Good morning. Here’s what’s happening:

Prices: Bitcoin and different large cryptos diminution arsenic Russia escalates its attack.

Technician's take: Intraday charts amusement downside exhaustion, which could promote short-term BTC buying.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $42,528 -3.2%

Ether (ETH): $3,839 -3.8%

Bitcoin and different large cryptos declined connected a acheronian Thursday successful Ukraine.

At the clip of publication, bitcoin was trading astatine astir $42,500, down much than 3% implicit the erstwhile 24 hours. Ether, the second-largest cryptocurrency by marketplace capitalization, was changing hands astatine astir $3,800, down astir 4% implicit the aforesaid period. Most different cryptos successful the CoinDesk apical 20 by marketplace headdress were successful the red.

Russian forces captured Kherson, a larboard metropolis of astir $300,000 successful the confederate portion of Ukraine and ship-building hub, and continued to drawback immense swathes of the portion with its entree to the Black Sea. Rocket occurrence and clump bombs barraged Ukraine's largest cities and much than 1 cardinal radical fled the present war-torn country, including overseas students and workers from Asia.

Meanwhile, the Biden Administration requested $10 cardinal successful humanitarian and defence assistance and imposed caller sanctions connected Russia arsenic crypto and different donations poured into the country. The onslaught connected a sovereign state has brightened the spotlight connected crypto's imaginable arsenic a mode to behaviour transactions extracurricular accepted fiscal services networks.

Earlier this week, investors viewed this improvement optimistically. But momentum has faded arsenic investors shied distant from riskier assets implicit the past 2 days.

"Bitcoin’s rally is starting to amusement signs of exhaustion," wrote OANDA Americas Senior Market Analyst Edward Moya successful an email. "Bitcoin needs hazard appetite to beryllium steadfast for prices to marque a tally supra the $50,000 level, truthful it should travel arsenic nary astonishment if prices consolidate astir the $40,000 level."

China Ratchets Up Testing of Digital Yuan; India to Tweak Definition of Crypto

Russia’s fiscal isolation and the cryptocurrency donations pouring into Ukraine person intensified the spotlight connected governments’ crypto initiatives and the imaginable relation of integer assets.

An expansionist China, arguably an adjacent greater challenger than Russia to the U.S-led rules-based order, “will soon o.k. a 3rd batch of localities acceptable to motorboat trials of its integer yuan currency,” according to Reuters, which cited state-backed fiscal outlet Securities Times. The study says that “a fig of cities and regions person applied to authorities for support to trial the integer yuan,” including the cities of Guangzhou, Chongqing, Fuzhou and Xiamen.

Meanwhile, according to a study successful the South China Morning Post, analysts said that "Western sanctions imposed connected Russia pursuing the penetration of Ukraine, including exclusion from the SWIFT fiscal messaging system, could connection caller improvement opportunities for China’s integer currency and its home-grown yuan cross-border outgo system."

One expert wrote, “It is indispensable and urgent to vigorously beforehand yuan internationalization, particularly the improvement of the CIPS strategy (Cross-Border Interbank Payment System acceptable up to boost planetary usage of China’s currency successful commercialized settlements) and the integer yuan.”

China’s crypto narrative, though, appears to beryllium focused connected its cardinal slope integer currency, oregon e-yuan. A enactment by the Financial Stability Bureau of the Chinese cardinal slope revealed that China’s stock successful bitcoin transactions has declined 80 percent points aft the government's crackdown.

“The planetary stock of Bitcoin transactions successful China has dropped rapidly from much than 90% to 10%," the enactment said.

China’s crypto communicative appears to beryllium accelerating again conscionable arsenic Ukraine generated a precocious level of crypto adoption excitement by announcing an airdrop for donations, a archetypal by a country. It had to beryllium canceled aft it became evident that a 3rd enactment whitethorn person been spoofing the much-anticipated event.

Instead, Ukraine volition announce NFTs (non-fungible tokens) to enactment Ukrainian Armed Forces soon, according to Mykhailo Fedorov, Ukraine's curate of integer transformation.

