Good morning. Here’s what’s happening:

Market moves: Bitcoin broke supra $44,000 arsenic short-term holders profited for the archetypal clip since November.

Technician's take: BTC has confirmed a interruption supra its 2 month-long downtrend.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $43,906 +3.4%

Ether (ETH): $3,147 +3.4%

There are nary losers successful CoinDesk 20 today.

Bitcoin (BTC) broke supra a cardinal terms level astatine $44,000 arsenic bitcoin short-term holders earned profits for the archetypal clip since precocious November.

At the clip of publication, the oldest cryptocurrency was changing hands astatine $43,906, up 3.4% during the past 24 hours, according to CoinDesk data.

Bitcoin got different terms boost connected Monday aft much than 11% terms gains past Friday. The past clip bitcoin gained by much than 11% successful a 24-hour play was successful June, according to information from TradingView and Bitstamp.

As CoinDesk reported, astir $71 cardinal flowed into bitcoin-focused funds past week, the largest magnitude since aboriginal December.

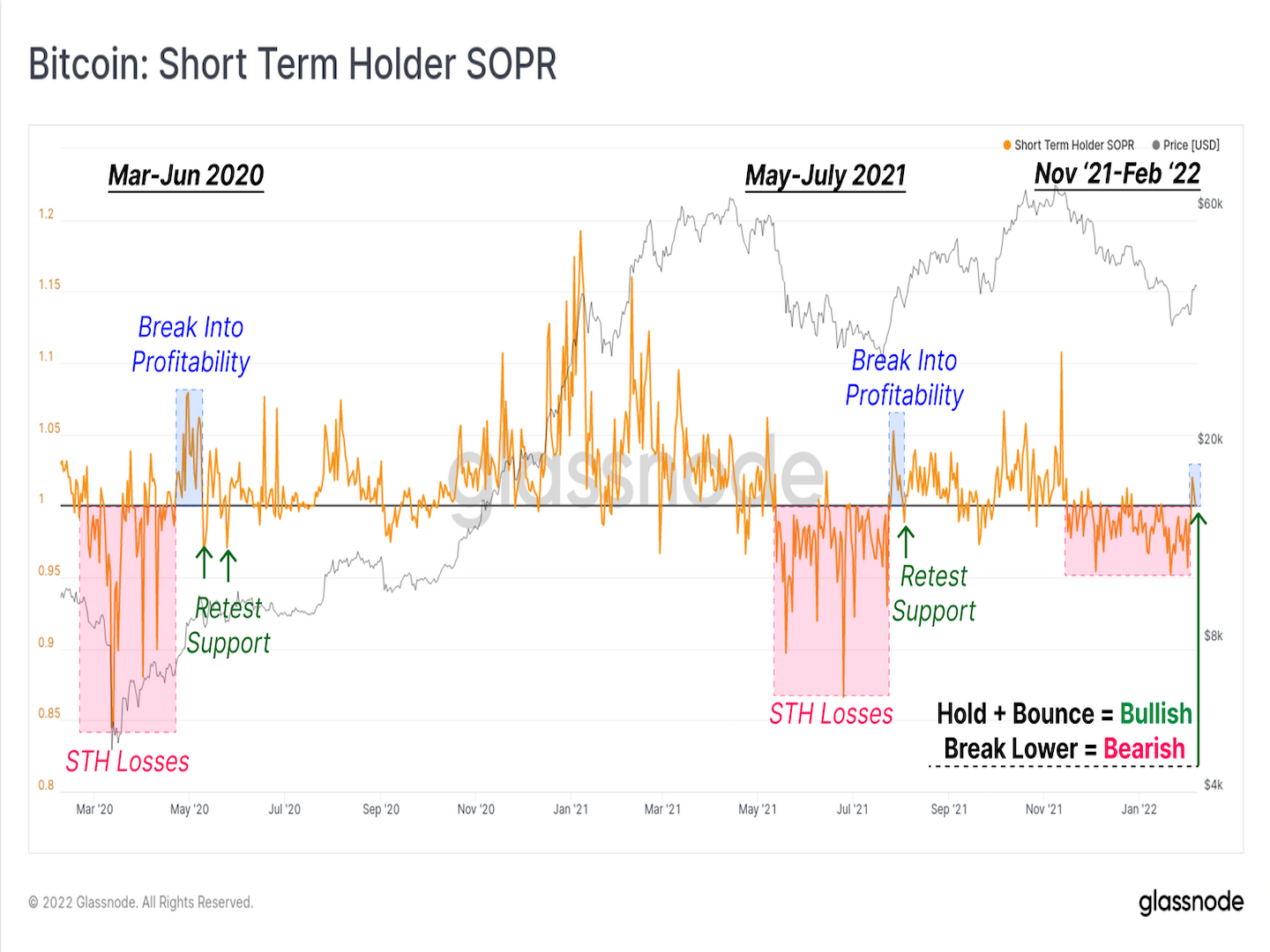

As bitcoin’s terms increased, coins that were spent and younger than 155 days, oregon those coins owned by short-term holders (STH), realized profits connected aggregate for the archetypal clip since precocious November, according to blockchain information steadfast Glassnode.

Since March 2020, the marketplace has managed to “break into a bullish uptrend” erstwhile the short-term holders broke into profitability, Glassnode wrote successful its newsletter connected Monday.

(Glassnode)

In the broader cryptocurrency market, prices of astir tokens besides rallied connected Monday. Ether, the second-biggest cryptocurrency by marketplace capitalization, was trading astatine $3,147, up 3.4% in the past 24 hours, according to CoinDesk data.

At the clip of writing, polygon (MATIC), the token of scaling systems task Polygon, was starring the latest terms rally, up by astir 20% successful the past 24 hours, according to Messari. The task announced connected Monday that it raised $450 cardinal successful a circular of backing led by Sequoia Capital India.

