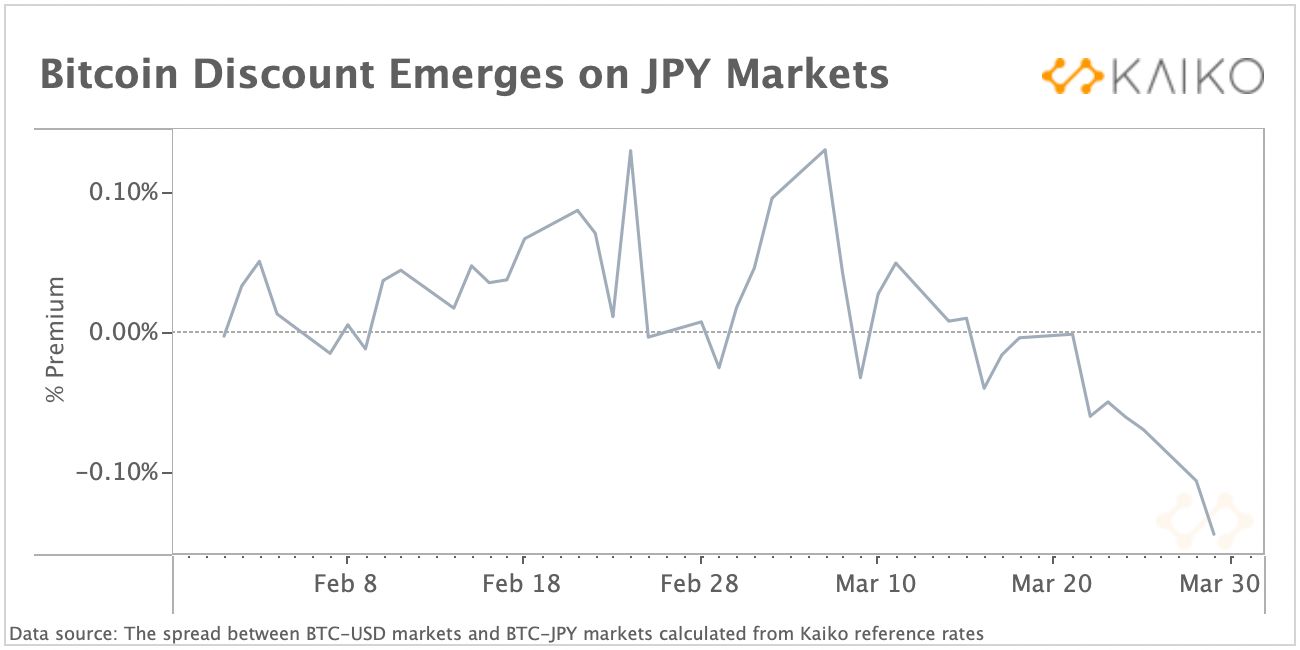

Market Moves: Bitcoin trades astatine a discount successful the JPY markets.

Derivatives Insight: Open involvement successful AAVE soars.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Damanick Dantes, markets reporter, CoinDesk

Charlotte Principato, fiscal services analyst, Morning Consult

Rep. Stephen Lynch, Massachusetts (D)

While the Japanese yen's caller descent has frightened the country's vigor buyers, the capitalist assemblage seems to beryllium impervious to the heightened fiat currency volatility.

The yen depreciated 8% to 125 per U.S. dollar successful 3 weeks ended connected Monday earlier recovering to 121 per dollar aboriginal today, though it is inactive down 6% for the period and the year. Several analysts are disquieted that the Federal Reserve's plans to present rapid-fire complaint hikes and the Bank of Japan's persistent easing bias could spot the yen weakening to 150 per dollar wrong 12 months.

Even so, bitcoin is trading astatine a discount successful the Japanese yen market, according to information tracked by Paris-based Kaiko Research. The dispersed betwixt the BTC/USD and BTC/JPY markets flipped to antagonistic aboriginal this period arsenic the yen started to suffer ground.

