Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin mounts a tiny Sunday comeback.

Insights: Crypto companies whitethorn look much scrutiny successful Singapore.

Technician's take: BTC is connected way for its archetypal consecutive seven-week decline.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $31,122 +3.5%

Ether (ETH): $2,139 +4.5%

As comebacks go, it wasn't much. But Bitcoin volition instrumentality what it tin get astatine this point.

So volition different cryptos hammered past week by the toxic premix of geopolitical unrest, rising involvement rates, recessionary fears and the implosion of the terraUSD (UST) stablecoin and the LUNA token that backs it.

Bitcoin was precocious trading supra $31,000, up astir 6% implicit the past 24 hours and much than 16% from the $26,600 depths it sank to mid-Friday. "Bitcoin did so look downward unit that saw it losing the $30K support, but it did not autumn beneath the 25K level," Joe DiPasquale, the CEO of crypto money manager BitBull Capital, wrote to CoinDesk.

Ether, the 2nd largest crypto by marketplace cap, was precocious up likewise and changing hands astatine astir $2,100 aft dropping beneath $1,800 for the archetypal clip successful 2 months. Most large altcoins spent Sunday good successful the green, recovering immoderate of the crushed they mislaid past week arsenic the crypto marketplace headdress tumbled by $300 billion. SOL roseate much than 10% astatine 1 constituent though its $55 terms was down from implicit $70 astatine the commencement of the week.

ADA, AVAX and AXS posted increases ranging betwixt 9% and 11%. BCH was among the fewer losers earlier Sunday.

Crypto gains dovetailed with equity markets that yet enjoyed immoderate bully quality Friday aft six consecutive days of declines. The tech-focused Nasdaq closed up 3.8%, portion the S&P 500 and Dow Jones Industrial mean roseate 2.3% and 1.4%, respectively. Still, the week's economical atrocious quality is improbable to shingle investors from their risk-averse positions of caller months.

On Wednesday, the U.S. Commerce Department announced that user prices had risen 8.3% successful April, somewhat amended than the erstwhile period but nevertheless a motion that ostentation driving a scope of goods and services would linger. Even the erstwhile torrid lodging marketplace has felt shockwaves arsenic owe rates person risen implicit 5.3%, expanding the trouble for would-be homeowners to concern their purchases. Investors person been acrophobic that U.S. cardinal slope hawkishness was inadequate to tame rising prices without throwing the system into recession.

In an email Friday, Hargreaves Lansdown Senior Investment and Markets Analyst Susannah Streeter highlighted "investor worries implicit inflation, proviso concerns the UST fall, which sent LUNA tumbling to a fraction of a cent. "For present the crypto chaotic westbound is taking a breather aft reeling from the clang brought connected by the illness of a alleged stablecoin," Streeter wrote, adding: "This latest plunge successful the instrumentality of luck demonstrates that speculating successful cryptocurrencies is highly precocious hazard and are not suitable for investors who don’t person wealth they tin spend to lose.’’

BitBull's DiPasquale noted that "a near-term bounce" successful Bitcoin "is inactive intact but a due reversal needs much buying activity." He called past week's debased "a decent buying accidental for semipermanent exposure," but besides warned that "the coming period whitethorn bring further volatility arsenic much factual steps by the FED to combat ostentation travel to the fore."

Singapore volition beryllium eyeing locally registered crypto firms

As the week closed successful Asia, LUNA and UST were de-listed from astir exchanges arsenic the Terra blockchain was halted for 9 hours (currently resumed) and the marketplace seemed to cull a betterment plan.

The question connected galore people’s minds is, however volition token holders beryllium made whole? That’s wherever things get complicated.

Terraform Labs, the Singapore-registered institution down the Terra protocol, doesn’t person a imperishable office. The Singapore code it provides is simply a registration agent, location to hundreds of Singaporean companies. Its offices are rented co-working spaces worldwide; similar galore Web 3 startups, there’s nary ceremonial headquarters.

The lone assets the institution has are from the Luna Foundation Guard. This non-profit organization, besides registered successful Singapore and overseen by Do Kwon, controls the wallets that were to enactment the UST peg during times of utmost volatility. The bulk of these wallets are present empty, with the lone happening of worth remaining being the astir $69 cardinal successful avalanche token (AVAX).

Singapore’s regulators are alert of the inclination of crypto companies utilizing a Singaporean entity to behaviour concern overseas with nary worldly ties to the country. In April, its Parliament passed a measure into instrumentality that included provisions that necessitate domestically registered crypto companies that bash concern overseas to beryllium licensed chiefly for anti-money laundering reasons, but leaves the doorway unfastened successful the aboriginal for this to expand.

