Good morning. Here’s what’s happening:

Markets: Bitcoin started the time promisingly earlier dropping, but altcoins Terra, Avalanche and Shiba Inu rose.

Insights: Canadian crypto sanctions amusement however crypto and CBDCs diverge.

Technician's take: Bitcoin tested the $40,000 absorption level connected Wednesday earlier declining.

Bitcoin (BTC): $37,306 -1.8%

Ether (ETH): $2,594 -1.1%

Bitcoin spurted up done overmuch of Wednesday morning, mirroring the show of equity markets that, for the archetypal clip successful days, seemed oblivious to the mushrooming tensions connected the Russia-Ukraine border.

But by midday, the largest cryptocurrency by marketplace capitalization had declined into reddish territory aft Ukraine declared a authorities of exigency and urged its citizens surviving successful Russia to depart. U.S. quality said that a Russian penetration was imminent.

At the clip of publication, bitcoin was trading beneath $37,500, down astir 2% implicit the past 24 hours. Ether, the second-largest crypto by marketplace cap, was changing hands beneath $2,600, down astir 1% during the aforesaid period. A fig of altcoins had a bully time with Terra's luna up astir 10%, and avalanche and shiba inu registering steadfast gains. Cardano and Solana besides roseate for the day.

"The altcoins successful the past 24 hours are having a precise aboriginal spring," said Marc Lopresti, the managing manager of plus manager, The Strategic Funds, connected CoinDesk TV. "We're going to spot continued spot successful the altcoins, peculiarly those that are portion of the metaverse," helium added.

Canadian Crypto Sanctions Show How Crypto and CBDCs Diverge

Central slope integer currencies (CBDC) are often equated to bitcoin. Some spell arsenic acold arsenic to accidental the eCNY, China’s CBDC, is simply a “government mentation of bitcoin.”

But the Ottawa trucker convoy has proven this to beryllium thing but.

The protestors’ funds are safu. Some of the bitcoin landed connected exchanges but astatine slightest $500,000 went to different wallet – possibly connected a non-Canadian exchange, oregon possibly a self-custodied 1 – and was past sent further afield.

Money tied up successful fiat currency, however, suffered a antithetic destiny due to the fact that it was frozen successful a dragnet to suffocate the protest. The thaw of accounts has already begun and the protestation is over.

Civil liberties associations successful Canada are concerned astatine the velocity of the frost and the deficiency of transparency astir the process. Usually lists of designated nationals are nationalist documents; the U.S. Office of Foreign Asset Control publishes a database that you tin peruse to find Russian officials and oligarchs, Iranian hackers and Hong Kong’s person Carrie Lam.

Civil liberties groups are challenging the constitutionality of the tribunal bid implicit fears that it could hap again. For now, bitcoin fixes this. But CBDCs? They are problematic. Where the examination betwixt bitcoin and CBDCs similar the eCNY falls abbreviated is that bitcoin is decentralized and with nary cardinal issuing authority. CBDCs are a integer mentation of currency issued by a cardinal bank.

Bitcoin and different cryptocurrencies usage a decentralized ledger but CBDCs are a integer mentation of currency issued connected a integer ledger. CBDC’s integer ledger is akin to a permissioned blockchain, which is apt wherever the erroneous examination originates.

One of the cardinal tenets of China’s CBDC is power of the yuan. Control of the proviso of the wealth – WeChat Pay and Alibaba’s digitization of fiat for usage connected their outgo rails annoys the Central Bank – ensures that wealth tin beryllium cancelled.

Should you go excessively politically noisy, your wallet tin beryllium disabled.

During past year’s CoinDesk Consensus conference, Yaya Fanusie, a Fellow astatine the Center for a New American Security, and erstwhile CIA counterterrorism financing analyst, highlighted that China’s CBDC efforts were each astir power using the illustration of H&Ms disappearance in-country implicit its enactment for a measurement to region Xinjiang Cotton from its proviso chain.

“This is truly astir data. The cardinal happening present is that the cardinal slope is, I think, inserting itself much into the outgo architecture,” helium said during Consensus 2021. “You’re creating architecture that gives the authorities a small spot much penetration into transactions.”

The truckers’ evasion of authorities sanctions by utilizing crypto shows that bitcoin has thing to bash with CBDCs. You can’t ‘’cancel’’ a bitcoin transaction similar you tin with a CBDC, and the lone happening you tin frost are the fiat ramps successful Canada.

Granted, an American CBDC oregon 1 made by a European state would person much privateness safeguards built into it than 1 from the People’s Bank of China. But Canadian banks are besides taxable to privateness instrumentality and usually necessitate tribunal orders to frost accounts.

Regardless of your sentiment of the truckers, let’s anticipation Ottawa’s is the exception, not the norm, and that we bash not person to beryllium if a CBDC would beryllium easier to power than bitcoin.

