Good morning. Here’s what’s happening:

Market moves: Bitcoin led a wide crypto betterment up of the U.S. CPI release.

Technician’s take: Buyers started to instrumentality to the market, though the upside seemed constricted to the $45,000 level.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $42,806 +2.4%

Ether (ETH): $3,240 +5.2%

Bitcoin went up arsenic precocious arsenic $43,106 connected Tuesday, starring a wide marketplace betterment successful crypto. The determination came aft the banal marketplace successful the U.S. halted its five-day rout up of the Consumer Price Index (CPI) information merchandise connected Wednesday.

At the clip of publication, the astir valued cryptocurrency was changing hands supra $42,800, up implicit 2% successful the past 24 hours, according to CoinDesk data.

(CoinDesk)

Bloomberg reported the banal marketplace climbed connected Tuesday aft Jerome Powell, the seat of the Federal Reserve, reassured investors the Fed volition combat the existent precocious inflation, signaling the cardinal slope whitethorn trim its equilibrium expanse this year.

As CoinDesk reported, bitcoin and the wide crypto marketplace person behaved strongly similar a hazard plus recently.

A cardinal lawsuit to ticker connected Wednesday is the merchandise of December’s U.S. user terms scale (CPI). Economists anticipate a 0.5% month-to-month summation successful CPI to 7.1%.

In the past 2 months, bitcoin’s terms experienced high volatility aft the CPI information release. While immoderate crypto traders and investors presumption bitcoin arsenic a hedge against inflation, others see it arsenic a hazard plus similar stocks, which respond to tightened monetary argumentation resulting from precocious inflation.

Most different large cryptocurrencies besides roseate connected Tuesday. Ether, the second-biggest cryptocurrency by marketplace capitalization, was up implicit 5% to supra $3,200, astatine the clip of publication. Layer 1 token NEAR remained the biggest winner. It is up astir 13% implicit the past week contempt the crypto sell-off.

