Good morning. Here’s what’s happening:

Market moves: Bitcoin moved small arsenic large markets successful Asia caput into the weeklong lunar New Year break.

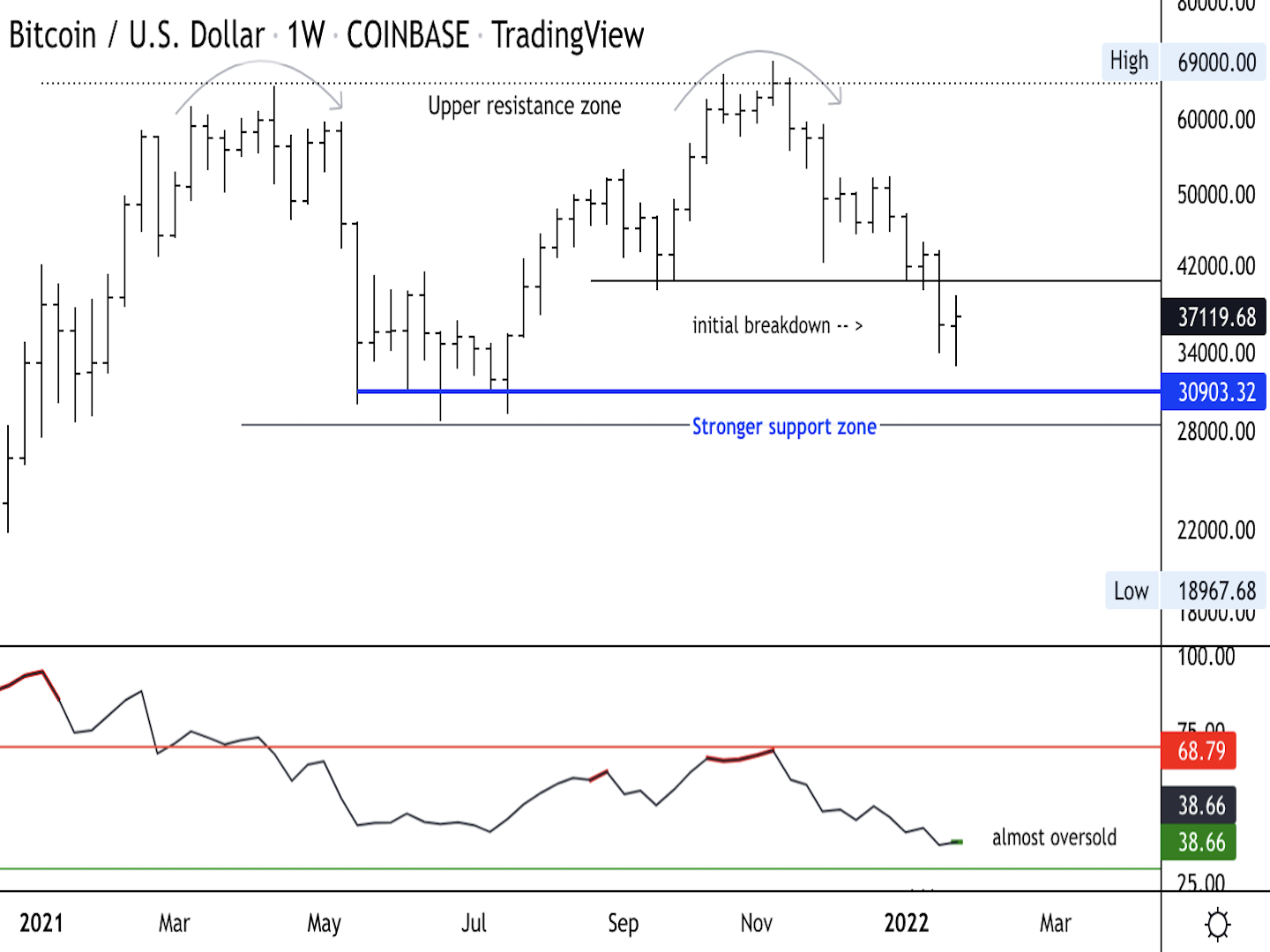

Technician's take: BTC is stabilizing betwixt $30K and $40K arsenic oversold conditions stay intact.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $38,033 +0.1%

Ether (ETH): $2,617 +1.1%

Bitcoin moved small implicit the play with airy trading volume, arsenic the bulk of the markets successful Asia caput to the weeklong Lunar New Year holiday.

