Good morning. Here’s what’s happening:

Market moves: Bitcoin fell arsenic U.S. stocks dipped further connected blistery ostentation data.

Technician's take: BTC is approaching overbought levels, though pullbacks could stabilize astatine betwixt $40K and $43K.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $43,807 -1.4%

Ether (ETH): $3,105 -4.1%

Bitcoin (BTC) struggled to stay supra $44,000 connected Thursday, arsenic U.S. stocks fell further pursuing hawkish remarks by a Federal Reserve official.

Responding to a amazingly precocious complaint of inflation, Federal Reserve Bank of St. Louis President James Bullard said helium supported raising involvement rates by a afloat percent constituent by July, Bloomberg reported. His comments came aft the U.S. Labor Department connected Thursday reported that the user terms scale (CPI) for January deed 7.5%, which was higher than what analysts had expected.

Bitcoin started falling arsenic banal prices declined further from an archetypal driblet earlier successful the day. At the clip of publication, the oldest cryptocurrency was changing hands astatine $43,807, down 1.4% successful the past 24 hours, according to CoinDesk data.

Meanwhile, ether, the second-biggest cryptocurrency by marketplace capitalization, was down implicit 4% to $3,105 successful the aforesaid period.

“Things similar golden and BTC often person a little driblet successful blistery CPI prints due to the fact that the marketplace starts rapidly assuming faster complaint hikes by the Fed,” Lyn Alden Schwartzer, laminitis of Lyn Alden Investment Strategy, explained successful a tweet connected Thursday.

