Good morning. Here’s what’s happening:

Market moves: Bitcoin led crypto’s tiny betterment from past week’s sell-off, but spot measurement remained bladed implicit the weekend.

Technician’s take: BTC upside is constricted arsenic semipermanent method indicators turned negative.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $41,845 +0.1%

Ether (ETH): $3,154 +2.0%

Bitcoin pushed past the $42,000 level implicit the weekend, aft past week’s wide marketplace bloodbath, which sent the No. 1 cryptocurrency by marketplace capitalization spiraling toward $40,000 from astir $48,000. At the clip of publication, ether and astir of the altcoins successful CoinDesk’s apical 20 by marketplace capitalization were up significantly, though inactive mode down implicit the past week.

Bitcoin and astir different cryptocurrencies fell past week amid the Federal Reserve’s merchandise of minutes from its December meeting. The Fed signaled that it would tighten monetary argumentation faster than was erstwhile expected.

The starring cryptocurrency fell to arsenic debased arsenic $40,505.3 connected Coinbase connected Saturday, its lowest level since Sept. 21, earlier it rebounded supra $42,000, information from TradingView and Coinbase show.

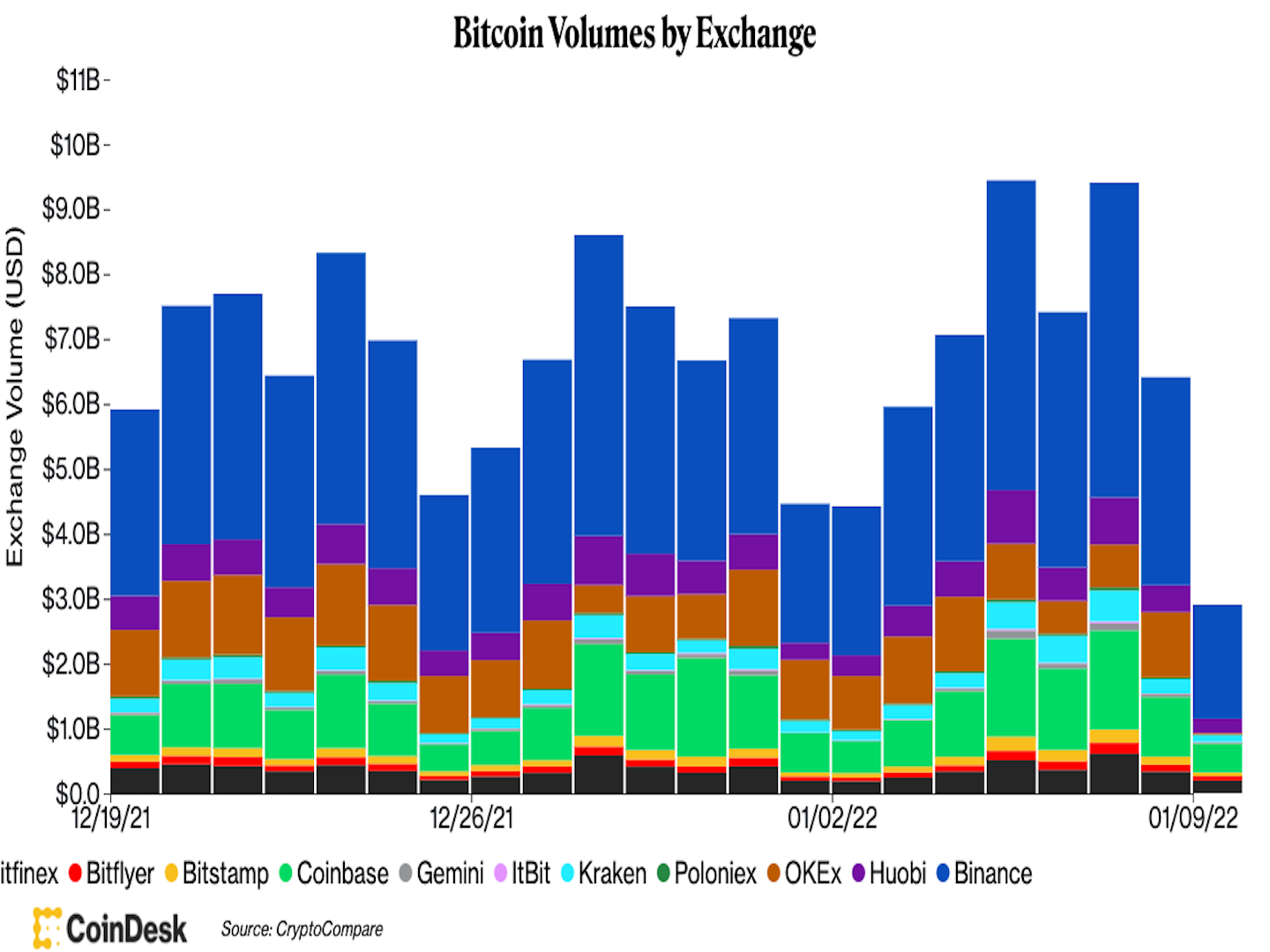

But arsenic markets successful Asia open, it remains uncertain whether the betterment volition past since bitcoin’s spot trading measurement crossed large centralized exchanges connected Sunday was thin, according to information compiled by CoinDesk.

Source: CoinDesk/CryptoCompare

Bitcoin fell for six consecutive days earlier the play and the downward determination escalated aft the Fed minutes showed that policymakers discussed assertive involvement complaint hikes and a faster gait to normalize its equilibrium sheet.

“The minutes confirmed a beardown hawkish bias with markets present pricing successful a 90% accidental of a Fed [rate] hike successful March,” Singapore-based crypto quant trading steadfast QCP Capital wrote successful its Telegram transmission connected Sunday. “...In the bigger picture, it seems apt that the all-time highs successful BTC and ETH volition stay capped for astir of 2022 arsenic a effect of cardinal slope tightening.”

