Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Ether-bitcoin implied volatility dispersed suggests investors are focused connected macro factors. Bitcoin shorts surge connected Bitfinex.

Featured stories: U.S. output curve signals recession.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time. Today’s amusement volition diagnostic guests:

David Gan, laminitis and wide partner, OP Crypto

Pavel Kravchenko, co-founder, Distributed Lab

Major cryptocurrencies traded successful acquainted terms ranges portion accepted hazard assets picked up a bid aboriginal Friday aft Russian President Vladimir Putin reportedly said determination were immoderate "positive shifts" successful talks betwixt Russia and Ukraine.

While bitcoin bounced 1.3% to astir $40,000, it remained locked successful a six-week triangle pattern identified by Jan. 24 and Feb. 24 lows and Feb. 10 and March 2 highs. Ether, the second-largest cryptocurrency, besides traded similarly.

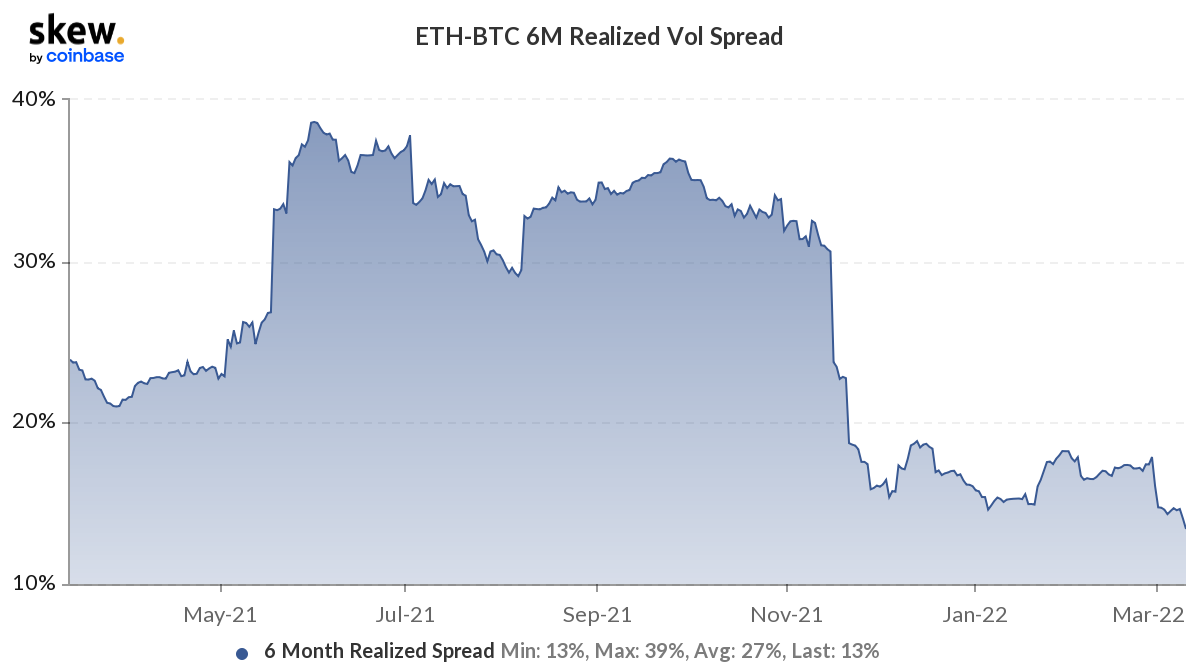

The dispersed betwixt the six-month ether and bitcoin implied volatilities fell to a two-year debased of 13%, possibly indicating that the cryptocurrencies' fortunes are much powerfully tied to each different than before. Implied volatility refers to investors' expectations for terms turbulence implicit a circumstantial period.

Ether-bitcoin six-month implied volatility dispersed (Source: Skew)

Perhaps, the communal unit driving the 2 could beryllium the adjacent week's Federal Reserve meeting. The cardinal slope is expected to assistance borrowing costs by 25 ground points and connection much clues connected erstwhile and however it plans to shrink its equilibrium sheet.

The long-short ratio connected Bitfinex, 1 of the apical 10 crypto exchanges by trading volumes, tanked astir 70% to the lowest since July 2021, arsenic the fig of bearish bets surged.

Some investors took it arsenic a warning of an impending drop, portion others anticipated a potential abbreviated squeeze that would nonstop bitcoin higher.

