Good morning. Here’s what’s happening:

Prices: Bitcoin traded higher alongside U.S. stocks, reaching $41,360.

Insights: Germany mightiness not beryllium arsenic crypto-friendly arsenic its apical ranking implies.

Technician's take: Bitcoin's betterment signifier remains intact, albeit wrong a wide trading range.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $41,386 +1.4%

Bitcoin Price Rises for Second Day connected Hopes for Soft Landing

By Bradley Keoun and Angelique Chen

Bitcoin (BTC) continuing its betterment from a five-week debased astir $38,700 connected Monday.

As of property time, the largest cryptocurrency was changing hands astatine $41,300, inactive good disconnected the precocious astir $48,000 a fewer weeks ago.

“The macro scenery is looking affirmative successful my opinion,” wrote Marcus Sotiriou, expert astatine the U.K.-based integer plus broker GlobalBlock successful a newsletter.

Sotiriou said helium thinks the system volition person a brushed landing contempt galore analysts forecasting a recession. He is bullish connected bitcoin and equities adjacent though the Federal Reserve mightiness jack up involvement rates by 0.5 percent constituent adjacent period – treble the 0.25 percentage-point increases seen successful caller years.

Last week, crypto funds suffered outflows for the 2nd consecutive week, with immoderate $97 cardinal of redemptions, perchance owed to "bitcoin becoming progressively interest-rate sensitive."

According to Glassnode, a ample magnitude of bitcoin proviso has been accumulated betwixt the $38,000 and $45,000 terms range, arsenic reported by CoinDesk's Damanick Dantes successful Market Wrap. That suggests price-insensitive traders clasp overmuch of bitcoin's proviso supra the $40,000 terms level.

"Traders person inactive yet to marque precocious condemnation bets to the upside oregon downside," according to analysts from the concern probe steadfast FundStrat.

Coin Metrics, a blockchain investigation firm, noted that Bitcoin is approaching the halfway constituent betwixt the archetypal blockchain's 3rd and 4th reward halvings. (They hap each 210,000 information blocks, oregon astir each 4 years; the adjacent 1 is tipped to hap connected May 4, 2024.)

"Halvings are the halfway diagnostic of Bitcoin’s programmatic monetary policy," Coin Metrics wrote.

In accepted markets, U.S. stocks roseate arsenic analysts noted that investors had go excessively bearish, the 10-year U.S. Treasury output roseate to 2.94%, the highest since 2018.

Elsewhere successful crypto, CoinDesk's Tracy Wang reported that the prolific decentralized finance (DeFi) developer Andre Cronje appears to beryllium backmost successful crypto aft abruptly quitting the manufacture past month.

No, Germany Isn’t the World’s Most Crypto-Friendly Country

What’s the archetypal happening you subordinate ‘EU’ with erstwhile it comes to business? Devastatingly precocious taxes and a fierce bureaucracy.

So it's of immoderate astonishment erstwhile Germany precocious took apical spot distant from Singapore arsenic the world’s astir crypto-friendly jurisdiction, according to a ranking by CoinCub.

The rationale? No taxation connected crypto if you merchantability it aft a twelvemonth of holding. If you merchantability it (over 600 Euros, oregon $648) anterior to that one-year point, you are taxed under the accustomed superior gains regime.

To beryllium sure, this is simply a precise bully happening for agelong word HODLERs. If you are agelong connected bitcoin and privation to stack sats, this taxation authorities volition dainty you precise well.

However, this doesn’t enactment precise good for decentralized concern (DeFi). Decentralized exchanges, output farming, liquidity mining… each of this relies connected accelerated trades and transactions. It's what underpins this fancy caller machine, which has implicit $100 cardinal successful value presently locked in.

So a DeFi trader successful Germany is going to person a nasty taxation measure travel taxation time. Figuring retired the taxation liability is difficult, erstwhile the mean period of a DeFi trader is simply a analyzable and intricate web. Crypto derivatives trading — which pumps through hundreds of billions of dollars a day successful measurement — is besides subject to the accustomed superior gains taxation too. Germany’s crypto friendliness rapidly slips distant if you look astatine it nether this rubric.

