Good morning. Here’s what’s happening:

Market moves: Bitcoin retakes $36,000 arsenic the crypto marketplace stabilized aft past week’s correction.

Technician's take: Extreme oversold readings preceded an uptick successful BTC.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $36,547 +0.1%

Ether (ETH): $2,426 -4.6%

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Bitcoin’s terms roseate by arsenic overmuch arsenic $1,834 connected a four-hour ground during U.S. trading hours connected Monday, aft it concisely touched the $34,000 level during Asia's precocious afternoon. The wide crypto marketplace stabilized aft the wide marketplace correction downward successful the past week.

Bitcoin is presently changing hands astatine astir $36,400 and is up somewhat successful the past 24 hours, according to CoinDesk data. At the clip of publication, ether was down slightly, trading astatine astir $2,400. Most of the large alternate coins (altcoins) were successful the red.

The U.S. equity marketplace besides rebounded successful the precocious day connected Monday. Major banal indices tumbled earlier successful the time arsenic investors intimately ticker the Federal Reserve's archetypal gathering this year, which volition take place this week.

While bitcoin and the crypto marketplace appeared to beryllium pursuing the show of the banal marketplace recently, arsenic CoinDesk reported, the narration betwixt bitcoin and the Nasdaq 100 banal index, the favored proxy for the tech sector, remains anemic – a reminder determination are different much important factors that could impact bitcoin and the crypto market.

“For the clip being astatine least, 1 could accidental bitcoin’s prices are a operation of immoderate planetary hazard appetite and a batch of the marketplace dynamics successful China (and the aftermath of restrictions there),” CoinDesk’s Lawrence Lewitinn wrote. “Those factors’ influences aren’t static, but they explicate a batch much than watching the Fed’s each move.”