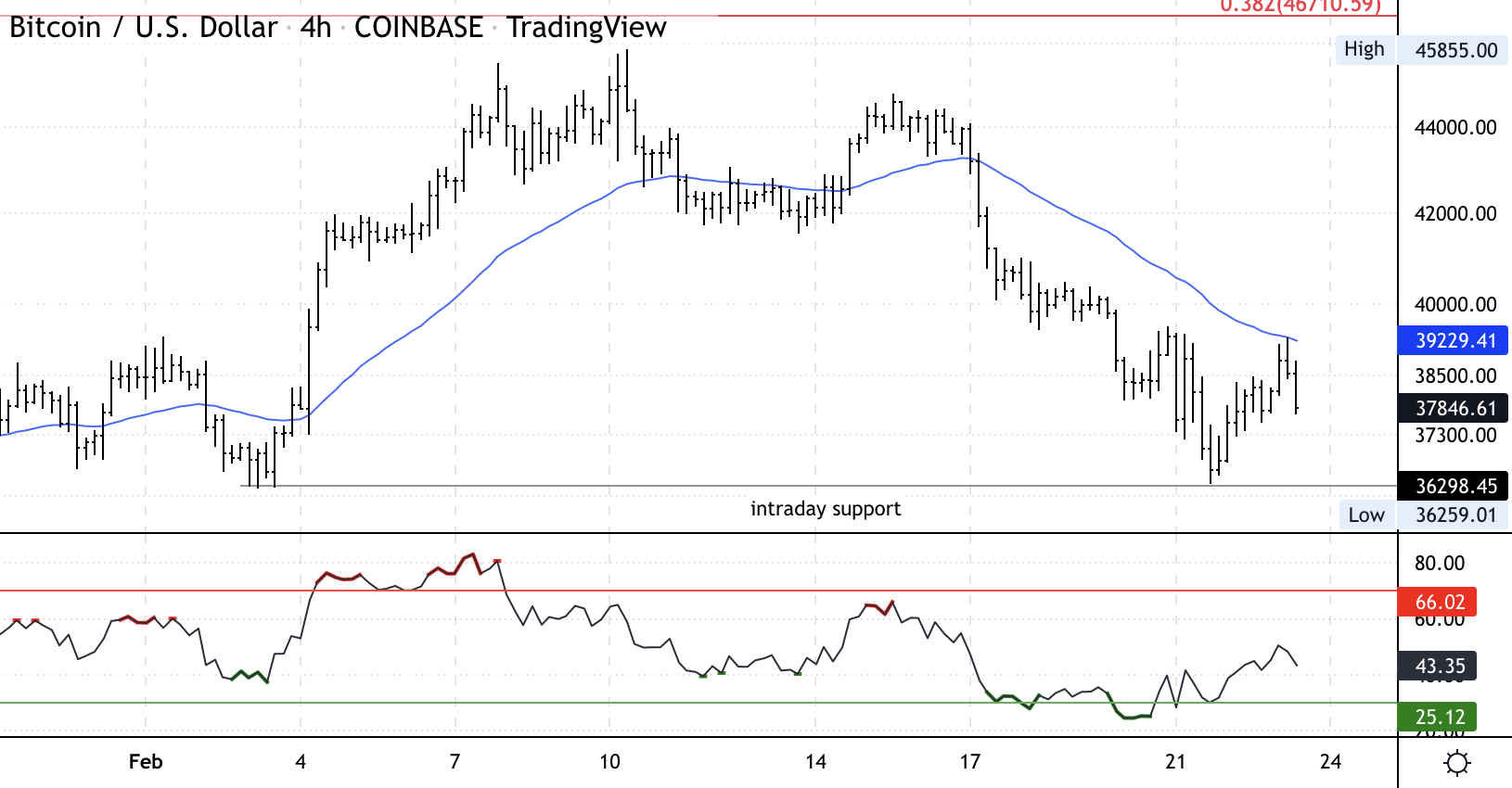

Bitcoin four-hour illustration shows support/resistance with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

The comparative spot scale (RSI) connected the four-hour illustration is neutral, which means the terms could stay wrong the $36,000-$40,000 scope into the Asia trading day. On the hourly chart, however, the RSI is declining from overbought levels. That means sellers could stay progressive implicit the abbreviated term.

Momentum signals are inactive negative, which is 1 crushed wherefore terms bounces person been little implicit the past fewer months. For now, upside appears to beryllium constricted beyond $46,000.

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Australia backstage superior expenditure (Q4)

5 p.m. HKT/SGT (9 a.m. UTC): France user assurance (Feb.)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): Chicago Fed nationalist enactment scale (Jan.)

11 p.m. HKT/SGT (3 p.m. UTC): U.S. caller location income (Jan./MoM)

"First Mover" examined the existent authorities of the crypto manufacture successful the Ukraine amid the Russia-Ukraine conflict. The hosts spoke with Michael Chobanian, laminitis of Ukraine crypto speech Kuna. Also, "First Mover" covered crypto markets investigation from Marc Lopresti of The Strategic Funds. Will today's rebound last? As portion of CoinDesk's Tax Week, David Kemmerer of CoinLedger focuses connected Form 1099-B.

"Bitcoin is besides inactive undergoing a dilatory reversion to the mean aft peaking astatine $68,000 successful aboriginal November. Essentially, fiscal gravity is drafting down a melodramatic speculative bull tally – bitcoin reached $36,000 for the archetypal clip ever conscionable implicit 1 twelvemonth ago. Meanwhile, though rising ostentation is besides a theoretical lawsuit for bitcoin, that thesis has yet to beryllium itself successful practice." (CoinDesk columnist David Z. Morris) ... "My ain view: NFTs are captious gathering blocks for a caller creator-centric integer system successful which our information is nary longer mined by net platforms and successful which artists, musicians, photographers, journalists and publishers are capable to link straight with their audiences. But they are lone that, gathering blocks." (CoinDesk Chief Content Officer Michael Casey) ... "Analysts accidental that the outcry is an denotation that Chinese consumers person turned much delicate to ostentation amid the pugnacious economical situation, and that Beijing, which has agelong been accused of exporting ostentation via its monolithic proviso of user goods globally, could besides look imported inflation." (South China Morning Post)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)