Good morning. Here’s what’s happening:

Prices: Bitcoin and different large cryptos dipped aboriginal implicit the play but regained crushed and were up precocious Sunday.

Insights: DBS Bank's determination to wantonness its retail crypto plans did not impact affect the banal terms of OSL genitor BC Technology Group, and is improbable to person a large interaction connected Singapore's attack to crypto.

Technician's take: BTC's upside momentum signals stay intact.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $46,702 +1.2%

Ether (ETH): $3,544 +2.1%

"

There are nary losers successful CoinDesk 20 today.

"

Bitcoin started the play quietly, but by precocious Sunday, the largest cryptocurrency by marketplace capitalization had soared past $47,300 astatine 1 point, a 2.6% summation from 24 hours earlier. BTC, which had dropped beneath $46,000 aboriginal Saturday, was much precocious trading astatine astir $46,700.

Ether, the 2nd largest crypto by marketplace cap, followed a akin signifier dipping and past regaining crushed to leap past the $3,550 level, up astir 3% implicit the aforesaid clip period.

Major altcoins were mixed, immoderate rising and others falling slightly. Meme coin DOGE roseate astir 5% connected astatine slightest 1 juncture from 24 hours earlier. DOGE alternate SHIB roseate much modestly. Solana and Cardano precocious roseate 3% and 2%, respectively. Terra's Luna token was disconnected astir 2%.

Trading was disconnected from higher levels earlier successful the week arsenic is often the lawsuit connected weekends.

Crypto's precocious play surge veered somewhat from large equity markets' show connected Friday, which did small much than clasp crushed from the erstwhile day. The tech-heavy Nasdaq and the S&P 500 fell somewhat arsenic investors seemed to beryllium girding for the U.S. Federal Reserve and different cardinal banks worldwide to proceed much hawkish monetary policies.

Low involvement rates and cardinal slope stimulus that whitethorn jar an system from a slumber pb to rising plus prices. But erstwhile ostentation increases and the system overheats, cardinal banks reverse these accommodative policies, typically spurring higher marketplace volatility.

Meanwhile, the macroeconomic situation remained arsenic unsettled arsenic it has been since Russia invaded Ukraine 5 weeks ago. After pictures emerged of horrific civilian casualties successful Bucha, a municipality adjacent the Ukraine superior Kyiv, Germany's defence minister, Christine Lambrecht, said successful a tv interrogation that the European Union should see halting Russian state imports.

EU bloc countries person resisted this action, fearful that it would nonstop their economies into recession. Brent crude oil, a wide watched measurement of vigor prices was trading astatine $102 per barrel, a monolithic summation from wherever it started the year.

Still, the crypto rally precocious past period whitethorn not beryllium over, said Joe DiPasquale, the CEO of money manager BitBull Capital.

"Bitcon's consolidation supra $46,000 volition beryllium cardinal for bullish continuation toward the $50,000 milestone," DiPasquale said, striking a cautiously optimistic note. "While we did spot rejection astir $48,000, arsenic agelong arsenic BTC remains supra $46,000, bulls tin beryllium hopeful of different move. If we suffer these levels successful the caller week, different trial of the debased $40Ks is the astir apt scenario."

DBS crypto reversal hurts OSL, but lone a little

The reply to some is, not really.

It’s not a concealed that authorities successful Singapore aren’t fans of retail crypto trading. Earlier this year, regulators banned direct-to-consumer selling for exchanges and told crypto ATM operators to turn disconnected their machines. It besides enactment DeFiance Capital, 1 of the larger crypto funds successful the city-state, connected an capitalist alert database due to the fact that it was “wrongly perceived arsenic being licensed oregon regulated by the Monetary Authority of Singapore.”

But Singapore hasn’t changed its code connected organization concern successful crypto. That has ever been what the state has been funny successful processing arsenic a hub, not retail, which requires nanny-like regulations to guarantee amateur traders leveraging their status savings don’t get rekt erstwhile their crypto presumption is liquidated. Needing to modulate with a dense manus isn’t what Singapore wants.

