Good morning. Here’s what’s happening:

Market moves: Bitcoin fell beneath $40,000 concisely arsenic U.S. stocks continued to driblet acknowledgment to a recently hawkish Federal Reserve.

Technician’s take: BTC buyers could respond to short-term oversold signals, though upside appears limited.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $41,797 -0.2%

Ether (ETH): $3,077 -2.6%

Bitcoin fell again connected Monday during U.S. trading hours aft a tiny betterment implicit the weekend. The bearish terms determination came aft U.S. banal marketplace losses deepened arsenic investors brace for actions from a much hawkish Federal Reserve.

The astir valued cryptocurrency fell beneath $40,000 concisely successful aboriginal hours earlier it moved backmost supra $41,000. At property time, bitcoin was changing hands astatine implicit $41,500, down astir 1% successful the past 24 hours, according to CoinDesk data.

Last week, prices of the oldest cryptocurrency fell for six consecutive days aft Fed minutes revealed policymakers had discussed assertive involvement complaint hikes alongside a faster gait to normalize its equilibrium sheet.

“The tightening of fiscal conditions is expected to negatively interaction hazard assets specified arsenic equities and crypto arsenic they go little charismatic than safe-haven bonds,” crypto trading information steadfast Kaiko wrote successful its play newsletter connected Monday.

