Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Most cryptos diminution arsenic investors await the U.S. cardinal bank's apt determination to summation involvement rates a half-point.

Insights: Minnows amusement their committedness to bitcoin.

Technician's take: BTC is astatine hazard of a breakdown arsenic terms momentum slows.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $37,841 -2%

Ether (ETH): $2,796 -2.5%

Biggest Gainers

Biggest Losers

Bitcoin, different cryptos decline

Bitcoin and different cryptos proceed their spiral of the past 5 days arsenic investors await the worst-kept concealed successful caller U.S. monetary policy, a half-point complaint involvement complaint hike by the Federal Reserve.

The largest cryptocurrency by marketplace capitalization was precocious trading astatine astir $37,800, down implicit 2% implicit the past 24 hours. Ether, the second-largest crypto by marketplace cap, was changing hands astatine astir $2,800, disconnected likewise for the aforesaid period. Most different large cryptos were successful the red, albeit not by much. SOL, ADA and AVAX had each precocious fallen much than a percent point. CRO and TRX each roseate astir 5% and ALGO jumped astir 6% a time aft announcing that it would go the authoritative blockchain level of FIFA, soccer's satellite governing body.

"The macro issues, whether it's the Ukraine war, planetary proviso concatenation issues and ostentation that's affecting each different state arsenic acold arsenic starring the Fed to tighten its policies, and successful times similar these risky assets mostly don't execute well," Kapril Rathi, co-founder and CEO of integer plus trading level CrossTower, told CoinDesk TV's "First Mover" program. "One tin reason crypto is beauteous overmuch successful the aforesaid class arsenic tech successful presumption of risk. We spot macro unit connected tech and cryptos astatine the aforesaid time."

The Federal Reserve has been wide expected to statesman a much hawkish attack to taming inflation, which has deed 40-year highs and threatens to summation further amid Russia's continued aggression successful neighboring Ukraine. The struggle has sent vigor prices skyrocketing arsenic galore countries look to alternatives from Russian energy, and proviso chains person suffered ongoing delays. The terms of Brent crude oil, a wide watched measurement of vigor markets, dropped somewhat from Monday but was inactive trading astatine astir $105 per barrel, up astir 40% since the commencement of the year.

In a report, Arcane Research noted that futures premiums remained historically low, "signaling persistent pessimism from progressive marketplace participants," and that the Fear and Greed Index was registering “Fear” oregon “Extreme Fear,” for a 4th consecutive week, its longest play of fearful marketplace sentiment this year.

Rathi struck a cautiously optimistic code astir bitcoin's pricing aboriginal successful the year. "In the adjacent six to 9 months, we volition spot an important relation that bitcoin volition play arsenic countries woody with ostentation truthful I americium expecting a bounce backmost successful the market."

The condemnation of bitcoin minnows

Bitcoin opened the week successful the red, with nary alleviation successful Asia and support hitting the $37,000 mark.

