Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin, ether and different large cryptos plummeted arsenic investors remained averse to risk.

Insights: Spot BTC ETFs motorboat successful Australia. But elsewhere, they are facing money outflows.

Technician's take: BTC's existent pullback is akin to what occurred successful September of past year, albeit with anemic terms momentum.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $38,418 -4.5%

Ether (ETH): $2,839 -5.7%

Top Gainers

There are nary gainers successful CoinDesk 20 today.

Top Losers

Bitcoin and different large cryptos plunge

After a promising commencement to the week, bitcoin swooned connected Tuesday, precocious dropping astir 4.5% implicit the past 24 hours arsenic investors continued their caller risk-off posture amid the aforesaid macroeconomic uncertainty that has been plaguing the satellite passim the year.

Just a time aft bitcoin soared past $40,500 connected quality of fiscal elephantine Fidelity's determination to allow consumers to put successful bitcoin successful their 401(k) status savings accounts, the largest cryptocurrency by marketplace capitalization was trading conscionable implicit $38,000, its lowest people since aboriginal March. Ether, the second-largest crypto by marketplace cap, was changing hands astatine astir $2,820, disconnected astir 5.7%, pursuing a time erstwhile it pushed past $3,000.

Other large altcoins by marketplace headdress were successful the red, galore of them importantly so. Terra's LUNA token and ADA were some precocious down implicit 7%. Popular meme coin DOGE fell much than 9%.

Analysts person been cautious successful predicting cryptos' inclination successful the coming weeks arsenic bitcoin has wrestled with the $40,000 threshold with 1 expert penning successful a study that secondary enactment could form "near $27,200."

Crypto declines tracked equity markets, which tumbled arsenic Wall Street digested an inauspicious opening to the net season, fiscal tightening by the U.S. cardinal bank, discouraging economical information and signs that Russia would escalate its attacks connected neighboring Ukraine. The tech-focused Nasdaq declined a whopping 3.9%, portion the S&P 500 fell 2.8%.

On Tuesday, Google genitor Alphabet (GOOG) said its first-quarter nett had dropped 8%, and successful a report, Deutsche Bank (DB) predicted "a large recession," revising its forecast of earlier this period for a milder downturn. The latest economical quality came arsenic Russia chopped disconnected earthy state supplies to Poland, which has been fearful that it could beryllium a people of Russian aggression. Separately, Russia accused Western countries supportive of Ukraine of conducting a proxy war.

"Bitcoin reversed little arsenic hazard aversion returned to Wall Street, with tech stocks starring the decline," Oanda Americas Senior Market Analyst Edward Moya wrote successful an email, noting Russia's determination connected Poland state exports. Moya added: "Ethereum besides turned antagonistic and volition proceed to travel what happens connected Wall Street."

Spot BTC ETFs motorboat successful Australia. But elsewhere, they are facing money outflows.

Australia is going to person its ain bitcoin exchange-traded funds (ETF) successful the adjacent future, contempt immoderate delays because of problems with the plumbing that delayed Wednesday’s (April 27) scheduled launch.

Australia follows a agelong database of bitcoin ETF issuances successful Canada and Europe. There’s inactive nary spot bitcoin ETF successful the U.S., but traders successful Toronto, Europe and South America are capable to commercialized often and successful sizable volumes if they choose.

But arsenic the Australian ETF prepares to motorboat it faces a marketplace with compressed premiums and accelerated outflows. One of Australia’s "priciest funds" is listing conscionable implicit a twelvemonth aft the archetypal bitcoin ETFs deed the marketplace successful Toronto.

In the eyes of traders, these ETFs replaced the Grayscale Bitcoin Fund (GBTC) arsenic a mode to clasp crypto successful registered oregon organization accounts. The premium connected GBTC flipped antagonistic and has stayed profoundly successful that territory ever since – present astatine -23%. (Grayscale is simply a CoinDesk sister company.)

The U.S. inactive doesn’t have a spot bitcoin ETF. But different nations rapidly listed their own, and the conveyance became fashionable astatine exchanges successful Europe and South America. As U.S.-based investors are acquainted with the Canadian marketplace they flocked northward, including ARK Investment.

