Good morning. Here’s what’s happening:

Prices: Bitcoin returned to wherever it started the weekend.

Insights: Singapore's increasing crypto regulatory scrutiny has raised concerns among organization investors.

Technician's take: BTC's trading scope could persist into the pursuing week.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $38,594 +2.2%

Ether (ETH): $2,844 +3.9%

Biggest Gainers

Biggest Losers

There are nary losers successful CoinDesk 20 today.

Bitcoin investors continued their caller dour temper this play amid ongoing macroeconomic uncertainty and a widely-expected, half-point involvement complaint hike by the U.S. cardinal slope by Wednesday.

The largest cryptocurrency by marketplace headdress was precocious trading astatine astir $38,400, up astir 2.2% for the past 24 hours but astir wherever it started the weekend. Bitcoin finished April down 17%, its worst period yet successful a ragged 2022 for cryptos.

Ether, the 2nd largest crypto by marketplace cap, followed a akin play signifier and was trading astatine astir $2,840, up astir 3.9% implicit the erstwhile time but small changed from precocious Friday. Most different large cryptos were precocious up, though gains implicit the play were smaller. Terra's luna token and SOL were up implicit 5% and 7%, respectively astatine 1 point. Popular meme coin DOGE roseate astir 6%. Trading was airy arsenic is often the lawsuit connected weekends.

"At the moment, determination are nary large bullish catalysts connected the skyline and BTC is apt to grind successful this scope oregon interruption down little earlier much assertive accumulation tin begin," Joe DiPasquale, CEO of money manager BitBull Capital wrote to CoinDesk. "The deficiency of bullish catalysts is inactive evident and U.S. equities person amusement weakness arsenic good arsenic the U.S. dollar scale rose. All these factors proceed to measurement down BTC."

DiPasquale noted that the Federal Reserve Federal Open Market Committee's apt determination to effort to tame ostentation done a much hawkish complaint summation "could effect successful terms volatility." The Fed is besides expected to explicate however it volition trim its plus portfolio of owe and Treasury securities, which has ballooned to $9 trillion during the pandemic.

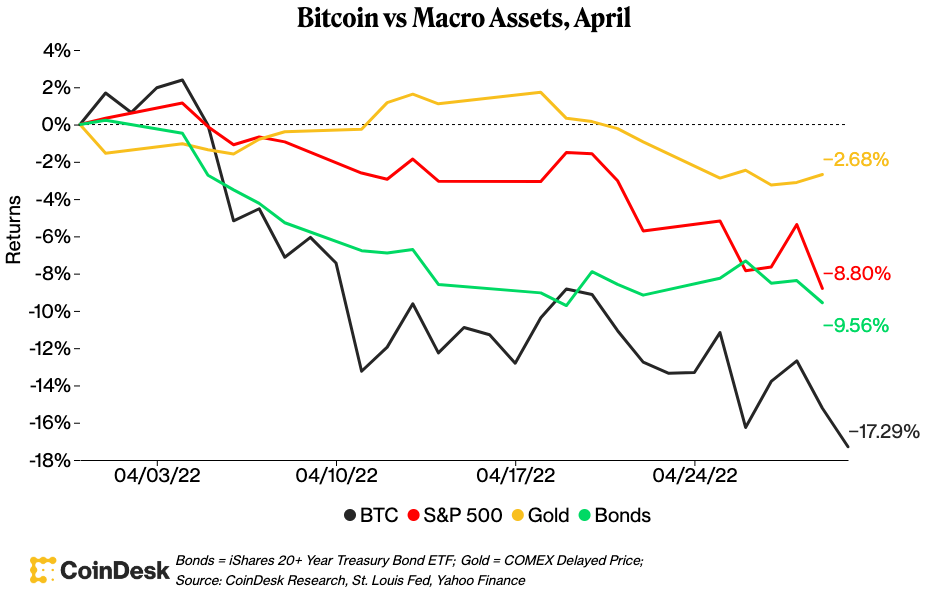

Bitcoin vs different assets (CoinDesk Research)

Crypto declines successful caller days person mostly dovetailed with large banal indices arsenic investors veer distant from riskier assets. The tech-heavy Nasdaq plunged a hefty 4% connected Friday. The S&P 500 and Dow Jones Industrial Average were disconnected 3.6% and 2.7%, respectively. Gold was up slightly. The Nasdaq 100, an scale of mostly tech, biotech and healthcare companies, plummeted 13% successful April.

Economic maturation has slowed worldwide, a effect of Russia's unprovoked penetration of Ukraine. On Friday, the European Union reported that the economies of 19 countries that usage the euro grew by conscionable 0.2% for the archetypal 4th of the year. The quality followed the announcement that the U.S. system had grown by a sluggish 0.4% implicit the aforesaid period. Rising vigor prices and proviso concatenation delays exacerbated by the Russian violative person hampered businesses worldwide.

With Bitcoin failing to clasp the $42,000 level this week, DiPasquale was measured successful his expectations for the coming days. "We person continued to spot $38K levels acting arsenic enactment but continued investigating of this scope whitethorn effect successful a breakdown toward $35K-$32K," helium wrote, adding: "Bulls volition privation to spot the bleeding halt and superior buyers stepping successful earlier they tin beryllium assured of a inclination reversal."