Bitcoin's long-short ratio connected Bitfinex (Source: TradingView)

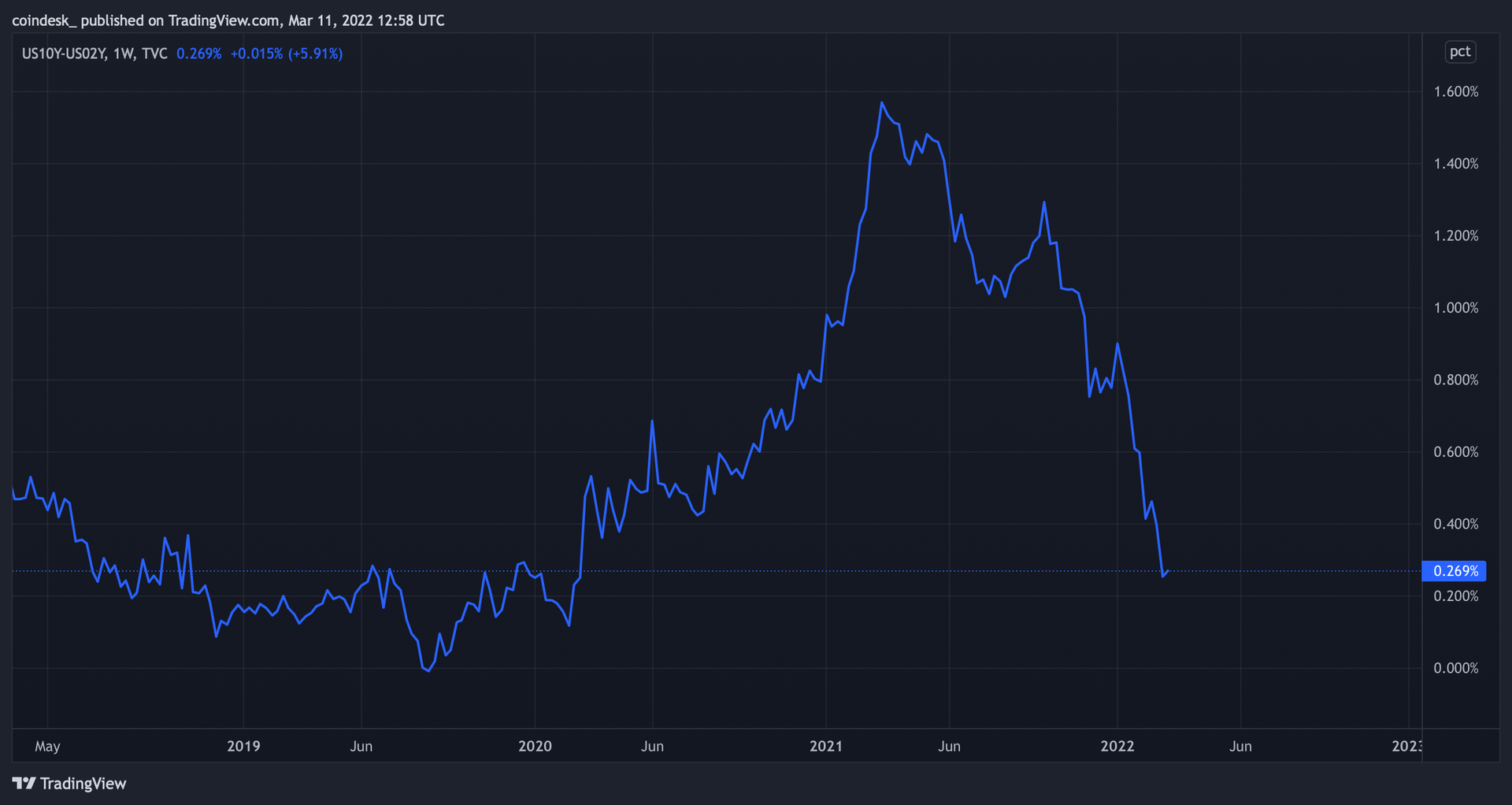

US Treasury Yield Curve Close to Signaling Recession

The U.S. Treasury output curve has collapsed, with the dispersed betwixt yields connected 10-year and two-year notes sliding to a two-year debased and conscionable 26 ground points abbreviated of inversion – a recession signal.

A curve inversion is erstwhile short-term borrowing costs emergence supra semipermanent borrowing costs.

In a enactment published Thursday, Goldman Sachs warned of a U.S. recession adjacent year, putting the probability astatine 35%, according to Bloomberg. Further, the concern slope downgraded their maturation forecast for 2022, citing soaring lipid prices and economical fallout from the ongoing Russia-Ukraine subject conflict.

Recession fears whitethorn bode good for assets with a safe-haven appeal. While bitcoin's nexus with the existent economical enactment is inactive comparatively weak, the cryptocurrency tends to determination oregon little successful tandem with hazard assets, chiefly high-beta stocks, as discussed successful Tuesday's First Mover edition.

U.S. Treasury output curve, oregon dispersed betwixt the 10- and two-year yields (Source: TradingView)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)