Good morning. Here’s what’s happening:

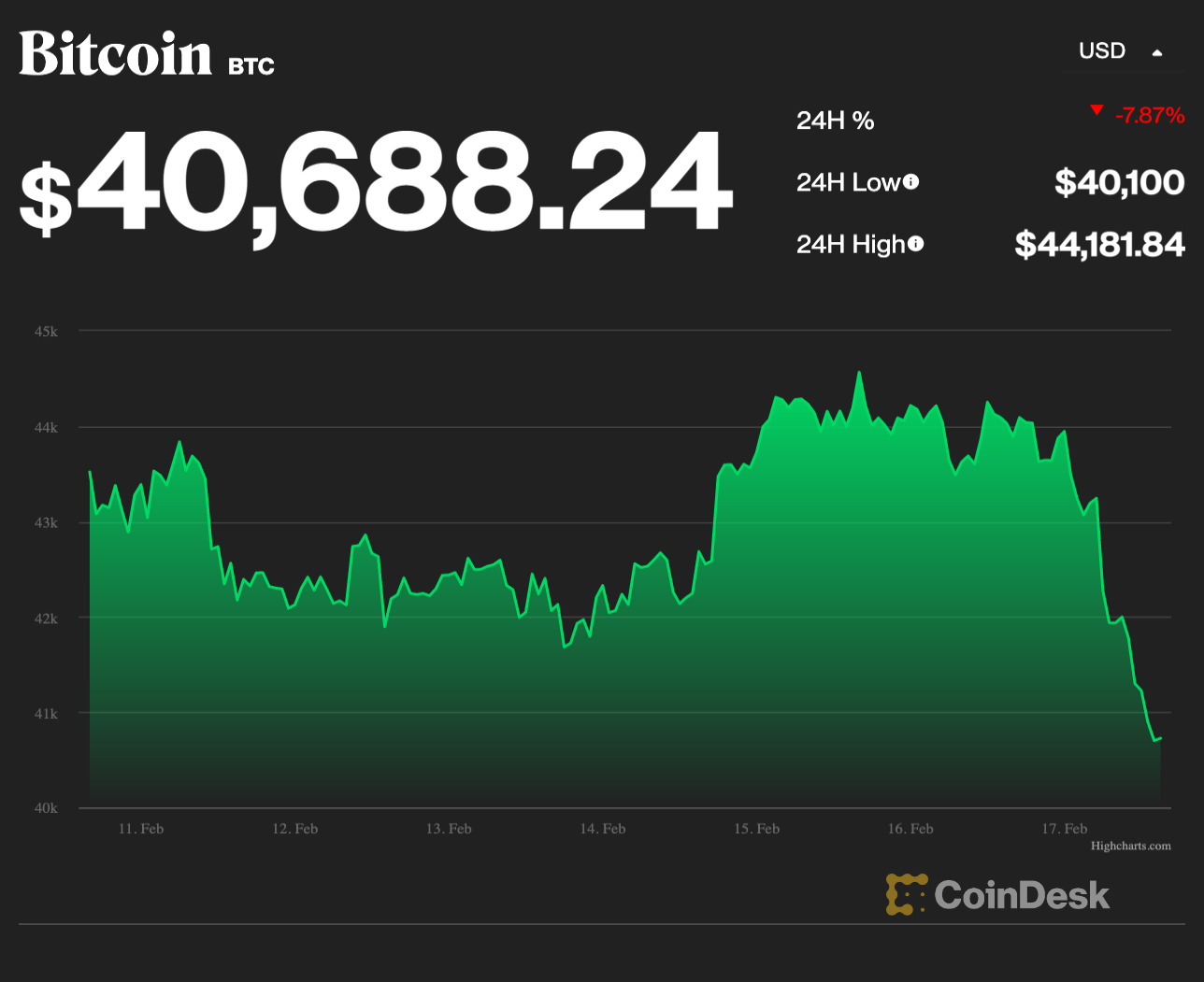

Market moves: Bitcoin plummets beneath $41,000 arsenic Ukraine tensions rise; altcoins besides drop

Technician's take: BTC sellers stay progressive astatine absorption levels, maintaining the short-term downtrend.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $40,688 -7.8%

Ether (ETH): $2,886 -8.3%

"

There are nary gainers successful CoinDesk 20 today.

"

Ukraine, Ukraine, Ukraine. Inflation.

Investors resumed their antiaircraft posture arsenic Russia seemed erstwhile again connected the mode to invading neighboring Ukraine. Even arsenic U.S. Secretary of State Antony Blinken requested a gathering with his Russian counterpart, a mortar onslaught successful the Donbas portion of the Ukraine damaged aggregate buildings, according to antithetic reports.

