Good morning. Here’s what’s happening:

Prices: Bitcoin was higher for a 3rd consecutive day, changing hands astir $41,500. But the headiest (and astir ridiculous) crypto-markets enactment was successful ApeCoin.

Insights: Bitcoin "minnows" mightiness beryllium small, but don't uncertainty their resolve.

Technician's take: There has been a nonaccomplishment of downside momentum connected bitcoin's regular chart, which could support short-term buyers active.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $41,542 +0.5%

Ether (ETH): $3,092 -0.2%

Bitcoin holds $41,500 successful mixed trading time for crypto, stocks

Indecisiveness ruled markets Wednesday arsenic bitcoin flipped betwixt gains and losses connected the time and U.S. stocks ended the league mixed.

One happening that was wide was that ApeCoin (APE) was pumping, though adjacent that determination was panned arsenic ridiculous, entirely speculative and based connected unconfirmed tweets.

Bitcoin was holding adjacent the $41,500 terms level aft a three-day terms summation of astir $3,000. Analysts said that the largest cryptocurrency was benefiting from optimism that a spot bitcoin exchange-traded money might triumph support from the U.S. Securities and Exchange Commission.

“I don't deliberation there's immoderate 1 large catalyst for terms question up oregon down close now,” Jason Deane, bitcoin marketplace expert astatine Quantum Economics, told CoinDesk's Angelique Chen.

In traditional markets, the Standard & Poor's 500 Index of ample U.S. stocks ended the time somewhat down, portion the Nasdaq Composite Index fell 1.2%; Netflix tumbled much than 30%. The U.S. 10-year Treasury output slid 0.07 percent point to 2.84%.

In different crypto news, the elephantine crypto speech Binance unveiled its caller Twitter emoji Wednesday, and soon took it down aft users pointed retired its resemblance to a swastika.

