Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin stuck astatine 100-day moving mean arsenic European stocks and euro slide.

Featured stories: Record debased bitcoin futures premium connected Binance indicates capitulation and marketplace bottom. ProShares bitcoin futures ETF registers inflows.

And cheque retired the CoinDesk TV amusement "First Mover," hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9 a.m. U.S. Eastern time. Today's amusement volition diagnostic guest:

Tanvi Ratna, founder, Policy 4.0

Kevin Owocki, founder, Gitcoin

Bitcoin failed to bushed a cardinal price-resistance level aboriginal Wednesday amid mixed enactment successful accepted markets and reports of the adjacent circular of bid talks betwixt Ukraine and Russia.

The biggest cryptocurrency by marketplace worth reached regular highs astatine the descending 100-day moving mean (MA) hurdle astatine $45,000 earlier retreating to $44,000, according to illustration level TradingView. The cryptocurrency was inactive up 28% from past Thursday's one-month lows.

The full crypto marketplace capitalization rose past $2 trillion, arsenic alternate cryptocurrencies charted a much important betterment rally alongside bitcoin's bounce. Programmable blockchain Terra's LUNA token roseate to a two-month precocious of $96, taking the week-on-week summation to 92%.

The crypto betterment looked acceptable to proceed connected accrued request from Russia and Ukraine and arsenic ostentation expectations surged and accepted markets priced retired prospects of assertive monetary tightening by cardinal banks.

"Bitcoin is connected a dependable footing here, but we whitethorn conscionable accrued absorption astir $46,000 handle," Matthew Dibb, COO and co-founder of Stack Funds, said. "Recent moves person shown grounds of the correlation betwixt BTC and equities dropping; however, this is simply a important period for economical information that whitethorn clasp immoderate surprises."

"We judge this whitethorn prolong successful the adjacent word fixed that determination are caller money inflows for the period that indispensable beryllium allocated," Dibb added.

While futures tied to the S&P 500 rose, European stocks dipped and the euro-U.S. dollar speech complaint slipped to its lowest since March 2020. Markets apt saw the European system taking a comparatively bigger deed from the Ukraine-Russia warfare and the West's punitive sanctions connected Moscow.

Gold took a bull breather portion oil, concern metals and grains were bid again, hinting astatine hotter ostentation successful coming months. Even so, wealth markets continued to standard backmost bets of monetary argumentation tightening by the Federal Reserve and the European Central Bank.