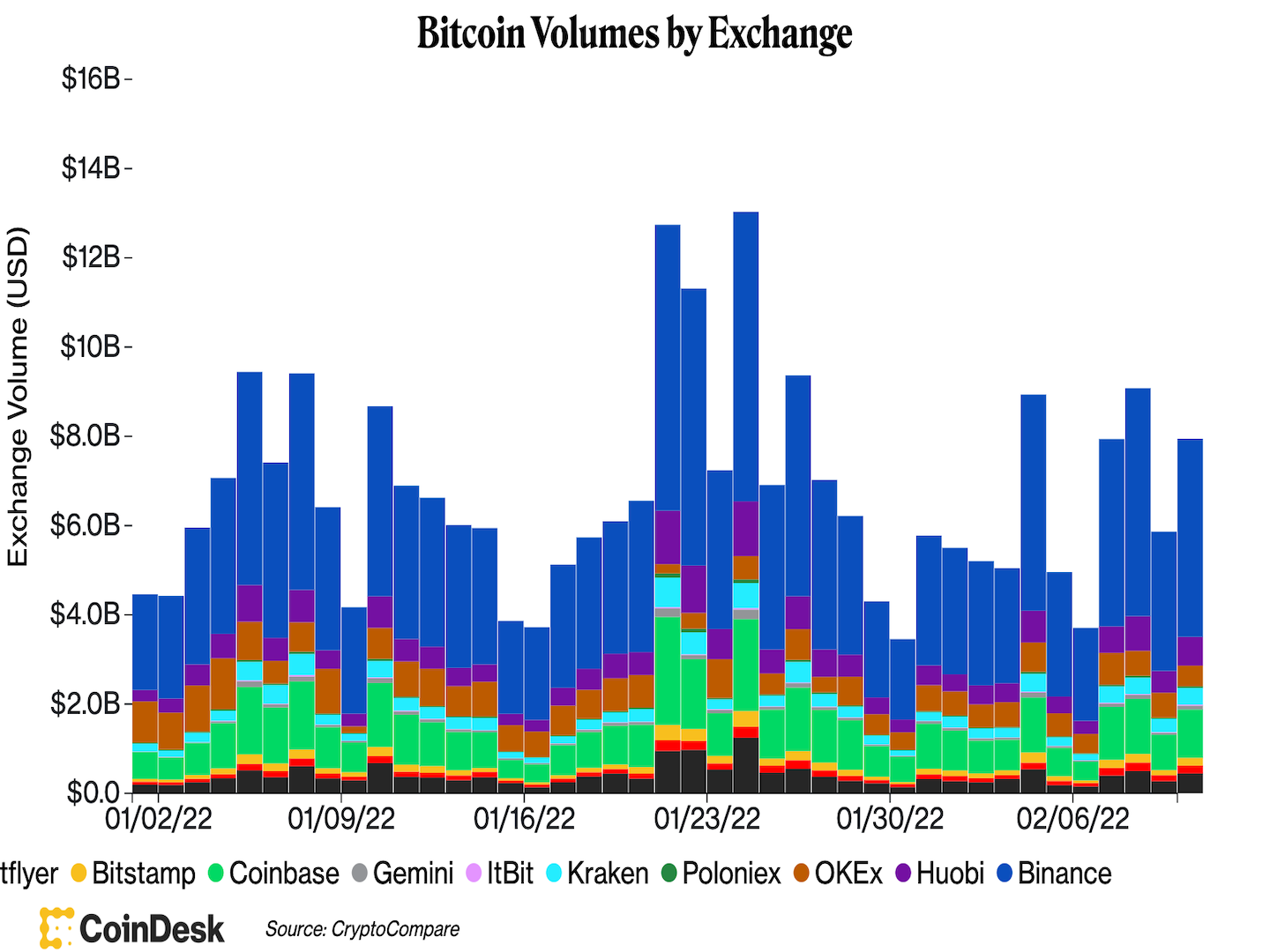

Bitcoin's spot trading measurement crossed centralized exchanges besides roseate connected Thursday from a time ago. Trading measurement successful wide was higher than a week ago, based connected information compiled by CoinDesk.