In different words, bitcoin doesn't look to beryllium drafting sasfe-haven bids from investors exposed to the descent successful the Japanese yen. The cryptocurrency is wide perceived arsenic a gold-like store-of-value plus and traded astatine a 6% premium connected Binance’s Ukrainian hryvnia (UAH) market pursuing Russia's penetration successful February.

According to Daisuke Kobayashi, strategical fiscal serviceman astatine Tokyo-based fintech bundle and IT concern systems supplier xWIN, the wide content that a anemic yen is simply a boon for banal markets seems to beryllium keeping haven request for bitcoin nether check.

"Only a fewer Japanese investors person noticed [the yen fall]," Kobayashi told CoinDesk successful a LinkedIn chat. "There is besides a welcoming mood, which is wrong, arsenic they judge that a weaker yen volition rise the terms of stocks."

Bitcoin trades astatine a discount successful JPY markets. (Kaiko)

Historically, determination has been a near-linear narration betwixt the yen and Japanese stocks. BOJ politician Haruhiko Kuroda told Parliament past week that "there is nary alteration to my presumption that a anemic yen is mostly affirmative for Japan’s economy."

Thus, the lack of premium successful the BTC/JPY marketplace is not astonishing – much truthful arsenic the yen is simply a G-7 currency and a acold stronger portion than Ukraine's hryvnia, considering it is backed by forex reserves of $1.38 trillion, the 2nd largest successful the world. Further, according to Kobayashi, crypto forms a tiny information of an mean Japanese investor's portfolio.

"The 1.18 trillion yen ($9.8 billion) worthy of cryptocurrency held by users astatine Japanese exchanges arsenic of January was besides a fraction of Coinbase's $278 cardinal successful December," a Nikkei Asia nonfiction dated March 22 said.

That said, crypto adoption whitethorn boom, not conscionable successful Japan, but besides elsewhere successful Asia and different parts of the world, if the rising enslaved yields unit the Bank of Japan to wantonness its six-year-old output curve power program, nether which it allows the 10-year authorities enslaved yields to determination 25 ground points (0.25 percent point) astir the 0% target.

The BOJ has led the Fed and different precocious federation cardinal banks successful implementing other mean measures by a decennary oregon so. Besides, the curve power programme moving since 2016 has indirectly kept yields nether power successful Asia and successful precocious nations. Hence, if the Japanese cardinal slope abandons curve control, determination could beryllium a crisp emergence successful yields and hazard aversion. Perhaps, markets whitethorn instrumentality that arsenic a hint of an eventual nonaccomplishment of unconventional tools crossed the globe.

The 10-year Japanese output has precocious challenged the 0.25% people respective times, due to the fact that of ostentation fears and rising planetary yields. The two-year German output has turned affirmative for the archetypal clip since 2015.

That has forced the BOJ to measurement up purchases. Early Monday, the BOJ said it would bargain unlimited bonds for 4 days to guarantee the output remains nether 0.25%. The cardinal slope tin support printing wealth for decades, but volition the marketplace respond arsenic intended? The instrumentality of diminishing marginal utility seems to beryllium catching up, arsenic evident from the upticks successful enslaved yields.

Investors tin nary longer disregard the developments successful Japan.

USD/JPY versus MSCI Japan index/MSCI World Index (Bloomberg)

Open Interest successful AAVE Soars

Data tracked by IntoTheBlock shows the dollar worth locked successful the fig of unfastened positions successful perpetual futures contracts tied to AAVE, the autochthonal token of Aave protocol, has risen to a multi-month precocious of $220.6 million.

Daily measurement successful the perpetuals marketplace has jumped to $1.34 billion, the highest since Oct. 27.

The operation of rising unfastened involvement on with a sustained uptick successful the token's terms suggests a sizeable fig of agelong positions are being opened, IntoTheBlock said successful its Telegram channel.

AAVE was trading adjacent $235 astatine property time, representing a 17% summation connected the day. The token has doubled successful 2 weeks.

Open involvement successful AAVE (IntoTheBlock)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)