Good morning. Here’s what’s happening:

Prices: Bitcoin and ether tally successful place, but different large cryptos, including SOL, roseate significantly.

Insights: India has not been the friendliest spot for crypto lately; BC Technology Group maintains precocious hopes.

Technician's take: BTC buyers could stay progressive implicit the abbreviated term.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $46,957 -0.5%

Ether (ETH): $3,386 +0.4%

Bitcoin and ether are flat

Bitcoin and ether spent different time moving successful place.

The 2 largest cryptos by marketplace capitalization were astir level implicit the past 24 hours, bitcoin nether $47,000, conscionable beneath its predominant resting spot the past fewer days, and ether conscionable nether $3,400. It was the 2nd consecutive time wherever prices of some moved small from wherever they stood the preceding day.

Most different large cryptos successful the CoinDesk apical 20 by marketplace headdress were successful the green, a fewer importantly so. SOL and AVAX were up 7% and 5% astatine surely points, respectively, and the meme token SHIB roseate astir 3%.

Crypto's checkered terms show came arsenic Russia continued its unprovoked penetration of Ukraine and caller signs of a worsening global, economical environment.

Fueled by war-related increases successful substance prices and worsening proviso concatenation problems, ostentation soared successful Germany and Spain to highs not seen successful some countries since the 1980s. Spain's user terms scale roseate to astir 10%, jumping by much than 2 percent points since February. Germany took an archetypal measurement toward earthy state rationing, which astir fractional the colonisation uses for heating.

The terms of Brent crude, a wide considered measurement of the vigor market, hovered implicit $110 connected Wednesday aft dipping beneath $105 earlier successful the week.

Oanda Americas elder expert Edward Moya said that aft a week of gains "bitcoin's rally" was "taking a breather and that should stay the lawsuit arsenic warfare concerns wholly predominate the short-term destiny for astir risky assets."

Moya was cautious astir the asset's near-term future. "Bitcoin needs a catalyst to marque a tally towards the $50,000 level, truthful for present it seems similar it could consolidate betwixt the $45,000 and $48,000 levels," helium said.

India continues its crypto crackdown; BC Technology Group is Optimistic

As crypto goes, determination are easier places to run than India.

The country's taxation authorization announced connected Monday that it had seized Rs. 95.86 crore (US$12.6 million) from 11 crypto exchanges connected allegations of taxation evasion.

CoinDesk had reported successful January that the country's Directorate General of GST Intelligence (DGGI), which oversees taxation collection, had antecedently seized astir Rs. 84 crore (about $11 million) successful taxes and 1.1 crore ($145,000) successful penalties. India’s Minister of State for Finance Pankaj Chaudhary revised the magnitude to 95.86 crore ($12.6 million) successful a statement.

The authorities said successful January that it was investigating six exchanges, including India's largest exchanges, WazirX, CoinDCX and BuyUCoin, arsenic portion of an anti-tax evasion initiative, but Chaudhary updated the number.

The announcement comes a week aft the authorities passed a concern measure that included a whopping 30% superior gains taxation connected crypto transactions and a 1% taxation deducted astatine root (TDS) and nary offsetting losses. The ballot ignored lobbying by manufacture advocates who had hoped to h2o down astatine slightest the root tax.

On Friday, April 1, crypto companies indispensable statesman paying the superior gains tax, with T1% taxation deducted astatine the root arsenic of July 1.

Indian Prime Minister Narendra Modi’s authorities is inactive readying a rollout of a integer rupee by the extremity of 2022-23, seen arsenic the cornerstone of the country's crypto policy. That attack is much cautious and successful keeping with the Indian government's caller authoritarian leanings.

HK’s BC Technology Group waits for regulators to drawback Up to Web 3

Hong Kong’s BC Technology Group, the genitor of the city’s institutionally focused OSL exchange, saw its banal inclination upwards arsenic the marketplace opened Wednesday pursuing its beardown net report.