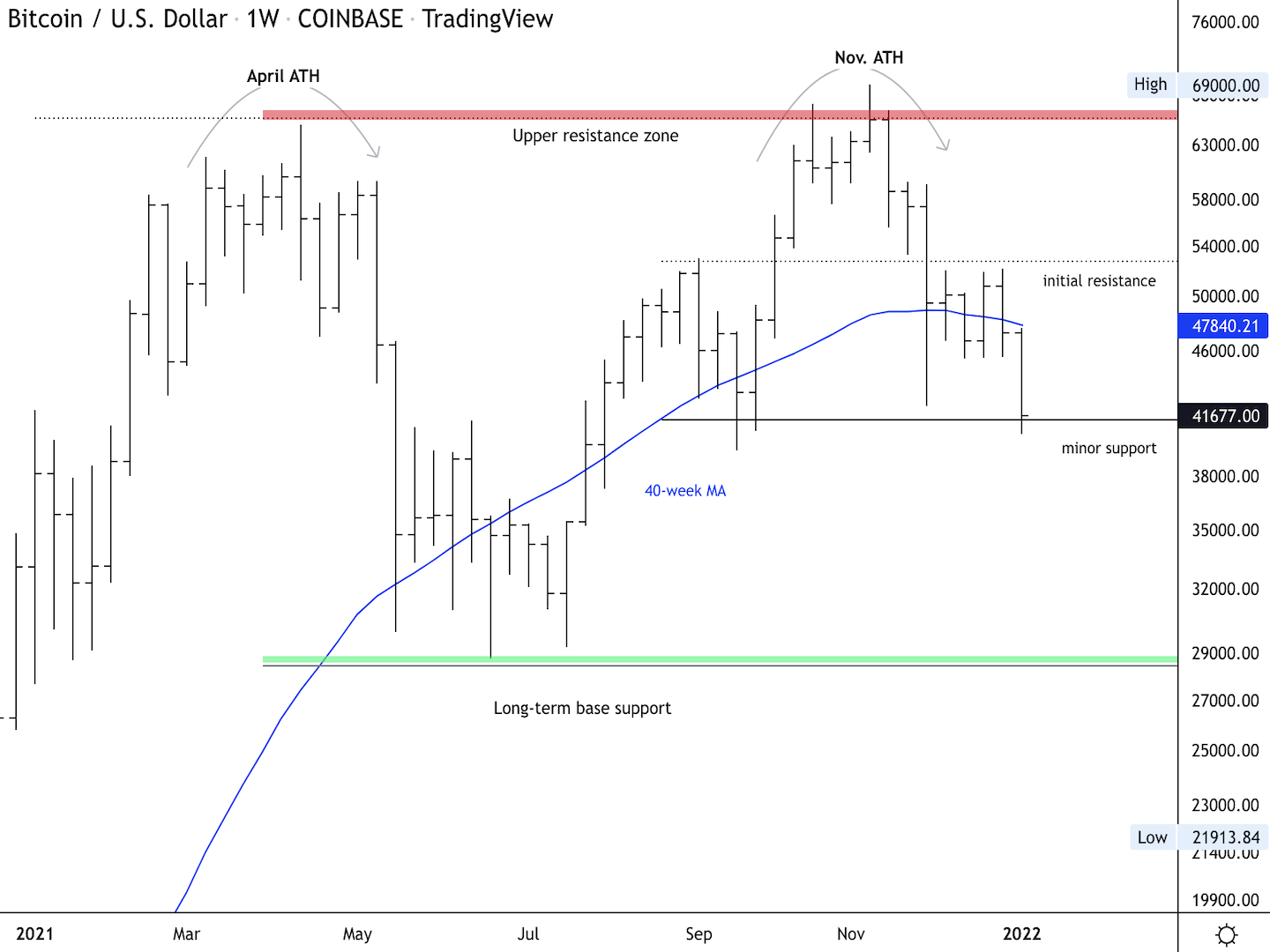

Bitcoin (BTC) remains successful a two-month agelong downtrend, defined by a bid of little terms highs.

The cryptocurrency was down astir 9% implicit the past week arsenic upside momentum continued to slow.

There is insignificant enactment astir $40,000, which could stabilize the existent pullback. However, upside appears constricted astir the $45,000 absorption level. This means buyers could rapidly instrumentality profits if a terms bounce occurs.

The comparative spot scale (RSI) connected the regular illustration is the astir oversold since Dec.11, albeit wrong a terms downtrend.

Over the long-term, BTC is susceptible to further selling, particularly if buyers neglect to clasp the $38,000-$40,000 enactment portion implicit the weekend. On the play chart, the RSI is not yet oversold, which suggests the downtrend remains intact.

Lower enactment is astir $28,000, which is adjacent the June 2021 low.

BTC is astir 2 weeks distant from registering a downside exhaustion signal, which typically precedes a countertrend terms bounce. Still, akin oversold readings connected the regular illustration person been delayed arsenic buyers stay connected the sidelines.

Australia TD securities ostentation (Dec. MoM/YoY)

8:30 a.m. HGT/SGT (12:30 a.m. UTC) Australia gathering permits (Nov. MoM/YoY)

3 p.m. HGT/SGT (7 a.m. UTC) China M2 wealth proviso (Dec. YoY)

5:30 p.m. HGT/SGT (9:30 a.m. UTC) Eurozone Sentix user assurance (Jan.)