While ETF issuers were erstwhile secretly cheerful of GBTC’s destiny that cheer mightiness person been glib arsenic connected the eve of the listing of the archetypal Australian bitcoin ETF information shows large outflows from crypto ETFs and premium compressions.

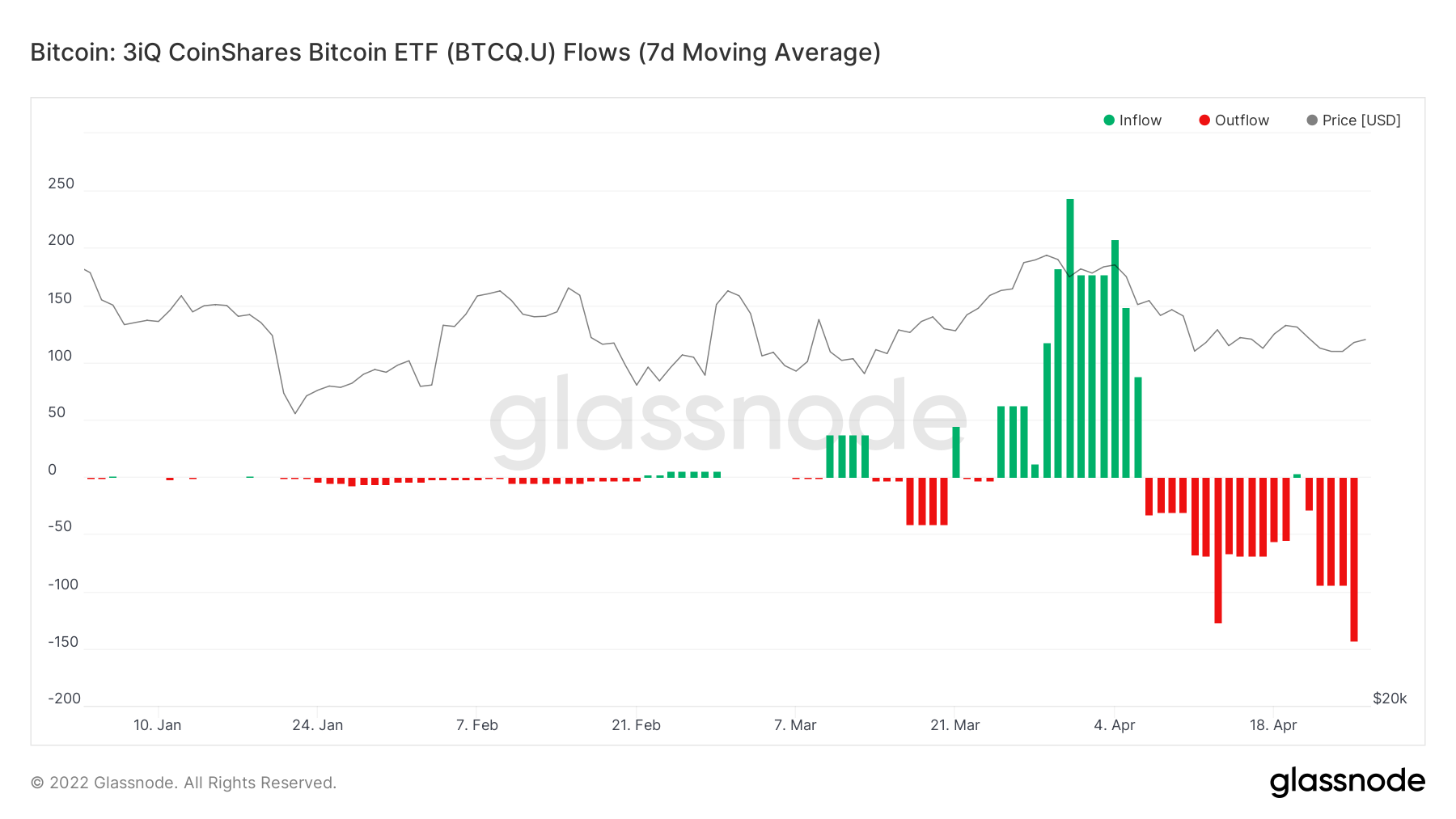

(Glassnode)

As bitcoin continues its rangebound trajectory, drifting betwixt $37,000 and$45,000, ETF traders look to person mislaid interest and are choosing to exit the 3iQ Coinshares bitcoin ETF via redemptions aft buying the dip successful March. Of course, determination person been different periods of outflows but they haven’t been this prominent.