Research: Bitcoin Minnows Are Fierce Fish

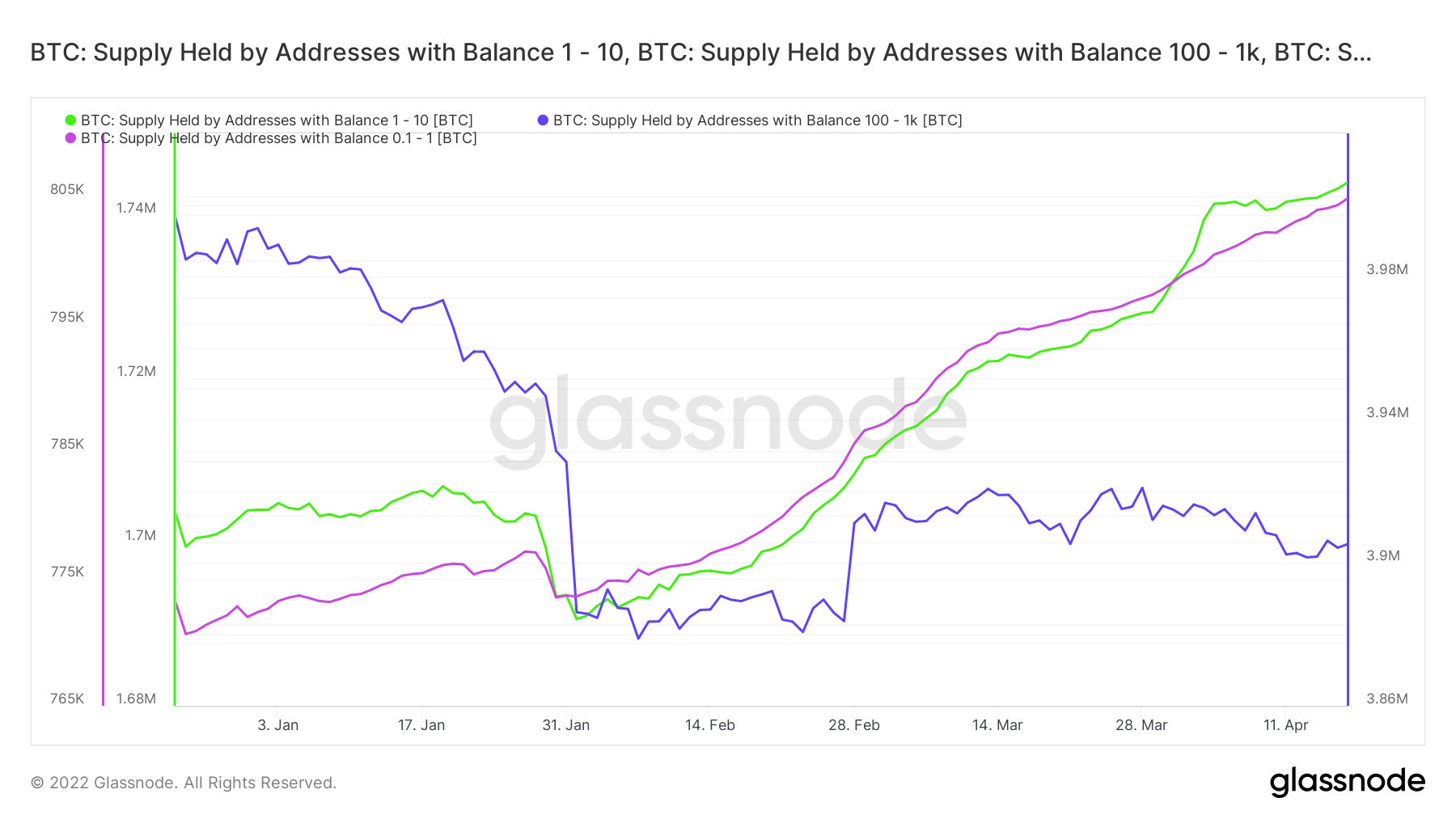

After January’s terms correction, which seemed melodramatic by galore standards but par for the people for crypto traders, bitcoin "minnows" (which we are calling those that clasp 0.1-10 BTC) began accumulating crypto astatine grounds speed.

(Glassnode)

All the while, the fig of wallets with a bitcoin equilibrium of 100-1,000 declined, suggesting a selloff by larger holders.

According to a new study from Glassnode, these "minnows" besides person a fierce appetite for symptom and are hodling their crypto done immoderate aggravated volatility and terms compression adjacent though their coins person yet to acquisition a breakout.

For its part, Glassnode is defining semipermanent holders arsenic those who bought earlier bitcoin’s all-time high In October 2021, portion anyone who bought aft that day is considered a short-term holder.

Those who bought aft the all-time precocious — careless of portfolio size — didn’t similar the ride.