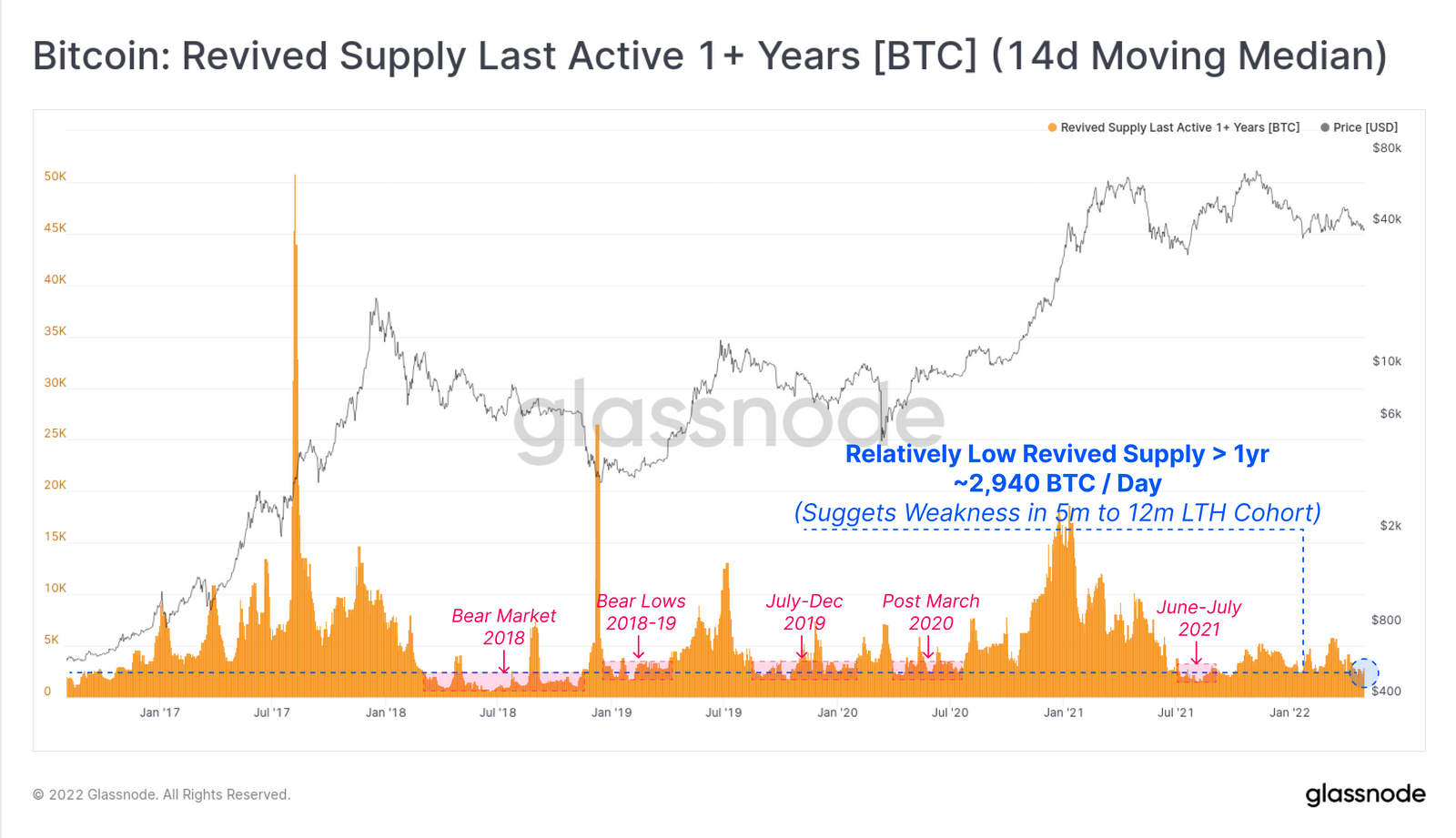

As the marketplace continues to beryllium range-bound and not marque immoderate assertive moves successful an upward direction, Glassnode has noted successful a caller study that the newest "Long Term Holders" (defined arsenic those who bought earlier bitcoin’s all-time precocious successful October 2021) are “peering into the abyss of holding unprofitable positions” and are preparing to capitulate and merchantability disconnected similar their peers that person held for longer are already doing.

“The existent marketplace operation for bitcoin remains successful an highly delicate equilibrium, with short-term terms enactment and web profitability leaning bearish, whilst semipermanent trends stay constructive. The capitulation of Long-Term Holders appears to beryllium continuing,” Glassnode wrote.

(Glassnode)

In anterior reports, Glassnode has noted that there’s a large redistributing occurring successful crypto wherever the semipermanent holders panic merchantability to caller entrants.

We’ve called this cohort the minnows, arsenic these mighty but tiny food person bought crypto from large-holder whales due to the fact that of their condemnation successful the plus class.