Singapore's little crypto affable environment

Three Arrows Capital is the latest crypto steadfast that’s decided to call Singapore quits and determination to Dubai.

“The vigor successful Dubai’s integer plus manufacture is electrical close now,” money co-founder Su Zhu told CoinDesk during the Crypto Bahamas conference. “We person decided to determination our Three Arrows office to Dubai and I’m looking guardant to gathering much exertion startups.”

“For a while, Singapore was making pro-crypto decisions, but present something’s changed course,” added Kyle Samani, the fund’s different co-founder.

To beryllium sure, connected insubstantial Singapore hasn’t precocious immoderate caller acceptable of rules that would impact a money similar Three Arrows Capital. The authorities has been wide that its argumentation position is to make a “conducive situation for specified activities to flourish successful Singapore.”

But that is for organization capital. The Monetary Authority of Singapore has besides been wide that it doesn’t o.k. of retail investors getting profoundly progressive successful crypto.

“We person taken a pugnacious enactment connected unfettered entree to retail nationalist due to the fact that retail investors should not beryllium dabbling successful cryptocurrencies. Many planetary regulators stock akin concerns astir retail vulnerability to cryptocurrencies,” the agency’s Managing Director Ravi Menon said successful a caller interview, adding that it has granted retail crypto licenses but they travel with strict presumption and conditions.

Funds similar Three Arrows Capital don’t woody straight with retail crypto. They aren’t unfastened to non-institutional oregon accredited investment.

It mightiness person thing to bash with DeFiance Capital, 1 of Three Arrows’ peers successful the city.

In March, DeFiance Capital was placed on an Investor Alert List by MAS. DeFiance Capital isn’t definite wherefore it happened, and MAS won’t springiness CoinDesk a wide answer.

Putting a money connected an capitalist alert list, which has antagonistic connotations, and not explaining the reasoning, isn’t a bully look.

It besides mightiness beryllium the opening of problems successful doing concern successful Singapore.

Visas for overseas unit are increasingly difficult to attain, and the logical communicative of the metropolis being a monolithic beneficiary of Hong Kong’s superior and endowment formation isn’t needfully shaping up with TradFi besides looking astatine Dubai arsenic the adjacent hub alternatively of Singapore.

At the aforesaid time, Dubai is making the relocation process arsenic casual arsenic imaginable with visas sponsored by the Dubai International Financial Centre (DIFC) peculiar economical portion processed successful little than a week. Plus, the DIFC has a parallel ineligible system

