Good morning, and invited to First Mover. Here’s what’s happening this morning:

Market Moves: Risk-off drives bitcoin lower. The cryptocurrency's three-day illustration shows an impending decease cross.

Chartist's Corner: ‘Built to Fail?’ Why TerraUSD’s maturation is giving concern experts nightmares.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Sergey Vasylchuk, laminitis and CEO, Everstake

Maxim Galash, CEO, Coinchange

Dan Jeffries, managing director, AI Infrastructure Alliance

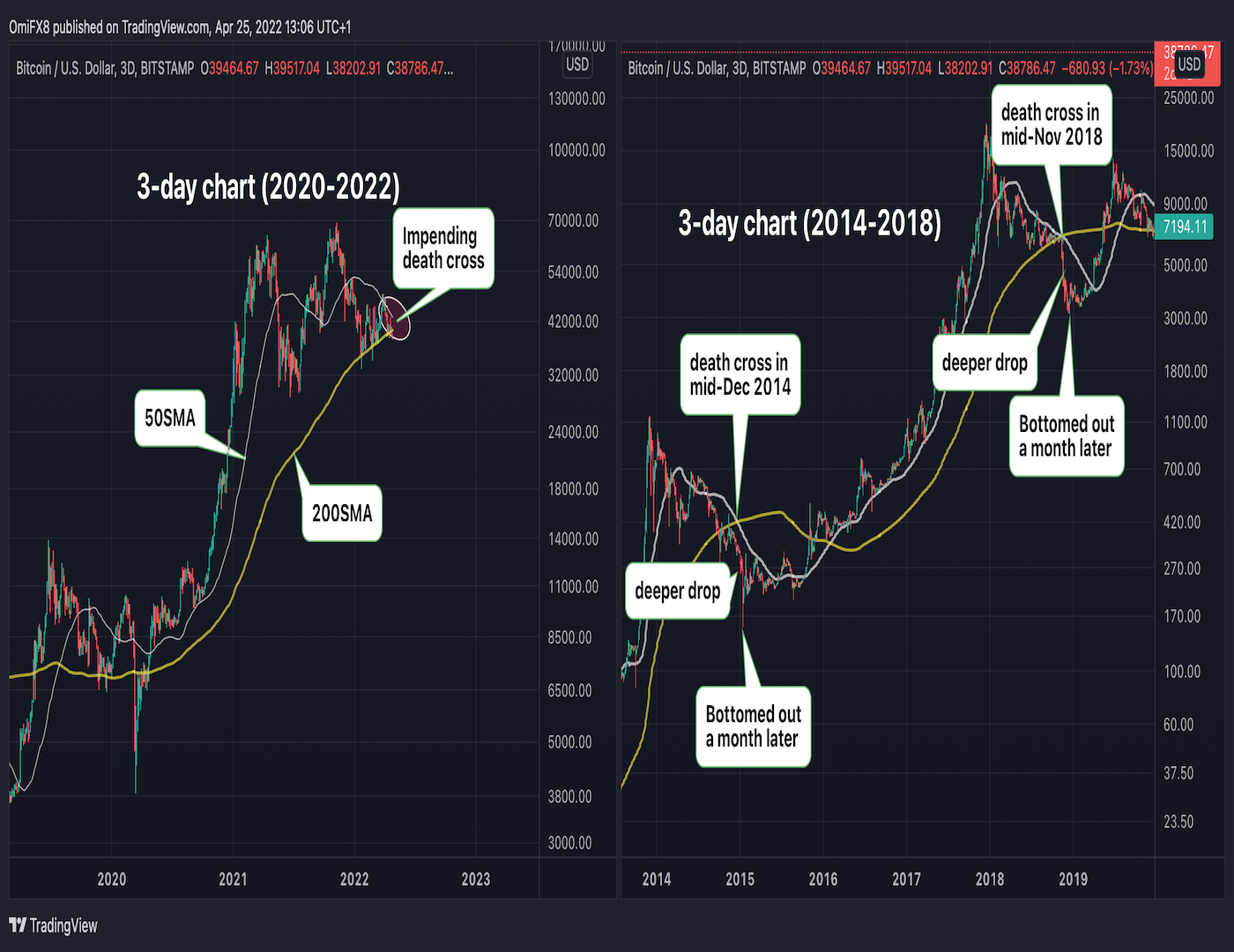

Bitcoin's bear market has plentifulness of steam left. That's the connection from an impending decease transverse connected the lesser-followed three-day chart, wherever each candle represents 72 hours.

