Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin, equities awesome hazard reset arsenic West sanctions Russia for invading Ukraine.

Featured stories: Declining "Buy The Dip" mentions connected societal media suggest fading "hopium."

And cheque retired the CoinDesk TV amusement "First Mover," hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time. Today's amusement volition diagnostic guests: Michael Sonnenshein, CEO, Grayscale Investments; Ben Schiller, managing editor, features, sentiment and probe astatine CoinDesk and Laura Shin, writer of "The Cryptopians." Grayscale is owned by Digital Currency Group, the genitor institution of CoinDesk.

Bitcoin and the U.S. banal futures trimmed aboriginal losses arsenic the White House, European Union and the U.K. signaled economical sanctions connected Russia successful effect to President Putin's determination to nonstop troops into eastbound Ukraine and formally recognized 2 rebel-held regions successful the country.

According to the Financial Times, Boris Johnson, U.K. premier minister, said the "first barrage of economical sanctions" would beryllium announced connected Tuesday, informing that Putin was bent connected a "full-scale penetration of Ukraine."

While it is challenging to pin down the nonstop origin of the betterment successful bitcoin and banal futures, the West's determination to steer wide of subject engagement and inflict economical harm via sanctions whitethorn person calmed fears of a full-scale warfare and enactment a level nether plus prices.

"This is simply a strategical decision for Putin and a full-scale warfare is adjacent little apt aft contiguous than before," macro money manager Igor Schatz tweeted.

The going enactment successful the currency markets hints astatine a continued hazard reset successful crypto and banal markets during the American trading hours. The growth-sensitive Aussie dollar and Kiwi dollar were trading 0.5% and 0.64% higher against the safe-haven greenback arsenic of penning and the AUD/JPY was up 0.74%.

Bitcoin was trading adjacent $37,700 astatine property time, representing a 1.8% summation connected the day, and the futures tied to the S&P 500 were down 0.3%. The cryptocurrency fell to a 20-day debased of $36,250, and banal futures were down 1% during Asian trading hours connected fears that a warfare would beryllium intolerable to avoid.

Fading 'Hopium' and Thin Liquidity

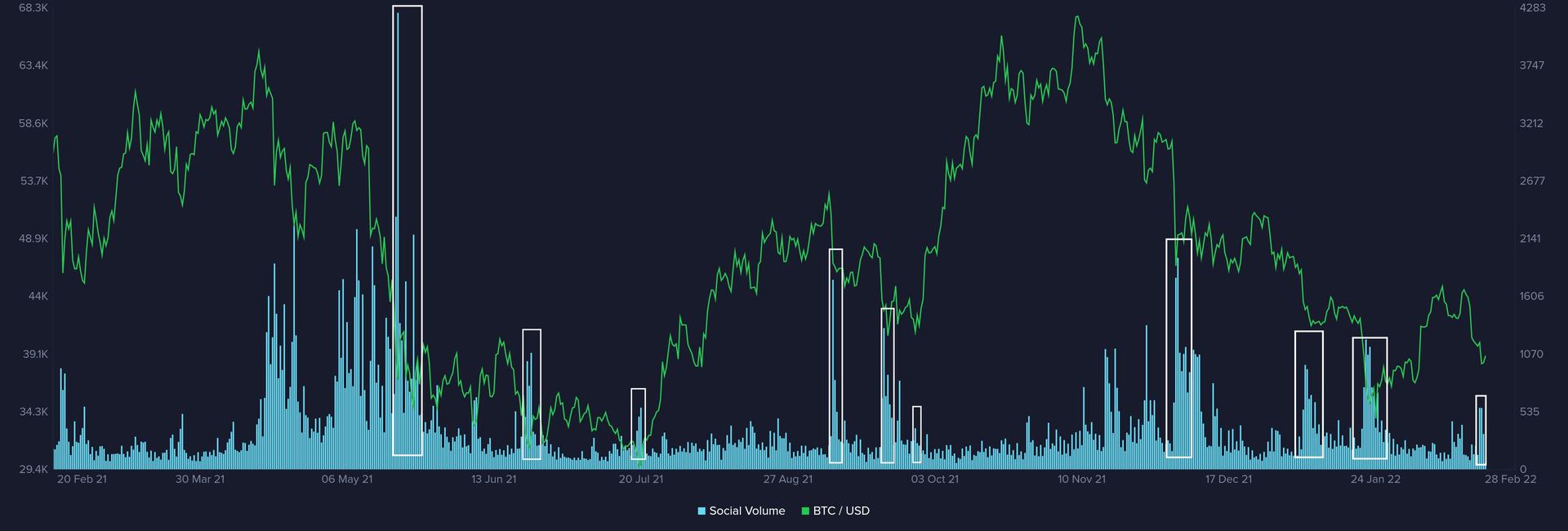

Data tracked by blockchain analytics level Santiment shows "buy the dip" mentions connected societal media proceed to diminution successful a motion of fading "hopium" – crypto slang for hopes of a speedy betterment and a continued bull run.