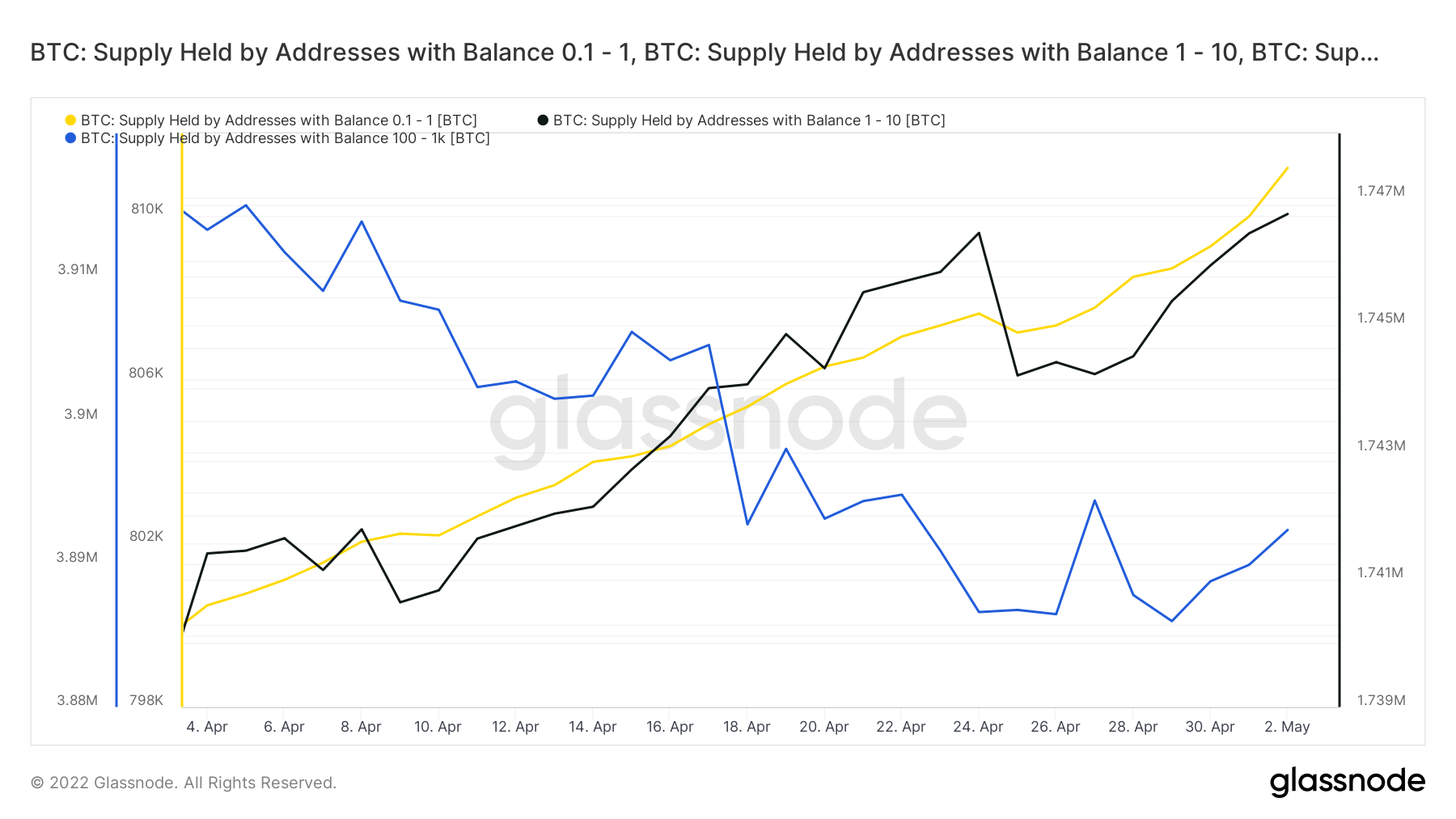

(Glassnode)

And these minnows proceed to turn and multiply. Despite that the past period has been comparatively boring and compressed for the markets the proviso held by wallets with betwixt 0.1-10 BTC has continued to emergence to the constituent wherever they collectively clasp 2.5 cardinal bitcoin.

There’s a agelong mode to spell until the "flippening" happens. Glassnode thinks this inclination could beryllium reversed if the minnows find themselves extracurricular their symptom tolerance. After all, Glassnode points to $46,910 arsenic the introduction constituent for astir of these short-term holders, putting the mean coin held by a minnow astatine an unrealized nonaccomplishment of -17.9%.

