Good morning, and invited to First Mover. I’m Lyllah Ledesma, present to instrumentality you done the latest successful crypto markets, quality and insights.

Market Moves: Bitcoin traders took a beating overnight arsenic agelong liquidations surged, portion Tether's USDT stablecoin mislaid its $1 peg.

Feature: We instrumentality a look astatine what Terra thinks is the easiest mode to instrumentality the UST to a peg.

Bitcoin (BTC) concisely deed lows of $25,200 successful the aboriginal hours of Thursday greeting arsenic Tether's stablecoin USDT lost its $1 peg, continuing this week's carnage successful crypto markets.

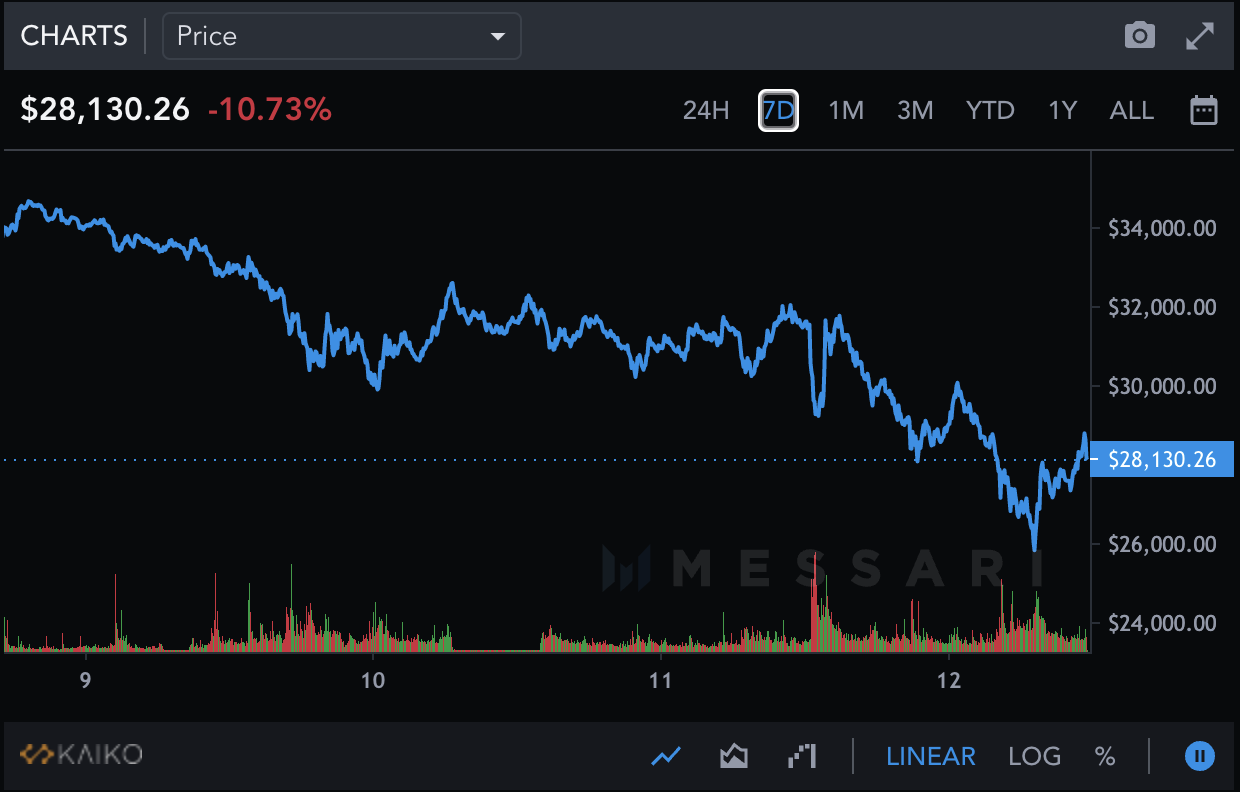

Bitcoin is trading down 20% implicit the past 7 days and has not seen levels this debased since December 2020.

USDT, the world’s largest stablecoin by marketplace capitalization, dipped to 97 cents successful Asian hours, losing its parity with the U.S. dollar. It deed arsenic debased arsenic 96 cents connected Coinbase.