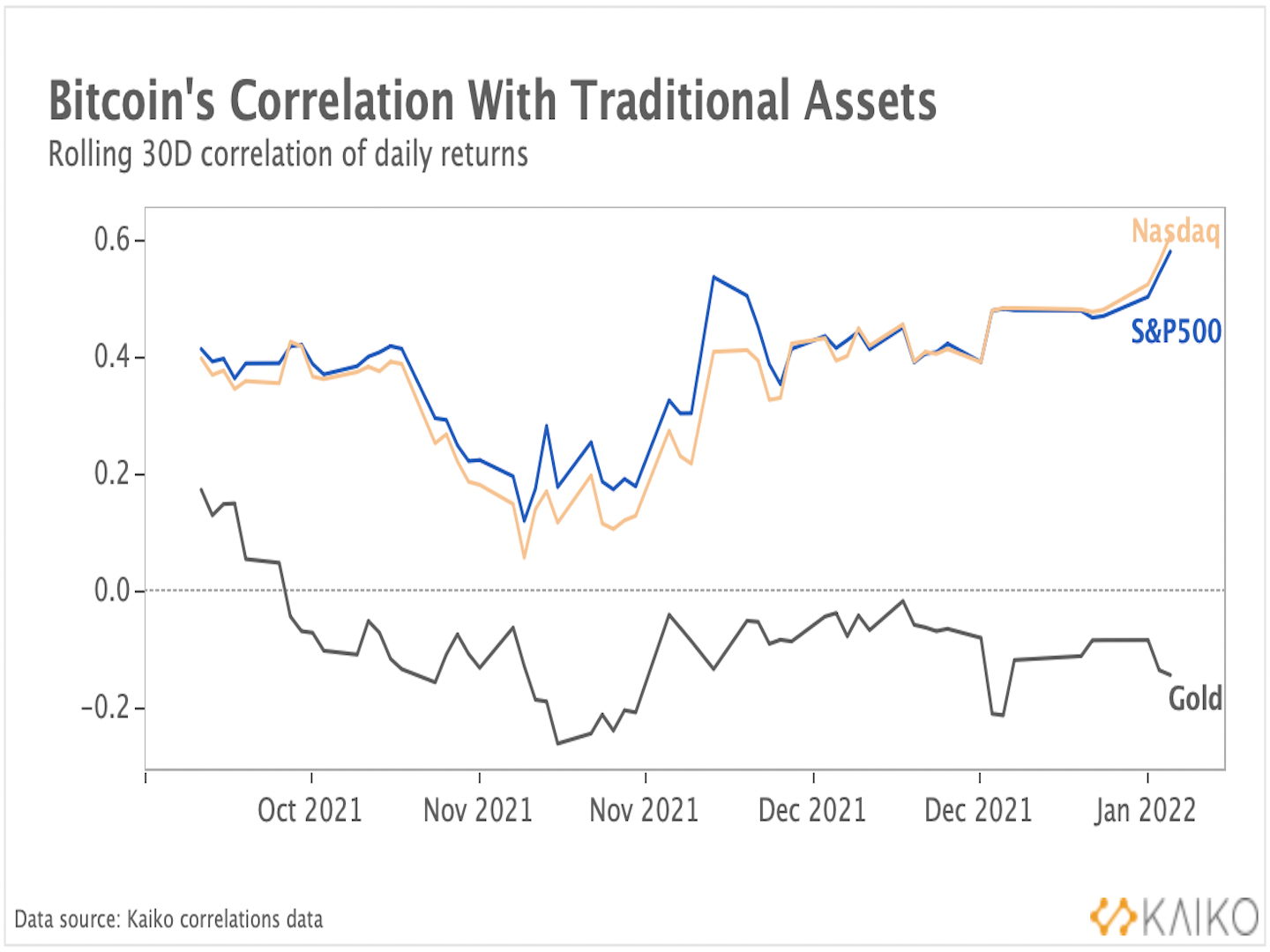

According to Kaiko, the interaction of the Fed’s December gathering has sent the correlation betwixt bitcoin and accepted assets to the highest successful much than a year.

(Kaiko)

“The Federal Reserve’s December gathering had a beardown interaction connected planetary fiscal markets, with traders reacting swiftly to the imaginable of monetary tightening,” Kaiko wrote. “During the volatility, bitcoin behaved powerfully similar a hazard asset.”

Following bitcoin, astir of the large cryptocurrencies were besides successful the reddish connected Monday. Ether, the second-biggest cryptocurrency by marketplace capitalization, plummeted beneath $3,000 astatine 1 constituent earlier it returned supra $3,000.