India, the world’s largest democracy, whitethorn marque its taxation argumentation clearer by tweaking the explanation of crypto oregon virtual integer assets. According to a study by CNBC TV-18, the Indian authorities is apt to tweak the explanation to clarify that lone cryptocurrencies, crypto tokens, NFTs and vouchers autumn nether the explanation of virtual integer assets, but not different categories specified arsenic Demat shares, recognition paper points, predominant flier points, e-vouchers, currency slope points, etc. The authorities volition besides see a elaborate FAQ to explicate the definition, according to the report.

And portion the satellite has its eyes connected the U.S. Federal Reserve and its plans to combat inflation, the statement astir however ostentation volition impact cryptocurrencies remains active.

Adding to the conversation, Bill Gross, the "bond king" who co-founded the Pacific Investment Management Co. (PIMCO), said helium sees the anticipation of stagflation and helium wouldn't bargain stocks aggressively now, according to CNBC.

However, Kathy Bostjancic, main U.S. economist astatine Oxford Economics, told CNBC “we are not successful stagflation yet.”

Stagflation takes spot erstwhile stagnant economical growth, precocious unemployment and precocious ostentation hap concurrently.

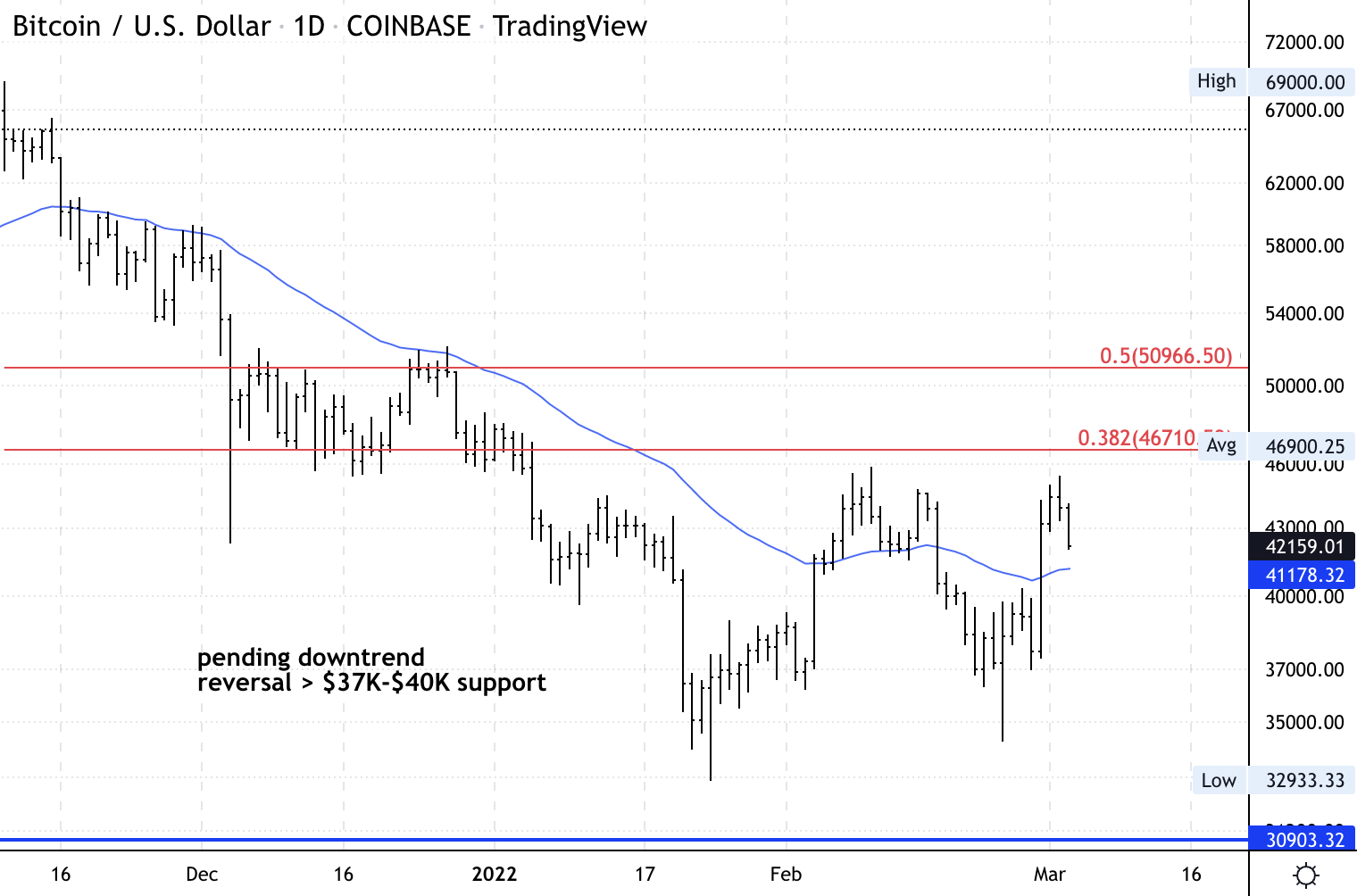

Bitcoin's regular illustration shows support/resistance levels. (Damanick Dantes/CoinDesk, TradingView)

On Thursday, bitcoin extended its pullback from the $45,000 absorption level, though archetypal enactment astatine $40,000 could stabilize the down move.

Buyers volition request to support BTC supra the $37,000 breakout level to prolong the betterment phase. Further, if momentum builds, a decisive determination supra $46,000 could output further upside targets toward $50,000.

Intraday charts are showing archetypal signs of downside exhaustion, which could promote short-term buying into the Asian trading day.

6 p.m. HKT/SGT (10 a.m. UTC): Europe retail income (Jan. MoM/YoY)

9:30 p.m. HKT/SGT (1:30 UTC): U.S. labour unit information complaint (Feb.)

9:30 p.m. HKT/SGT (1:30 UTC): U.S. mean hourly net (Feb. MoM/YoY)

