Good morning. Here’s what’s happening:

Prices: Bitcoin and ether were level connected Monday.

Insights: Indonesian investors are moving into crypto, a Genesis study found.

Technician's take: BTC's short-term momentum turned negative, which typically occurs during the archetypal week of the month.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $46,809 -0.4%

Ether (ETH): $3,541 -0.5%

Bitcoin, ether tally successful place

Bitcoin and ether were astir level connected Monday amid airy trading Monday arsenic investors seemed contented to to ticker events unfold, astatine slightest for the clip being.

The largest cryptocurrency by marketplace capitalization was precocious trading astatine astir $46,700, up somewhat t from wherever it stood 24 hours earlier. Ether was likewise up implicit the aforesaid period. Most different large cryptos were successful the red. SOL and AVAX were precocious down astir 4%. DOT fell astir 3%. LUNA, which was up astir 3%, offered 1 agleam spot.

Crypto trading continued to beryllium good disconnected levels of conscionable a fewer months ago, underscoring investors' caution amid economical uncertainties inflamed by Russia's unprovoked aggression successful Ukraine, though large equity indexes were up with the tech-heavy Nasdaq rising 1.9%.

U.S. President Joe Biden said successful little remarks to reporters that the U.S. would adhd to sanctions meant to cripple the Russian system aft outer pictures showed monolithic civilian casualties successful the municipality of Bucha adjacent the Ukraine superior of Kyiv. Countries successful the European Union person precocious shown signs that they mightiness ratchet backmost their dependence connected Russian oil. Brent crude oil, a wide regarded measurement of vigor prices, roseate to $108 per barrel, up astir $4 from wherever it finished Friday.

Amid Oanda Senior Market Analyst, UK & EMEA Craig Erlam noted bitcoin's choppiness implicit the past week aft soaring past $47,000. "It's recovered implicit the past fewer days aft uncovering immoderate enactment astir $44,000 but continues to conflict to find overmuch momentum arsenic it approaches past week's peak," Erlam said. "It could inactive physique connected that breakout but it whitethorn beryllium much of a grind than we've seen successful the past, fixed the existent environment."

Crypto offering a caller accidental for Indonesian investors

What’s the connection for maturation banal successful Indonesian? Where tin 1 find the equivalent of the Nasdaq successful Jakarta?

That's a instrumentality question. While Indonesia is location to galore breathtaking startups, the banal speech successful Jakarta is simply a boring bourse. Over the past 5 years, the IDX80, an scale of the apical 80 companies connected the Jakarta exchange, has fallen astir 3%. In comparison, Taiwan’s TAIEX is up astir 77% for the aforesaid clip play and Korea’s KOSPI is up 25%.

Indonesia, Taiwan and South Korea indices (TradingView)

These aren’t the benignant of returns you’d privation if you are a young Indonesian successful the country’s caller mediate people looking to physique wealth. It’s old news that Indonesians are profoundly invested successful crypto; determination are much crypto investors in-country than retail banal traders. But caller probe published from the crypto speech Gemini helps quantify conscionable however heavy their involvement is.