Leverage Traders Capitulate, Hinting astatine Market Bottom

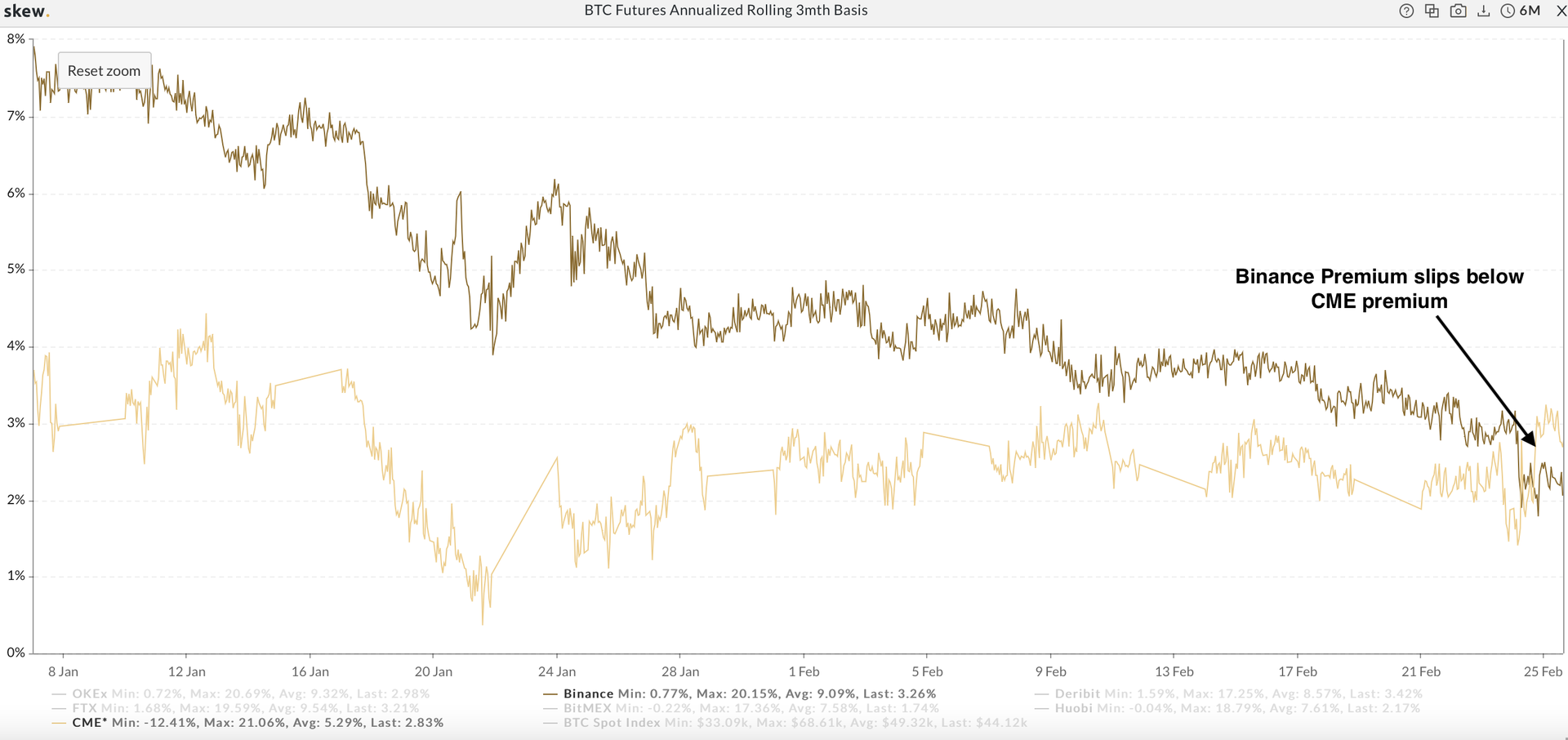

The annualized rolling three-month premium successful bitcoin futures listed connected crypto speech Binance fell to grounds lows aboriginal this week, hinting astatine capitulation and marketplace bottom.

"Binance's 24-hour mean ground [spread betwixt futures and spot prices] reached a caller all-time debased connected Monday of 1.17%, beneath the bottommost 1.18% seen connected July 21, 2021. This points towards a precise pessimistic sentiment among leveraged traders and, yes – a motion of capitulation," Vetle Lunde, marketplace expert astatine Arcane Research, told CoinDesk successful a Twitter chat.

Offshore crypto trading platforms similar Binance and Bybit connection comparatively precocious leverage than the regulated Chicago Mercantile Exchange and are considered a proxy for retail leverage traders. While Binance offers 20x leverage, the CME offers 2-3x with overmuch stricter borderline requirements.

Capitulation refers to a concern erstwhile traders liquidate their loss-making positions during extended marketplace declines successful fearfulness of incurring deeper drawdowns. It's a motion of utmost pessimism and panic selling typically seen astatine the extremity of carnivore markets.

So, the grounds debased Binance premium possibly indicates that bitcoin's carnivore run, which began astatine dizzy heights of $69,000 successful mid-November, has tally its course.

Supporting that decision is the comparative optimism connected Chicago Mercantile Exchange, which represents institutions and ample traders.

Chart of bitcoin's annualized rolling three-month terms premium, connected Binance and CME. (CoinDesk)

The CME three-month rolling premium has stabilized successful the 2% to 3% scope since hitting lows nether 1% successful January, information provided by crypto derivatives probe steadfast Skew show. Last week, the CME futures traded astatine a higher premium than those listed connected Binance – the archetypal specified lawsuit since March 2020.

"The information that CME's ground bottommost coincided with BTC's January bottommost and has since grown suggests that astute wealth has a much affirmative outlook connected the marketplace onwards, compared to its peers," Lunde noted.

