Good morning. Here’s what’s happening:

Prices: Bitcoin and ether roseate somewhat but investors nervously awaited the adjacent crook successful Ukraine and a long-awaited crypto enforcement bid by U.S. President Joe Biden

Insights: Singapore's strict attack to crypto whitethorn beryllium deterring immoderate companies successful the manufacture from establishing a beingness there.

Technician's take: Narrow terms zones could payment short-term BTC trades. Support astatine $37K; absorption astatine $43K-$45K

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $38,673 +.9%

Ether (ETH): $2,574 +2.6%

Bitcoin was up somewhat connected Tuesday amid different time of fearfulness and tumult successful Ukraine, and economical angst successful the satellite beyond. Jittery investors besides awaited a long-awaited crypto enforcement bid connected Wednesday by U.S. President Joe Biden that volition outline the country's attack to regulation.

Yet astatine the clip of publication, bitcoin (BTC) was trading astatine astir $38,600, up somewhat implicit the erstwhile 24 hours. Ether (ETH) was changing hands astatine a small nether $2,600, a astir 2.5% gain. Other large altcoins were a mixed bag.

"Bitcoin is higher connected the time arsenic hazard appetite showed signs of beingness aft U.S. stocks had the worst rout successful a fewer years," wrote OANDA Americas Senior Markets Analyst Edward Moya successful an email.

Russia continued its run to isolate Ukraine's large Black Sea ports to the southbound and laic siege to its large cities, bombarding subject and, increasingly, civilian targets. More than 2 cardinal Ukrainians person fled their devastated country. Ukraine President Volodymyr Zelensky vowed to "fight to the end, astatine sea, successful the air," echoing Winston Churchill, Britain's premier curate during World War II, successful an affectional video address.

The U.S., European and different countries, which person condemned the unprovoked invasion, continued to ratchet up economical unit connected Russia. President Joe Biden announced the U.S. would prohibition the importing of Russian oil. The terms of Brent crude lipid has soared to $130 a barrel, sending vigor prices higher worldwide. The terms of a gallon of state successful the U.S. reached an mean $4.17 per gallon, an all-time high.

Meanwhile, a caller circular of major, planetary brands, including McDonald's (MCD) and Coca-Cola (KO) said they were pausing operations successful Russia. The latest events and the Biden Administration's expected announcement of a crypto enforcement bid that could contributed to investors' jitters. They

Moya noted that "bitcoin’s fundamentals are inactive sound, but galore progressive traders are putting the crypto commercialized connected clasp and focusing connected a fistful of commodity supercycle trades." He added: "Bitcoin is forming a trading scope and implicit the adjacent fewer weeks it could commercialized betwixt the $35,000 and $45,000 trading range."

What’s the Point of Singapore’s Digital Payment Token License if it's Too Hard to Get?

Three years agone Arthur Hayes (jokingly) bragged during a debate that his BitMEX crypto speech was successful Seychelles due to the fact that regulators could beryllium bribed with a coconut.

Hayes was trying to irritate his cantankerous statement hostile connected signifier portion colorfully illustrating that determination were alternate regulators to those successful New York.

But successful 2022 New York’s hardly the lone regulatory assemblage due to the fact that different fiscal capitals vie to pull the crypto industry.

Singapore is often referred to arsenic the adjacent crypto hub successful Asia, peculiarly due to the fact that of its estimation for spotless governance and a strict regularisation of law.

Its strongman founder, Lee Kuan Yew, saw the nation’s way to prosperity arsenic 1 of bully governance and honesty. Unlike its neighbors, the authorities isn’t tally by kleptocrats: Its civilian servants are paid good for their competency, constabulary don’t instrumentality bribes and the pat h2o is drinkable.

As overmuch arsenic Seychelles’ regulator mightiness person honorable intent and beryllium tally by crisp people, the cognition of the state among immoderate radical is that it's the Third World.

So erstwhile Singapore’s Monetary Authority, its all-in-one regulator and cardinal bank, started gathering a broad crypto model called the Digital Payment Token license, the manufacture was excited.

There’s nary crushed to support ourselves parked successful places with a less-than-stellar reputation, the manufacture thought. Let’s each determination to Singapore.

From the Third World to First, but for the crypto era.

Since the doors opened for applications successful aboriginal 2020, 180 firms applied for a DPT license. But 30 applications person been withdrawn, including Binance’s, and 2 were outright rejected.

That’s rather the crisp funnel, particularly for a maturing plus class.

It’s 2022, not 2012. Crypto is young compared with different plus classes, but it has moved rapidly.

“Singapore’s modular is precise high, and they volition inquire you to enforce question rules connected your platform,” Patrick Chiu, the laminitis of Hong Kong’s AP Capital, a money with a increasing integer plus portfolio, told CoinDesk.

