Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin, ether driblet arsenic investors reassess bearish implications of lingering macro uncertainty.

Featured stories: Investors successful the cryptocurrency options markets are showing little request for extortion against prolonged terms declines successful ether (ETH), the autochthonal cryptocurrency of the Ethereum blockchain. Trading indicators suggest that determination mightiness a large determination coming successful the ratio betwixt ether’s terms and bitcoin’s, known arsenic ETH/BTC.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Tim McCourt, elder managing director, CME Group

Daniel Lacalle, main economist, Tressis

Damanick Dantes, markets reporter, CoinDesk

Bitcoin slipped to $42,000, pausing the post-Fed betterment rally arsenic the U.S. banal futures pointed to a anemic open. Ether fell nether $3,000, with illustration traders waiting for a bullish UTC adjacent supra captious absorption connected method charts.

Market participants continued to measure the implications of the caller hawkish moves by the Federal Reserve up of U.S. President Joe Biden's Europe travel to sermon further sanctions connected Russia.

"My instrumentality present is that fundamentals are precise supportive, but fearfulness of borderline hazard appetite contagion is holding backmost the terms action," Ilan Solot, a spouse astatine the Tagus Capital Multi-Strategy Fund, said successful an email.

"The caller bounce successful planetary equities – concurrent with spiking inflation, hawkish Fed, and warfare – has near galore investors unconvinced the betterment is sustainable," Solot added.

The cryptocurrency's 90-day correlation to the S&P 500, Wall Street's benchmark index, has deed a 17-month precocious of 0.495.

In different words, the cryptocurrency's near-term prospects look tied to U.S. stocks and a continued rally successful the S&P 500 could spot bitcoin summation much ground. On Tuesday, the S&P 500 closed supra its 200-day moving mean – the archetypal alleged bullish adjacent successful a month.

Ether Options Shed Bearish Skew, ETH/BTC Eyes Big Move

The request to support against a prolonged weakness successful ether appears to person waned, according to information provided by the crypto derivatives analytics steadfast Skew.

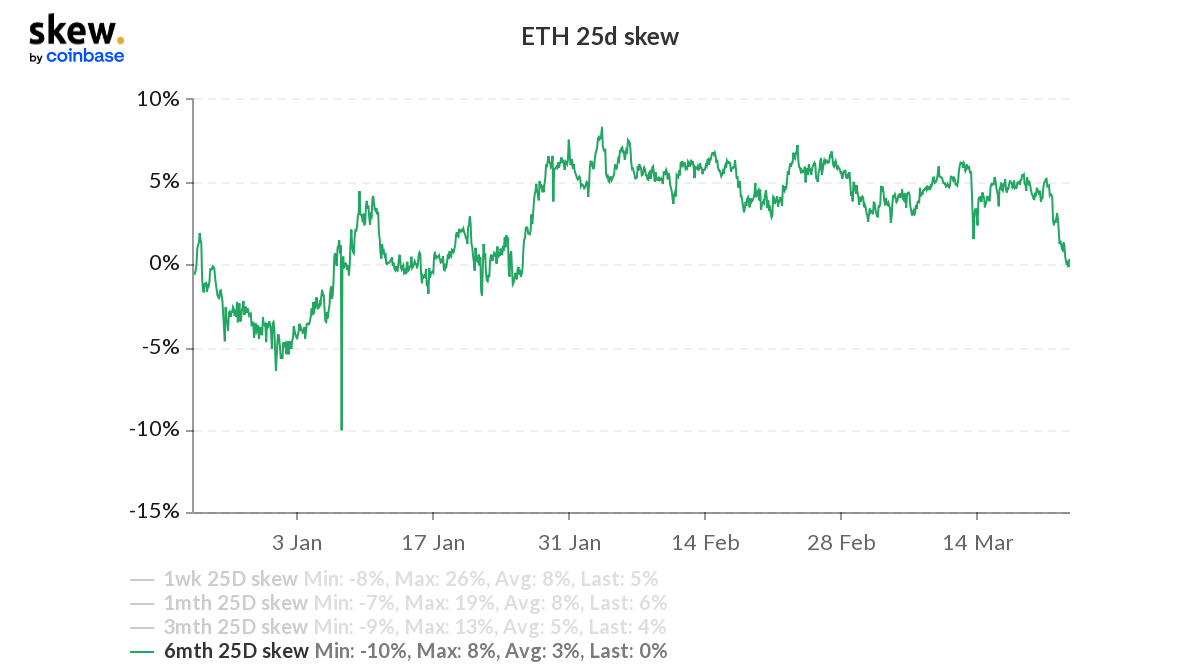

The six-month put-call skew, which tells however overmuch little onslaught puts expiring successful six months are being bid up versus higher onslaught calls, has declined from 5% to 0% this week, shedding bias for puts oregon bearish bets offering downside extortion for the archetypal clip since Jan. 25.

The semipermanent gauge has flipped from bearish to neutral a week aft Ethereum developers successfully tested the long-awaited merge of the programmable blockchain's proof-of-work and proof-of-stake chains, dubbed Eth 2.0.

