Good morning. Here’s what’s happening:

Weekend Prices: Bitcoin and different cryptos fell importantly arsenic the warfare successful Ukraine escalated.

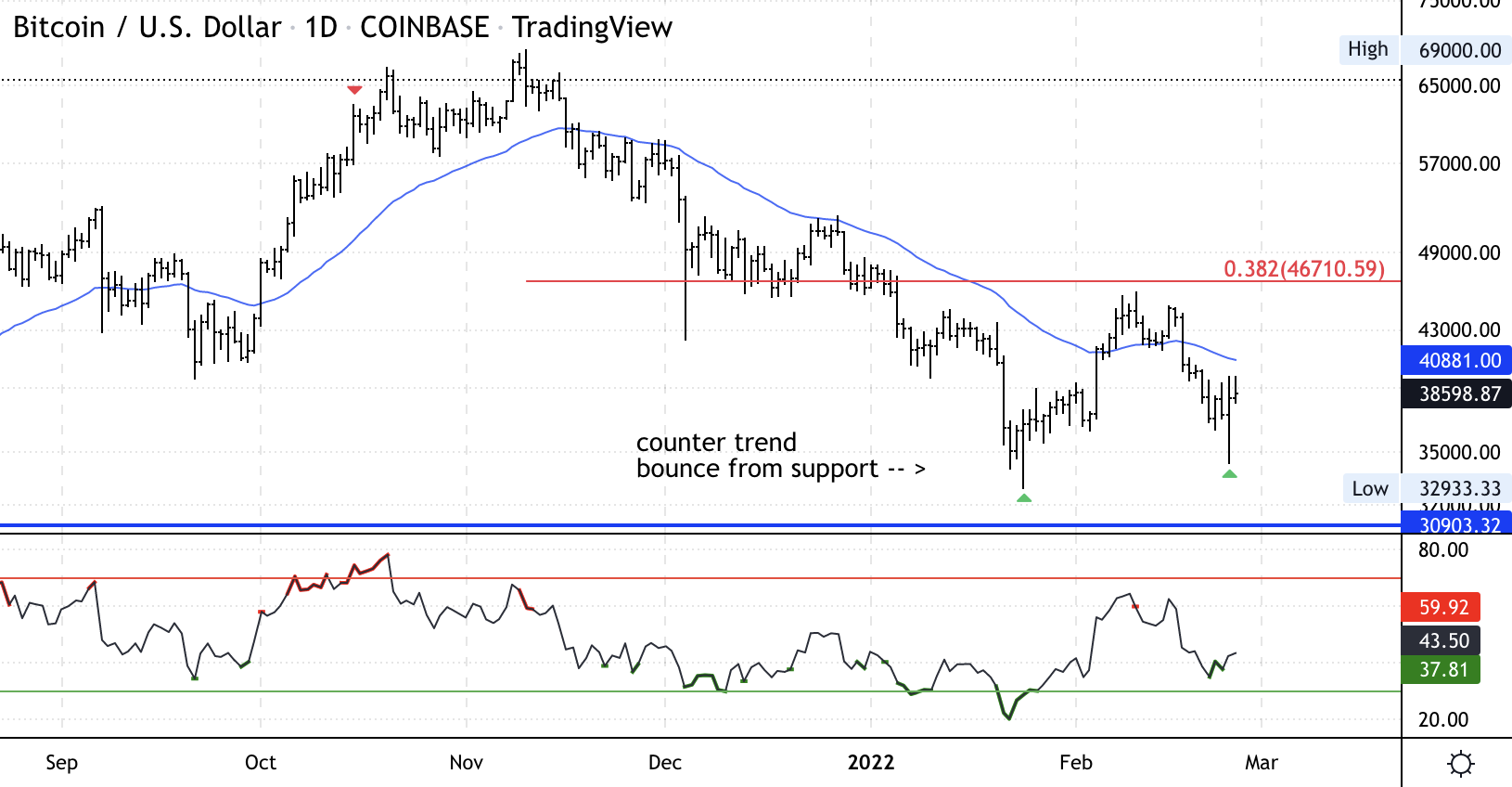

Technician's take: Investors are apt to stay progressive trading betwixt $30,000 and $46,000.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $37,721 -3.2%

Ether (ETH): $2,628 -5.1%

After mostly holding their ain done the aboriginal portion of the weekend, bitcoin and different large cryptocurrencies plummeted connected Sunday arsenic the warfare successful Ukraine intensified.

Satellite images showed columns of Russian troops heading toward the Ukraine capital, Kyiv. On Sunday, Russian President Vladimir Putin placed his atomic forces connected alert successful effect to sanctions and different measures that the U.S. and its Western European allies person taken to punish Russia and enactment Ukraine. Later successful the day, Ukraine announced it had agreed to clasp bid talks with Russia to extremity the invasion.