And with this outflow comes a compression successful premiums to the constituent wherever it's present a discount.

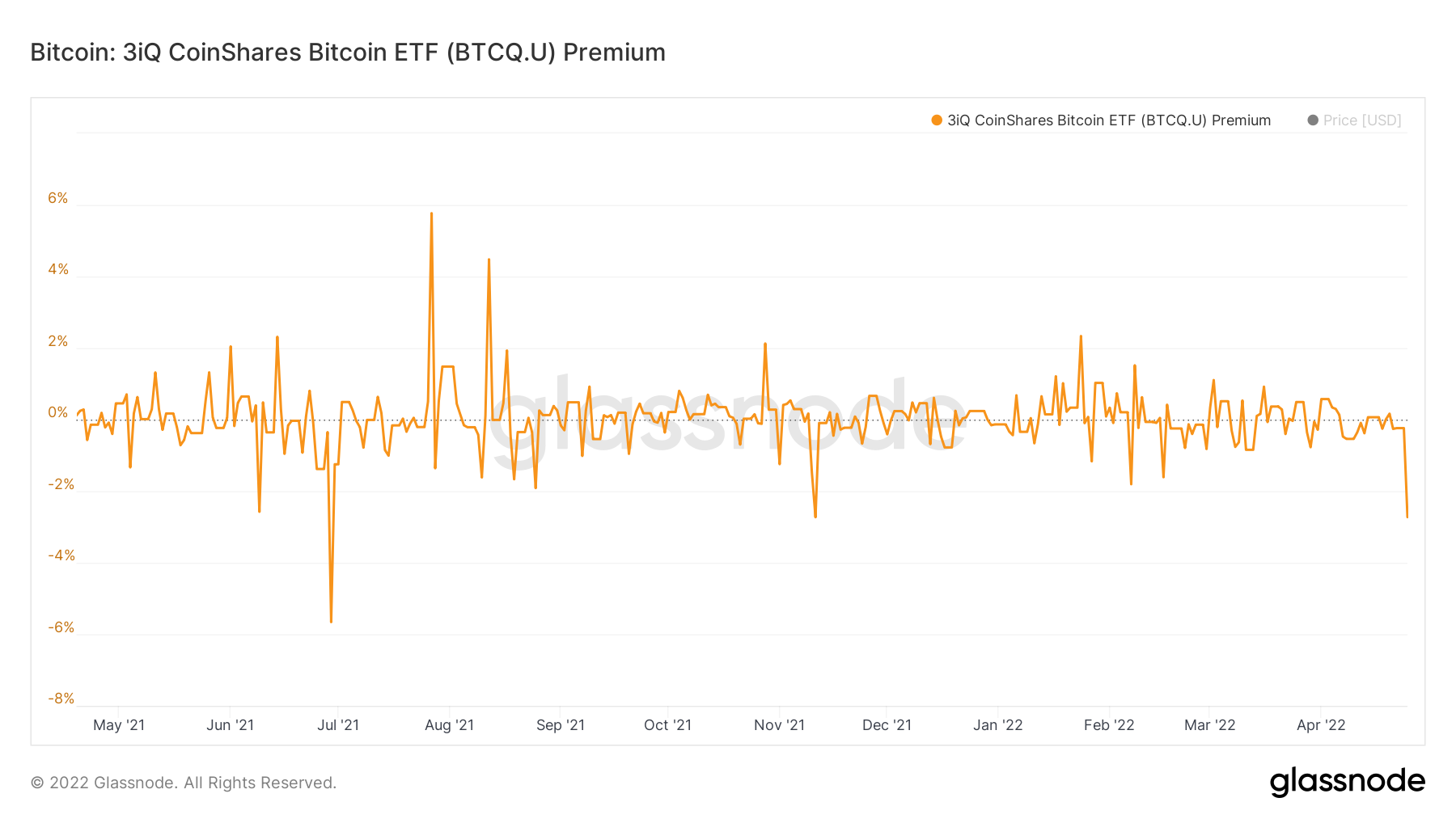

(Glassnode)

The 3iQ Coinshares bitcoin ETF is present trading astatine a -2.7% discount. This isn’t GBTC-level atrocious due to the fact that the ETF is known to gyrate betwixt premiums and discounts. During the 2021 summertime rebound aft the outpouring clang (where it deed a debased of 5%), for instance, the ETF traded astatine a premium of 5.7%, occasionally rebounding to highs of 2.5%-2.7% passim the twelvemonth arsenic the terms oscillated upwards.

