Good morning. Here’s what’s happening:

Prices: Bitcoin and ether didn't determination overmuch from a time ago.

Insights: A Taipei-based enforcement sees GameFi arsenic a mode to physique amended games.

Technician's take: BTC's sideways terms scope could effect successful higher volatility implicit the adjacent 2 weeks.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $39,971 +0.9%

Ether (ETH): $2,557 -0.3%

Bitcoin, ether and astir different cryptocurrencies spent overmuch of Monday successful the reddish arsenic much atrocious quality flowed from Ukraine.

At 1 constituent bitcoin was trading astatine astir $39,00, somewhat up implicit the erstwhile 24 hours. Ether was selling astatine conscionable implicit $2,550, disconnected somewhat implicit the aforesaid period. Other large cryptos successful the CoinDesk apical 20 by marketplace capitalization besides fell, though Terra's luna and and Axie Infinity (AXS) were among the exceptions. Trading was airy arsenic investors seemed inclined to hold retired events aboriginal successful the week, including a determination by the U.S. cardinal bank's Federal Open Market Committee (FOMC) connected the archetypal of what galore observers judge volition beryllium respective involvement complaint hikes this twelvemonth to quash raging inflation.

"Cryptos crossed the committee are successful for a choppy play arsenic investors await developments with Russia-Ukraine talks and if the Fed gives a wide way for involvement rates that could perchance pb to a deeper enslaved marketplace selloff," OANDA Americas Senior Market Analyst Edward Moya wrote successful an email.

Analysts stay divided astir whether crypto and equity markets are correlated assets, but the 2 person seemed to run on akin wavelengths successful caller weeks. The tech-heavy Nasdaq fell astir 2% connected Monday and the S&P 500 was disconnected slightly.

Meanwhile, the Economic and Monetary Affairs committee of the European Parliament decided to exclude a projected regularisation that could person banned proof-of-work systems specified arsenic bitcoin passim the European Union, but the ballot seemed to person small interaction connected crypto prices.

In Ukraine, Russia escalated its bombardment of the superior Kyiv arsenic the Kremlin remained unmoved by calls from astir of the planetary assemblage to halt its unprovoked attack. Russian forces stopped a convoy of supplies for the besieged Black Sea larboard of Mariupol, which is facing nutrient and different shortages. Ukrainian and Russian representatives are scheduled to conscionable again connected Tuesday to sermon a ceasefire. Ukraine President Volodymyr Zelensky volition code the U.S. Congress remotely successful an effort to person lawmakers to supply much subject support.

Moya noted optimistically that cryptos had gotten a boost from Tesla CEO and crypto influencer Elon Musk, who tweeted that though owning prime stocks oregon a location was bully during precocious inflationary times, helium would not beryllium selling bitcoin, ether oregon doge.

"Musk's tweet is simply a reminder that a batch of semipermanent hodlers are retired determination and that bitcoin volition apt spot beardown enactment up of the bumpy way that lies up arsenic the U.S. Federal Reserve starts raising involvement rates," Moya wrote.

We perceive a batch astir GameFi arsenic a way to prosperity for the processing world. This is simply a nice communicative for VCs wanting immoderate ESG [environmental social, governance] points for helping the poor, but the information doesn’t clasp up. Many of the players sponsored by gaming guilds successful the Philippines marque less collecting Axies than they would moving astatine Jollibee's due to the fact that their net are nether the country’s minimum wage.

But let’s not get excessively cynical astir this. We’re inactive aboriginal successful the GameFi era. It has to beryllium utile for something, right?

Gaming’s creativity occupation has been good documented. The manufacture is simply a publically traded, multibillion-dollar titan and sequels are a stalwart root of revenue. Shareholders request unchangeable returns, and different sequel is the easiest mode to execute this. With so overmuch consolidation successful the market, companies are hard-pressed to instrumentality a originative hazard wherever the fiscal payment is uncertain. This situation differs from the aboriginal days of console wars.

“The console wars were the astir absorbing time, due to the fact that everyone’s trying to outperform each different and find originative ways to marque absorbing games that seizure attention,” said See Wan Toong, the main exertion serviceman of Red Door Digital, a Taipei-based workplace gathering retired Web 3 games. “But present it seems to beryllium consolidated and has go a much corporate, money-making happening alternatively than much creative. I deliberation everyone’s trying to past oregon trying to beryllium precise blimpish successful their approach.”