If DBS were to really motorboat a retail crypto speech it wouldn’t look similar what galore retail traders are utilized to seeing. There would beryllium a constricted enactment of tokens, and decentralized concern (DeFi) would decidedly beryllium retired of the question. While determination would undoubtedly beryllium an constituent of convenience due to the fact that of the integration with the bank, it would beryllium challenged to pull important measurement due to the fact that it wouldn’t beryllium competitory with starring exchanges successful presumption of features.

In its caller earnings, OSL’s parent, BC Technology Group, highlighted its Software-as-a-Service (licensing its speech bundle to different entities) arsenic a maturation point.

The institution cites “service fees from SaaS of HK$10.1 cardinal (US$1.2 million), an summation of 104.2% twelvemonth implicit year,” arsenic a operator of this quarter’s growth, specifically naming its concern with DBS arsenic a mode to grow the concern past organization lone and connected to retail.

But against radical gross of HK$352 cardinal (US$45 million), this magnitude is insignificant.

“OSL’s organization vulnerability and licensed presumption acold eclipse that flimsy negative,” Esme Pau, an expert with Tonghai Securities, told CoinDesk. “With [its] halfway concern successful serving nonrecreational investors. OSL is simply a proxy to integer assets institutionalization. In the broader strategy of things, expanding regulatory clarity is the definite aboriginal absorption of question for integer assets.”

Investors didn’t look to attraction either. Even aft the quality broke, the banal continued its week-long winning streak connected the Hong Kong markets up 5%.

Tonghai predicts the institution volition crook a nett successful the mean word fixed the competitory moat it has of being the lone licensed speech successful Hong Kong – a overmuch larger, and little competitive, marketplace than DBS’s retail crypto play.