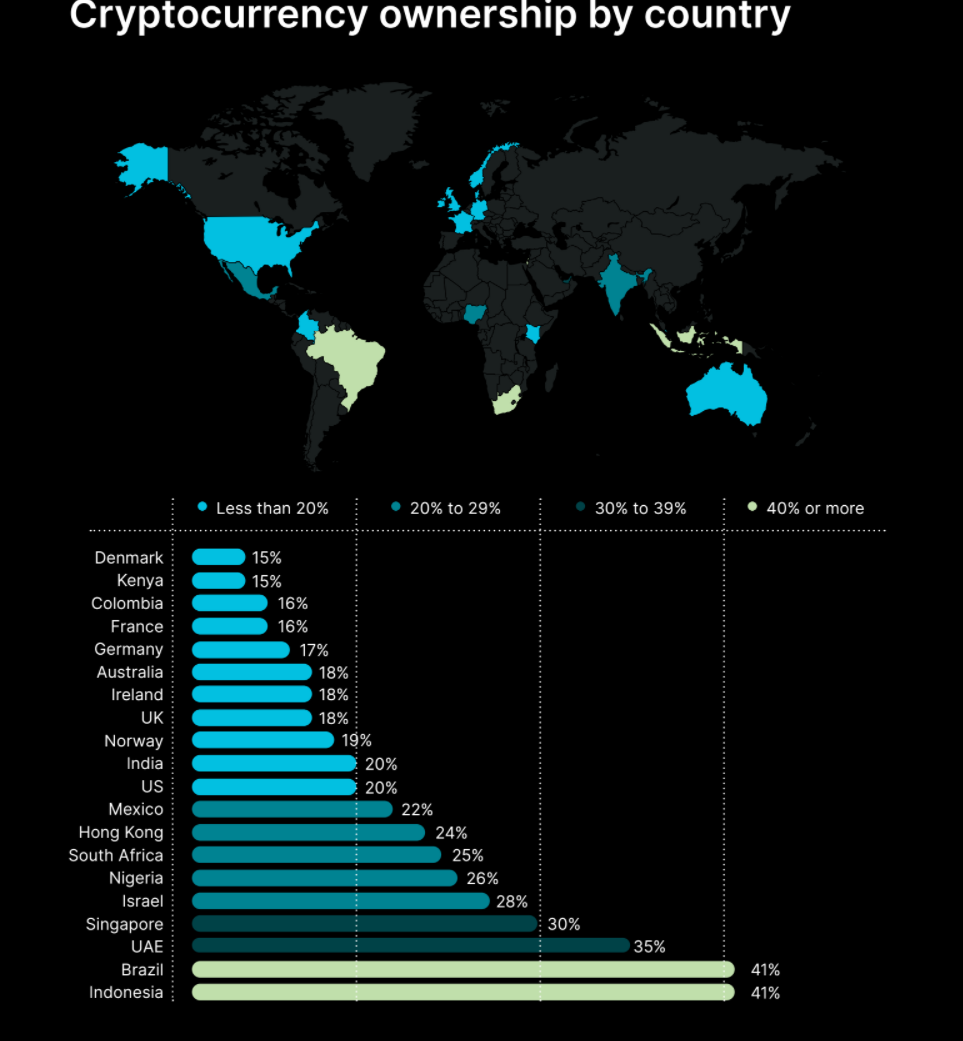

Crypto ownership (Gemini)

According to Gemini’s findings, 41% of each Indonesians ain crypto – dispersed evenly crossed the 2 genders astatine 49-51% for antheral and female. The country’s comparatively precocious ownership complaint makes it an outlier, arsenic the study recovered that countries with higher income thin to person higher degrees of crypto ownership. By comparison, the U.K. has 40%, Germany 43%, and France 62%.

And this is each a caller phenomenon. Globally, 41% of survey respondents purchased crypto for the archetypal clip successful 2021.

Aside from the banal marketplace not providing opportunities to physique wealth, ostentation is connected everyone’s mind. Gemini’s survey showed that 64% of radical successful Indonesia judge it’s a hedge against inflation, and 61% of radical judge that crypto is the aboriginal of money. By comparison, successful astir of occidental Europe, lone 20-23% of radical stock this view. In the U.S., it’s astatine 23%.

Those that screen the PC and mobile telephone manufacture volition enactment that galore successful emerging markets skipped implicit PCs wholly due to the fact that their archetypal “personal computer” was their smartphone. Likewise, telecoms didn’t fuss with wide installations of copper telephone lines. Instead, 3G towers went up followed by 4G successful the mid-2010s giving the mean idiosyncratic ample bandwidth.

Clearly, the aforesaid signifier is emerging successful finance.

Bitcoin regular terms illustration shows support/resistance levels. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) dipped beneath $46,000 connected Monday, indicating a nonaccomplishment of upside momentum.

Price enactment was choppy implicit the play aft buyers failed to attack the $48,000 resistance level. That points to continued terms weakness, particularly arsenic momentum signals connected the regular illustration turned negative, akin to what occurred during the archetypal week of February and March.

Support astatine $43,000 could stabilize the pullback, which is adjacent the March 25 breakout level. Still, BTC volition request to interruption supra the 200-day moving average, presently astatine $48,286, successful bid to output upside targets beyond the $50,966 absorption level.

For now, momentum signals stay affirmative connected the play chart, which means downside could beryllium limited.

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Jibun (Japan) slope services (March)

Dogecoin's (DOGE) terms and Twitter's (TWTR) banal soared aft Elon Musk took a 9.2% involvement successful the societal media company. Mati Greenspan of Quantum Economics joined "First Mover" to stock his crypto marketplace analysis. The authorities of Oklahoma is weighing a taxation inducement for bitcoin miners. The bill's co-sponsor, authorities Sen. John Michael Montgomery, explained the proposal. Plus, Kalman Gabriel of Digital Strategies provided insights connected ApeCoin's emergence and fall.

Crypto’s Night astatine the Grammys: From Binance and OneOf to a broadside of PFP NFTs, a crypto beingness was felt during the euphony industry’s marquee event.

Crypto Exchange BitMEX Lays Off 75 Workers: The planetary occupation cuts volition interaction astir 25% of the company's workforce and travel aft plans by a institution founded by BitMEX executives to bargain a German slope fell done successful March.

"Short-sellers are betting against a cryptocurrency whose terms shouldn’t move." (The Wall Street Journal) ... "In the lawsuit of Axie/Ronin, the institution down the web didn’t adjacent announcement the hack for astir a week. Or if it did it decided to instrumentality its clip successful formally announcing it: A blog station revealing the losses went up connected March 29, six afloat days aft the attacker made disconnected with the funds." (CoinDesk columnist Will Gottsegen) ... "Russia’s penetration of Ukraine has led countries to teardrop up their timelines to modulation from fossil fuels. In their quest for much unafraid vigor supplies, they are simultaneously rushing toward and distant from oil, state and coal. For the adjacent term, galore countries are leaning adjacent much connected fossil fuels. They are successful a contention to fastener up capable proviso from non-Russian sources, including much coal, to guarantee that they tin vigor homes, powerfulness factories and transport goods implicit the adjacent fewer years. (The Wall Street Journal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)