Pullbacks typically extremity with assemblage sentiment leaning cautious oregon bearish, arsenic is the lawsuit now.

"The signifier that we person recognized is simply a 3 question of Buy the Dip mentions during the downtrend each little than the erstwhile 1 and aft 3 waves the bottommost occurs earlier the marketplace recovers," Santiment's marketplace insights blog noted precocious Monday.

Buy The Dip mentions connected societal media and bitcoin's price. (Chart by Sentiment)

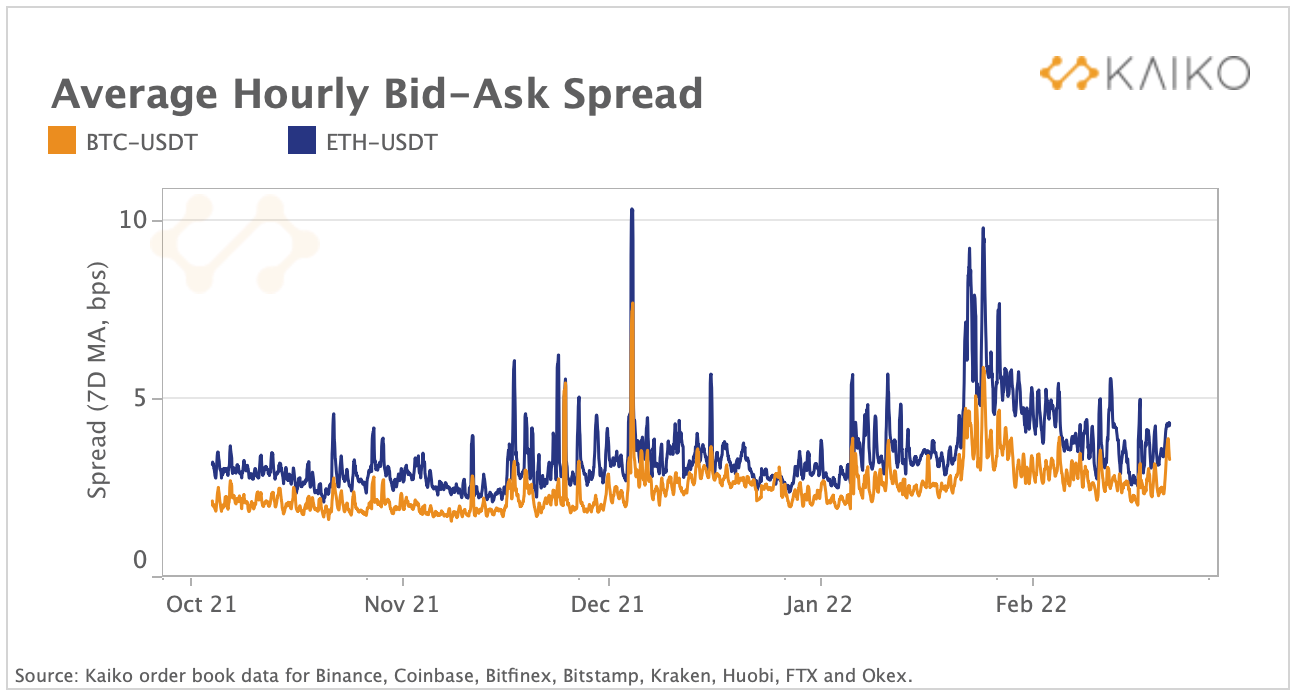

Market moves could beryllium convulsive arsenic liquidity measured by mean hourly bid-ask spreads is thinner than 2 months ago.

"Over the past 2 months, the bid-ask dispersed for Bitcoin and Ethereum USDT-denominated trading pairs connected the biggest exchanges has widened and go much volatile than the erstwhile fewer months," Kaiko Research's play newsletter said.

However, liquidity is overmuch amended than what it was during the January terms slide.

Kaiko takes into relationship information from 8 large exchanges, including Binance and Coinbase, to support a tab connected however liquidity is behaving market-wide.

The terms betterment whitethorn person a fillip from the derivatives marketplace activity.

Data provided by Santiment amusement bitcoin's perpetual futures market was aligned bearish aboriginal today, with funding rates, oregon outgo of holding agelong positions, dipping into the antagonistic territory.

So, a continued terms betterment whitethorn unit shorts to unwind their trades, starring to an exaggerated determination to the higher side.

Meme token SHIB's 50-day moving mean (MA) crossed beneath its 200-day MA, confirming the archetypal decease cross, a method signifier indicating imaginable for a large sell-off.

That said, the decease transverse is based connected backward-looking moving averages and are unreliable arsenic standalone indicators.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)