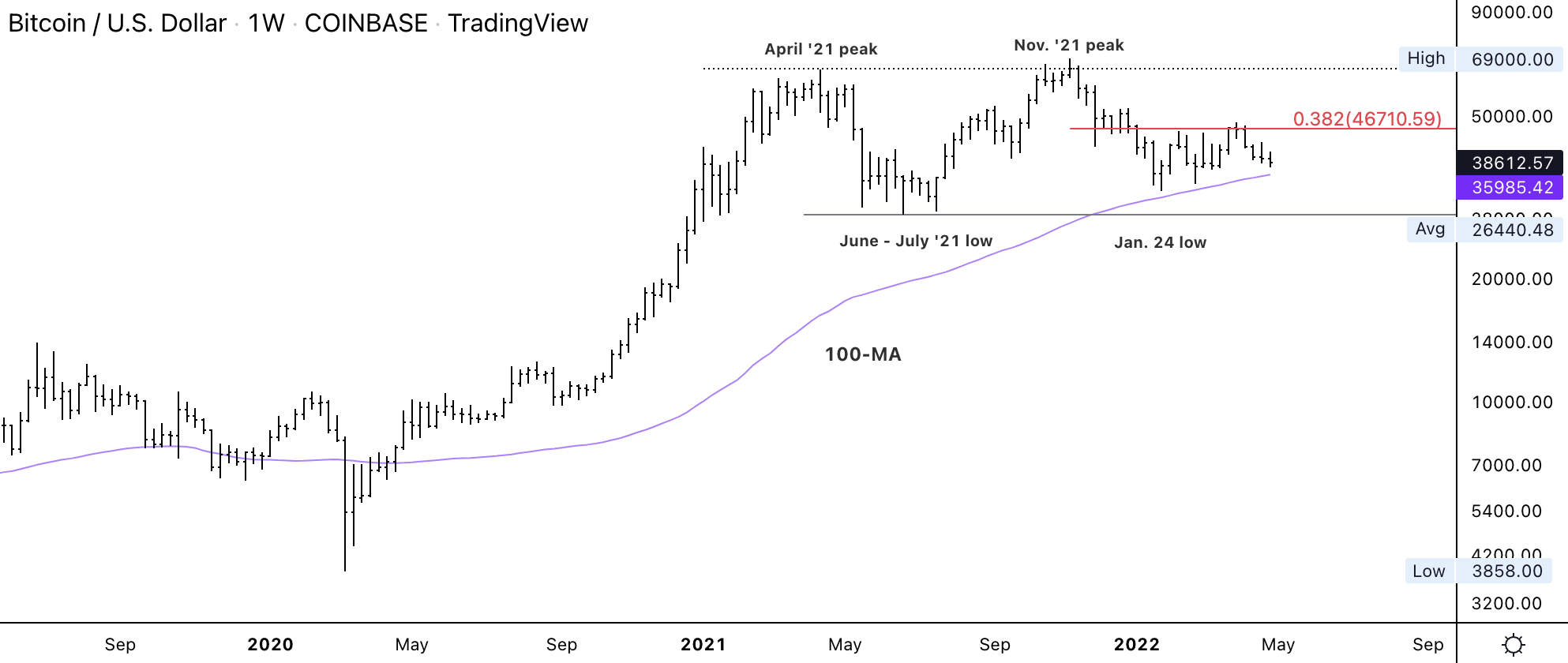

Bitcoin play illustration shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is investigating enactment astir its 100-week moving average, though upside momentum has slowed implicit the past month. The cryptocurrency could stay successful a wide trading scope until a decisive breakout oregon breakdown occurs.

BTC is connected way for an 18% diminution this period and is down astir 40% from its all-time precocious astir $69,000 reached successful November of past year.

Most method indicators are neutral connected the regular and play illustration and bearish connected the monthly chart. That could summation the hazard of a breakdown successful price, particularly if enactment astatine $37,500 fails to hold.

A bid of higher terms lows since Jan. 24 has supported buying enactment connected dips. Still, absorption astatine $46,710 has capped rallies implicit the past 3 months.

For now, BTC is connected ticker for a countertrend reversal awesome adjacent week, per the DeMARK indicators, which typically precedes a little upswing successful price.

8:30 a.m. HKT/SGT(12:30 UTC): Jibun (Japan) Bank manufacturing PMI (April)

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Australia and New Zealand Banking Group occupation advertisements (April)

1 p.m. HKT/SGT(5 a.m. UTC): Japan user assurance scale (April)

In lawsuit you missed it, present is the astir caller occurrence of "The Hash" connected CoinDesk TV:

Earlier this week, "The Hash" hosts discussed apical stories, including the Ukrainian government's caller inaugural to usage NFT donations successful the warfare against Russia, Panama's caller crypto instrumentality and backstage equity concern steadfast Apollo's caller prosecute for its integer plus division.

Swiss National Bank Owns No Bitcoin, but Could Buy successful the Future, Chairman Says: While bitcoin contiguous doesn't conscionable norms for currency reserves, said Thomas Jordan, there's nary method barroom to purchases.

Please Don’t Buy a 'KYC’d' Wallet for the Bored Apes Team’s Otherside Mint: Yuga Labs’ agelong awaited “Otherside” NFT merchantability has spawned a secondary marketplace for specially registered Ethereum addresses. Caveat emptor.

Dubai Real Estate Developer to Accept Crypto Payments Amid UAE Push for Crypto Hub Status: Several of the world's biggest crypto exchanges person flocked to the emirates successful the past fewer months.

NFT Subscriptions Are Better Paywalls: Turning subscriptions into a bearer plus is amended for everyone, says our media columnist. This nonfiction is portion of CoinDesk's Payments Week.

Bitcoin Payments Remain successful Their Infancy but There Are Green Shoots Everywhere: Can cryptocurrencies, stablecoins and CBDCs coexist arsenic methods of payment? Industry leaders radiance a airy connected the aboriginal of crypto payments. This portion is portion of CoinDesk's Payments Week.

How Human-Centered Design Can Fix Crypto Payments: Web 3 should bargain plan ideas from Web 2, Grace “Ori” Kwan says successful a CoinDesk Payments Week op-ed.

"There’s a fascinating treatment to beryllium had astir whether what Hwang did was full-blown fraud, but I won’t fuss trying to outdo Matt Levine connected that front. Instead, I privation to absorption connected the fiscal mechanics of what Archegos was up to, and wherefore it’s highly important for cryptocurrency holders oregon traders to understand." (CoinDesk columnist David Z. Morris) ... "Yet, that surface-level appraisal misses immoderate striking caller adoption trends that aren’t easy evident to mainstream commentators. Minorities and assorted different marginalized groups are turning to crypto arsenic a instrumentality and processing unique, caller innovative uses for it – often astatine a faster gait than communities that person traditionally had much privileged entree to resources. This acquisition demands a cautious attack to fostering diversity. We indispensable not propulsion the babe retired with the bathwater." (CoinDesk Chief Content Officer Michael Casey) ... "The wide selloff has erased trillions of dollars successful marketplace worth from the tech-heavy gauge, with investors souring connected shares of everything from bundle and semiconductor companies to social-media giants." (The Wall Street Journal) ... "The closings and demands for changeless checks and vigilance, particularly successful Shanghai, person ignited nationalist frustration, exhausted section officials and aesculapian workers, and sapped economical momentum." (The New York Times)

3 years ago

3 years ago

English (US)

English (US)