Good morning. Here’s what’s happening:

Market moves: Bitcoin roseate somewhat connected Sunday but was inactive mode disconnected its terms of a week ago; astir large altcoins dipped implicit the weekend.

Technician's take: BTC was confined to a choky scope implicit the weekend. Indicators are neutral, though oversold conditions could support short-term buyers active.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

"First Mover" hosts spoke with CoinDesk columnist David Morris for his views connected crypto firms specified arsenic FTX and Crypto.com becoming large advertizing players astatine this year's U.S. shot title game, the Super Bowl. Polygon co-founder Sandeep Nailwal shared details down the firm's latest rise that let it to physique Web 3 applications and put successful zero-knowledge technology. Plus, Kareem Sadek of KPMG Canada spoke astir the firm's determination to adhd crypto to its equilibrium sheet.

Bitcoin (BTC): $42,176 +0.1%

Ether (ETH): $2,879 -0.7%

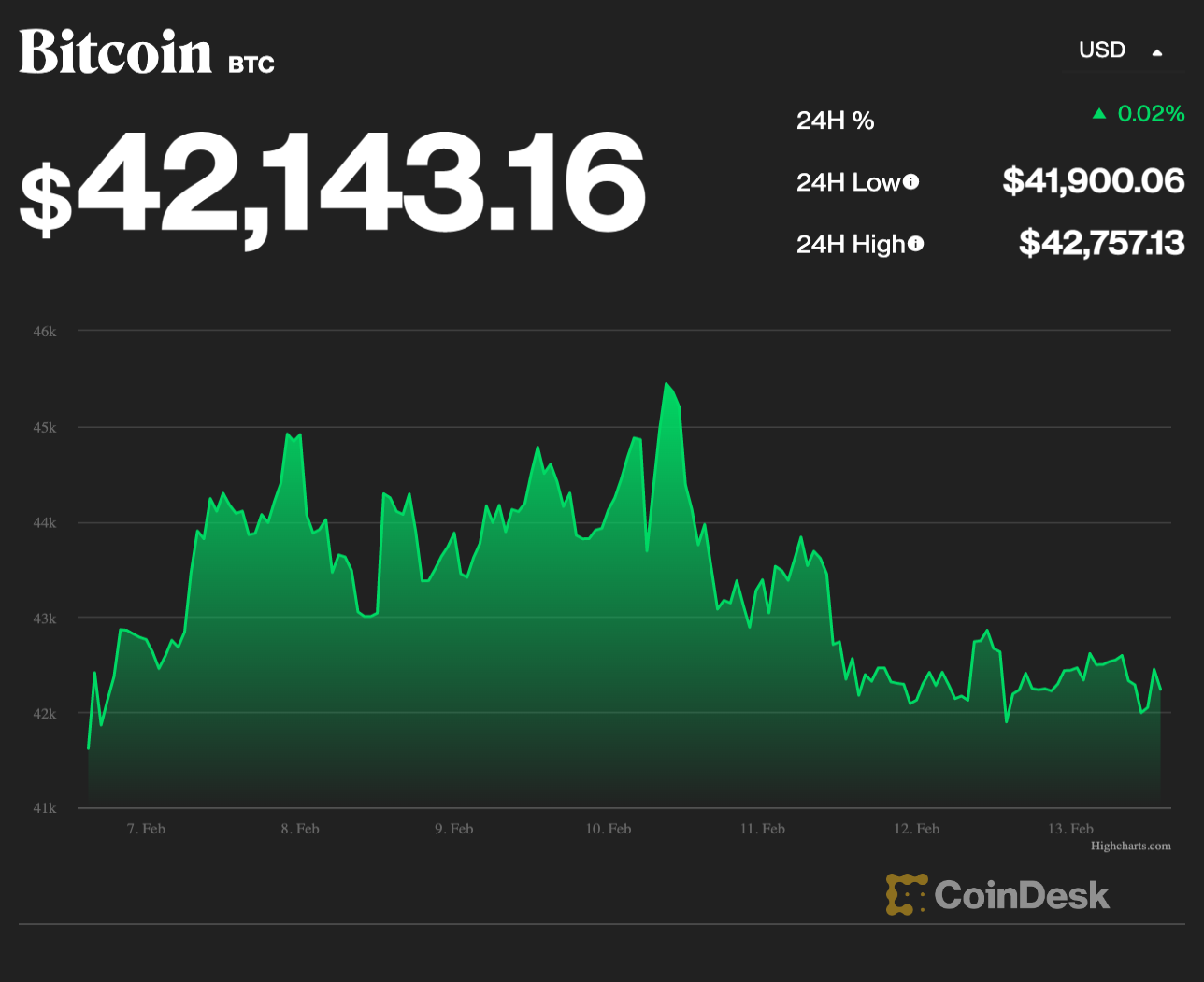

Bitcoin inched upward connected Sunday but remained good disconnected wherever it started the week amid investors' concerns astir ongoing inflationary unit and a imaginable warfare with Russia.