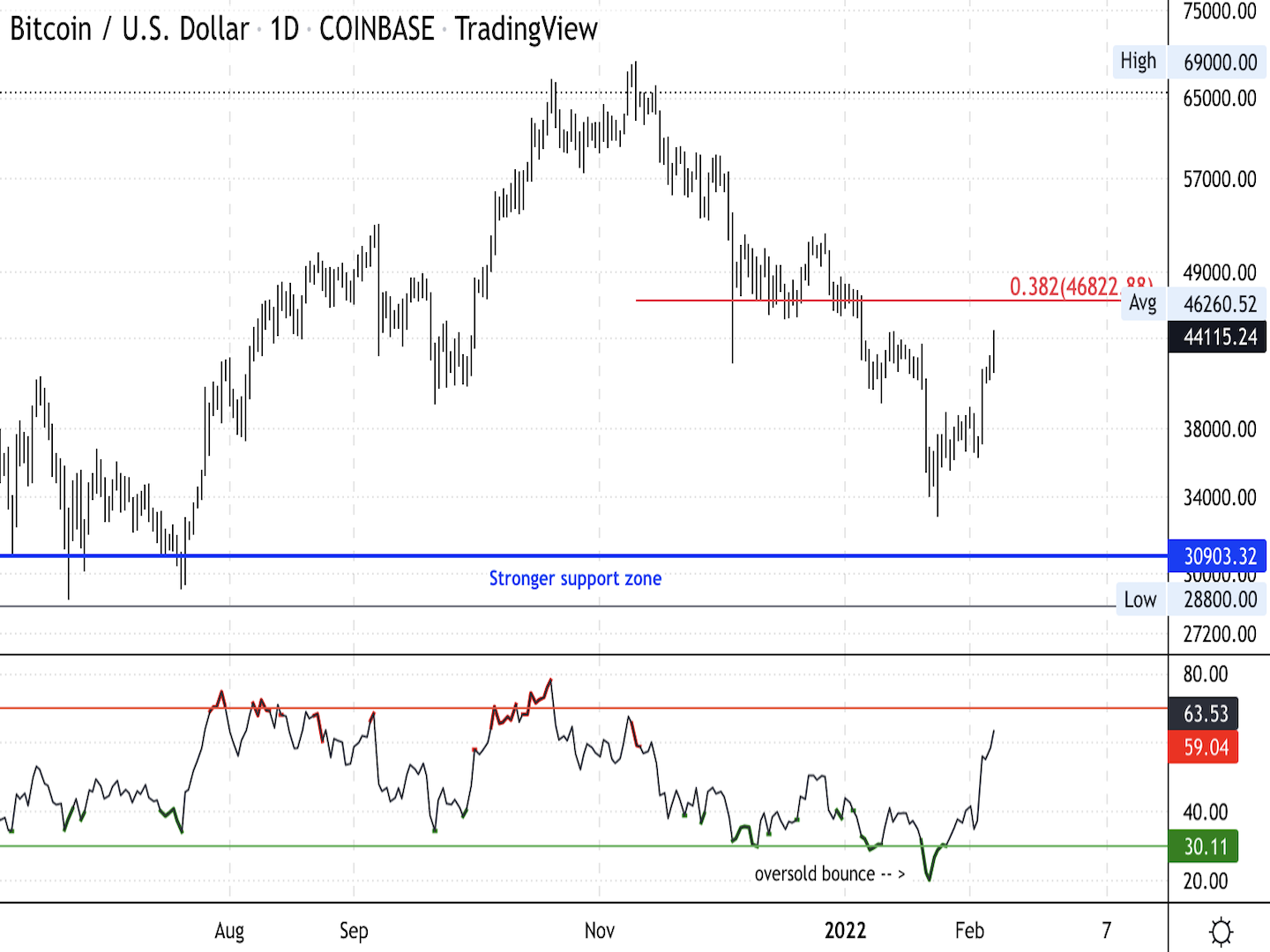

Bitcoin regular terms illustration shows support/resistance with RSI connected bottommost sheet (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) maintained enactment supra $40,000 implicit the play and is up 6% implicit the past 24 hours.

The cryptocurrency was trading astatine astir $44,200 astatine property clip and has confirmed a interruption supra its 2 month-long downtrend.

The intermediate-term outlook has go little bearish for BTC fixed the caller terms bounce. That means buyers could stay progressive toward the adjacent level of absorption of $45,000 to $47,000. At that point, a little pullback is to beryllium expected aft retracing 38% of the anterior downtrend.

The comparative spot scale (RSI) connected the regular illustration is not yet overbought, which leaves further country for terms gains this week. Buying enactment has stalled implicit the past fewer weeks aft the RSI archetypal signaled oversold conditions connected Dec. 10.