What volition hap to Australia’s bitcoin ETF from Cosmos? Given that it's launching successful a marketplace with a nett outflow from bitcoin ETFs arsenic good arsenic exchanges arsenic traders look to HODL, it’s improbable that the premium volition last.

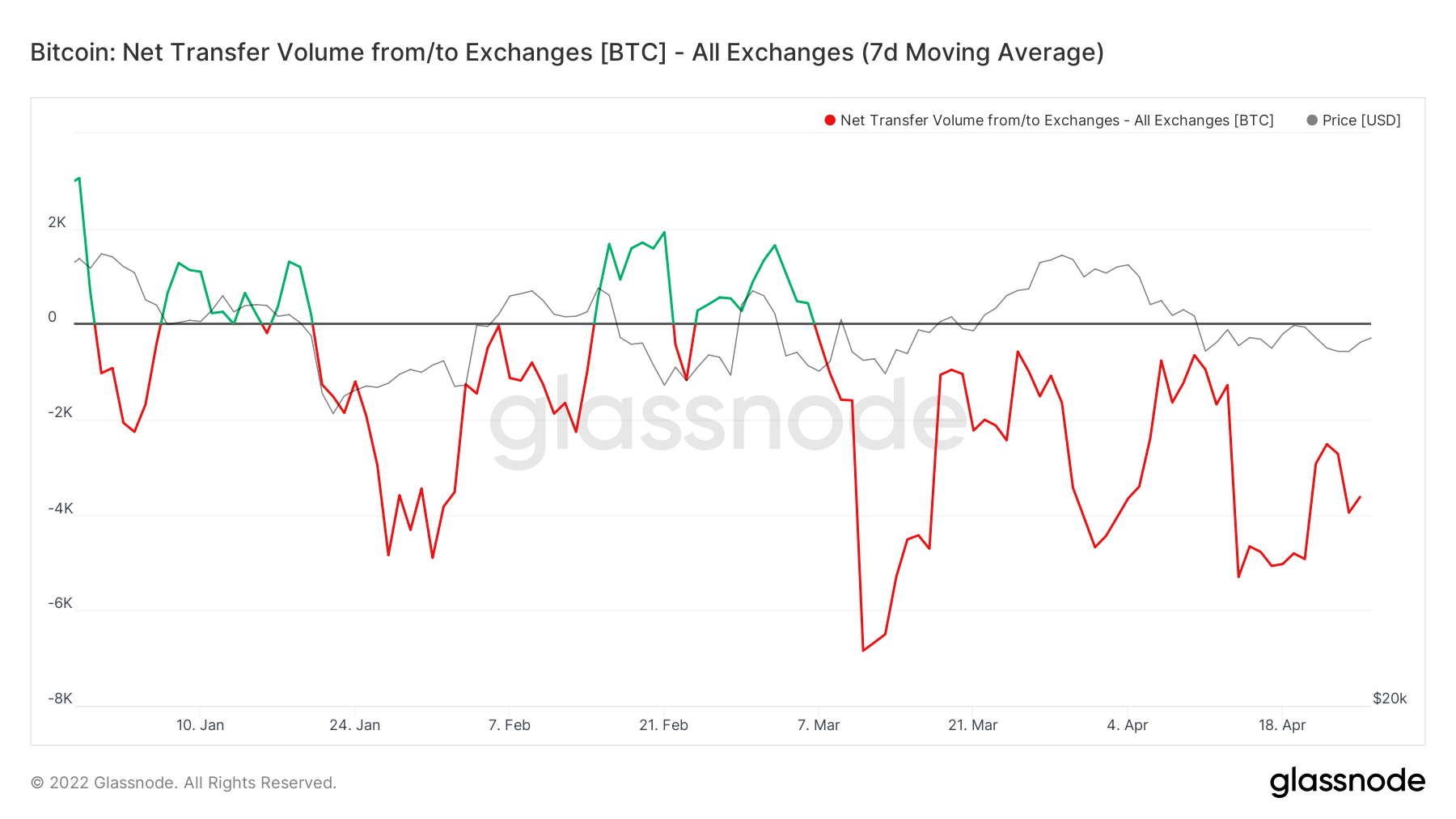

(Glassnode)