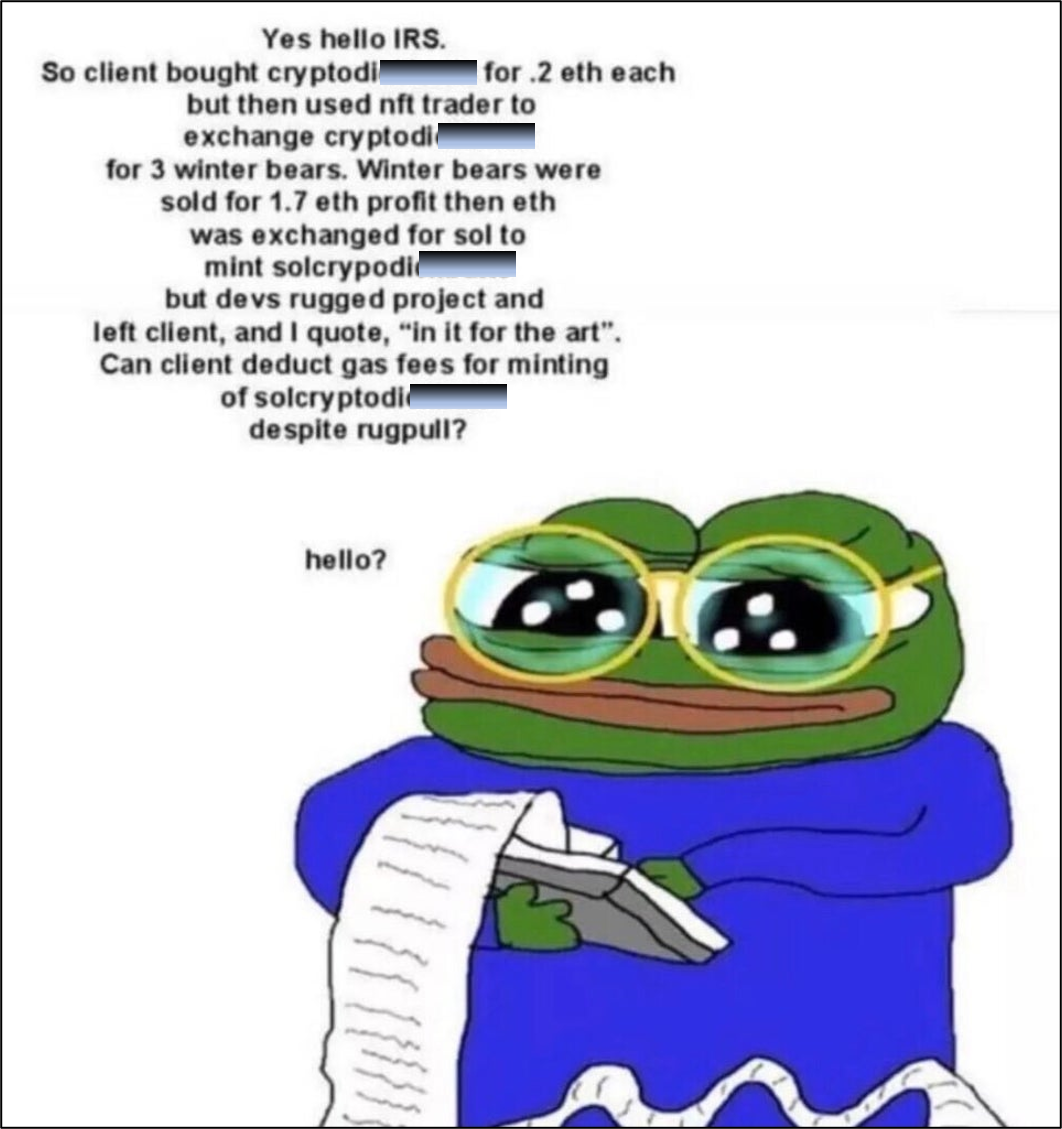

A Pepe meme astir the complexity of DeFi and taxes (author unknown)

Crypto has people gravitated to hubs similar Singapore because of the deficiency of superior gains tax. Singapore is an land metropolis with nary earthy resources, truthful successful bid to jumpstart its improvement arsenic a hub it created a tax-friendly authorities to promote trade.

With nary superior gains taxation there’s nary request to interest astir the magnitude of holding erstwhile experimenting with caller protocols. You’re conscionable capable to trade.

Granted, Singapore has made immoderate moves that would beryllium considered "anti-crypto" but this inactive doesn’t mean the state should beryllium considered crypto unfriendly.

The Monetary Authority of Singapore (MAS) discourages crypto trading by the wide nationalist due to the fact that it knows that if capable radical get rekt aft leveraging their status savings, they volition kick to politicians who volition inquire for much oversight and power — this oversight and power conscionable isn’t successful the DNA of a fiscal hub similar Singapore's.

But contempt this discouragement, the deficiency of superior gains taxation inactive exists and anyone that wants to commercialized tin spell close ahead. Singapore besides discourages different behaviour similar drinking intoxicant and smoking tobacco, and accompanies some with hefty vice taxes. No specified vice taxation exists for crypto.

Bitcoin (BTC) returned supra $40,000, which is the midpoint of its three-month agelong terms range. Still, the cryptocurrency faces archetypal resistance astatine $43,500, which could stall the existent upside successful price.

BTC was trading astir $41,200 during the New York trading day, and was up 2% implicit the past 24 hours.

The comparative spot scale (RSI) connected intraday charts is approaching overbought levels, akin to what occurred successful late-March, which preceded a pullback successful price. On the regular chart, however, the RSI is neutral, which means buyers could stay progressive astatine support.

For now, BTC continues to clasp enactment supra $37,500 – a cardinal level that has kept the betterment signifier intact. Further, a bid of higher terms lows since Jan. 24 indicates a slowdown successful selling pressure, albeit with 20% terms swings.

Momentum signals connected the play illustration are inactive positive, which could constituent to further upside toward the $46,710 absorption level implicit the intermediate term.

10:30 a.m HKT/SGT(2:30 a.m. UTC) International Monetary Fund Global Outlook Press Conference

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Australia’s First Bitcoin ETF to Be Listed Next Week: Report: BTC was up by 2% implicit the past 24 hours, compared with an 11% emergence successful RUNE and LUNA.

Terra’s LUNA Surges 17% arsenic UST Becomes Third-Largest Stablecoin: Terra has besides purchased grounds amounts of Convex tokens successful the past month, a probe found.

FTX Plan Said to Face CFTC Roundtable Next Month: A connection from FTX.US connected nonstop derivatives clearing is acceptable to beryllium the absorption of nationalist treatment connected May 23.

3 years ago

3 years ago

![Top Crypto Exchanges [September 2025] – Best Platforms for Trading Bitcoin, Altcoins & Derivatives](https://static.news.bitcoin.com/wp-content/uploads/2025/09/best-crypto-exchanges-sept-2025-768x432.png)

English (US)

English (US)