Still, momentum signals stay antagonistic connected the play and monthly chart, indicating immoderate caution down the latest terms rally.

2:30 a.m. HKT/SGT (10:30 a.m. UTC): Japan labour currency net (Dec. YoY)

2:30 a.m. HKT/SGT (10:30 a.m. UTC): Japan wide household spending (Dec. YoY)

2:50 a.m. HKT/SGT (10:50 a.m. UTC): Japan slope lending (Jan. YoY)

3:30 a.m. HKT/SGT (11:30 a.m. UTC): National Australia Bank's concern conditions (Jan.)

3:30 a.m. HKT/SGT (11:30 a.m. UTC): National Australia Bank's concern assurance (Jan.)

Bitcoin Holds Above $42K arsenic Major Cryptos Rebound, Privacy-Focused Web 3 Application Builder Aleo Raised $200M astatine $1.45B Valuation

"First Mover" hosts spoke with Voyager Digital co-founder and CEO Steve Ehrlich for an in-depth investigation connected the crypto markets arsenic large cryptocurrencies bounced back. Privacy-focused Web 3 exertion builder Aleo raised $200 cardinal successful a Series B backing circular astatine a valuation of astir $1.45 billion. Aleo CEO and Chief Technology Officer Howard Wu shared his program for expansion.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)