“First Mover” hosts spoke with Ernst & Young Principal & Global Innovation Leader Paul Brody astir his outlook for Ethereum successful 2022 and immoderate of the cardinal issues that request to beryllium addressed. Looking astatine the markets, the U.S. system added 199K jobs past month, less than expected. Ben McMillan, CIO of IDX Digital Assets, shared his presumption connected the crypto markets and the interaction of macro factors. Plus, Open Earth Foundation Executive Director Martin Wainstein shared insights into utilizing NFT creation to assistance tackle clime change.

“Even much than successful equities, Warren Buffett’s timeless proposal applies: Be fearful erstwhile others are greedy, and greedy erstwhile others are fearful.” (CoinDesk columnist David Morris)...”I look astatine the DAO abstraction and decidedly tin spot however tokens, governance systems, cross-border and trustless relationships tin assistance with executing wholly morganatic causes (like ConstitutionDAO). I besides judge this whitethorn beryllium the close way towards much analyzable and possibly legally self-sufficient constructions. But we’re not determination yet. (ATH21 CEO Cristina Carrascosa successful a CoinDesk op-ed)...”Policymakers should deliberation holistically astir 3 realities. One is that clime alteration is not going away. The different is that Bitcoin is not going away. The 3rd is that Bitcoin’s geography-agnostic miners are highly adaptable and volition proceed to question retired the astir cost-effective vigor sources anyplace and anyhow.” (CoinDesk Chief Content Officer Michael Casey)

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)