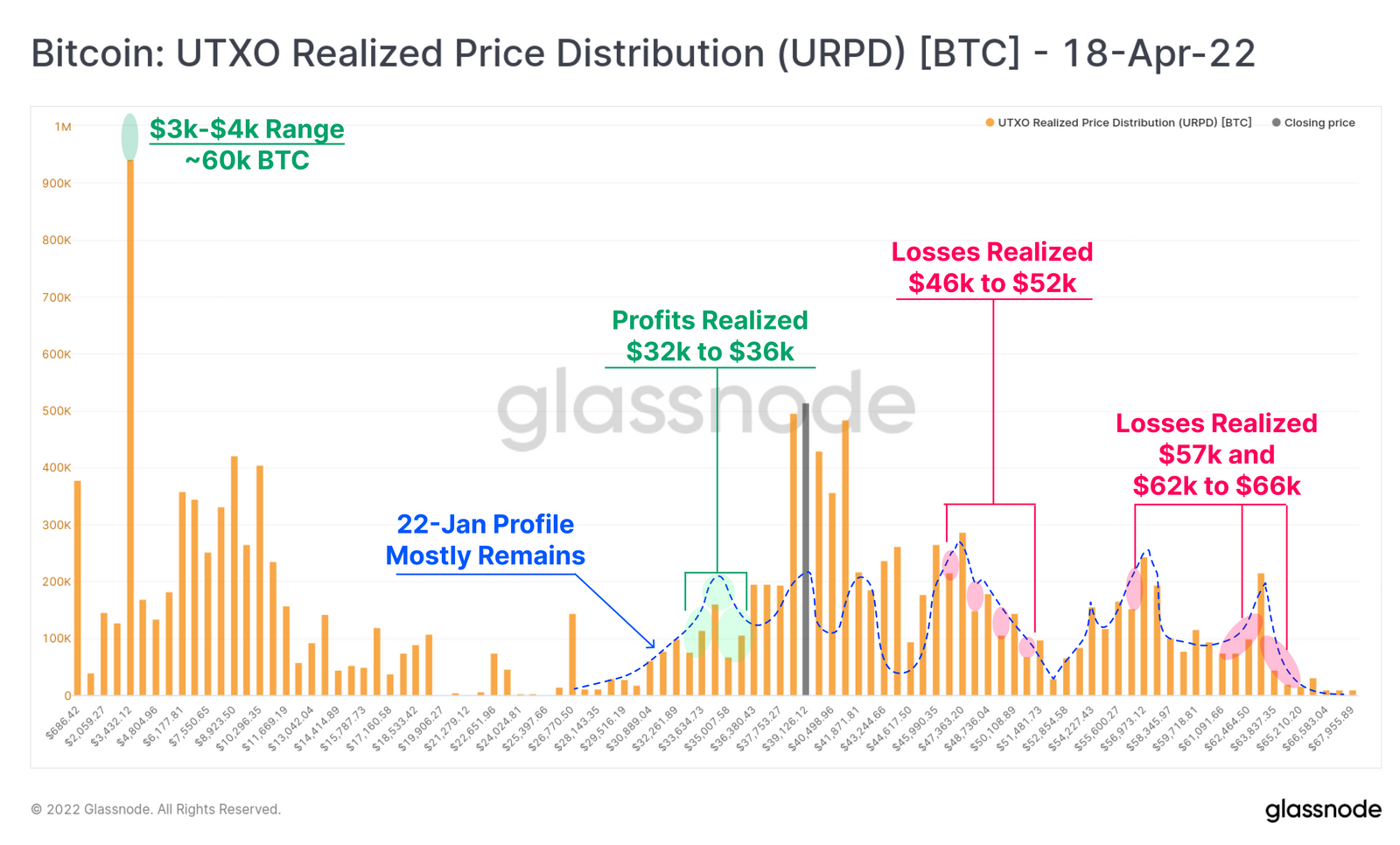

Glassnode points to a monolithic selloff by those who bought astatine the apical (short-term holders) astatine astir $50K-$60K.

“What we tin spot is that the caller correction pushed a historically important measurement of LTH coins into an unrealised loss. This means that the magnitude of buying betwixt August and November, which has present go underwater HODLing, is immoderate of the astir important of each time,” Glassnode wrote.

Glassnode notes that investors that bought the top, those progressive betwixt August 2021 and January 2022, person seen prices plunge beneath their outgo ground and person dumped bitcoin causing a “large standard redistribution of the bitcoin proviso to caller hands.”

And these caller hands aren’t needfully semipermanent holders picking up further supply.

At the aforesaid time, Glassnode observes that those that purchased bitcoin successful the past week of January — the minnows — are inactive hodling.

“Much of the measurement illustration from 22-Jan remains intact. Despite an further 2.5 months of sideways consolidation, a ample proportionality of the marketplace appears unwilling to walk and merchantability their coins, adjacent if their coins are held astatine a loss,” Glassnode wrote.

(Glassnode)

A large portion of the bitcoin ethos is investigating your faith, oregon conviction, successful the plus class. Crypto has sustained immense periods of volatility, carnivore markets, and bull arsenic well, yet determination inactive are investors consenting to dive in.

“This correction has been historically significant, suggesting the assurance and condemnation of Bitcoin investors has been thoroughly tested,” Glassnode wrote. “What we person seen implicit the past 5-months is simply a 50%+ correction that appears to person importantly reshuffled the ownership operation of BTC. A large galore Long-Term Holders with coins supra $50k look wholly unfazed, whilst others person been wholly shaken-out, astatine a historically important rate.”

Some whales got shaken retired but the minnows support connected swimming.

Bitcoin (BTC) has maintained support supra $37,500 implicit the past month, indicating a nonaccomplishment of downside momentum.

On intraday charts, however, BTC appears to beryllium overbought, which could concisely stall the existent upswing successful price.

A bid of higher terms lows since Jan. 24 suggests continued buying involvement astir the $32,000-$37,500 enactment zone, which is the bottommost of a year-long terms range.

The adjacent large resistance level is seen astatine $46,700, which has capped terms rallies implicit the past fewer months. Typically, terms rises statesman to stall aft retracing astir 38% to 50% of the prevailing downtrend, akin to what occurred successful September of past year.

Still, the important slowdown successful BTC's semipermanent uptrend suggests upside could beryllium constricted implicit the adjacent fewer months.

7:30 a.m. HKT/SGT(11:30 p.m. UTC): Japan National Consumer Price scale (YoY/March)

5 p.m. HKT/SGT(9 a.m. UTC): Euro Area Harmonised Index of Consumer Prices (MoM/March)

8 p.m. HKT/SGT(12 p.m. UTC): International Monetary Fund continues Spring meetings.

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

It's Bananas, but Unconfirmed Metaverse Rumors Are Pumping ApeCoin: The latest terms pump successful almost-anything-goes crypto markets shows conscionable however speedy and casual it tin beryllium to interaction disconnected a caller flurry of speculation.

Binance.US Quits Blockchain Association, Forms In-House Lobbying Shop: A root adjacent to the institution says the groups’ goals “were not afloat aligned.”

US Sanctions Russian Crypto Mining Host Bitriver: Bitriver and 10 subsidiaries were added to the OFAC database Wednesday successful transportation with their ties to the Russian economy.

Elon Musk Shouldn't Lead Twitter: Crypto, the root of truthful galore of Twitter’s problems, besides provides a blueprint successful advocating for permissionless protocols.

3 years ago

3 years ago

English (US)

English (US)