The question is, erstwhile volition these short-term holders capitulate? Many of the semipermanent holder whales are nonrecreational investors oregon funds that tin spend to lose, whereas minnows are retail investors. Long-term investors besides person a condemnation successful the plus class; that’s wherefore they invest. But they besides person a nett and nonaccomplishment connection to people to their money subscribers astatine the extremity of the month, and these superior allocators won’t similar seeing tons of red.

Retail investors, however, are usually purely based connected condemnation and ideology. If bitcoin continues to beryllium range-bound beneath $46,000, wherever galore of them entered, it volition beryllium absorbing to spot the spot of their convictions and however agelong they last.

Bitcoin regular terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to clasp support supra $37,500, but could look higher volatility implicit the adjacent fewer days.

The cryptocurrency was astir level implicit the past 24 hours and implicit the past week. That indicates indecision among traders – a communal taxable truthful acold this year.

Momentum signals person weakened connected daily, play and monthly charts, which increases the accidental of a breakdown successful price. Lower enactment is seen astatine astir $30,000-$32,000, which could stabilize pullbacks implicit the abbreviated term.

Still, different method indicators are neutral, which means intraday buying could beryllium short-lived. There is beardown resistance astatine $46,700 that could headdress upside moves, akin to what occurred successful precocious March.

The comparative spot scale (RSI) connected the regular illustration has remained beneath 50 (a neutral reading) implicit the past month. The past clip the RSI sustained debased readings was past November and December, which preceded a terms driblet beneath $46,000.

For now, buyers person failed to support consecutive play closes supra $40,000, which is the midpoint of a three-month terms range.

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Australia location loans (March)

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Australia concern lending for homes (March)

5 p.m. HKT/SGT(9 a.m. UTC): Eurostat retail income (MoM/March)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Wikipedia Editor Molly White elaborate crypto-related offenses and however she persuaded the Wikipedia enactment to halt accepting crypto donations. Plus, Kapil Rathi of CrossTower provided crypto marketplace investigation and Sergey Vasylchuk of Everstake discussed however crypto tin assistance prevention Ukraine's UNESCO World Heritage Sites.

Andreessen Horowitz Commits $500M for Indian Startups: Report: The determination comes arsenic much VCs people India’s increasing startup ecosystem.

‘Smart Money’ Wallets Are Unloading APE, Filling Up connected aSTETH, Nansen Data Suggests: “Otherdeed for Otherside” NFTs person seen the astir enactment successful the past 24 hours, according to the on-chain analytics firm.

(Crypto) Action! Indie Movie Studio Received $10M successful Bitcoin for Shares Last October: Angel Studios’ October 2021 fundraise featured Uncorrelated Ventures and Gigafund, the Elon Musk-aligned VC.

What a Mining Moratorium Could Really Mean for New York’s Crypto Industry: The state's projected two-year prohibition is inching person to reality, and experts pass astir its perchance chilling effect.

Otherside and the Future of NFT Consolidation: In the aftermath of its chaotic metaverse onshore sale, Yuga Labs says it has outgrown Ethereum. Quelle surprise.

"The [European Union] is not acceptable for a state embargo, but it imposed a prohibition connected Russian ember aft the massacre successful the Ukrainian municipality of Bucha. And the precocious probability of an statement connected lipid underscores however overmuch the warfare successful Ukraine has forced Europe to rethink its reliance connected Russian energy. In 2020, the bloc imported astir 35% of its oil, 40% of its earthy state and conscionable nether 20% of its ember from Russia, according to the EU statistic office." (Washington Post) ... "Coronavirus cases are surging again successful South Africa and nationalist wellness experts are monitoring the situation, anxious to cognize what’s driving the spike, what it says astir immunity from erstwhile infections and what its implications are globally." (The New York Times) ... "Fees person risen truthful dramatically due to the fact that Bitcoin has a competitory marketplace for transaction fees, which money web security, and rising request has made transactions much pricey. The past clip Bitcoin fees were debased capable for thing adjacent to micropayments was June of 2015, erstwhile the outgo of a elemental nonstop broke 5 cents. They haven’t looked backmost since. Even successful the heavy acheronian doldrums of the 2019 carnivore market, with the bitcoin (BTC) currency trading arsenic debased arsenic $3,000, fees were consistently supra 10 cents." (CoinDesk columnist David Z. Morris)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)