At the clip of publication, the oldest cryptocurrency is changing hands astatine implicit $38,100, up somewhat implicit the past 24 hours, according to CoinDesk data. Ether, the 2nd biggest cryptocurrency by marketplace capitalization, was trading implicit $2,600 up somewhat implicit the aforesaid period.

Data compiled by CoinDesk shows that bitcoin’s trading measurement crossed large crypto exchanges sank importantly implicit the play compared with the past week.

Source: CoinDesk/CryptoCompare

The lunar New Year, besides known arsenic Chinese New Year oregon Spring Festival, is the caller twelvemonth based connected the accepted lunisolar calendar of China. It is celebrated by galore countries successful Asia and the solemnisation usually lasts for weeks. Major banal indexes successful China, Hong Kong, South Korea and Singapore are closed for the Lunar New Year holiday, arsenic astir traders instrumentality the clip disconnected for household reunions.

While the crypto marketplace is 24/7, trading activities successful Asia whitethorn spot immoderate simplification successful the coming week owed to the holidays.

Bitcoin play terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Still, longer-term indicators are neutral/bearish, which could bounds upside astatine the $40,000-$43,000 resistance zone.

For now, the comparative spot scale (RSI) connected the play illustration is approaching oversold levels, akin to what occurred successful March 2020, which preceded a terms rally. This time, however, the monthly illustration indicates beardown selling unit that could support BTC’s intermediate-term downtrend.

On the regular chart, the RSI has risen from oversold levels since Jan. 22, which could pull short-term buyers.

For confirmation, traders could show the Nasdaq 100 Index of stocks, which has short-term enactment astatine $14,000. An oversold bounce successful accepted markets could beryllium a near-term affirmative for crypto prices arsenic correlations rise.

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia backstage assemblage recognition (Dec. MoM/YoY)

1 p.m. HKT/SGT (7 a.m. UTC): Japan operation orders (Dec. YoY)

1 p.m. HKT/SGT (7 a.m. UTC): Japan user assurance scale (Jan. YoY)

1 p.m. HKT/SGT (7 a.m. UTC): Japan lodging starts (Dec. YoY)

6 p.m. HKT/SGT (10 a.m. UTC): Eurostat gross home merchandise s.a. (Q4 MoM/YoY)

"First Mover" hosts spoke with crypto custody steadfast Fireblocks CEO Michael Shaulov and FTX.US President Brett Harrison arsenic some companies person attained $8 cardinal valuations aft their respective backing rounds recently. Plus, CoinDesk concluded its Privacy Week with crypto OG and Electronic Coin Company CEO Zooko Wilcox sharing his insights into the authorities of privateness successful crypto arsenic the manufacture continues to expand.

"And if you inquire me, regulators person made the aforesaid mistake they made connected subprime: They failed to support the nationalist against fiscal products cipher understood, and galore susceptible families whitethorn extremity up paying the price." (The New York Times columnist Paul Krugman) ... "The question of whether it's been a occurrence for its investors is astir apt little important, for the wellness of the space, than whether it's been a occurrence for the creators it purports to serve. Events this week person precipitated thing of an individuality crisis: Does OpenSea privation to beryllium a marketplace, a hub for artists oregon an unregulated casino?" (CoinDesk columnist Will Gottsegen) ... "And determination are broader affirmative lessons to beryllium learned – supra all, that affluent and influential radical inactive person to grounds astatine slightest a shred of competence to get what they want. The Libra effort was a shambolic messiness from the jump, with Facebook showing again and again that it hadn’t thought done the implications of either its wide extremity oregon its circumstantial proposals." (CoinDesk columnist David Z. Morris) ..."What we find is that astir of these cryptocurrencies — prevention algorand, cardano and dogecoin — woefully underperformed bitcoin and what they were expected to bash during specified a downturn." (CoinDesk columnist Lawrence Lewitinn) ... “If governments ever wanted to prosecute successful an assertive programme of spending, present is the time. This is simply a cleanable clip to contented bonds arsenic agelong arsenic imaginable and proceed with semipermanent concern plans — and arsenic agelong arsenic the complaint of instrumentality connected those plans is successful excess of the backing costs, they wage for themselves.” (Padhraic Garvey, caput of probe astatine ING slope to The New York Times) ... "One of the top strategies of each clip is to simply bent around. When things are not going your way, conscionable bent around. Don’t spell away. Things change." (Analytics-based tennis manager Craig O'Shannessy connected Rafa Nadal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)