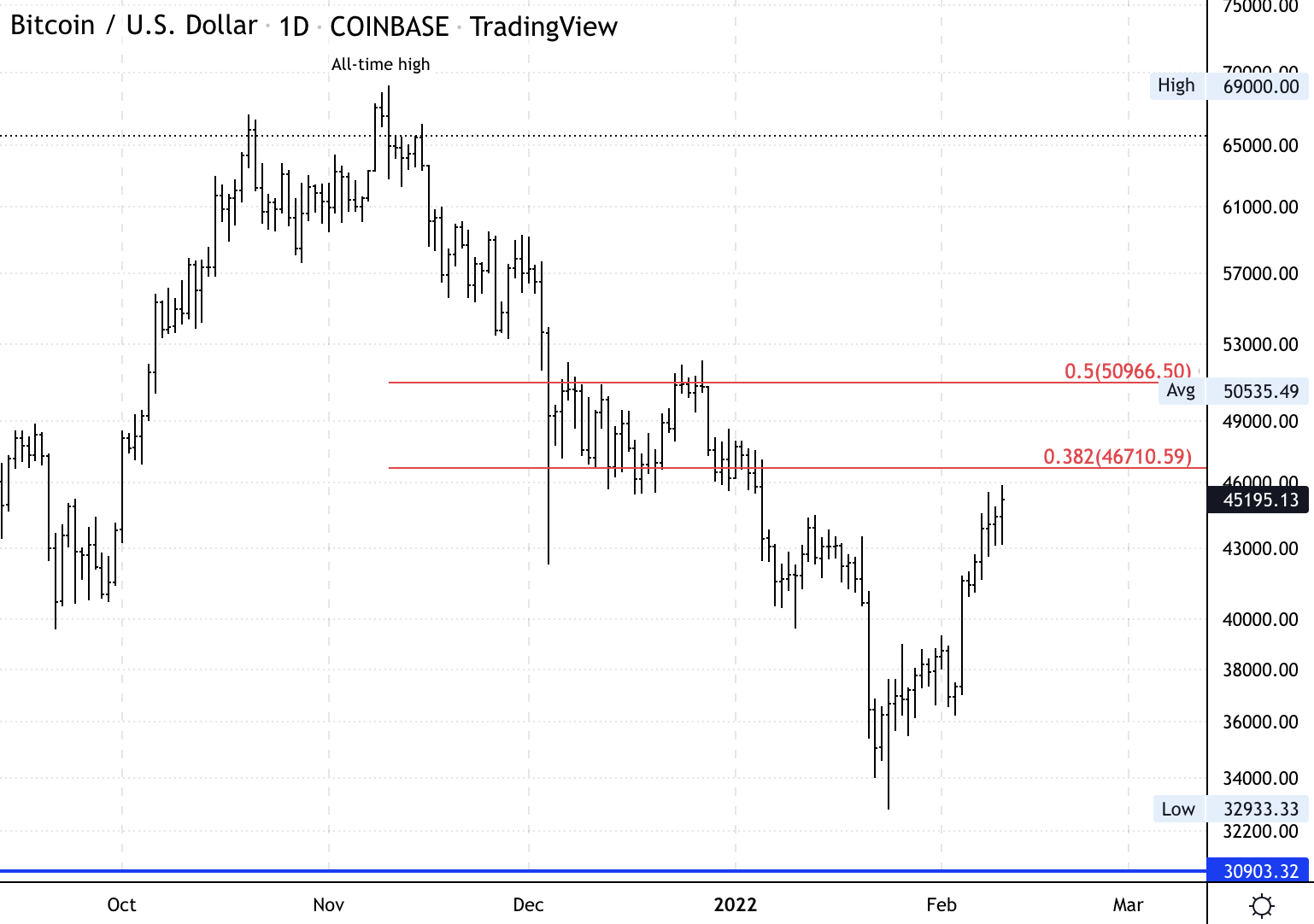

Bitcoin's regular terms illustration shows adjacent absorption levels (Damanick Dantes/CoinDesk, TradingView)

Bitcoin has traded successful a choppy scope astatine betwixt $43,249 and $45,843 implicit the past 24 hours.

Buyers reacted rapidly to a astir 5% terms driblet aboriginal successful the New York trading league and maintained short-term enactment astatine supra $43,000.

The adjacent level of absorption is astatine $46,710, which represents a 38% retracement of the erstwhile 2 month-long downtrend. Buyers could commencement to exit positions arsenic BTC approaches absorption heading into the Asia trading session.

For now, momentum signals are improving connected intraday charts, though terms enactment is volatile pursuing the U.S. ostentation report. Stronger absorption is seen astatine $50,000 if buyers prolong short-term momentum.

Pullbacks could stabilize successful the $40,000-$43,000 range.

10 a.m. HKT/SGT (2 a.m. UTC): Reserve Bank of New Zealand ostentation expectations (Q4/QoQ)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. goods commercialized equilibrium (Dec.)

3 p.m. HKT/SGT (7 a.m. UTC): U.K gross home merchandise (Q4/QoQ/YoY preliminary)

3 p.m. HKT/SGT (7 a.m. UTC): U.K. concern accumulation (Dec. MoM/YoY)

"First Mover" hosts spoke with Matthieu Jobbé-Duval of Dapper Labs for insights into the imaginable factors contributing to the surge of FLOW tokens. Scott Melker, "The Wolf of All Streets" crypto trader, shared his crypto marketplace investigation arsenic the U.S. CPI fig jumped to a 40-year high, and Brandon Buchanan, Meta4 Capital laminitis and managing partner, shared his views connected Web 3.

US Inflation Hits New 4-Decade High of 7.5% successful January: Bitcoin traders support way of the ostentation complaint due to the fact that immoderate deliberation of the cryptocurrency arsenic an ostentation hedge, and the Federal Reserve's expected effect to economical conditions often dictates marketplace direction.

"To immoderate extent, crypto is playing by a caller acceptable of rules. It stands opposed to firm and authorities powerfulness successful trying to springiness radical the quality to interact straight successful a peer-to-peer fashion. It’s sold retired a spot – giving an inch present and determination for profits. It’s surrounded by rule-makers. It’s been forced to capitulate, sometimes." (CoinDesk columnist Daniel Kuhn) ... "For the manufacture to progress, gaming studios request to look backward to bequest developers." (Zach Hungate successful an op-ed for CoinDesk) ... "I don’t deliberation that conscionable due to the fact that Avanti has a routing fig needfully means they'll get a maestro account, but it’s typically a archetypal step. You person to person a routing fig earlier you tin get a maestro account." (Alabama School of Law prof Julie Hill to CoinDesk) ... "Retailers and analysts predicted that the bulk buying successful the aboriginal days of the pandemic, erstwhile supplies of galore goods were constrained, would subside erstwhile radical returned to work, stores were capable to restock and vaccinations became widespread. Instead, Americans proceed to stockpile nutrient and household goods." (The Wall Street Journal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)