At the clip of publication, bitcoin was trading nether $37,800, down implicit 3%. Ether was changing hands astatine astir $2,600, down implicit 5%. The 2nd largest crypto by marketplace headdress started the play astatine implicit $2,700. Almost each large altcoins had dropped significantly. Terra's luna and avalanche were disconnected astir 7% and 8.5%, respectively.

Joe DiPasquale, the CEO of money manager BitBull Capital, said that bitcoin had returned to the aforesaid $37,000 enactment enactment it faced past Monday. But helium added that lone "a broader sell-off connected risk-on assets," stemming from larger economical pressures could support bitcoin nether $37,000 oregon unit it overmuch little successful the days ahead.

DiPasquale said that bitcoin's pricing precocious Sunday was important for "setting the code ahead." "Because crypto trades 24/7, it is sometimes seen arsenic an aboriginal indicator wherever equities markets whitethorn spell connected Monday's opening."

If bitcoin dips, helium said that the adjacent enactment enactment would look astatine $35,000. But helium besides struck an optimistic note, saying that his steadfast has been "hearing that $35K has been a large buy-in constituent for larger buyers, including firm treasuries this year."

US Case Against BitMEX, Arthur Hayes Was International Overreach, but Now Its Merits Won’t Be Tested successful Court

As the week ended successful Asia, the long-running saga implicit BitMEX seemed to beryllium concluding.

Late Thursday U.S. time, BitMEX founders Arthur Hayes and Benjamin Delo pleaded guilty to violating the U.S. Bank Secrecy Act (BSA).

“As a effect of its willful nonaccomplishment to instrumentality [anti-money laundering] and [know-your-customer] programs, BitMEX was successful effect a wealth laundering platform. For example, successful May 2018, Hayes was notified of allegations that BitMEX was being utilized to launder the proceeds of a cryptocurrency hack,” the U.S. Department of Justice said successful a property merchandise Thursday.

The plea followed a $100 cardinal colony in August to resoluteness charges against the institution (entirely abstracted from those against its executives) arsenic the exchange’s caller enactment – the archetypal founders Arthur Hayes, Ben Delo, Samuel Reed and Gregory Dwyer had near the institution – wanted to awesome that this was a caller chapter.

Remember: BitMEX is incorporated successful the Seychelles, with its main offices successful Hong Kong and Singapore. Hayes and Delo resided offshore.

But these settlements mean the prosecution’s lawsuit against BitMEX, and the abstracted 1 against Hayes and Delo, volition ne'er beryllium tested successful court. (Reed and Dwyer haven’t signaled their intent to settle.) Certainly, those accused of a transgression person the close to participate a plea woody to settee their case; tribunal proceedings are drawn out, stressful affairs. However, this statement inactive means that the ambiguity astir the lawsuit volition endure and we’ll ne'er cognize the spot of the DOJ’s argument.

Remember, BitMEX has ne'er accepted fiat currency, dissimilar different exchanges. It lone traded successful bitcoin (BTC) until recently. Only successful November it added tether (USDT) to the database of accepted crypto.

So if an instauration doesn’t really judge fiat currency oregon supply an off-ramp for it, tin it beryllium charged nether the Bank Secrecy Act?

The lawsuit introduced a caller country of jurisprudence for the BSA, Ross Feingold, a Taipei-based lawyer and governmental hazard consultant, said during the case’s aboriginal days.

Feingold, who had formerly served arsenic in-house counsel for Royal Bank of Scotland, Deutsche Bank and JPMorgan successful Hong Kong, highlighted that this would person been a precedent-setting lawsuit for the BSA arsenic it would person been 1 of the archetypal uses of the Secrecy Act against a non-bank fiscal institution.

Prior to BitMEX, the Secrecy Act was utilized successful 2018 against a steadfast called Central States Capital Markets, which had akin gaps successful its KYC/AML authorities similar BitMEX. But that lawsuit ended with a deferred prosecution statement wherever CSCM agreed to alteration its procedures successful speech for nary charges.

Braden Perry, a erstwhile Commodity Futures Trading Commission enforcement lawyer and present a spouse astatine Kennyhertz Perry, said astatine the clip that this was "dangerous territory for the CFTC.”

“The CFTC’s progressively expanded presumption of their jurisdiction volition apt beryllium challenged, particularly against offshore exchanges and participants that person constricted ties to the United States,” he said at the time.