Travel rules impact strict anti-money laundering (AML) requirements connected incoming and outgoing funds.

Chiu said the licence presumption person presumption and stipulations that “aren’t emblematic for planetary exchanges.”

Everyone was invited to apply, said Chiu. But there’s a gangly regulatory wall.

But absent are the accustomed stalwart names successful crypto. Sure, there’s a batch to accidental astir Binance dropping retired fixed its baggage. But what astir Coinbase (COIN)?

Chiu thinks the precocious licence requirements whitethorn beryllium deterring galore of the accustomed names successful crypto due to the fact that of however antithetic the requirements are for crypto.

For example, the licence requires face-to-face cognize your lawsuit (KYC) vetting, Chiu said. Not truly applicable for galore firms. There’s besides the request that the crypto lone stays wrong a web of whitelisted wallets wrong Singapore. Given the size of the market, this would nary uncertainty hamper liquidity.

Bringing successful overseas superior is possible, but due to the fact that of the reporting requirements it’s conscionable not realistic, particularly for crypto traders that expect velocity and liquidity that isn’t matched successful immoderate different plus class.

The question is, what benignant of trader are these rules hoping to attract? It looks similar a buy-and-HODL type.

As it stands there’s a pathway for radical to bargain and clasp crypto nether the licensing scheme, and that’s astir it. Institutions mightiness instrumentality an involvement successful this to adhd it to their equilibrium sheet, but it's improbable that nonrecreational traders oregon degens volition beryllium precise interested.

By each accounts licensed decentralized concern (DeFi) is going to beryllium intolerable if the integer assets can’t permission the whitelisted wallets.

All of this definite sounds antithetical to crypto’s precise fundamentals.

Sure, regulated crypto successful Singapore volition beryllium arsenic spotless arsenic the country’s governance. But if the assets are stuck successful Singapore, volition anybody care?