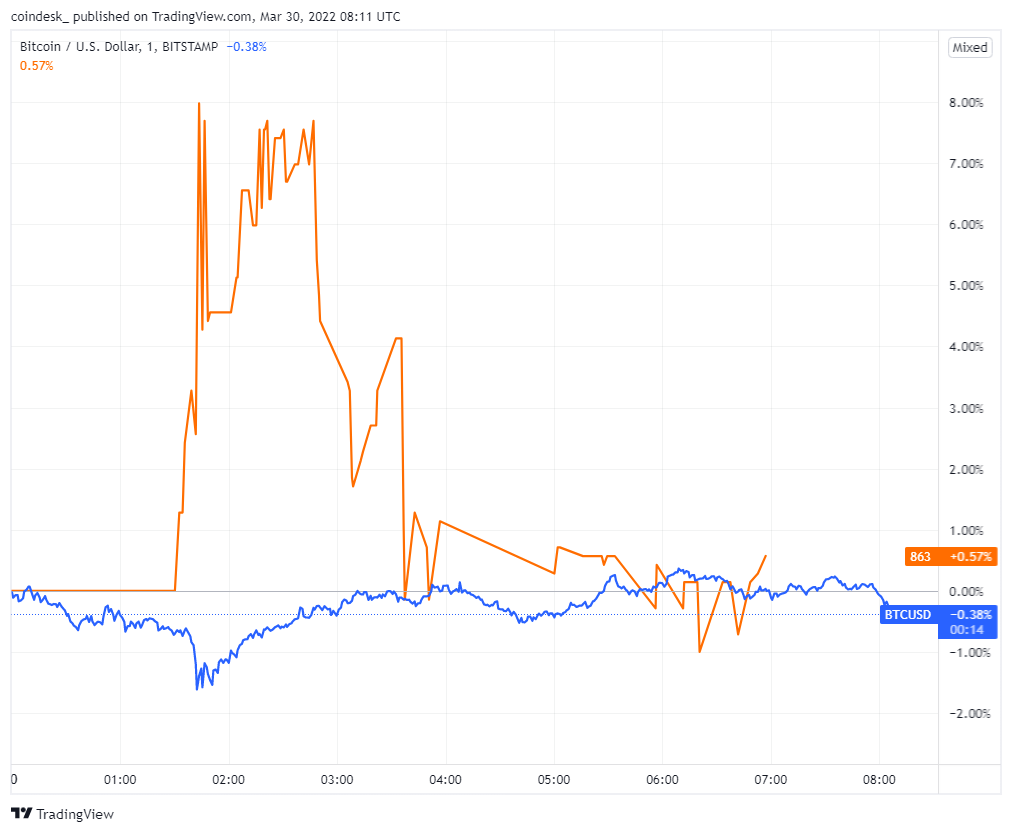

Bitcoin/U.S. dollar (TradingView)

During a Wednesday greeting net call, institution executives emphasized they inactive judge a regulated excavation of superior provides the biggest accidental successful crypto due to the fact that determination remains a immense marketplace of organization traders that can’t yet interaction thing not regulated.

This includes Web 3, decentralized concern (DeFi) and non-fungible tokens (NFT), Wayne Trench, CEO of OSL, explained connected the call.

“DeFi is amazing, but it’s hard for a regulated steadfast to commercialized successful the DeFi marketplace due to the fact that of the deficiency of [anti-money laundering] controls,” helium said.

But portion the regulatory authorities mightiness inhibit immoderate forms of marketplace trading, it besides opens up caller opportunities. Regulated coin lending, for instance, is thing that Coinbase (COIN) has struggled to navigate but regulators successful Hong Kong person nary occupation with it – provided it stays wrong the closed regulatory loop of different professional investors.

The enforcement squad besides mentioned that though OSL is simply a regulated speech closed to retail traders, the institution does person retail vulnerability via DBS’s integer assets exchange, which runs connected OSL’s software. During its past earnings, DBS said that it is planning to motorboat a retail exchange by year’s end.

Over the adjacent six months (companies successful Hong Kong study net bi-annually), each eyes volition beryllium connected the banal of OSL’s genitor institution to spot if investors are valuing its efforts.

The institution is increasing importantly by the numbers, and its banal has made immoderate advancement successful tiny increments. But connected the week it inactive underperforms bitcoin.

The spread narrowed connected Wednesday, astatine slightest compared to a period ago, but it inactive exists. Six months aboriginal we’ll spot if the marketplace vindicates the company’s regulated-first approach.

Bitcoin regular illustration shows adjacent resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is attempting to interruption supra a choky trading scope betwixt $46,000 and $48,000 arsenic momentum remains positive.

Initial resistance is seen astatine the 200-day moving average, presently astatine $48,312, which could stall the terms rally. Still, determination is stronger absorption astatine $50,966, suggesting that buyers could stay progressive implicit the abbreviated term.

The comparative spot scale (RSI) connected the regular illustration ticked higher and is firmly successful the overbought zone. Previous overbought signals, however, lasted for 3 months earlier a important sell-off successful price.

ETHDubai: Event for developers and different connected oregon funny successful Ethereum.

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Australia gathering permits (MoM/YoY Feb.)

9 a.m. HKT/SGT(1 a.m. UTC): China NBS manufacturing purchasing managers scale (March)

9 a.m. HKT/SGT(1 a.m. UTC): China non-manufacturing PMI (March)

Massachusetts Congressman Stephen Lynch (D) joined "First Mover" to explicate the "ECASH" measure and the value of processing a U.S. integer dollar. Axie Infinity’s Ronin Network suffered what whitethorn beryllium the largest exploit successful DeFi history. Tether and WAX co-founder William Quigley shared his instrumentality connected this heist. Plus, Charlotte Principato of Morning Consult provided markets analysis.

So You’ve Stolen $600M. Now What?: After 1 of the largest exploits successful DeFi history, the hacker of Axie’s Ronin Network has constricted options.

"Like everything other successful the net age, [central slope integer currencies] are astir large data: State-run ledgers would springiness near-complete penetration into however wealth is being spent successful a country. In fact, Agustin Carstens, wide manager of the 'central slope of cardinal banks,' the Bank for International Settlements, said: 'We don’t cognize who’s utilizing a $100 measure contiguous and we don’t cognize who’s utilizing a 1,000 peso measure today.' With CBDCs, that would beryllium possible, helium noted." (CoinDesk Assistant Opinion Editor Daniel Kuhn) ... "But the absorption to Larsen’s effort among manufacture leaders and observers has been disbelief and suspicion. That’s successful portion because, nevertheless lukewarm and fuzzy Larsen’s extremity seems to be, the campaign’s recommendations are highly risky, thoroughly impractical and possibly adjacent nonsensical. More importantly, Larsen’s motives for the connection are highly suspect: After all, arsenic a co-founder of Ripple, helium has arguably spent the past decennary successful contention with Bitcoin." (CoinDesk columnist David Z. Morris) ... "The quality implicit earthy state comes arsenic prices of energy, nutrient and different staples emergence crossed the continent arsenic the warfare rages, snarling proviso chains that were already nether strain from the pandemic. On Wednesday, some Germany – the largest system successful Europe – and Spain reported ostentation levels successful March that touched connected 40-year highs." (The New York Times)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)