As the twelvemonth began, Terra’s LUNA token had a marketplace headdress of $33 billion. Its UST stablecoin had a market headdress of $10 billion. Now, with Terra blockchain halted, possibly for bully this time, some person a virtual worth of $0.

Should determination beryllium a ineligible lawsuit made against the companies down the protocol by the token holders, what benignant of assets could beryllium seized? What jurisdiction does the Singapore authorities person implicit Do Kwon and co-founder Daniel Shin? On institution filings with section authorities, some supply addresses successful Singapore but it's unclear if they reside determination afloat time, arsenic Kwon maintains a residence successful South Korea, too.

With its suit against the Securities and Exchange Commission (SEC), Terraform Labs and Do Kwon asserted that American regulators don’t person jurisdiction implicit Kwon, a Korean residing successful Singapore. They person nary ties to the U.S., truthful however tin they beryllium targeted by regulators? they argued. But they mightiness find themselves dealing with Singapore’s justness system, and portion the state has a favorable securities model compared to the U.S. its courts are known to beryllium different strict.

Should the Singaporean authorities consciousness similar the nation’s estimation is astatine involvement due to the fact that of a registered institution with fewer worldly ties that blew up tens of billions of dollars, it volition travel aft them hard and whitethorn commencement the process of closing the doorway wholly connected crypto firms that usage a Singaporean ammunition but bash concern abroad.

If that happens, volition Terraform and Kwon besides assertion the “no jurisdiction” route?

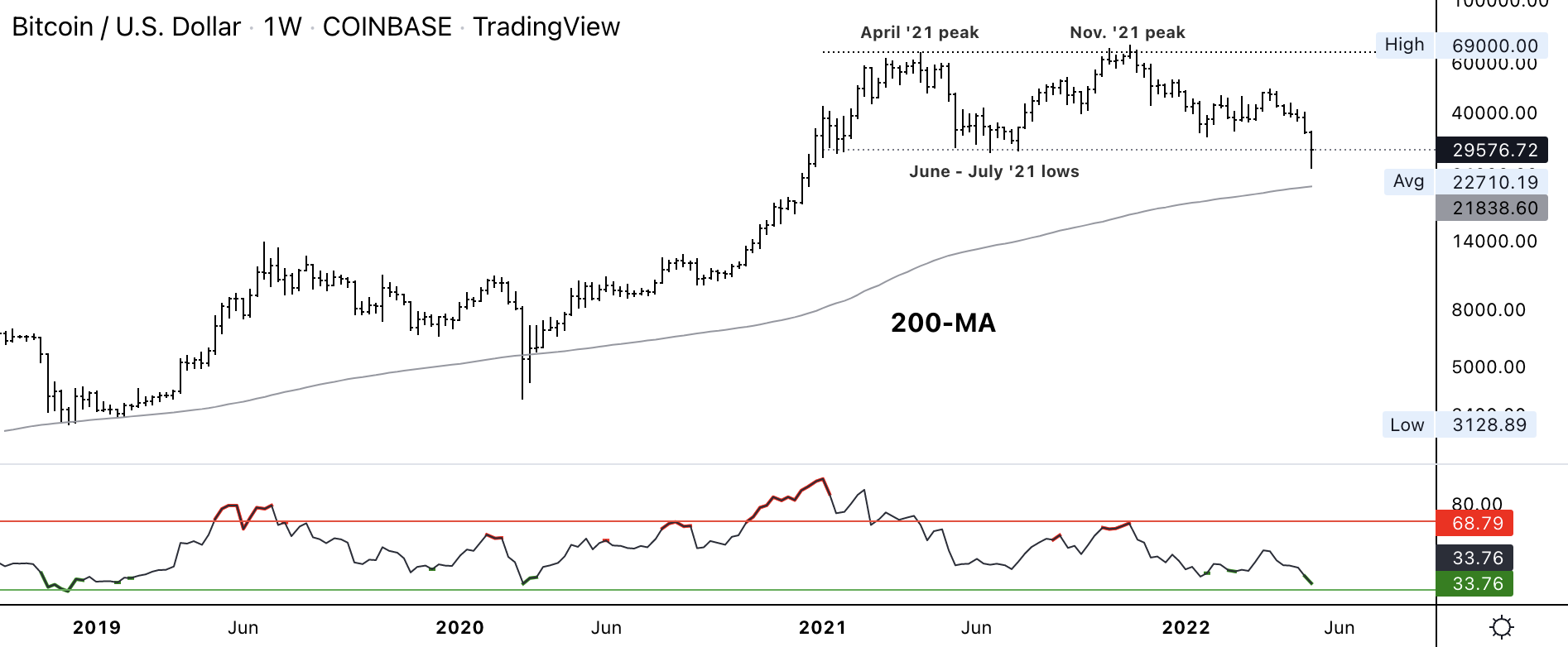

Bitcoin play terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) bounced toward $30,000 connected Friday arsenic buyers reacted to oversold conditions. Still, immoderate upside appears to beryllium limited, and the cryptocurrency could look resistance astatine $33,000 and $35,000.