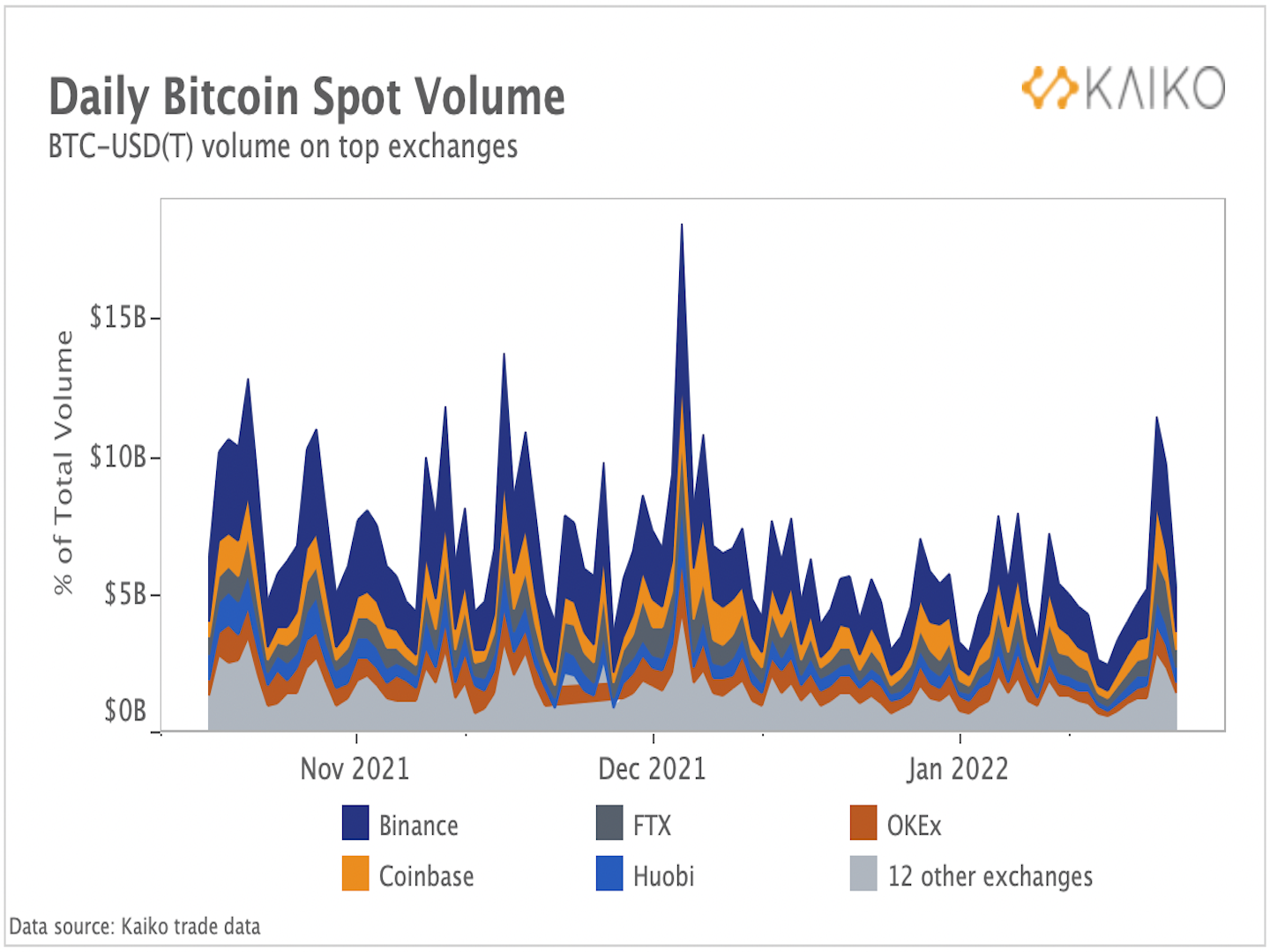

According to crypto trading information analytic steadfast Kaiko, contempt a crisp sell-off past week, bitcoin’s regular spot trading measurement past week was inactive little than it was during December’s terms plunge.

(Kaiko)

The mean regular spot trading measurement of bitcoin connected large cryptocurrency exchanges has mostly remained beneath $5 cardinal successful the past month, down importantly since aboriginal fall, Kaiko wrote successful its play newsletter connected Monday. This is partially due to the fact that Chinese exchanges OKEx and Huobi person suffered measurement nonaccomplishment owed to the crypto trading prohibition successful China past year.