Terra’s UST stablecoin besides continued to flounder, hitting levels arsenic debased arsenic $0.28, according to CoinDesk data.

“UST de-pegging has caused market-wide ripple effects,” said Charles Storry, caput of maturation astatine Phuture, a crypto scale platform. “What we are seeing present is panic. People moving for the exits and losing faith.”

In accepted markets, the S&P 500 has mislaid implicit 4.5% this week. The Nasdaq Composite fell to its lowest level since November 2020, falling by much than 3%.

Over the past 7 days, BTC has not pushed supra the $35,000 mark, according to information from Messari.

Martha Reyes, caput of probe at BEQUANT said successful an email with CoinDesk that the markets successful meltdown mightiness contiguous an accidental for organization players to commencement gathering positions and propulsion stablecoin regularisation to supply much confidence.

“While we can't telephone the bottommost and correlations among plus classes stay elevated, bitcoin has survived corrections of 70-80% successful the past. This whitethorn beryllium an accidental for institutions to physique positions astatine amended levels,” said Reyes.

She added: “The uncertainty astir stablecoins is simply a interest and could pb to different flush-out but we whitethorn yet get the much-needed regulatory model that could entice institutions in. Regulators thin to beryllium reactive, truthful this whitethorn beryllium the catalyst for greater stablecoin regulation.”

BTC agelong liquidations took a beating overnight too. According to information from Coinglass, implicit the past 24 hours, $430 cardinal was liquidated.

Long liquidations took up $277 cardinal and shorts accounted for $198 million.

“This is simply a modular lawsuit you spot successful accepted futures markets and is present taking its toll connected the crypto markets owed to the nascent plus and the deficiency of experienced investors utilizing these instruments,” said Hashdex’s caput of Europe, Laurent Kssis.

According to Kssis, the information that agelong liquidations are dominating the marketplace could propulsion the terms of BTC down further.

“$30,000 was the cardinal enactment level truthful $25,000 could beryllium a absorption present the $30K level has been broken,” said Kssis.

Terra Proposes Token Burn and Increase successful Pool Size to Stop UST Dilution

Terra believes that the downwards unit connected UST’s peg is diluting Luna, impeding betterment for some portion creating an excess of UST, and the mode to lick this is done burning UST and expanding the disposable excavation of Luna.

“The superior obstacle is expelling the atrocious indebtedness from UST circulation astatine a clip accelerated capable for the strategy to reconstruct the wellness of on-chain spreads,” said Terra successful a Tweet.

Algorithmic stablecoins similar UST are expected to beryllium automatically pegged to the terms of different currency. As explained successful a prior CoinDesk larn article, traders tin swap LUNA for UST astatine $1 careless of the marketplace terms due to the fact that the algorithms successful the backend volition negociate the proviso of LUNA creating capable scarcity to warrant the $1.

A token burn refers to taking crypto retired of circulation on the blockchain. It tin beryllium thought of arsenic a deflationary event, due to the fact that it would summation the worth of the remaining blockchain. For token holders, it would beryllium a akin lawsuit to a stock buyback.

In a proposal enactment guardant to token holders, Terra said that it wants to pain the astir 1 cardinal UST (roughly $690 million) successful the assemblage excavation portion expanding the Base Pool of LUNA disposable to 100 cardinal which successful crook increases minting capableness to implicit $1 billion. This volition assistance expedite the outflows of UST from the system, and frankincense pushing it backmost person to its peg, portion pushing down the terms of Luna.

“Currently, the burning of UST is excessively dilatory to support gait with the request for excess UST to exit the system, which is hindered by the BasePool size,” reads the proposal. “Eliminating a important chunk of the excess UST proviso astatine erstwhile volition alleviate overmuch of the peg unit connected UST.”

Some comments connected the connection asked if this happened due to the fact that of a bug successful Terra’s coding, oregon if it was besides a merchandise of a broader marketplace downturn driven by the diminution successful bitcoin’s price.

Validators of the web are capable to ballot for this proposal. According to a ballot tracker, the Yes broadside has received 50.47% of the ballot portion the abstain broadside has 49.1%. 87.8% of eligible voters person already formed a ballot, and the walk threshold is 50%.

Today’s newsletter was edited by Lyllah Ledesma and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)