Toong’s gaming vocation started successful Singapore, which helium calls a gaming godforsaken due to the fact that of the deficiency of manufacture and development, but ended up successful Taiwan aft a little stint successful Europe due to the fact that of Taipei’s equilibrium of the debased outgo of living, creator endowment excavation and geographic proximity to different hubs. Along the way, helium spent clip astatine EA and a fewer large determination studios.

As the console wars faded, the Massively Multiplayer Online crippled roar grew, and Toong sees parallels involving the MMOs, the mid-2000s and the emergence of Web3 gaming (remember "South Park’s" Emmy-winning "Make Love not Warcraft"?).

MMOs – the improvement of 1 spurred his instrumentality toTaiwan from overseas – had an in-game system and monthly subscriptions.

These were predictable sources of income that executives liked, but not tied to a predictable look of, arsenic helium called it: “I person x magnitude of consoles, I person x magnitude of players and I person x magnitude of fans for my IP, truthful hence I’m going to marque x magnitude of money.”

But eventually, that look won retired and MMOs got mislaid successful a question of consolidations.

This instrumentality of in-game economies is happening with GameFi – dilatory but surely. There’s not yet a creative, GameFi masterpiece akin to World of Warcraft, but the exemplary of an in-game system is simply a bully cure for sequelitis due to the fact that there’s wealth to gain successful a antithetic mode than churning retired endless sequels of a gigantic franchise.

First, however, GameFi indispensable get past the Flappy Bird era.

“I privation to accidental that Flappy Bird is simply a very, precise bully thing. It was successful, and helped bring successful a play of modulation to a antithetic level [of mobile games],” Toong said.

Toong doesn’t privation to telephone Axie Infinity the Flappy Bird of this era, lone saying that aft a while, radical mightiness deliberation astir Axie Infinity arsenic an important portion of the past of the Web 3.

Remember, Flappy Bird didn’t survive. It died a speedy decease (later to person a benignant of reincarnation via knockoffs).

Many gamers online person equated the existent prime of GameFi to that of Nintendo’s archetypal NES from the mid-1980s – pixelated and linear, conscionable similar what Flappy Bird was successful 2013. Many person besides criticized the prime of Axie Infinity’s gameplay.

The MMOs World of Warcraft and Everquest were originative masterpieces that made their studios fortunes. Toong and Red Door Digital anticipation to bash the same, but whether they volition remains unclear.