The appetite for high-risk assets, including cryptocurrencies, tumbled. At the clip of publication, bitcoin, the largest cryptocurrency by marketplace capitalization, was trading astatine astir $40,600, down astir 8% implicit the past 24 hours. Ether, the second-largest crypto by marketplace cap, was disconnected similarly. All different altcoins successful the CoinDesk apical 20 by marketplace headdress were successful the red.

Crypto's plunge coincided with a akin determination down among U.S. equities, peculiarly more-volatile tech stocks. The tech-laden Nasdaq fell astir 3%, portion the Dow Jones Industrial Average and S&P 500 fell 2.2% and 1.7%, respectively.

Reports of firing successful a borderline portion and accusations that Moscow is orchestrating a mendacious emblem operation, oregon an intent to pin the blasted for starting struggle connected Ukrainian forces, "has ratcheted up tensions and led to much investors seeking little risky positions," wrote Susannah Streeter, elder Investment and markets expert for U.K.-based, plus absorption firm, Hargreaves Lansdown, successful an email.

In a week that featured abstracted reports connected January's Producer Price Index (PPI), which roseate to 9.8%, and the U.S. cardinal bank's ongoing inflationary concerns discussed astatine its astir caller meeting, investors returned to gold, which roseate implicit $1,900 astatine 1 constituent Tuesday, and different lower-risk assets. "The terms of gold, seen arsenic a harmless haven successful times of crisis, has risen by different 1.37% to $1,896 an ounce, an 8 period high," Streeter wrote.

At the clip of publication, golden was trading astatine $1,898.

Meanwhile, astir 2 weeks aft a gathering betwixt its president President Xi Jinping with Russian President Vladimir Putin, China continued to measurement its effect to the rising Ukrainian borderline tensions arsenic it tries to equilibrium its economical ties with Russia and the West. China imports a important magnitude of lipid from Russia but is besides acrophobic by imaginable U.S. commercialized restrictions that would apt effect from aligning excessively intimately to Russia.

In a gathering with French President Emmanuel Macron, Xi called for a diplomatic solution to the brewing crisis, according to a study from China authorities media connected Wednesday.

Bitcoin four-hour illustration shows support/resistance, with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) pared earlier gains aft sellers reacted to overbought conditions connected the charts. Resistance betwixt $44,000 and $46,000 capped upside moves implicit the past month, which contributed to terms weakness.

BTC was down 7% implicit the past 24 hours. Lower enactment astatine $38,000 and $40,000 could stabilize the existent pullback into the Asia trading day.

The comparative spot scale (RSI) connected the four-hour illustration is oversold, akin to what occurred connected Feb. 3, which preceded a 20% terms jump. This time, however, the $46,000 absorption level could support sellers progressive toward stronger enactment astatine $30,000.

Further, a bid of higher terms lows from Jan. 24 was breached connected intraday charts, indicating a nonaccomplishment of upside momentum.

3 p.m. HKT/SGT (7 a.m. UTC): UK retail income (Jan. MoM/YoY)

3:30 p.m. HKT/SGT (7:30 a.m. UTC): Switzerland concern accumulation (Q4 YoY)

9 p.m. HKT/SGT (1 p.m. UTC): Speech by Frank Elderson, subordinate of the European Central Bank enforcement board

"First Mover" hosts spoke with Dante Disparte of stablecoin issuer Circle arsenic the institution doubles its worth to $9 cardinal successful caller woody agreements with SPAC steadfast Concord Acquisition. Don Kaufman of TheoTrade shared his crypto marketplace analysis.

FBI Launches New Crypto Crimes Unit: The National Cryptocurrency Enforcement Team volition analyse ransomware and different crimes with tools including blockchain analysis.

Bitcoin’s 'Energy Problem' Is Overblown: Yes, Bitcoin consumes a immense magnitude of electricity. But we indispensable look astatine some its vigor sources and its wide imaginativeness successful bid to afloat recognize the situation.

“If you look astatine consumers’ fiscal presumption and the spot of the labour market, you person to accidental that successful wide it’s beauteous good.” (Joshua Shapiro, an economist astatine consulting steadfast Maria Fiorini Ramirez Inc., successful The Wall Street Journal) ... "Web 3’s solutions whitethorn not yet beryllium desirable, but it seems similar an experimentation worthy undertaking." (CoinDesk columnist Daniel Kuhn) ... "This explicit telephone to usage blockchain tech to lick large corporate enactment problems perfectly captures Ethereum’s taste presumption successful the cryptosphere. The clearest opposition is with bitcoiners, who are successful information focused connected a corporate occupation – currency absorption – but mostly framework that successful hyper-individualist presumption of spot and ownership." (CoinDesk columnist David Morris) ... "I surely didn't put successful crypto. I'm arrogant of the information that I avoided it. It's similar immoderate venereal disease." (Berkshire Hathaway Vice President Charlie Munger)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)