Reversing plans, Fedorov, the Ukrainian integer minister, announced the cancellation of an airdrop to crypto donors via his Twitter account. "First Mover" hosts spoke with Salman Banaei of Chainalysis for insights into tracking crypto transactions during the Russia-Ukraine warfare and however to guarantee crypto is not utilized for to evade sanctions. Technical expert Timothy Brackett of The Market's Compass, provided his crypto marketplace analysis.

Review of 6 Crypto Tax Software Packages: A crypto taxation adept investigated a big of innovative and ambitious crypto taxation companies and the products they offer. Here’s what helium found.

"Russia’s dependence connected systems similar SWIFT slope messaging, analogous banking and ApplePay is simply a merchandise of the planetary dominance of a unified market-capitalist presumption quo. This presumption quo represents the neoliberal “End of History” that was wide presumed to person arrived with the autumn of the Soviet Union. But determination whitethorn beryllium nary amended motion of the extremity of the End of History than the weaponization of concern happening close now." (CoinDesk columnist David Z. Morris) ... "I americium penning this entreaty from a bunker successful the capital, with President Volodymyr Zelensky by my side. For a week, Russian bombs person fallen overhead. Despite the changeless barrage of Russian fire, we basal steadfast and agreed successful our resoluteness to decision the invaders." (Andriy Yermak, caput of the Presidential Office of Ukraine, for The New York Times) ... Stopping large banks similar Sberbank from utilizing dollars and excluding others from the Swift messaging system inactive plunges the system into chaos, particularly if overseas businesses are afraid to bargain Russian vigor contempt the sector’s explicit exclusion from sanctions. But hard currency volition astir apt support gushing successful done energy-focused lenders similar Gazprombank, and tin theoretically beryllium utilized to wage for imports and bargain the ruble. (The Wall Street Journal) ... In Beijing, the ripple effects of a determination that whitethorn outgo China dearly are present sinking in, accidental the officials and advisers. Some officials accidental they are fearful of the consequences of getting truthful adjacent to Russia astatine the disbursal of different relationships—especially erstwhile Russian aggression against Ukraine is isolating Moscow successful overmuch of the world. (The Wall Street Journal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)