Momentum signals stay antagonistic connected the daily, play and monthly charts, which typically leads to a play of debased oregon antagonistic returns. Further, BTC is connected way for its first-ever consecutive seven-week decline, according to Coinbase (COIN) terms information provided by TradingView, dating backmost to 2014. That's besides a motion of antagonistic terms momentum.

For now, BTC is approaching little support adjacent its 200-week moving average, which is present astatine $21,800. Immediate enactment is betwixt $27,000 and $30,000, which could stabilize terms enactment implicit the adjacent fewer days.

Also, connected Thursday, short-term countertrend signals appeared connected the charts, which typically leads to a little terms bounce.

The comparative spot scale (RSI) connected the play illustration is the astir oversold since March 2020, though beardown absorption and antagonistic momentum suggests constricted upside implicit the adjacent fewer months.

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

"First Mover" dove further into the UST stablecoin debacle and its punishing interaction connected crypto markets. BTC, different crypto prices were climbing but the outlook is uncertain. And what were the lessons learned? Joining big Christine Lee were Michael Coscetta of Paxos, which has a antithetic benignant of stablecoin than UST, and Benoit Bosc of GSR gave his markets analysis.

Do Kwon’s Proposed Terra ‘Revival’ Puts UST, LUNA Holders successful Charge: A “Revival Plan” submitted Friday by the Terraform Labs CEO would redistribute ownership of the network.

Terra Blockchain Resumes Following 9-Hour Halt: Blocks 7607790 and 7607791 came done astatine astir 11:27 UTC Friday.

Elon Musk Says He's Committed to Twitter Deal After Putting It connected Hold: The landmark woody that would spot Elon Musk instrumentality implicit Twitter and marque it backstage has deed a stumbling artifact arsenic Musk wants to verify the magnitude of fake accounts.

Crypto-Related Stocks successful Asia See Volatile Trading Amid Bitcoin Recovery: Traditional marketplace investors risked-off publically traded companies related to the crypto assemblage amid a driblet successful prices this week.

Why the Fed Will Go Back to Easy Money: Amid a recession and governmental paralysis, the Federal Reserve volition person nary prime but to revert to quantitative easing. What volition that mean for cryptos similar bitcoin?

"It's a sobering infinitesimal for those of america successful the crypto watching business. I’ve spent a large woody of clip implicit the past 2 years trying to item absurdities successful the bubbly crypto marketplace (including predicting luna’s failure), but I inactive find myself somewhat shocked by conscionable however exposed civilians became to 1 of the astir experimental projects successful the industry. And to beryllium explicit, the crypto manufacture is inactive champion thought of arsenic wholly experimental." (CoinDesk columnist David Z. Morris) ... "The downfall of UST arsenic an algorithmic stablecoin is simply a Black Swan lawsuit and should ne'er person happened. It was a task worthy implicit $18 cardinal – practically excessively large to fail. Stronger regulatory controls overseeing the project’s automated trading strategy could person mitigated the concern a agelong clip ago." (Fluid CEO Ahmed Ismail, for CoinDesk) ... “It’s hard to say, ‘Is this Lehman Brothers?’ We’re going to request immoderate much clip to fig it out. You can’t respond astatine this benignant of speed.” (Paxos co-founder Charles Cascarilla, quoted successful The New York Times) ... Saudi Aramco has posted its highest profits since its 2019 listing arsenic lipid and state prices surge astir the world....In a property release, the steadfast said it had been boosted by higher prices, arsenic good arsenic an summation successful production. The penetration of Ukraine has seen lipid and state prices skyrocket. Russia is 1 of the world's biggest exporters but Western nations person pledged to chopped their dependence connected the state for energy. Oil prices were already rising earlier the Ukraine warfare arsenic economies started to retrieve from the Covid pandemic and request outstripped supply. Other vigor firms including Shell, BP and TotalEnergies person besides reported soaring profits arsenic a result, though galore are incurring costs exiting operations successful Russia." (BBC)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)