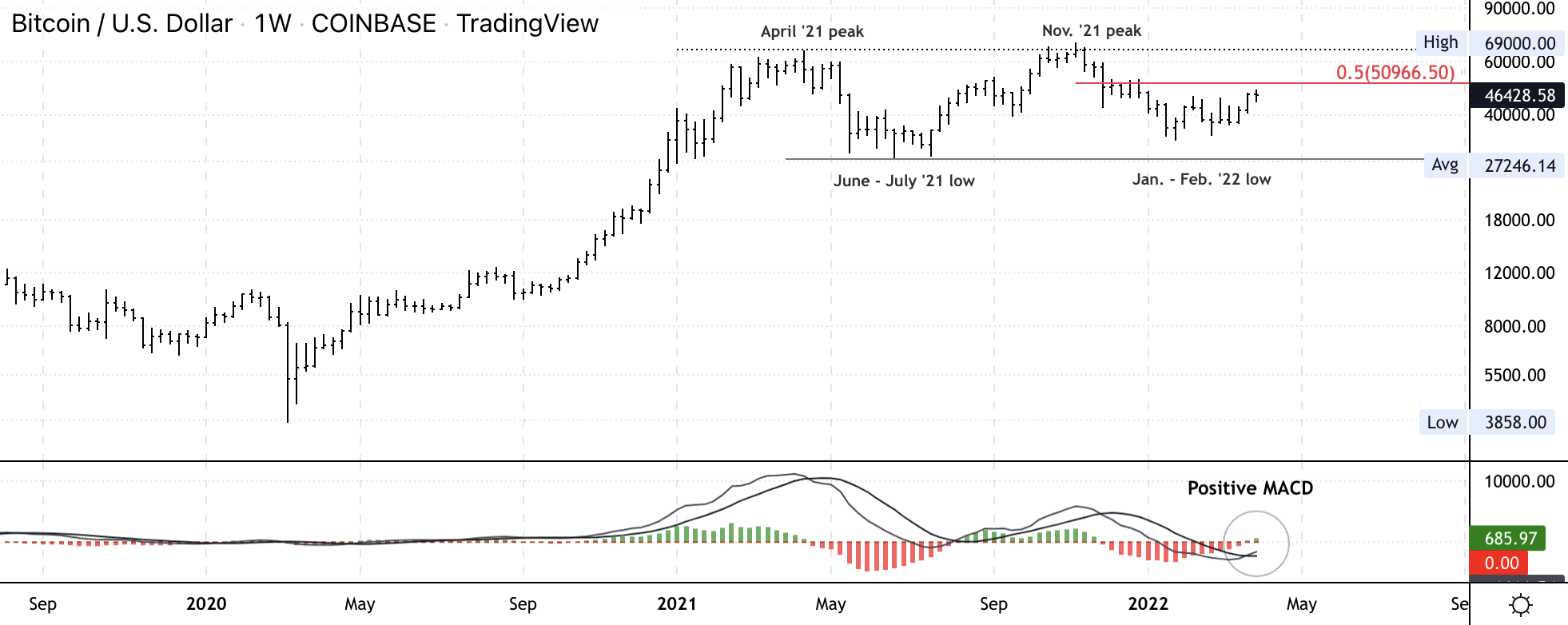

Bitcoin play terms illustration shows support/resistance, with MACD connected bottom. (Damanick Dantes/CoinDesk, TradingView)

The cryptocurrency is up 5% implicit the past week, though resistance astatine $48,000 and $50,996 could stall the rally, akin to what occurred successful September of past year.

This time, however, pullbacks could beryllium brief, truthful agelong arsenic buyers support enactment supra $43,000-$45,000. Further, the important nonaccomplishment of downside momentum, per the MACD indicator, implicit the past fewer weeks could promote further buying connected terms dips.

The comparative spot scale (RSI) connected the regular illustration is approaching neutral territory aft an overbought speechmaking appeared connected March 28. That suggests a intermission successful the existent terms rally, which typically occurs during the opening of the month.

For now, BTC is investigating enactment astir its erstwhile breakout constituent astatine $45,000. Upside exhaustion signals, per the DeMARK indicators provided a timely countertrend reversal set-up earlier this week, though a continuation of that merchantability awesome has not been confirmed. That means terms enactment is presently neutral, pending a decisive interruption supra oregon beneath the five-day terms range.

Celo Connect integer league featuring task leaders and investors

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Australia and New Zealand Banking Group occupation advertisements (March)

10 p.m. HKT/SGT(2 p.m. UTC): U.S. mill orders (MoM March)

Massachusetts lawmakers Elizabeth Warren and Stephen Lynch were successful the spotlight arsenic each pushed integer dollar proposals. Congressman Lynch joined "First Mover" to explicate the measure helium has co-sponsored. Jason Guthrie of WisdomTree weighed successful connected the arguable European Parliament crypto ballot and different quality moving the crypto markets. Plus, Rapper Jim Jones and Disrupt Art CEO Rob Richardson discussed their caller NFT drop.

Does the Metaverse Need a Free Trade Agreement?: It’s seeking to beryllium the centerpiece of Web 3, but a palmy metaverse could tally headfirst into immoderate old-style protectionist barriers similar enactment permits and information blocks, commercialized argumentation adept Sam Lowe tells us.

7 Wild Bitcoin Mining Rigs: Here are immoderate of the innovative and sometimes hilarious functions bitcoin miners person recovered for their rigs.

Other voices: Ben McKenzie Would Like a Word With the Crypto Bros (The New York Times)

"From this period connected - nary much Russian state successful Lithuania 🇱🇹. Years agone my state made decisions that contiguous let america with nary symptom to interruption vigor ties with the agressor. If we tin bash it, the remainder of Europe 🇪🇺 tin bash it too!" (Lithuania President Gitanas Nausėda connected Twitter)... "The NFT amusement is nary longer a alien to the road. Believers successful this recently fashionable signifier of integer plus person flocked en masse to assorted NFT-focused events successful the past half-year, opening with NFT.NYC successful November and passing done Miami for NFT Basel. Even this year’s variation of South by Southwest successful Austin, Texas, had a large NFT presence. (I was fortunate capable to be each three.)" (CoinDesk NFT newsman Eli Tan) ... "My conversations this week with galore Los Angeles-based integer artists opened up a antithetic perspective. As they eagerly opened their iPhones to amusement maine their latest NFT driblet oregon different originative venture, it occurred to maine there’s an adjacent much almighty root of permissionlessness being unleashed successful this space: money." (CoinDesk Chief Content Officer Michael Casey)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)