The death cross occurs erstwhile the 50-candle elemental moving mean (SMA) crosses beneath the 200-candle SMA. Aficionados of method investigation see the ominously sounding illustration signifier a informing of a much profound terms drop.

And portion its predictive powers are perpetually questioned, fixed it is based connected backward-looking moving averages, its past grounds connected the three-day illustration arsenic a doom indicator is perfect.

Bitcoin's stalled carnivore marketplace resumed with prices falling by much than 40% successful the weeks pursuing the confirmation of the decease transverse connected the three-day illustration successful mid-November 2018. Similar terms enactment was observed pursuing the decease transverse of mid-December 2014.

Notably, bitcoin bottomed retired a period aboriginal connected some occasions. In different words, the post-death transverse sell-off marked the last legs of the the-then carnivore markets.

So, if past is simply a guide, bitcoin could beryllium successful for different circular of beating earlier prospects crook bright.

Bitcoin dropped to $38,300 aboriginal Monday arsenic renewed coronavirus outbreak successful China threatened to worsen the precocious inflation-low maturation concern facing the planetary economy. Ether followed suit, dropping to $2,800 astatine 1 point, the lowest since mid-March.

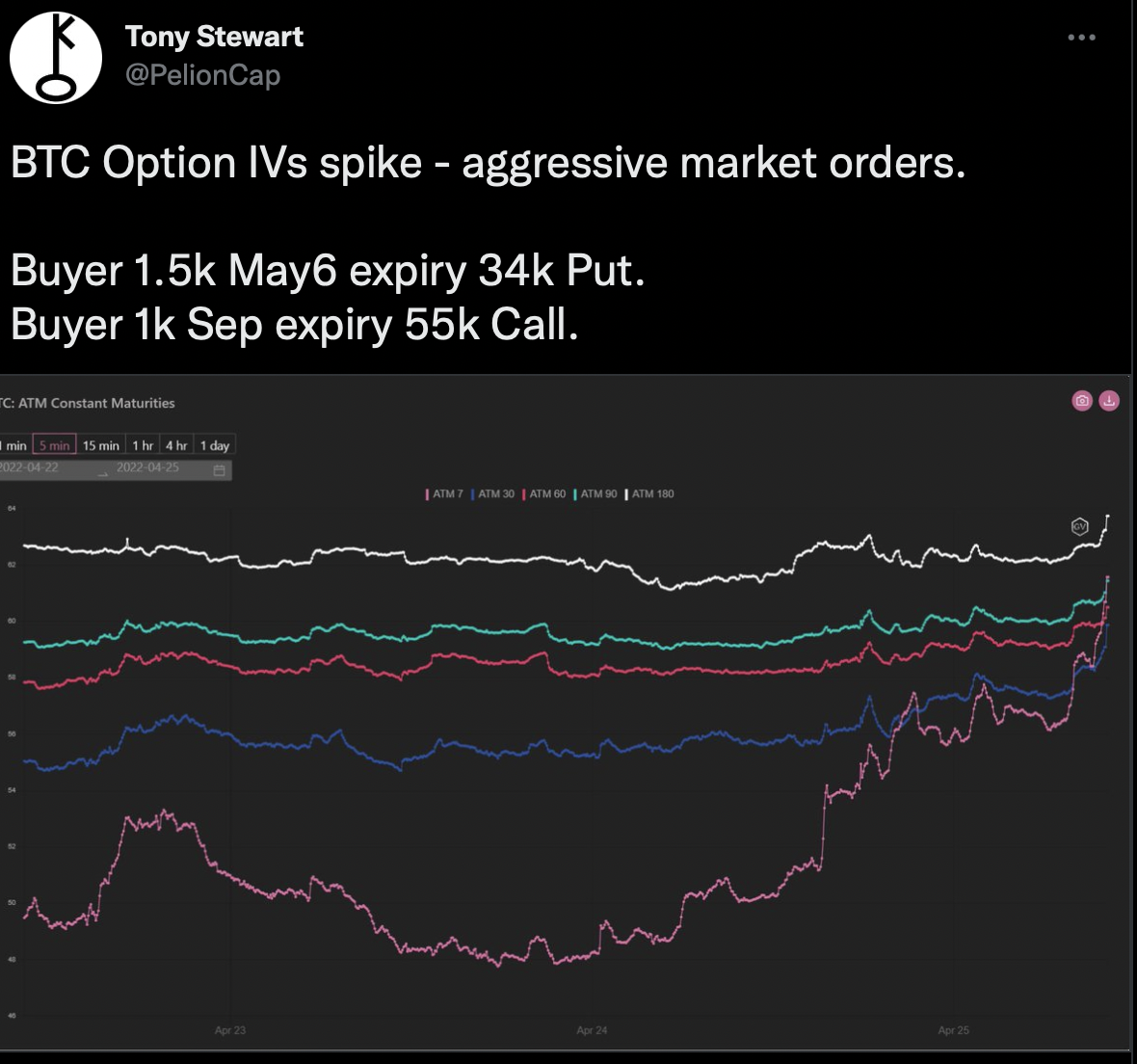

Bitcoin's implied volatility, oregon expectations for terms turbulence, spiked connected assertive options buying.

That was expected, fixed the implied volatility looked inexpensive compared to its humanities standards and beingness average. The implied volatility is mean-reverting. Therefore, savvy traders bargain options erstwhile the IV is inexpensive and merchantability erstwhile it is expensive.

‘Built to Fail’? Why TerraUSD’s Growth Is Giving Finance Experts Nightmares

Late connected Monday, April 18, the stablecoin terraUSD (UST) edged retired Binance’s BUSD to go the third-largest stablecoin by marketplace cap. There are present astir $18 cardinal UST successful circulation. That’s good beneath the astir $50 cardinal full for Circle’s USDC, oregon the $82 cardinal worthy of Tether’s USDT roaming the Earth.

But UST is besides overmuch antithetic from those competitors, successful ways that could marque it incredibly risky.