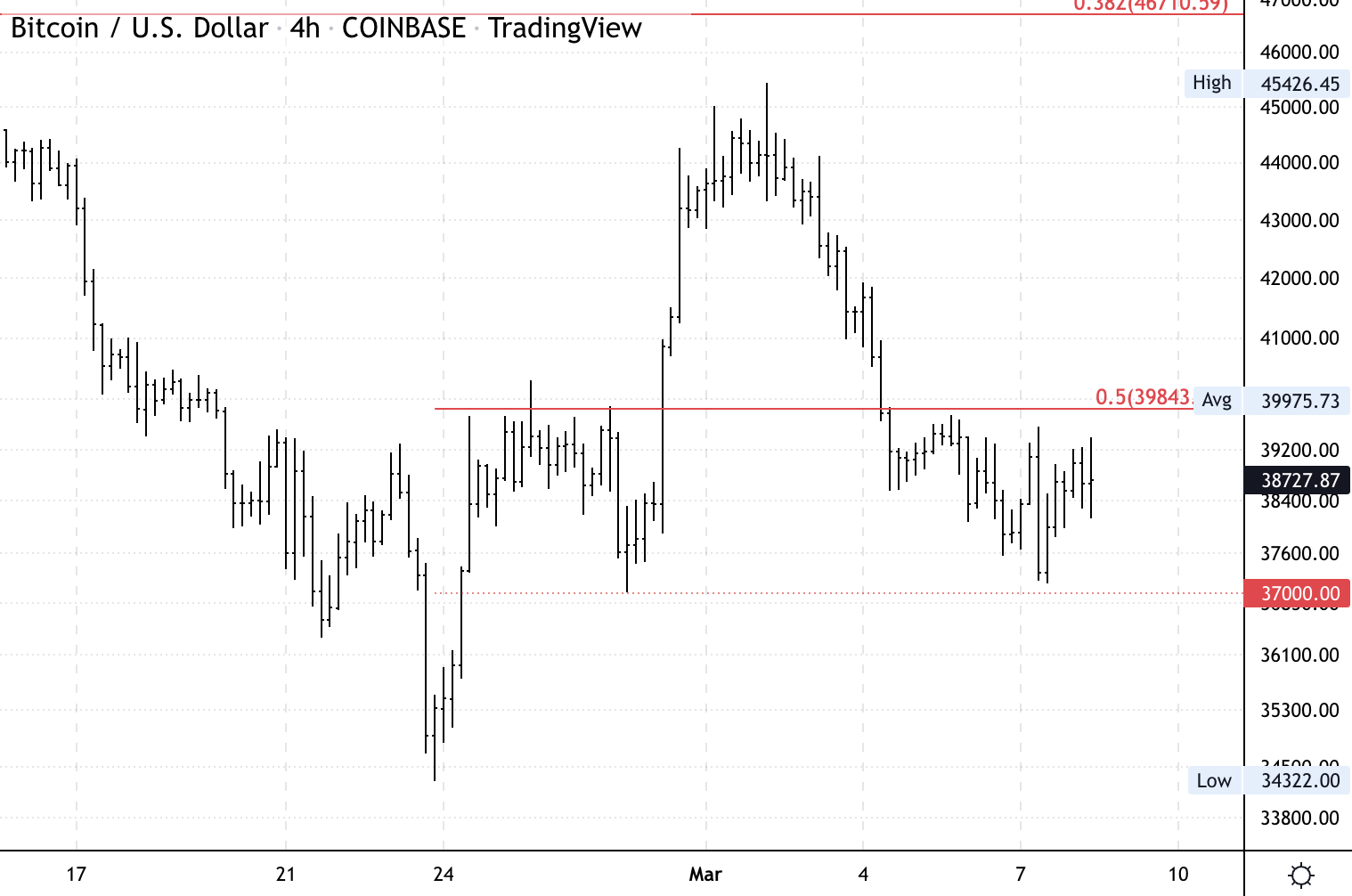

Bitcoin four-hour illustration shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) has held enactment astatine $37,000 implicit the past fewer days, which could output short-term upside targets toward the $40,000-$45,000 absorption zone. Support refers to the terms level wherever a downtrend tin beryllium expected to intermission due to the fact that of a attraction of request oregon buying interest.

The cryptocurrency precocious traded astir $38,700 and is up astir 3% implicit the past 24 hours. A decisive interruption supra $40,000 could promote further buying into the Asia trading day.

For now, constrictive terms zones could payment short-term positioning among traders arsenic astir method indicators are neutral.

A counter-trend exhaustion awesome connected the regular bitcoin chart, per the DeMARK indicators, appeared connected Monday. That could constituent to short-term stabilization successful price, though the erstwhile awesome connected Dec. 29 did not effect successful a terms bounce.

At times, erstwhile confirmed, reversal signals could beryllium adjuvant for little trades. For example, determination was a method set-up for a terms reversal connected Jan. 24, which preceded a 30% terms rally. In a carnivore market, however, terms swings thin to slice wrong the absorption of the prevailing downtrend.

BTC volition request to clasp supra $37,000 enactment and interruption done the $46,700 absorption level successful bid to awesome a inclination reversal.

9:30 a.m. HKT/SGT(1:30 a.m. UTC): China user terms scale (Feb. MoM/YoY)

9:30 a.m. HKT/SGT(1:30 a.m. UTC): China shaper terms scale (Feb. YoY)

Japan instrumentality tools orders (Feb. YoY)

4 p.m. HKT/SGT (8 a.m. UTC): Speech by Guy Debelle, Reserve Bank of Australia adjunct politician (financial markets)

"First Mover" hosts spoke with Ukraine Ministry of Digital Transformation Deputy Minister Alex Bornyakov arsenic the United Nations records astir 2 cardinal refugees person near Ukraine arsenic Russia's battle continues. Darrell Duffie of the Stanford Institute for Economic Policy Research weighed successful connected the relation of China's integer yuan successful Russia sanctions. Crypto speech OKX Director Adrian Yang provided marketplace insights. Plus, celebrating International Women's Day, Lisa Mayer, Boss Beauties laminitis and CEO, shared however her institution is helping bring pistillate empowerment to the community.

Bain Capital Launches $560M Crypto Fund: The $155 cardinal concern elephantine volition absorption connected DeFi and Web 3 and isn't acrophobic to get its hands soiled with liquid tokens.

No 1 wants dollars truthful they don’t bid immoderate interest. But the reverse is existent for stablecoins. Demand for stablecoins perpetually exceeds supply. So radical with stablecoins to lend tin complaint premium involvement rates, and crypto platforms hopeless for stablecoins connection precocious involvement rates to pull caller stablecoin lenders. That’s wherefore stablecoin involvement rates are truthful high. It’s elemental economics. (CoinDesk columnist Frances Coppola) ... While the determination not to region [Brantly] Millegan from the ENS Foundation seems democratic, it’s important to retrieve however precisely voting powerfulness was initially distributed this past fall. Thanks to the lopsided organisation and delegation of tokens, Millegan has ever had outsize powerfulness implicit this ecosystem. (CoinDesk columnist Will Gottsegen) ... "Russian lipid makes up a tiny proportionality of the crude that the U.S. imports. The U.S. gets astir of its crude imports from Canada, Mexico and Saudi Arabia." (The Wall Street Journal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)