But historically speaking, beardown flows are besides a bullish sign arsenic investors look to clasp on to their crypto aft the extremity of a correction anticipating prices to increase. Traders volition yet instrumentality on with their liquidity and the premium volition return, but it volition beryllium a pugnacious fewer months earlier it happens arsenic each bitcoin ETFs look to regain their footing.

Talk astir launching successful a pugnacious market.

Bitcoin regular terms illustration shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) extended its diminution connected Tuesday, though support astatine $37,500 could stabilize the down move.

The cryptocurrency is attempting to support a bid of higher terms lows since Jan. 24, which typically coincides with rising terms momentum. This time, however, a bearish setup connected the monthly illustration could summation the hazard of a breakdown successful price.

Buyers volition request to support BTC elevated supra $40,000, the midpoint of a three-month terms range, successful bid to prolong the existent betterment phase.

BTC's existent pullback is akin to what occurred successful September of past year, erstwhile buyers began to instrumentality profits astir the $46,000-$50,000 resistance zone. Still, dissimilar the existent situation, past year's rally supra $40,000 benefited from affirmative semipermanent momentum.

For now, BTC's wide trading scope could proceed for different week until a decisive breakout oregon breakdown is confirmed.

Crypto Bahamas league with investors, developers and different blockchain leaders

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Gemini volition supply custody and clearing for Australia's archetypal bitcoin ETF fund. Gemini Global Head of Business Development Dave Abner joined "First Mover" to explicate the details of this collaboration and the imaginable of a spot bitcoin ETF successful the U.S. Plus, PWC enforcement and CryptoCapsules big Henri Arslanian discussed Elon Musk's acquisition of Twitter. Ming Wu of Strips Finance discussed quality of involvement rates trading.

Fireblocks Sees $500M Stampede Into Terra DeFi successful First Week: Pent-up request for Terra’s ecosystem among Fireblocks’s aboriginal entree programme hedge funds and affluent investors has been “crazy.”

Dogecoin, ApeCoin See Higher-Than-Usual Liquidations successful Volatile Trading: Futures tracking the 2 tokens notched up astir $35 cardinal successful losses for traders.

Bitcoin Miner CleanSpark Raises $35M successful Equipment-Backed Debt From Trinity Capital: Equipment-based financing is becoming an progressively fashionable enactment for mining firms to money their growth.

NFL Draft Goes NFT: Football League Releases New Collection connected Polygon: The league says its authoritative NFT level is inactive successful its “test and learn” phase, but has seen promising results since launching successful November.

The Pitfalls of 'Community-as-Company': When a faulty astute declaration outgo the Akutars NFT postulation astir $35 million, task leaders said they'd bail it out.

Other voices: How Elon Musk Won Twitter (The Wall Street Journal)

The determination [to let 401(k)s to put successful bitcoin] is the latest successful the enactment of bitcoin-centric products and offerings by Fidelity, which was 1 of the archetypal large firms to lukewarm up to the then-rising plus people successful 2018. (CoinDesk newsman Shaurya Malwa) ... In effect to [China President Xi Jinping’s] telephone to rev up growth, Chinese authorities agencies are discussing plans to accelerate large operation projects, particularly successful the manufacturing, technology, vigor and nutrient sectors, arsenic good arsenic to contented coupons to individuals to spur user spending, the radical said. (The Wall Street Journal) ... Crypto-assets are bringing astir instability and insecurity – the nonstop other of what they promised. They are creating a caller Wild West. To punctuation Littlefinger from “Game of Thrones,” “chaos is simply a ladder.” The communicative does not extremity good for this character. However, it lone takes a fewer to ascent precocious connected the ladder – adjacent if their gains are lone impermanent – to person galore others that they are missing out. (European Central Bank Executive Board Member Fabio Panetta)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)