At the clip of publication, the largest cryptocurrency by marketplace capitalization was trading astatine astir $42,200, up somewhat implicit the past 24 hours. Ether and different large altcoins fell. Ether was trading astatine astir $2,880, disconnected slightly.

"Overall, crypto is down this week, including a descent successful prices Friday that immoderate judge is correlated to reports of Russian subject exercises indicating that an penetration and imaginable resulting warfare is imminent," said Joe DiPasquale, the CEO of money manager BitBull Capital.

Trading measurement for the past week was astir fractional its level of a twelvemonth ago, starring to the precocious terms volatility. "This week has seen the prices of large cryptos some emergence and autumn sharply," DiPasquale said.

CoinDesk bitcoin terms page

Crypto's choppy show has mostly emulated large banal indexes, which fell sharply connected Friday. The S&P 500 dropped astir 2% connected Friday and the tech-focused Nasdaq plummeted 2.7%.

To beryllium sure, bitcoin and ether are up successful February aft a lackluster archetypal period of the year, though solana and different altcoins are down "due to jitters implicit insecurities successful the Wormhole protocol," DiPasquale noted.

He added that "anything tin happen" if bitcoin approaches $40,000 due to the fact that of the little trading volumes. "If the support. enactment holds, we could spot a ample bounce, but it does not we could spot a important drop," helium said.