Stablecoins are tokens tracked by a blockchain, but successful opposition to assets similar bitcoin (BTC), they’re intended to consistently lucifer the buying powerfulness of a fiat currency, astir often the U.S. dollar. Stablecoins were archetypal created to springiness progressive crypto traders a instrumentality for moving rapidly betwixt much volatile positions, though arsenic we’ll see, the imaginable for large involvement rates connected loans has besides helped pull capital.

USDT and USDC are alleged “backed” oregon collateralized stablecoins. They support their 1:1 dollar “peg” due to the fact that they are (ostensibly) backed by slope accounts holding dollars, oregon by different dollar equivalent assets, for which tokens tin beryllium redeemed – though Tether has been notoriously reticent to specify the quality of its reserves.

UST, by contrast, began beingness arsenic what’s known arsenic an “algorithmic” stablecoin. These could besides beryllium referred to arsenic “decentralized” stablecoins due to the fact that decentralization is their primary crushed for existing. A collateralized stablecoin similar USDT oregon USDC is reliant connected banks and accepted markets. That makes them successful crook taxable to regulation, enforcement and ultimately, censorship of transactions. Circle and Tether are tally by centralized firm entities with the quality to blacklist users and adjacent prehend their funds. Both systems have done this, sometimes at authorities behest.

In principle, algorithmic stablecoins similar UST don’t person this censorship hazard due to the fact that they are not tally by centralized firm structures and bash not clasp backing successful accepted institutions similar banks. Of course, successful world “decentralization” is relative, and astir specified systems contiguous inactive person cardinal men, specified arsenic Do Kwon astatine Terraform Labs, oregon affiliated organizations that supply labour and funding. Whatever a system’s “decentralized” branding, regulators tin inactive spell after specified nationalist targets, a hazard that’s worthy keeping successful mind.

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Nelson Wang.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)