Good morning. Here’s what’s happening:

Prices: Bitcoin held dependable supra $40,000 arsenic respective altcoins surged.

Insights: Taiwan surprises with involvement complaint hike.

Technician's take: BTC's terms scope could persist, though determination is little accidental of different large sell-off.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $40,950 -0.3%

Bitcoin holds dependable arsenic immoderate altcoins surge

Bitcoin (BTC) floated conscionable abbreviated of the $41,000 level for overmuch of U.S. trading hours connected a time successful which respective large alternate coins held starring roles.

The largest cryptocurrency by marketplace capitalization was precocious trading a small nether $41,000, astir wherever it stood 24 hours agone erstwhile it surged past the psychologically important $40,000 barrier. That ascent came arsenic Asian equities markets opened seemingly tied, initially, to China's determination to enactment its existent property and tech industries to calm investors grown skittish implicit a regulatory crackdown and faltering economical growth. Asian markets connected Thursday continued to rally.

Ether (ETH) was changing hands astatine astir $2,800, a astir 2% summation implicit the past 24 hours. Most different large cryptos were successful the greenish implicit the aforesaid period, immoderate importantly so. The tokens for Avalanche (AVAX) and Solana (SOL)were up implicit 8% and 5% astatine 1 point. Bitcoin, which was up for parts of the day, had fallen astir 1% amid airy trading.

Bitcoin's terms diverged from the show of equities markets, which enjoyed a bully day, with the tech-heavy Nasdaq, the Dow Jones Industrial Average and S&P 500 each rising implicit 1%. The increases followed beardown gains a time earlier successful each 3 indexes.

"Bitcoin is struggling to travel the determination higher successful stocks," said Oanda Americas Senior Market Analyst Edward Moya successful an email.

Moya said investors were inclined to judge that stories of Russians "rushing to crypto markets to evade sanctions and minimize vulnerability to rubles were overdone." Chainalysis co-founder Jonathan Levin said the institution had "not seen evidence" of specified a trend.

Bad quality continued to determination successful from Ukraine, with continuing civilian and Russian subject casualties amid Russia's ongoing bombardment of large cities. A time aft U.S. President Joe Biden promised to supply $800 cardinal successful subject instrumentality and related enactment to Ukraine, the U.S. House of Representatives voted overwhelmingly to halt mean commercialized relations with Russia. Prices of Brent crude lipid roared backmost past $100, underlining the concerns of the U.S. Federal Reserve, which raised involvement rates 25 ground points to curb rising inflation. The existent 7.9% user terms scale successful the U.S. is the highest since the 1980s.

Moya struck an optimistic enactment astir bitcoin's prospects arsenic agelong arsenic investors stay consenting to judge a grade of risk. "Bitcoin’s semipermanent outlook is inactive upbeat and should beryllium supported if hazard appetite is not taxable to immoderate de-risking movements connected Wall Street," helium said.

Taiwan's astonishment involvement complaint hike

Taiwan’s cardinal bank announced late Thursday, to the astonishment of galore analysts, that it would beryllium raising involvement rates by 0.25 percent points.

This was a existent chaotic paper to many, due to the fact that a survey of economists by Bloomberg had 21 retired of 29 economists predicting nary change, with the 0.25% rise lone predicted by 2 of the 29 surveyed.

All this comes arsenic Taiwan’s GDP maturation is expected to proceed to beryllium historically strong, 4.5% forecasted for this year.

Taiwan’s astonishment determination to rise rates apt comes arsenic its cardinal slope tries to avoid being labeled a currency manipulator by Washington, D.C., for undervaluing its currency to boost exports against its tech-heavy competitors including South Korea and China.

Ironically, Taiwan is more of a currency manipulator than China due to the fact that of regular, undisclosed interventions successful the overseas speech marketplace by the cardinal slope to power the appreciation of its currency. If the Taiwan dollar were to weaken this adjacent 4th arsenic the U.S. raises rates, that mightiness substance the currency manipulator statement and pull unnecessary attention.

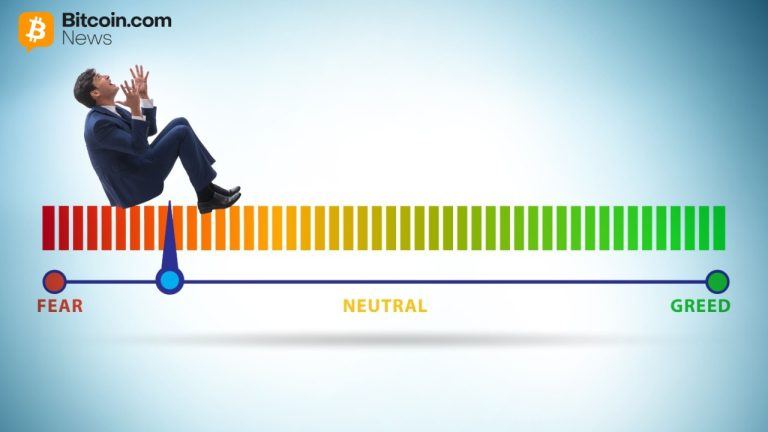

Bitcoin four-hour terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to hover astir the $40,000 terms level amid choppy trading conditions. The cryptocurrency faces beardown overhead resistance, which could stall the caller upswing successful price. Still, little enactment astatine $35,000 and $37,000 could stabilize pullbacks into the Asia trading day.

The comparative spot scale (RSI) connected the four-hour illustration is approaching overbought levels, akin to what occurred earlier this month, which preceded little pullbacks successful price. On the play chart, however, the RSI is rising from oversold levels, decreasing the likelihood of a important terms sell-off.

Typically, BTC consolidates for astir 2 months pursuing an utmost upswing oregon downtrend. That means the existent trading scope betwixt $30,000 and $40,000 could persist until a decisive breakout oregon breakdown occurs.

11 a.m. HKT/SGT(3 a.m. UTC): Bank of Japan involvement complaint determination and monetary argumentation statement

In lawsuit you missed it, present is the astir caller occurrence of The Hash connected CoinDesk TV:

On Wednesday, "The Hash" squad tackled apical stories, including Ukraine's latest measure legalizing crypto, 8 Congress members demanding the Securities and Exchange Commission clarify crypto institution investigations and a "MetaMetaverse" task that aims to beryllium the astir interoperable metaverse.

"As DAOs spread, they volition usher successful a caller mode of moving and a fierce caller epoch of integer competition, and successful doing so, alteration accepted organizations." (EY Global Blockchain Leader Paul Brady, for CoinDesk) ... "But whether the system tin withstand rising rates during a play of geopolitical turmoil and a lingering [COVID-19] pandemic is simply a question without an contiguous answer." (The New York Times) ... ‘’With the shadiness of stagflation looming, the Bank of England is successful a hard predicament, truthful it restricted the complaint emergence to 0.25 percent points to effort and guarantee maturation isn’t choked disconnected portion it tries to get a grip connected rampant prices. But this constricted determination means ostentation volition gaffe distant and descent upwards again. The commodity chaos unleashed by the struggle successful Ukraine, is acceptable to provender done to user prices, and unwelcome vigor bills are already poised to onshore connected mats successful April. The Bank is present predicting ostentation rises to 8% successful April and remains determination for the remainder of the quarter. It’s besides expecting different highest successful October, erstwhile the vigor terms headdress rises again." (Susannah Streeter, elder concern and markets analyst, Hargreaves Lansdown)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)