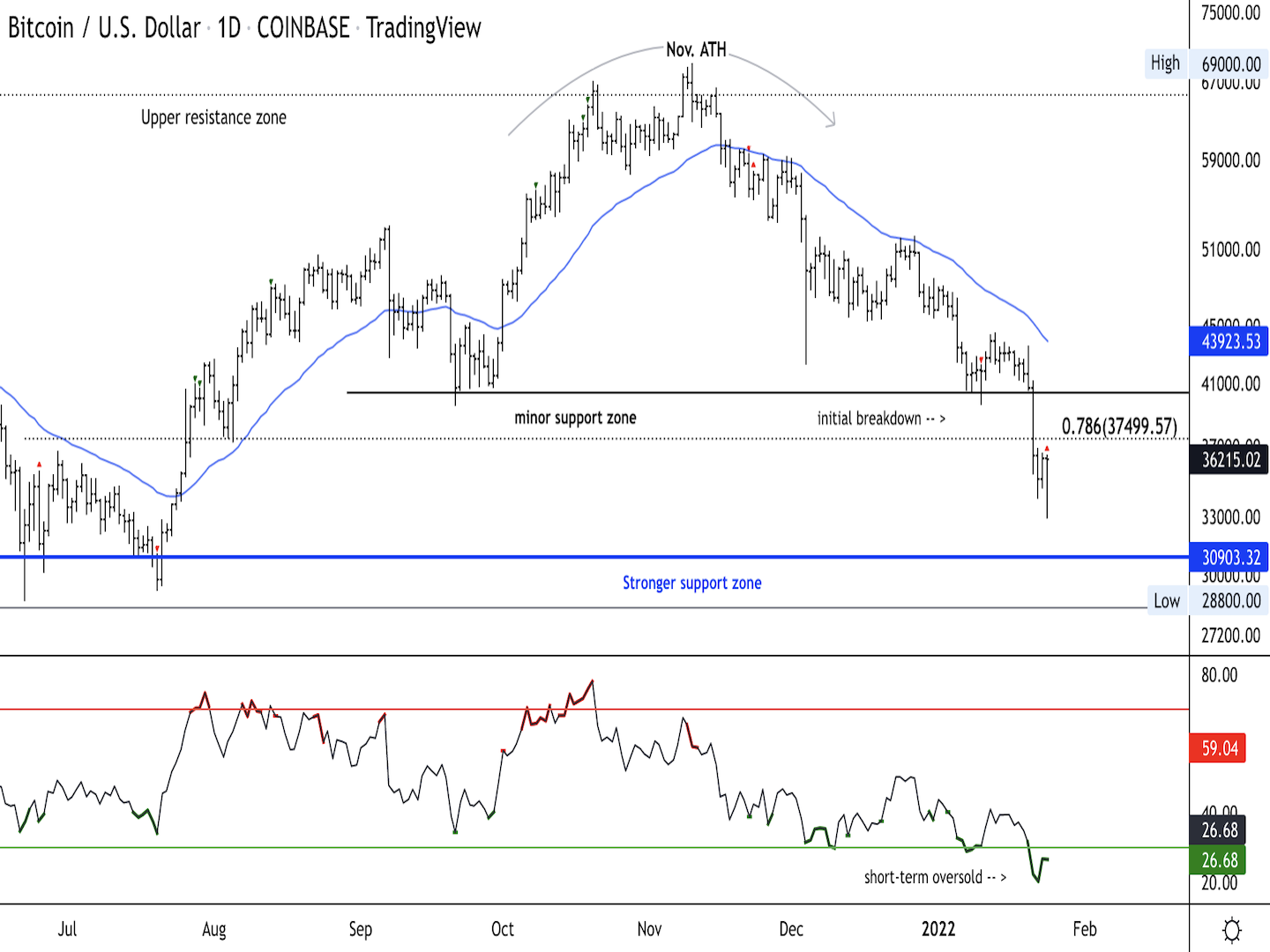

Bitcoin regular terms illustration shows support/resistance, with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) returned supra $35,000 aft aggregate oversold signals appeared connected the charts. The cryptocurrency faces archetypal absorption astatine $40,000, which could bounds upside implicit the abbreviated term.

Bitcoin is up 3% implicit the past 24 hours aft rising from an intraday debased adjacent $33,000, portion the broader crypto marketplace has stabilized.

The comparative spot scale (RSI) connected the regular illustration registered the astir utmost oversold speechmaking since the March 2020 crash. The erstwhile utmost debased was connected Nov. 20, 2018, which preceded a fewer months of rangebound terms enactment earlier a rally took place.

For now, a downtrend of little terms highs since November remains intact, which means sellers could stay progressive astatine absorption levels.

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia user terms scale (Q4, MoM/YoY)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): National Australia Bank's concern conditions (Dec)

8: 30 a.m. HKT/SGT (12:30 UTC): National Australia Bank's concern assurance (Dec)

11 p.m. HKT/SGT (3 p.m. UTC): U.S. Consumer Confidence (Jan.)

"First Mover" hosts were joined by Marc Lopresti, managing manager astatine The Strategic Funds, for an in-depth investigation connected the crypto markets arsenic cryptocurrencies endure yet different sell-off. Since November, astir $1.3 trillion has been wiped retired successful the full marketplace cap. Plus, what could we expect from the Biden administration's integer plus strategy that's reportedly acceptable to merchandise adjacent month? Nyca Partners Executive-in-Residence Matt Homer and CoinDesk Managing Editor for Global Policy & Regulation Nikhilesh De provided their insights. Then CoinDesk Executive Editor Marc Hochstein explained Privacy Week astatine CoinDesk.

"Surveillance economies powerfulness our biggest tech companies. Facebook and Google way our each measurement to present surgical advertisement strikes that marque america bare to bargain much worldly we don't need, with wealth we don't have, to impressment radical we don't adjacent know. They way wherever we go, what we like, who we cognize and love, and with whom we're sleeping." (Author and talker Daniel Jeffries penning for CoinDesk) ... "Well, here’s different instrumentality – it’s a atrocious clip to beryllium a time trader, but it’s besides a atrocious clip for NFT flippers, whose gains and losses are typically priced successful ETH. Even arsenic the terms has fallen, the mean magnitude of ETH exchanged for non-fungible tokens successful apical collections has stayed comparatively consistent." (CoinDesk media and civilization newsman Will Gottsegen) ... "That is the committedness of a virtual world: that you get to beryllium anybody you want, unhampered by flesh, gravity, environment, expectations and economics — oregon possibly conscionable the grounds you person created." (Vanessa Friedman/The New York Times) ...

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)