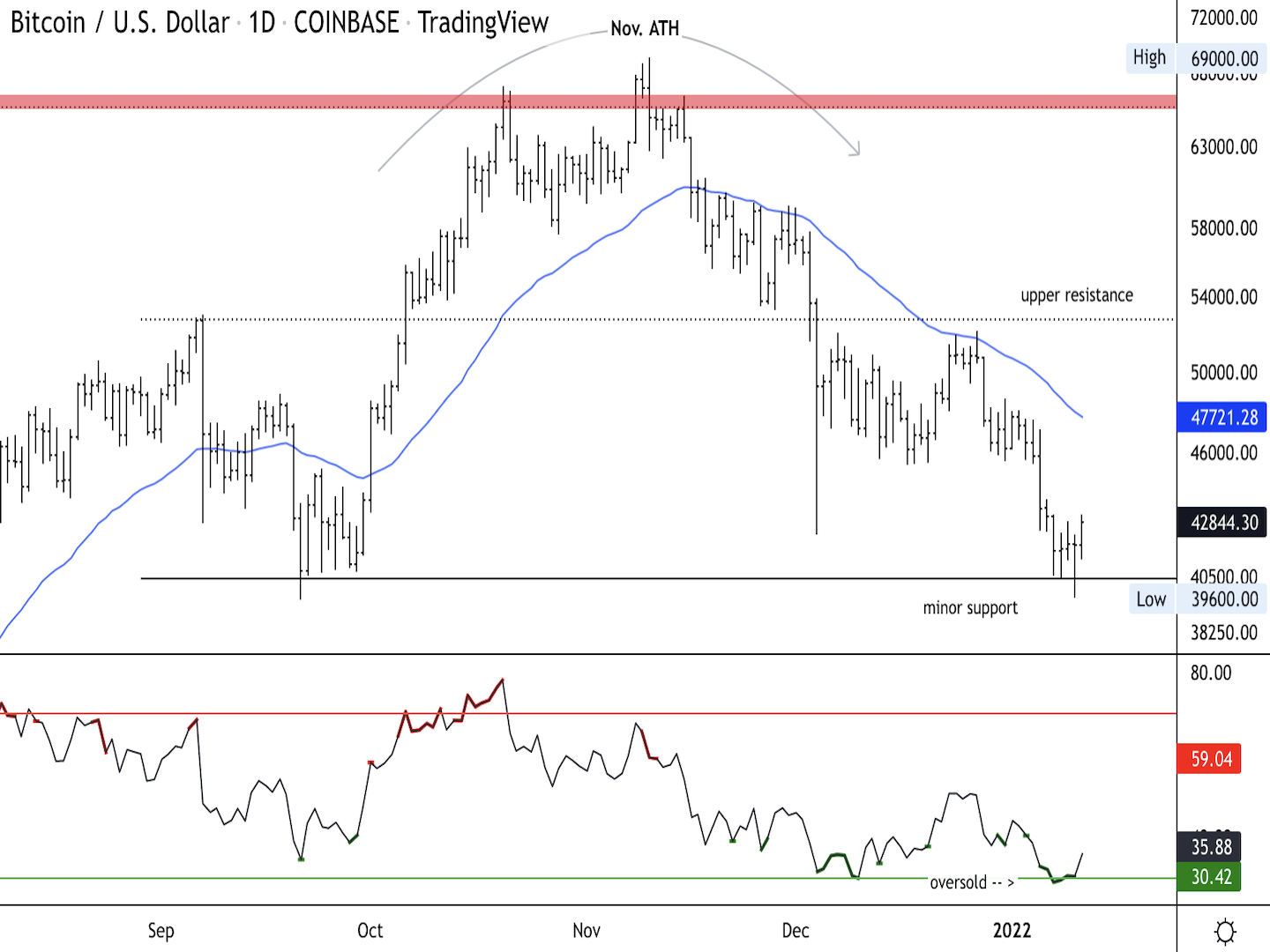

Bitcoin regular terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) went trading supra the $40,000 enactment level and was up astir 3% implicit the past 24 hours from 9 p.m. UTC. Buyers are starting to instrumentality to the market, though the upside appeared to beryllium constricted to the $45,000 absorption level, which is besides adjacent the 200-day moving average.

On intraday charts, upside momentum is improving, which suggests buyers could stay progressive into the Asia trading day.

BTC is the astir oversold since Dec. 10, according to the comparative spot scale (RSI) connected the regular chart. Typically, oversold readings precede terms recoveries, akin to what occurred successful precocious September. This time, however, terms absorption to the RSI and different indicators person been delayed.

Still, connected the play chart, the RSI is not yet oversold, which decreases the accidental of important buying pressure.

Australia Housing Industry Association caller location income (MoM Dec.)

8 a.m. HGT/SGT (12 a.m. UTC): Australia and New Zealand commodity terms (Dec.)

9 a.m. HGT/SGT (1 a.m. UTC): Bank of Japan Governor Haruhiko Kuroda property league astir monetary policies

9:30 a.m. HGT/SGT (1:30 a.m. UTC) China user terms scale (Dec. MoM/YoY)

9:30 p.m. HGT/SGT (1:30 p.m. UTC) U.S. user terms scale (Dec. MoM/YoY)

"First Mover" hosts spoke with Kevin O'Leary, aka Mr. Wonderful, for his presumption connected the booming NFT marketplace and the DeFi space. In addition, task capitalist and Pantera Capital Partner Paul Veradittakit shared his crypto outlook for 2022. Plus, CoinDesk Managing Editor for Global Policy and Regulation Nikhilesh De shared the latest investigative study connected Trump-era crypto policy.

“We mustn’t go exploited by the metaverse. Rather, it should service us. For that to happen, it needs a constitution.” (Binomial co-founders and tech entrepreneurs Stephanie Hurlburt and Rich Geldreich for CoinDesk) ... ”Yet, adjacent multinational companies person a boss: the public. Apple’s privateness propulsion and Facebook’s rebrand amusement that nary substance the size of the company, nationalist sentiment reigns supreme. If the nationalist displays capable appetite for a metaverse constitution, Big Tech’s hands volition beryllium tied.” (Hurlburt and Geldreich for CoinDesk) ... “If we spot ostentation persisting astatine precocious levels longer than expected, if we person to rise involvement rates much implicit time, we will. We volition usage our tools to get ostentation back.” (Jerome Powell testifying earlier Senate Banking Committee) ... “The Fed needs to instrumentality earnestly the systemic risks that endanger our economical progress, similar cryptocurrencies and stablecoins and astir importantly, clime change.” (Ohio Sen. Sherrod Brown astatine Powell hearing) ... “But the astir important origin is automation. And automation-fueled inequality is “not an enactment of God oregon nature,” helium added. “It’s the effect of choices corporations and we arsenic a nine person made astir however to usage technology.” (MIT economist Daron Acemoglu successful The New York Times)..."DeSo (which formerly operated arsenic BitClout) is successful rule an exemplar of what Web 3 could become. The strategy is built astir token economics intended to assistance contented creators get paid for their work, and users to negociate their DeSo assets utilizing integer wallets analogous to MetaMask oregon Samourai." (CoinDesk columnist David Morris)

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)