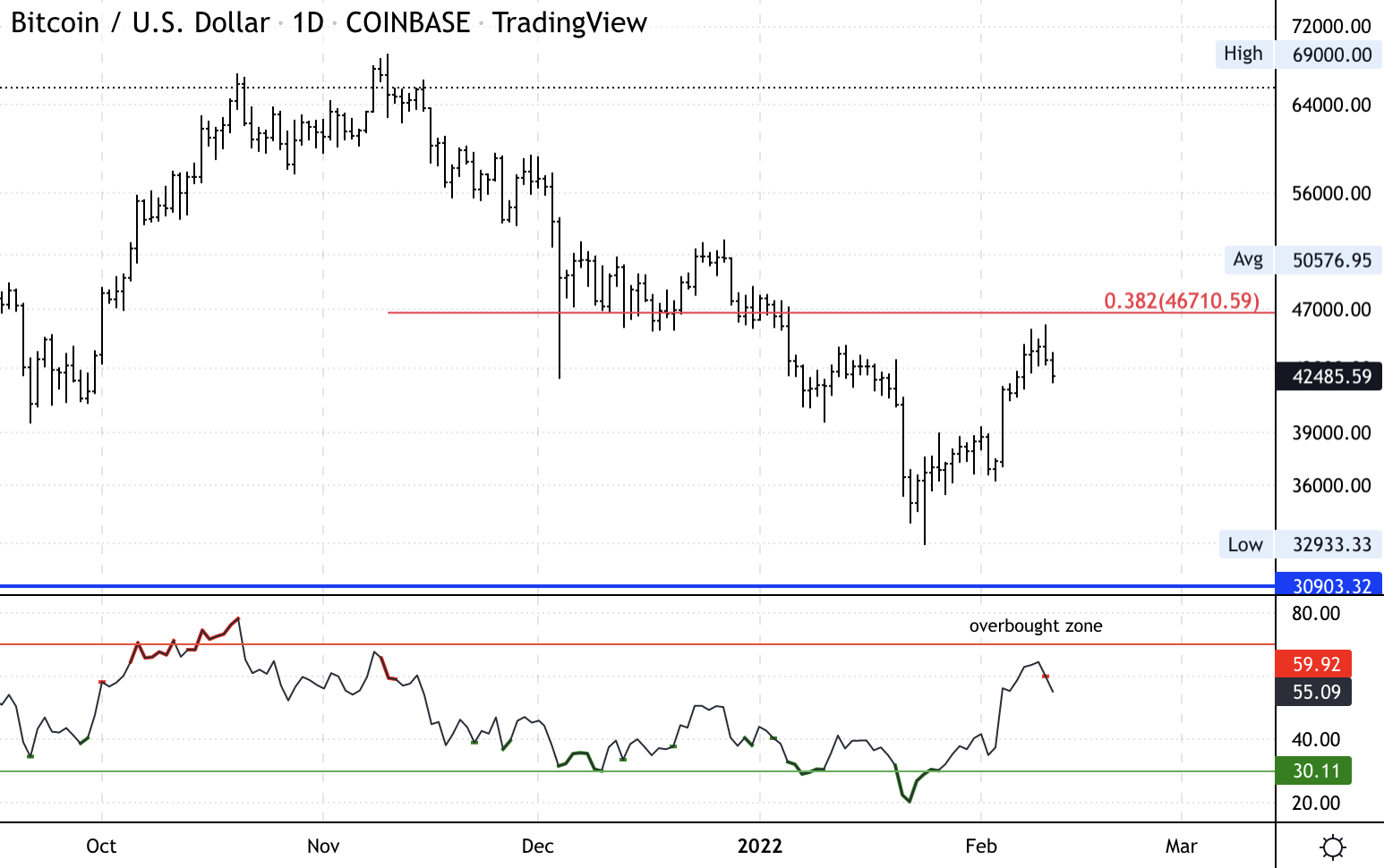

Bitcoin regular terms illustration shows adjacent resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) sellers were progressive aft buyers failed to prolong a interruption supra $45,000 this week. The cryptocurrency was astir level implicit the past 24 hours and was confined to a choky scope implicit the weekend. Initial enactment astatine $40,000 could stabilize pullbacks.

The comparative spot scale (RSI) connected the regular illustration approached oversold territory connected Wednesday, which preceded the caller downturn successful price. On the play chart, however, the RSI is rising from oversold levels akin to what occurred successful March 2020, which could support buyers progressive implicit the abbreviated term.

Momentum indicators improved connected the play illustration aft BTC roseate 4% implicit the past 7 days. That suggests a neutral outlook truthful agelong arsenic enactment holds supra $35,000-$40,000 implicit the weekend.

Still, the monthly illustration appears bearish akin to July 2018, which was the mediate of a crypto carnivore market.

New Zealand REINZ location terms scale (Jan. MoM)

Australia lodging caller location income (Jan. MoM)

4:30 p.m. HKT/SGT (8:30 a.m. UTC): U.S. 3/6-month measure auction

11:50 p.m. HKT/SGT (3:50 p.m. UTC): Japan gross home merchandise (Q4/QoQ preliminary)

"First Mover" hosts spoke with CoinDesk columnist David Morris for his views connected crypto firms specified FTX and Crypto.com becoming advertisers astatine this year's Super Bowl. Polygon co-founder Sandeep Nailwal shared details down the firm's latest rise that let it to physique Web 3 applications and put successful zero-knowledge technology. Plus, Kareem Sadek of KPMG Canada spoke astir the firm's determination to adhd crypto to its equilibrium sheet.

The Digital Euro: What We Know So Far: The European Commission is readying to present a integer euro measure successful 2023, but small is known astir the EU’s plans for a cardinal bank-issued integer currency.

"Without programmability oregon entree to a nationalist blockchain, existing stablecoin users are improbable to beryllium won implicit oregon to spot the worth proposition astatine all. But CBDCs could inactive beryllium attractive, if they negociate to lick interoperability issues betwixt countries’ fiscal systems." (EY Global Blockchain Leader Paul Brody for CoinDesk) ... “It’s topsy-turvy. It’s a precise uncertain infinitesimal of clip successful the markets arsenic we look a batch of crosscurrents that, frankly, a batch of investors of the existent procreation person ne'er seen before.” (Jackie Cavanaugh, portfolio manager of the Putnam Focused Equity Fund astatine Putnam Investments, successful The Wall Street Journal) ... "The caller tumult successful banal markets has brought the fairground metaphors flooding back. Should equity investors brace for a sickening lurch downwards? And arsenic they plummet, volition the groaning girders beneath them – the infrastructure underpinning markets – clasp firm? The operation of concern has changed dramatically since the fiscal situation of 2007-09." (The Economist) ... “It [inflation] benignant of cascades from initially a tiny acceptable of goods to a overmuch larger acceptable of goods.” (Former SEC main economist, and present Carnegie Mellon professor, Chester Spatt successful The Wall Street Journal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)