Good morning. Here’s what’s happening:

Market moves: Bitcoin was trading astatine implicit $36,000 connected Sunday aft continuing its caller diminution earlier successful the weekend.

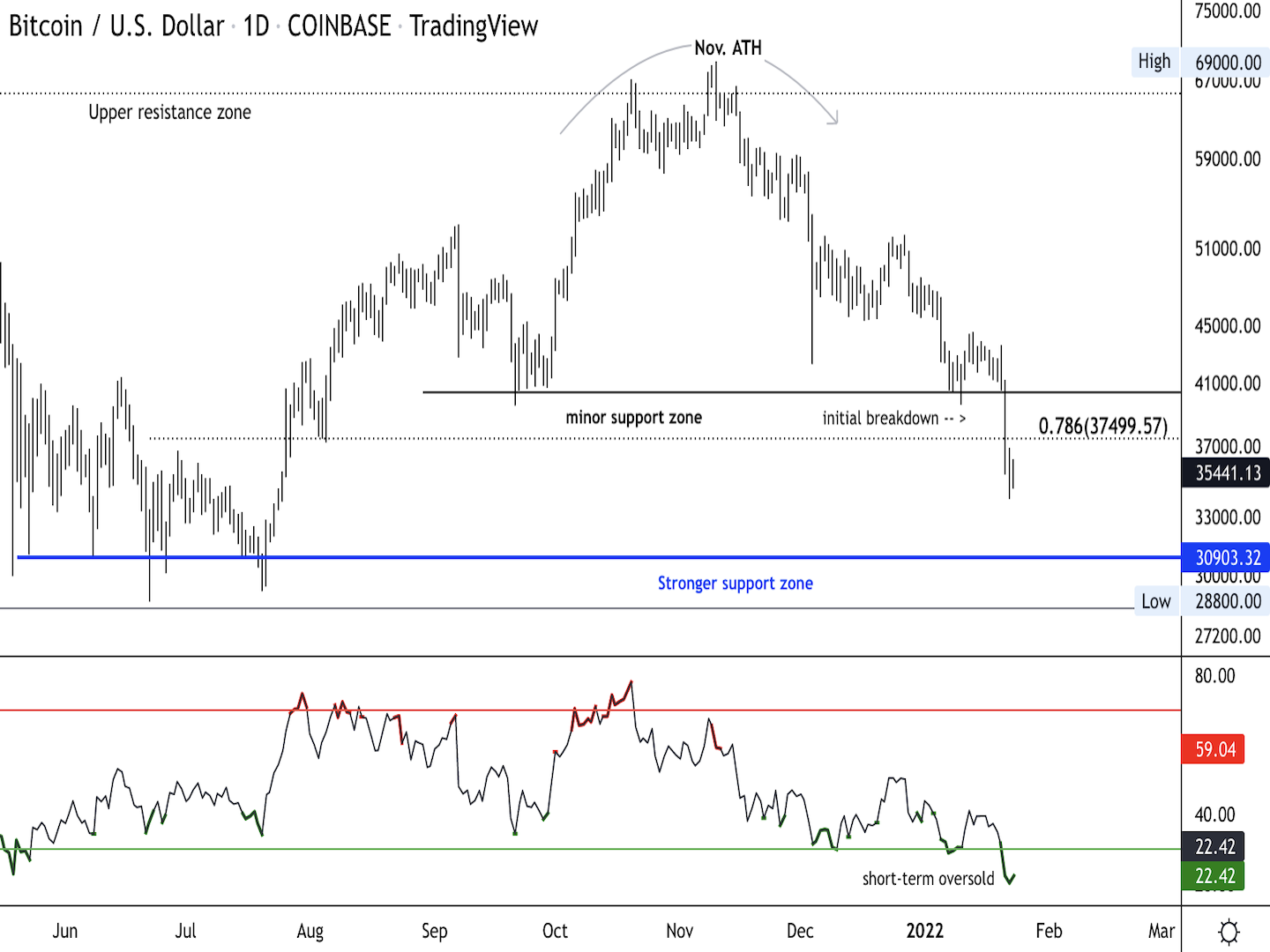

Technician's take: BTC is stabilizing connected intraday charts, though $30,000 is simply a much important level to ticker fixed the diminution successful semipermanent momentum.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $36,202 +3.4%

Ether (ETH): $2,532 +5.4%

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Bitcoin capped a forgettable 3 days, dipping beneath $34,400, earlier mounting a tiny comeback connected Sunday.

At the clip of publication, the world's largest cryptocurrency by marketplace capitalization was trading good supra $37,000, a astir 3.4% summation implicit the erstwhile 24 hours but good disconnected its all-time precocious adjacent $69,000 acceptable successful aboriginal November. Trading measurement was airy with galore investors continuing to measure troubling economical conditions and a pronounced diminution successful equities markets.