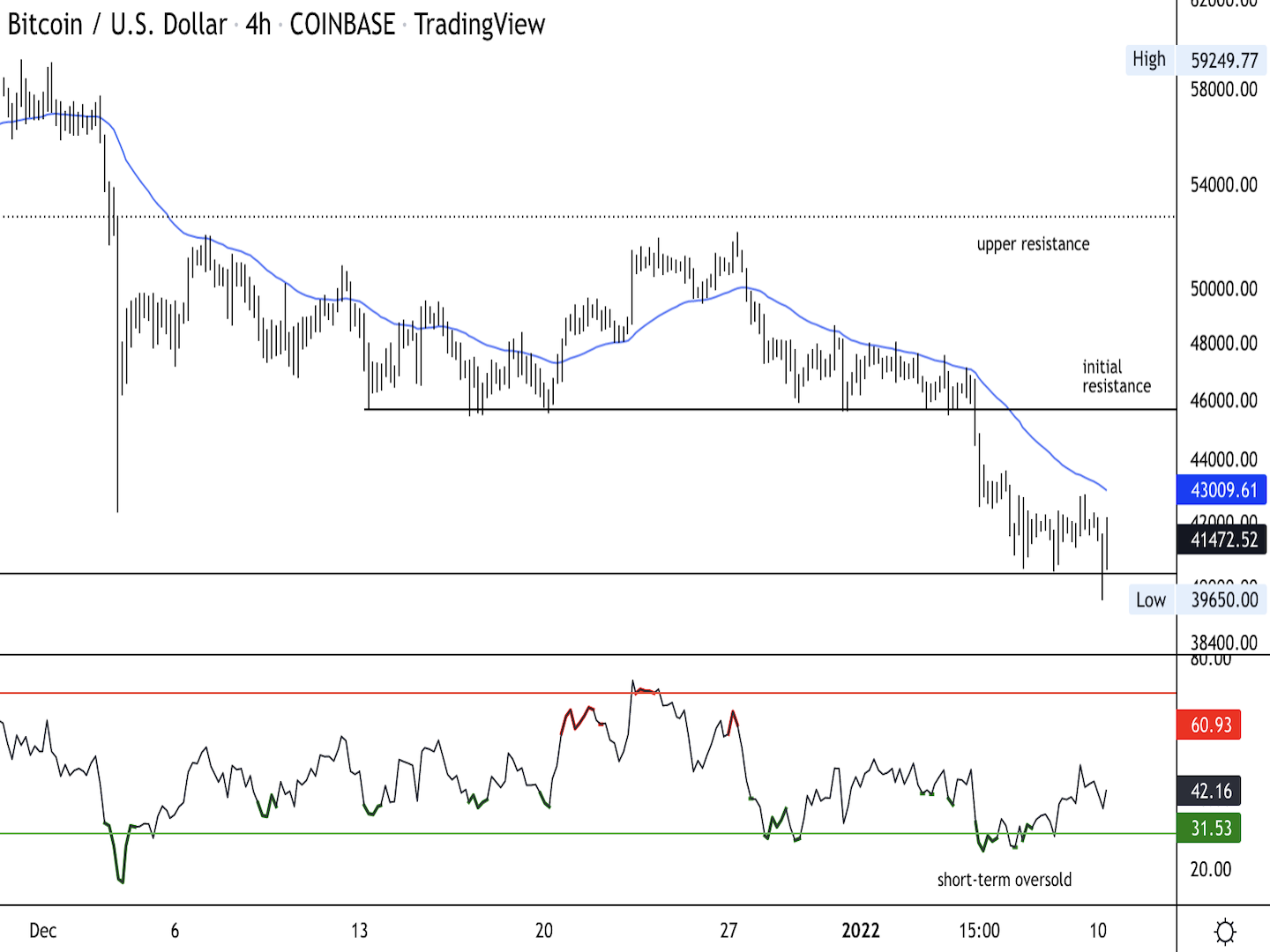

Bitcoin four-hour terms illustration shows support/resistance with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

BTC was down astir 2% implicit the past 24 hours, though the terms enactment has been reasonably muted implicit the past fewer days.

The comparative spot scale (RSI) connected the four-hour illustration is rising from oversold levels, which typically precedes a little terms bounce. On the regular chart, the RSI is the astir oversold since Dec. 10.

Upside momentum has weakened fixed BTC’s two-month agelong downtrend. This means sellers could stay progressive astir absorption levels.

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia imports and exports (Nov. MoM)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia retail income (Nov. MoM)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia commercialized equilibrium (Nov. MoM)

1 p.m. HKT/SGT (5 a.m. UTC): Japan starring economical scale (Nov. MoM)

11 p.m. HKT/SGT (3 p.m. UTC): U.S. Federal Reserve Chair Jerome Powell testifies earlier Congress

“First Mover” hosts discussed the metaverse with The Sandbox Co-founder and Chief Operating Officer Sebastien Borget. In addition, DFINITY laminitis and Chief Scientist Dominic Williams shared insights down the company’s net machine opening an Ethereum bridge. Finally, TheoTrade co-founder Don Kaufman offered marketplace analysis.

The Metaverse Needs a Constitution: If we privation our virtual worlds to beryllium escaped and open, they request rules. Or companies similar Meta (Facebook) volition marque them for us.

“And if you bash it close and for agelong enough, similar Ethereum oregon Binance, you mightiness go excessively deep-rooted to dispose of. In the existent regulatory environment, it is the champion accidental for blockchain companies to succeed. We did it differently. We tried to bash it “right.” And therefore, now, we person to close.” (Entrepreneur Zoe Adamovicz penning for CoinDesk connected closing her astir caller venture, Neufund) ... “There is simply a white-knuckle fearfulness connected the Street astir tech stocks. Tech stocks person been connected a bull run, and present Fed worries and the spiking 10-year output are crashing the tech enactment with investors hitting the merchantability fastener and heading for the elevators successful unison.” (Wedbush Securities Managing Director of Equity Research Dan Ives successful the The New York Times)...”In reality, DAOs are apt to endure from immoderate of the aforesaid principal-agent problems that beryllium successful the accepted world. In theory, customers tin bargain banal successful a institution and enactment successful the benefits that travel from making usage of their information arsenic well. They tin besides ballot retired the absorption team. In practice, this seldom happens.” (EY Global Blockchain Leader and CoinDesk columnist Paul Brody)

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)