Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Cryptocurrencies disregard a hawkish code from Federal Reserve Chair Jerome Powell as Goldman’s archetypal over-the-counter bitcoin enactment commercialized revives hopes of stronger mainstream information successful digital-asset markets.

Featured stories: Liquid staking elephantine Lido's LDO token doubles successful little than a month. DASH's method illustration shows a bullish breakout.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Joe Vezzani, co-founder and CEO, LunarCRUSH

Marc Chandler, managing manager and main marketplace strategist, Bannockburn Global Forex

Emin Gun Sirer, laminitis and CEO, Ava Labs

Cryptocurrencies gained crushed aboriginal Tuesday arsenic recession fears and expectations of a Federal Reserve (Fed) complaint chopped successful 2023, coupled with renewed hopes of stronger organization participation, overshadowed president Jerome Powell's hawkish comments.

Bitcoin topped $43,000, hitting the highest since March 3, portion ether, the autochthonal token powering Ethereum's blockchain, rose implicit 4% to $3,050. The full crypto marketplace capitalization accrued by 3.7% to $1.9 trillion, according to information provided by the charting level TradingView.

On Monday, the New York-based digital-asset fiscal institution Galaxy Digital announced a palmy execution of the archetypal over-the-counter (OTC) crypto transaction with the concern banking elephantine Goldman Sachs successful the signifier of a bitcoin non-deliverable enactment oregon NDO.

"This marks the archetypal OTC crypto transaction by a large slope successful the U.S. arsenic Goldman Sachs continues expanding its cryptocurrency offerings, demonstrating the continued maturation and adoption of integer assets by banking institutions," Galaxy said.

Galaxy's announcement is pivotal arsenic products similar non-deliverable options and non-deliverable forwards supply a model to accepted investors looking to summation vulnerability to crypto markets without holding the existent cryptocurrency. Thus, their availability could bring much mainstream investors to crypto markets.

"NDFs and different OTC derivatives could beryllium an important measurement to unlock request from accepted investors looking to summation vulnerability successful the abstraction but person operationally challenged," Ilan Solot, spouse astatine the Tagus Capital Multi-Strategy Fund, said successful an email.

A non-deliverable enactment is simply a derivative declaration cash-settled for the quality astatine its maturity alternatively than the existent transportation of the underlying asset. Similarly, a non-deliverable guardant is simply a setup wherever parties hold to instrumentality other sides of a transaction settled for currency astatine the expiry.

These instruments are rather fashionable successful the overseas speech markets, particularly for clients operating successful countries with a non-convertible oregon partially convertible currency similar the Indian rupee. In specified cases, overseas investors conflict to marque a carnal currency settlement.

Last year, B2C2, a crypto liquidity supplier and over-the-counter trader, conducted its archetypal transaction of a crypto non-deliverable guardant with trading steadfast QCP Capital.

Lido Token Leads Crypto Market Higher

LDO, the autochthonal token of liquid staking elephantine Lido, was starring the broader marketplace higher with a 16% summation connected a 24-hour basis, according to information root Messari.

The token picked up a bid adjacent $1.47 successful the 2nd fractional of February adjacent though the broader crypto marketplace suffered losses connected Russia's penetration of Ukraine and precocious roseate deed highs adjacent $4.00. That's a 172% summation successful little than 4 weeks.

According to observers, the token has benefitted from the rising popularity of liquid staking and the staking derivative token's adoption by decentralized concern (DeFi) protocols.

"It is apt owed to expanding consciousness of imminent Ethereum merge and the inclusion of Lido staked ETH successful DeFi elephantine Aave arsenic collateral," CK Cheung, concern expert astatine DeFiance Capital, told CoinDesk successful a Telegram chat.

"Lido is the ascendant subordinate successful ether liquid staking, which is acceptable to payment from the Ethereum merge with higher staking yields. Having staked ETH included successful Aave helps with superior efficiency," Cheung added.

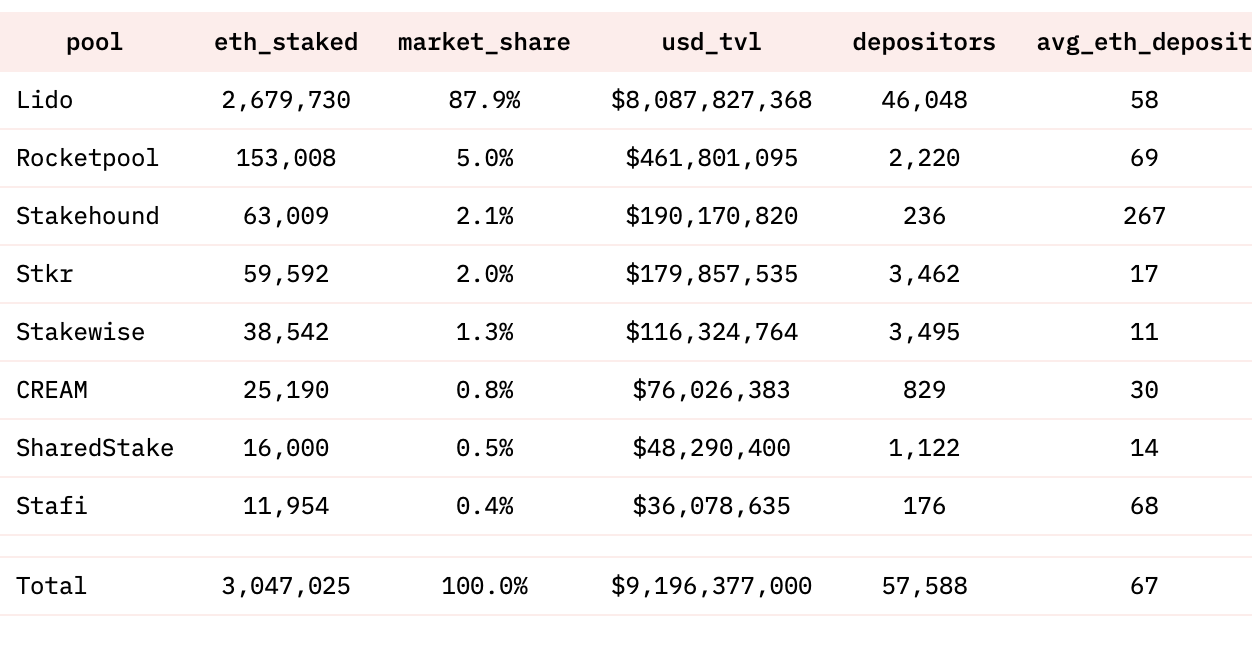

Lido is 1 of the largest entities staking ether, with implicit 2.5 cardinal ether deposited into the liquid staking protocol.

Ether liquid staking balances. (Dune Analytics)

Liquid staking protocols allow holders of tokens to involvement their assets without losing liquidity. Stakers person a derivative token oregon liquid practice of the staked plus that tin beryllium utilized to gain other output elsewhere.

DASH's regular terms chart. (TradingView/CoinDesk)

DASH has topped the Ichimoku cloud, confirming a bullish reversal. The cryptocurrency has besides recovered acceptance supra the horizontal absorption enactment astatine $120.

Previously called darkcoin, DASH is simply a cryptocurrency designed specifically for payments.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)