The tech-heavy Nasdaq fell 2.7% connected Friday arsenic investors continued to veer distant from stocks that led caller years' complaint successful stocks. Two different large indexes, the Dow Jones Industrial Average and S&P 500 fell 1.3% and 1.8%, respectively. The marketplace slump has stemmed from wide concerns astir involvement rates, proviso concatenation inefficiency and the ongoing coronavirus, which has been gathering spot successful galore parts of the U.S. adjacent arsenic it wanes successful others.

Ether dipped beneath $2,400 connected Saturday earlier returning to a basal campy supra that level, wherever spent the remainder of the weekend. At the clip of publication, the 2nd largest crypto by marketplace headdress was trading supra $2,500, an astir 5.5% rise. Most of the large altcoins spent Sunday successful the red.

"The marketplace is holding its enactment arsenic investors look to the opening of the Asian markets for a motion of what equities volition bash this week," Joe DiPasquale, the CEO of crypto money BitBull Capital told CoinDesk. "If Asian markets unfastened strong, we tin expect request for crypto to spell up, and adjacent much truthful if the U.S. markets person a beardown Mondday.

DiPasquale added that "crypto is inactive uncovering its mode arsenic to whether it is simply a integer gold-like hedge that moves inversely with equities, oregon whether it's a risk-on plus that volition neglect if equities proceed to neglect connected Monday arsenic galore equity indexes did connected Friday. While those astir bullish connected the concern lawsuit for crypto mention longer-term information that constituent to Bitcoin not being correlated with different plus classes, information implicit the past 2 years has shown a correlation successful the terms of Bitcoin and equities."

Bitcoin Sell-Off Deepens Below $40K; Minor Support Nearby

Bitcoin (BTC) failed to clasp short-term enactment astatine $40,000 arsenic sellers maintained the two-month agelong downtrend.

Intraday oversold signals were not capable to prolong bids, which means longer-term indicators are much reliable to find bitcoin’s terms direction.

BTC was trading astir $36,200 astatine property clip and is down 17% implicit the past week.

The slowdown successful upside momentum connected monthly and play charts has been a persistent taxable since December. As the semipermanent uptrend weakens, sellers typically outweigh buyers contempt occasional oversold signals.

Further, erstwhile drawdowns (percent diminution from highest to trough) go severe, short-term traders thin to trim their presumption sizes and tighten commercialized parameters astir intraday enactment and absorption zones.

Bitcoin is astir 40% beneath its all-time precocious of $69,000, which is simply a important drawdown. The erstwhile drawdown utmost was successful July erstwhile BTC settled adjacent $28,000 aft falling astir 50% from its peak.

For now, archetypal enactment is astir $35,000-$37,000, which could stabilize the existent sell-off. The comparative spot scale (RSI) connected the regular illustration is the astir oversold since May 19, which preceded 2 months of sideways trading earlier a rebound occurred.

If selling unit accelerates this week, BTC could find stronger enactment astir $30,000.

8:30 a.m. SGT/HKT (12:30 a.m. UTC): Jibun Bank manufacturing purchasing managers scale (PMI) (Jan. preliminary)

5 p.m. SGT/HKT (9 a.m. UTC): Euro Zone Markit Manufacturing PMI (Jan. preliminary)

10:45 p.m. SGT/HKT (2:45 p.m. UTC): U.S. Markit Manufacturing PMI (Jan. preliminary)

11:30 p.m. SGT/HKT (3:30 p.m. UTC): Dallas Fed manufacturing scale (Jan.)

"First Mover" hosts were joined by Congressman Tom Emmer (R-MN) arsenic helium introduces a caller measure aimed to bounds the Federal Reserve's quality to contented a integer currency. This comes arsenic the Fed has conscionable released a long-awaited achromatic insubstantial connected the integer dollar. Bitcoin crashed to a five-month low. Managing Director of MarketGauge Group Michele Schneider provided her analysis. Plus, erstwhile SEC Commissioner and Patomak Global Partners CEO Paul Atkins gave his instrumentality connected the latest regulatory awesome from SEC Chair Gary Gensler.

"What we would anticipation is that, arsenic we get into the adjacent weeks to period oregon so, we'll spot passim the full state the level of corruption get to beneath what I telephone that country of control."....(Anthony Fauci connected ABC's This Week)...."Now immoderate executives accidental proviso challenges are worse than ever. The deficiency of workers leaves a broader scope of products successful abbreviated supply, food-industry executives said, with availability sometimes changing daily." (U.S. Food Supply Is Under Pressure, From Plants to Store Shelves/The Wall Street Journal)..."Hunt offers an analogy here: Our aboriginal engagement with the metaverse could mimic how, with the assistance of science, we came to judge the existent beingness of an unseeable “microverse:” that realm of viruses, parasites and different microbes that we’ve since learned however to manipulate, sometimes successful sinister ways." (CoinDesk Chief Content Officer Michael Casey)..."Many altcoins are into enactment astatine their summertime 2021 lows, making it captious that bitcoin holds enactment arsenic it sets the code for the cryptocurrency space." (Katie Stockton, managing manager of Fairlead Strategies, quoted by CoinDesk)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)