But each of this was ne'er tested successful court. Could the Bank Secrecy Act use erstwhile the instauration successful question isn’t a slope and didn’t adjacent woody with currency? Can the CFTC modulate a marketplace that is based offshore and doesn’t specifically people U.S. residents? (While determination were concerns implicit BitMEX’s leaky IP blocking regime, it besides didn’t advertise.)

We won’t cognize however the tribunal would regularisation arsenic the lawsuit against BitMEX and the abstracted ones with Hayes and Delo person been settled. The prosecution’s grounds won’t beryllium tested successful the adversarial quality of a tribunal proceeding. Some of these questions mightiness beryllium answered successful the upcoming lawsuit involving the U.S. Securities and Exchange Commission and Terraform Labs.

Terraform Labs is claiming the bureau did not person jurisdiction implicit CEO Do Kwon erstwhile helium was served with a subpoena during a league successful New York due to the fact that neither the institution nor Kwon are U.S. residents. Terraform Labs’ lawyers are arguing that conscionable due to the fact that U.S. residents accessed the company’s services doesn’t mean determination was “purposeful availment.” The lawyers cited anterior lawsuit instrumentality (Royalty Network Inc. v. Dishant.com) that to assertion that due to the fact that a website is disposable successful a marketplace doesn’t mean that it’s a “purposeful effort to instrumentality vantage of the … market.”

That Hayes, et al. didn’t person their time successful tribunal is simply a shame. Under aggravated scrutiny, the government’s lawsuit against them mightiness not person been arsenic beardown arsenic it seemed.

Yes, Hayes taunted U.S. authorities: The archetypal indictment quoted comments helium made astatine the Tangle successful Taipei saying that Seychellian authorities could beryllium “bribed with coconuts” and equated dealing with New York regulators to forced sodomy.

Eventually, this portion of the submission was blocked by a judge and rightfully truthful arsenic anyone successful the assemblage could spot it was a gag directed towards New York University prof Nouriel Roubini, his cantankerous statement hostile onstage.

But the information this remark was highlighted by prosecutors shows that it mightiness beryllium Hayes’ ego that bothered them. Having an ego is surely nary crime.

Bitcoin regular illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) experienced a crisp reversal connected Thursday, and extended gains into Friday. For now, selling unit has faded, which means buyers could stay progressive betwixt the $30,000 and $46,000 range.

BTC returned supra $38,000 and is up 6% implicit the past 24 hours. On Friday, the cryptocurrency was down 2% implicit the erstwhile week, which meant the caller bounce had not shifted the short-term downtrend. On Sunday, bitcoin had dropped beneath $37,500 arsenic the warfare successful Ukraine intensified.

Thursday’s terms enactment triggered archetypal downside exhaustion signals, per the DeMARK indicators, akin to what occurred connected Jan. 24, which preceded a 30% upswing successful price. Still, successful carnivore markets, counter-trend signals tin beryllium little oregon invalid depending connected the presumption of semipermanent momentum readings. Currently, momentum remains antagonistic connected the play and monthly charts.

Immediate absorption is seen astatine $40,000, which could stall the existent terms bounce. There is stronger resistance astatine $46,700, which capped upside moves earlier this month.

2:30 p.m. HKT/SGT: U.S. goods commercialized equilibrium (Jan. preliminary)

2:30 p.m. HKT/SGT: U.S. wholesale inventories (Jan. preliminary)

3:45 p.m. HKT/SGT: U.S. Chicago purchasing managers scale (Feb.)

"First Mover" hosts spoke with cryptocurrency strategist and erstwhile CIA expert Yaya Jata Fanusie for his insights into the interaction of the Russia-Ukraine struggle and the relation of crypto successful this geopolitical crisis. Former CFTC Chairman Chris Giancarlo weighed successful connected the crypto regularisation turf warfare successful the U.S. Strips Finance laminitis and CEO Ming Wu provided his marketplace investigation arsenic cryptocurrencies are seeing a beardown rebound pursuing President Joe Biden's code Thursday. Plus, "First Mover" discussed highlights from CoinDesk Tax Week's bid of reports.

All these incidents show that it’s highly difficult, if not impossible, to flight idiosyncratic who’s determined to way you down. Know-your-customer (KYC) rules, aggregate passwords and data-tracking systems, with countless stores of accusation astir our on- and offline lives held connected corporate-owned servers astir the world, each militate against our online privacy. (CoinDesk Chief Content Officer Michael Casey) ... "Getting immoderate confirmations from a mates sources that it's legit. Deleting my informing for now. But proceed to beryllium vigilant, and ever beryllium dilatory and cautious erstwhile sending irreversible crypto transactions." (Vitalik Buterin connected Twitter) ... "Putin's warfare connected #Ukraine has already created 150,000 refugees, and 1000+ radical person been killed oregon injured." (Human Rights Foundation)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)