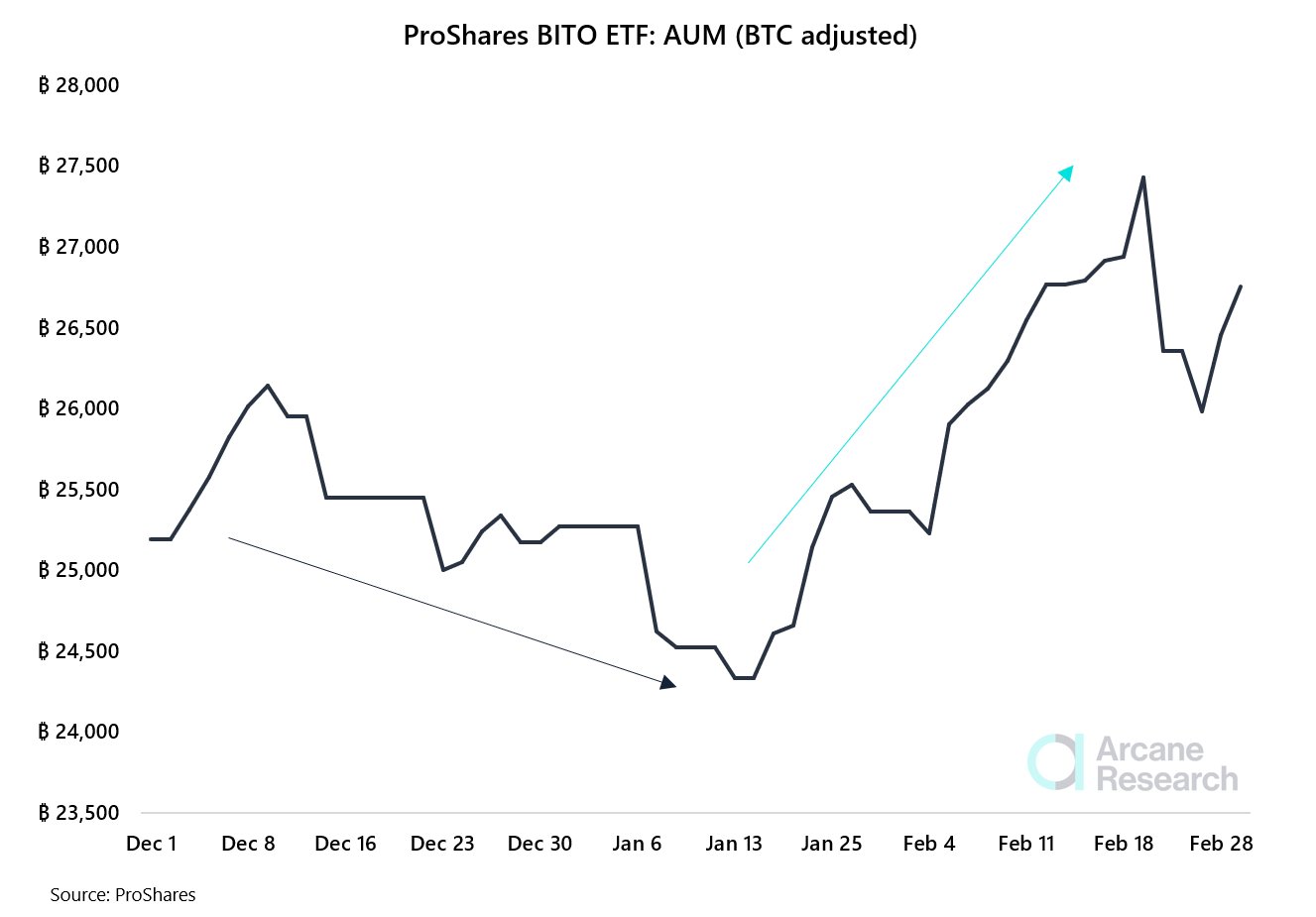

The comparatively higher premium connected the CME astatine least, successful part, stems from accrued inflows into ProShares's bitcoin futures-based exchange-traded money (ETF).

The fund's full assets nether absorption (AUM) roseate from astir 24,500 BTC to 27,500 BTC successful the 4 weeks to mid-February earlier precocious falling to 27,000 BTC, shown by Arcane Research. The ProShares bitcoin ETF was launched successful October connected the New York Stock Exchange nether the ticker BITO.

"Strong inflows to the BITO ETF lend to CME's unchangeable and subtle increasing basis," Lunde said.

The supra illustration shows the money witnessed outflows aboriginal this twelvemonth arsenic bitcoin cratered connected fears of faster Fed complaint hikes. However, the inclination has shifted to inflows since mid-January.

As of Feb. 24, ProShares' AUM was up 74% connected a year-to-date ground portion the AUM of ARK, according to information tweeted by Bloomberg's Eric Balchunas.

Futures-based ETFs are exposed to contango bleed and thin to underperform the underlying asset.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)