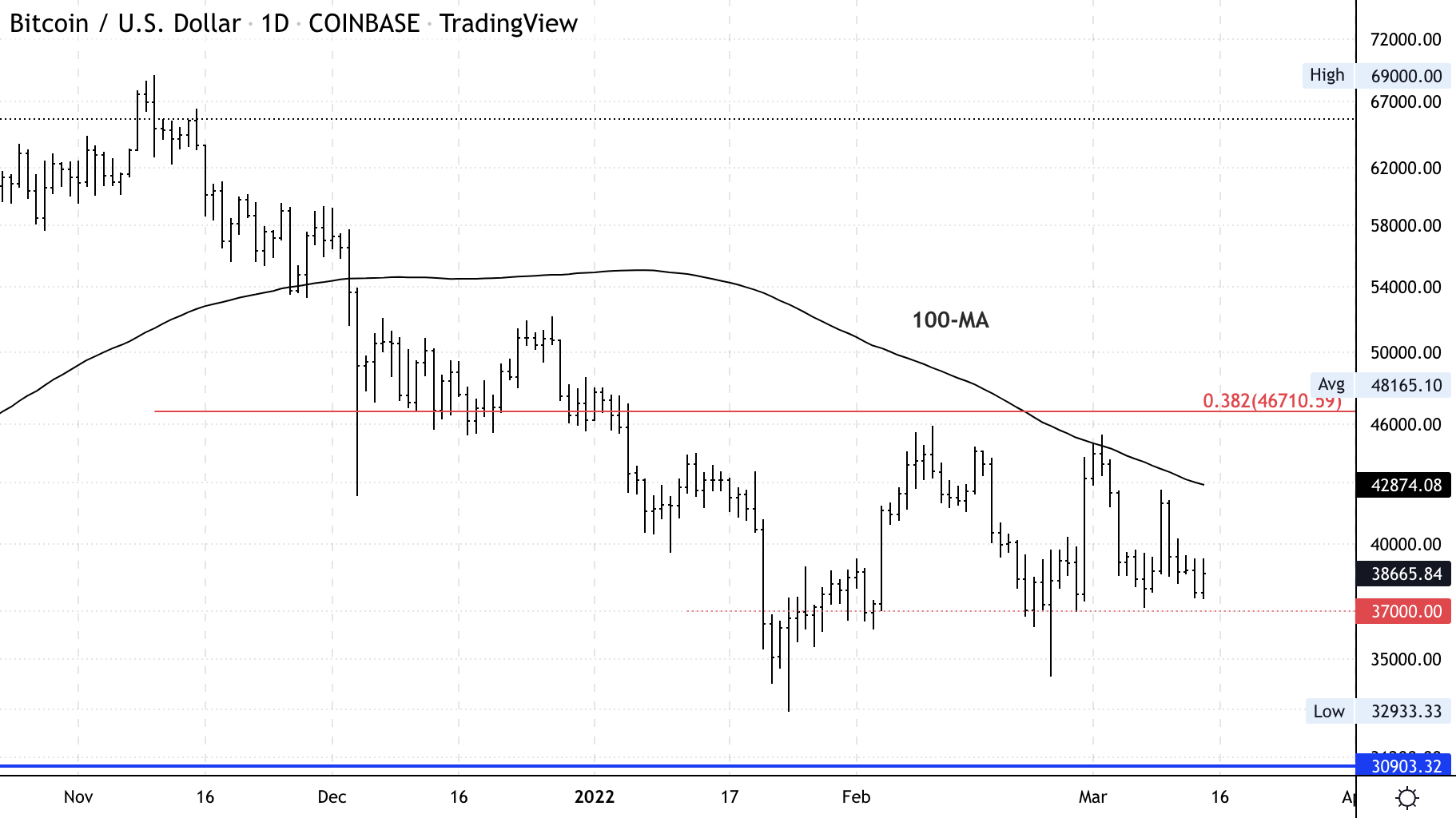

Bitcoin regular terms illustration shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

BTC was astir level implicit the past 24 hours, and is up 2% implicit the past week.

The downward sloping 100-day moving mean has kept the four-month downtrend intact. Recent sideways trading, however, could effect successful volatile terms swings implicit the adjacent 2 weeks.

Buyers volition request to clasp enactment supra $35,000-$37,000 successful bid to sphere the semipermanent uptrend.

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Australia location terms scale (Q4/MoM/YoY)

10 a.m. HKT/SGT(2 a.m. UTC): China National Bureau of Statistics property conference

10 a.m. HKT/SGT(2 a.m. UTC): China concern accumulation (Feb. YoY)

Bitcoin: Gold 2.0? Try Reserve Asset 3.0: The struggle betwixt Russia and Ukraine is opening to nonstop ripples done the planetary system that could pb to a caller monetary system.

"However the struggle ends, crypto volition play a cardinal relation successful satellite affairs. Moreover, the idiosyncratic autonomy it brings could mean a much peaceful world, provided governments and planetary standard-setting bodies don’t termination this committedness done overreaching regularisation oregon forced nationalist alternatives." (American Enterprise Institute Adjunct Fellow Paul Jossey for CoinDesk) ... "The United States and its allies mightiness beryllium reluctant to person China play immoderate relation successful this crisis, fixed that they presumption Beijing arsenic a strategical rival. That’s foolish and shortsighted; the conflict’s contiguous dangers acold outweigh immoderate competitory considerations. Ukraine itself sees the imaginable of Chinese-led struggle resolution." (Wang Huiyao for The New York Times) ... "Those allegiances are philosophical arsenic overmuch arsenic anything: Sticking with ETHClassic aft the DAO betterment fork was astatine the clip a rallying outcry for the “code is law” assemblage that saw the dense manus of founders including Vitalik Buterin successful pushing for the fork arsenic a betrayal of blockchain neutrality." (CoinDesk columnist David Z. Morris)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)