The upgrade volition let users to clasp coins successful a cryptocurrency wallet to enactment web operations successful instrumentality for recently minted coins and is apt to interaction ether's terms positively, analysts told CoinDesk.

Ether: Six-month put-call skew. (Skew)

The turnaround validates the bullish breakout connected ether's regular illustration confirmed connected Monday.

While the one-week, one- and three-month skews person retreated from February highs, they proceed to amusement a penchant for puts, meaning fears of a short-term pullback persist. Given the lingering geopolitical uncertainty and U.S. recession fears, that's hardly surprising.

The dollar worth dedicated to ether options contracts has topped the $6 cardinal people for the archetypal clip successful much than a month. On Friday, ether options worthy $2.28 cardinal are acceptable to expire.

Ether-bitcoin volatility dispersed suggests a large determination successful ETH/BTC

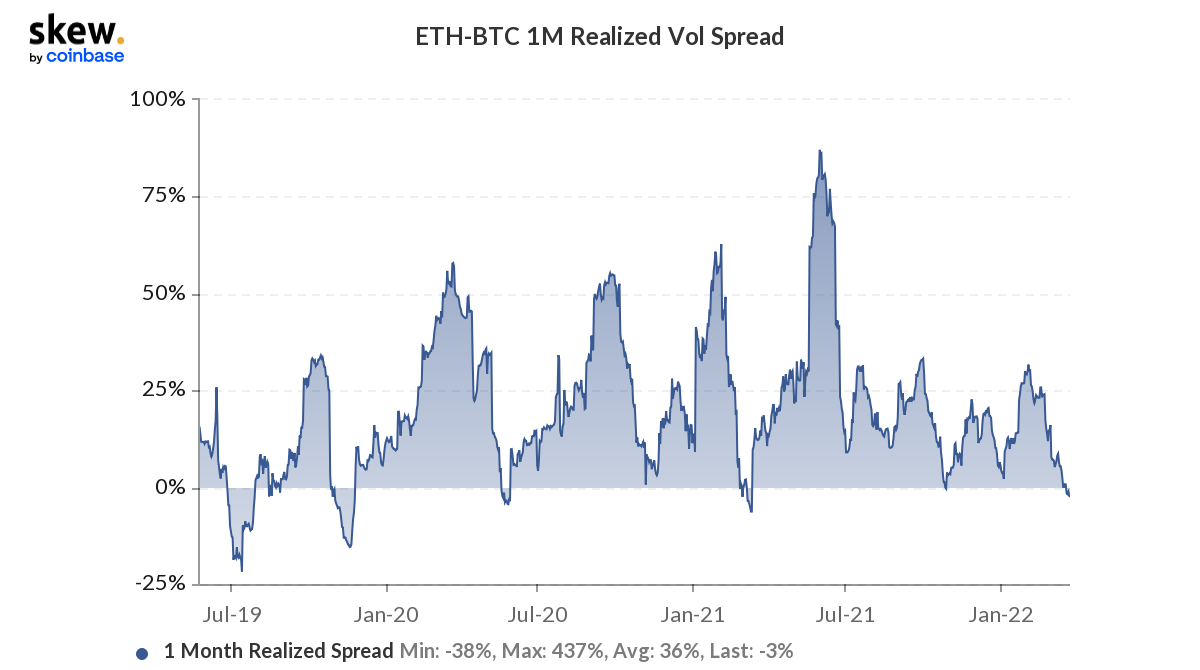

The dispersed betwixt the one-month implied volatility (IV) for ether (ETH) and bitcoin (BTC), a measurement of expected comparative terms turbulence betwixt the two, has turned antagonistic for the archetypal clip since March 2021, per information supplier Skew.

In different words, ether's implied volatility is trading astatine a discount to bitcoin for the archetypal clip successful a year. Historically, the antagonistic ether-bitcoin IV dispersed has marked the opening of large rallies successful the ether-bitcoin (ETH/BTC) ratio.

For instance, ETH/BTC rallied implicit 180% to 0.082 successful the weeks pursuing the implied volatility spread's antagonistic crook successful mid-March 2021. The ratio doubled to 0.040 successful little than 2 months aft the implied volatility dispersed dipped beneath zero successful mid-May 2020.

Outsized gains successful astir alternate cryptocurrencies usually travel a rally successful the ether-bitcoin ratio. "The fundamentals for ETH are aligned for a determination upwards, nevertheless a rally successful ETH would besides apt pb to an alt-wide rally crossed the board," Matthew Dibb, COO and co-founder of Stack Funds, told CoinDesk successful a WhatsApp chat.

ther-bitcoin one-month implied volatility spread. (Skew)

ETH/BTC was trading adjacent 0.07 astatine property time, according to charting level TradingView.

"We are seeing immoderate spot successful ETH, peculiarly comparative to different assets successful the ecosystem. ETH/BTC is present trading astatine astir 0.07 again and volition soon maine gathering immoderate short-term method absorption astatine 0.072,"Dibb added.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)